Price and wage flexibility

... • The greater public sector, the smaller role of private sector. We can justify it as follows: Market forces are the only way to stimulate labour productivity which is the fundamental growth factor in the long term. Crisis episodes usually confirm that absolutely free market should be subdued to reg ...

... • The greater public sector, the smaller role of private sector. We can justify it as follows: Market forces are the only way to stimulate labour productivity which is the fundamental growth factor in the long term. Crisis episodes usually confirm that absolutely free market should be subdued to reg ...

Module Exchange Rate Policy

... Module 43 Exchange Rate Policy KRUGMAN'S MACROECONOMICS for AP* Margaret Ray and David Anderson ...

... Module 43 Exchange Rate Policy KRUGMAN'S MACROECONOMICS for AP* Margaret Ray and David Anderson ...

New perspectives on the Great Depression

... the combination of Roosevelt and Keynes did more than successfully bring about the recovery of the U.S. from the Great Depression: “working in tandem, [Roosevelt and Keynes] effected a revolution in monetary policy that [in addition to bringing] the Great Depression to an end, la ...

... the combination of Roosevelt and Keynes did more than successfully bring about the recovery of the U.S. from the Great Depression: “working in tandem, [Roosevelt and Keynes] effected a revolution in monetary policy that [in addition to bringing] the Great Depression to an end, la ...

James A. Dorn MONEY, MACROECONOMICS, AND FORECASTING

... that his adaptive monetary rule is robust when tested against alternative monetary rules, and is more robust than a stable price-level rule. But his simulations do not capture the practical problems with implementing alternative monetary rules, and he has no way of testing the robustness of free-ban ...

... that his adaptive monetary rule is robust when tested against alternative monetary rules, and is more robust than a stable price-level rule. But his simulations do not capture the practical problems with implementing alternative monetary rules, and he has no way of testing the robustness of free-ban ...

Exchange Rates, Wages, and International Adjustment: Japan and

... • New U.S. fiscal stimulus is problematic: weak domestic financial institutions, and trade deficit would increase • China now a big actor on the world stage with stronger public finances and much stronger banking system • To stimulate the U.S. and world economies, the primary fiscal stimulus should ...

... • New U.S. fiscal stimulus is problematic: weak domestic financial institutions, and trade deficit would increase • China now a big actor on the world stage with stronger public finances and much stronger banking system • To stimulate the U.S. and world economies, the primary fiscal stimulus should ...

Slide 1

... 2. The gold standard – monetary unions – delivers automatic return to equilibrium, but at the cost of booms and Recessions 3. No agreement leads to misalignments, competitive devaluations and trade wars 4. Agreements require “rules of the game”, including a conductor ...

... 2. The gold standard – monetary unions – delivers automatic return to equilibrium, but at the cost of booms and Recessions 3. No agreement leads to misalignments, competitive devaluations and trade wars 4. Agreements require “rules of the game”, including a conductor ...

Public Debt, Finance and Imperialism

... Autonomy of central banks - monetary power of state – constrained by that of other states Key currency system: monetary liability of a dominant state becomes the basis for the international financial system. Instability inherent in this two –price framework are resolved and ...

... Autonomy of central banks - monetary power of state – constrained by that of other states Key currency system: monetary liability of a dominant state becomes the basis for the international financial system. Instability inherent in this two –price framework are resolved and ...

Foreign Exchange Rates I

... You buy a British Sweater for 75 dollars: Debit to CA The sweater manufacturer can ...

... You buy a British Sweater for 75 dollars: Debit to CA The sweater manufacturer can ...

... think the peso will fall relative to the dollar can borrow pesos, sell them for dollars and invest the dollars, expecting that after the peso’s fall they will sell their dollar asset and repay the peso debt with depreciated pesos. That means that a currency’s value can be driven down not only when i ...

PPT CH 10 - WTPS.org

... products made at home. Companies at home need to be protected from unfair foreign competition. Industries that make products related to national defense need to be protected. The use of cheap labor in other countries can lower wages or threaten jobs at home. A country can become too dependent on ano ...

... products made at home. Companies at home need to be protected from unfair foreign competition. Industries that make products related to national defense need to be protected. The use of cheap labor in other countries can lower wages or threaten jobs at home. A country can become too dependent on ano ...

IX. The First Global Economy: The Gold Standard

... See Barry Eichengreen (1997), Globalizing Capital: A Short History of the International Monetary System (), where he argues that even before World War I “… the rise of fractional reserve banking had exposed the gold standard’s Achilles’ Heel. Banks that could finance loans with deposits were vulnera ...

... See Barry Eichengreen (1997), Globalizing Capital: A Short History of the International Monetary System (), where he argues that even before World War I “… the rise of fractional reserve banking had exposed the gold standard’s Achilles’ Heel. Banks that could finance loans with deposits were vulnera ...

Economics Principles and Applications

... • Why does a higher exchange rate—a higher price for the pound—make the British want to sell more of them? – Because the higher the price for the pound, the more dollars someone gets for each pound sold ...

... • Why does a higher exchange rate—a higher price for the pound—make the British want to sell more of them? – Because the higher the price for the pound, the more dollars someone gets for each pound sold ...

Document

... Complexities of real world cause fixed exchange rates to be maintained with combinations of net factor receipts, net transfers, official reserve transactions, and interest rates However, one principle is always operable • The farther a fixed exchange rate is from the equilibrium ...

... Complexities of real world cause fixed exchange rates to be maintained with combinations of net factor receipts, net transfers, official reserve transactions, and interest rates However, one principle is always operable • The farther a fixed exchange rate is from the equilibrium ...

Ten years of floating exchange rate in Brazil

... again criticism of the floating BRL has mounted, be it because the currency is seen as not floating enough, or floating too much, or being too weak, or too strong, or helping some sectors of the economy or regions of the country at the expense of others. ...

... again criticism of the floating BRL has mounted, be it because the currency is seen as not floating enough, or floating too much, or being too weak, or too strong, or helping some sectors of the economy or regions of the country at the expense of others. ...

Central Banks

... The Bretton-Woods system (BWS): The US emerged from WWII as the major economic power of the world.11 By contrast European belligerents were impoverished. There was, on both sides of the Atlantic, a desire to rebuild an international monetary order to replace the gold exchange system that ceased to o ...

... The Bretton-Woods system (BWS): The US emerged from WWII as the major economic power of the world.11 By contrast European belligerents were impoverished. There was, on both sides of the Atlantic, a desire to rebuild an international monetary order to replace the gold exchange system that ceased to o ...

Chapter 2

... ANSWER: The euro allowed for a single currency among many European countries. It could encourage firms in those countries to trade among each other since there is no exchange rate risk. This would possibly cause them to trade less with the U.S. The euro can increase trade within Europe because it el ...

... ANSWER: The euro allowed for a single currency among many European countries. It could encourage firms in those countries to trade among each other since there is no exchange rate risk. This would possibly cause them to trade less with the U.S. The euro can increase trade within Europe because it el ...

Bein’ Green “It’s not easy being green.”

... Greenbacks were paper currency printed in green ink issued by the United States during the Civil War. While the greenbacks are no longer in use, the term “greenback” is still used casually to refer to paper dollars. In this month’s Investment Outlook we look at what has moved currencies. It is our v ...

... Greenbacks were paper currency printed in green ink issued by the United States during the Civil War. While the greenbacks are no longer in use, the term “greenback” is still used casually to refer to paper dollars. In this month’s Investment Outlook we look at what has moved currencies. It is our v ...

A Theory of Optimum Currency Areas1

... A single currency implies a single central bank (with note-issuing powers) and therefore a potentially elastic supply of interregional means of payments. But in a currency area comprising more than one currency, the supply of international means of payment is conditional upon the cooperation of many ...

... A single currency implies a single central bank (with note-issuing powers) and therefore a potentially elastic supply of interregional means of payments. But in a currency area comprising more than one currency, the supply of international means of payment is conditional upon the cooperation of many ...

One Market, One Money – - Archive of European Integration

... of the exchange rate premium. Until 2008 it appeared that the analysis of OMOMO had been correct in that the elimination of exchange rate uncertainty and transactions costs would yield small, but non-negligible microeconomic gains, with macroeconomic stability as an important additional benefit. The ...

... of the exchange rate premium. Until 2008 it appeared that the analysis of OMOMO had been correct in that the elimination of exchange rate uncertainty and transactions costs would yield small, but non-negligible microeconomic gains, with macroeconomic stability as an important additional benefit. The ...

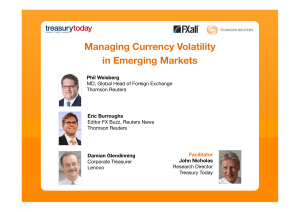

Managing Currency Volatility in Emerging Markets

... Volatility is not necessarily linked to EM status! Hedging in Volatile Times ...

... Volatility is not necessarily linked to EM status! Hedging in Volatile Times ...

Monetary Policy

... the basis of expected inflation because policy does not have immediate impact on inflation. • Variety of approaches toward forecasting inflation including statistical and theoretical modeling. • Stabilizing expected inflation stabilizes interest rates by limiting Fisher effect. ...

... the basis of expected inflation because policy does not have immediate impact on inflation. • Variety of approaches toward forecasting inflation including statistical and theoretical modeling. • Stabilizing expected inflation stabilizes interest rates by limiting Fisher effect. ...

New Austrian Economics Manifesto

... the gold standard. The monetary metal, out of which the monetary unit is made, ought ideally have to have constant marginal utility − as postulated by Menger in a much overlooked sentence (Geld, 3rd edition*). Following Mises, latter day Austrian economists hold that the marginal utility of gold can ...

... the gold standard. The monetary metal, out of which the monetary unit is made, ought ideally have to have constant marginal utility − as postulated by Menger in a much overlooked sentence (Geld, 3rd edition*). Following Mises, latter day Austrian economists hold that the marginal utility of gold can ...

Toward An International Commodity Standard

... the annual costs at 3 to 4 percent of the outstanding value), it is unclear why there has not been more enthusiasm for commodityreserve proposals. While they could not stabilize the general price level, these proposals might make its movements more predictable insofar as prices of finished goods and ...

... the annual costs at 3 to 4 percent of the outstanding value), it is unclear why there has not been more enthusiasm for commodityreserve proposals. While they could not stabilize the general price level, these proposals might make its movements more predictable insofar as prices of finished goods and ...

GLOBAL MARKETING MANAGEMENT by MASAAKI KOTABE

... Each country has its own currency through which it expresses the value of its products. In the post-World War II period, the United States agreed to to exchange the dollar at $35 per ounce of gold. The dollar became the common denominator in world trade. In the early seventies, the U.S. dollar stand ...

... Each country has its own currency through which it expresses the value of its products. In the post-World War II period, the United States agreed to to exchange the dollar at $35 per ounce of gold. The dollar became the common denominator in world trade. In the early seventies, the U.S. dollar stand ...

Early federal banks: Bank of N. America

... At ultralow rates, spendthrift governments can pile up debt painlessly When rates return to normal, danger of Greek-style debt trap ...

... At ultralow rates, spendthrift governments can pile up debt painlessly When rates return to normal, danger of Greek-style debt trap ...