WHAT IS WRONG WITH THE WASHINGTON CONSENSUS AND WHAT SHOULD by

... therefore they argue that the economy, prodded by intelligent authorities will show a greater Aspeed of adjustment@ than the Aautomatic pilot@ of a free market. In other words, the only analytical difference between Williamson and ideological Market Fundamentalists is the question of the length of t ...

... therefore they argue that the economy, prodded by intelligent authorities will show a greater Aspeed of adjustment@ than the Aautomatic pilot@ of a free market. In other words, the only analytical difference between Williamson and ideological Market Fundamentalists is the question of the length of t ...

Real exchange rate appreciation in the emerging countries

... Global economic and financial conditions were very favourable until the onset of the subprime crisis of summer 2007. Economies were continuing to grow robustly and the outlook for the emerging countries was good. The stabilisation of their economic situations and improving financial structures (in t ...

... Global economic and financial conditions were very favourable until the onset of the subprime crisis of summer 2007. Economies were continuing to grow robustly and the outlook for the emerging countries was good. The stabilisation of their economic situations and improving financial structures (in t ...

as a Powerpoint presentation

... of Yugoslavia, using the Serbian dinar as common currency. Entirely unified currency and coinage. The new Polish mark, linked to the German mark was destroyed by hyperinflation in 1924, while francs and dollars constituted the real currency. The Bank of Poland was created in 1924 together with the z ...

... of Yugoslavia, using the Serbian dinar as common currency. Entirely unified currency and coinage. The new Polish mark, linked to the German mark was destroyed by hyperinflation in 1924, while francs and dollars constituted the real currency. The Bank of Poland was created in 1924 together with the z ...

Mundell-Fleming vs Compensation and sterilization

... dollars, which could put upward pressures on Canadian interest rates’. Similarly, when the Bank wishes to slow down the appreciation of the dollar and sells Canadian dollars on the exchange markets, thus acquiring foreign currency, ‘to prevent downward pressure on Canadian interest rates ... the sam ...

... dollars, which could put upward pressures on Canadian interest rates’. Similarly, when the Bank wishes to slow down the appreciation of the dollar and sells Canadian dollars on the exchange markets, thus acquiring foreign currency, ‘to prevent downward pressure on Canadian interest rates ... the sam ...

This PDF is a selection from an out-of-print volume from... of Economic Research

... the world as a whole would soon return to a market-based multilateral payments mechanism. With its expertise, traditions, and location, London in 1947 would have been, as it is even now, the natural hub for a global convertible-currency system. The pace of international financial integration, and wi ...

... the world as a whole would soon return to a market-based multilateral payments mechanism. With its expertise, traditions, and location, London in 1947 would have been, as it is even now, the natural hub for a global convertible-currency system. The pace of international financial integration, and wi ...

Carbaugh, International Economics 9e, Chapter 16

... have foreign exchange reserves large enough to cover the domestic currency in circulation Put another way, the domestic money supply is limited by the amount of foreign reserves on hand Currency boards do not make loans or finance government deficits Carbaugh, Chap. 16 ...

... have foreign exchange reserves large enough to cover the domestic currency in circulation Put another way, the domestic money supply is limited by the amount of foreign reserves on hand Currency boards do not make loans or finance government deficits Carbaugh, Chap. 16 ...

PRIVATE MONEY: AN IDEA WHOSE TIME Introduction Richard W. Rahn HAS COME

... currency that people consider superior to government money. People making long-term contracts or investments would be eager to rely on a private currency only if they thought it would maintain its value better than the U.S. dollar or Japanese yen or other currencies. Proponents of competitive curren ...

... currency that people consider superior to government money. People making long-term contracts or investments would be eager to rely on a private currency only if they thought it would maintain its value better than the U.S. dollar or Japanese yen or other currencies. Proponents of competitive curren ...

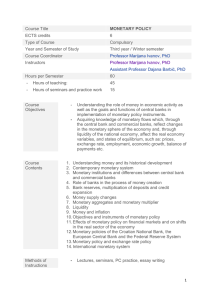

MONETARY POLICY Schedule (2016/17): Topics of lectures

... Acquiring knowledge of monetary flows which, through the central bank and commercial banks, reflect changes in the monetary sphere of the economy and, through liquidity of the national economy, affect the real economy variables, and states of equilibrium, such as: prices, exchange rate, employment, ...

... Acquiring knowledge of monetary flows which, through the central bank and commercial banks, reflect changes in the monetary sphere of the economy and, through liquidity of the national economy, affect the real economy variables, and states of equilibrium, such as: prices, exchange rate, employment, ...

Vulnerability Index – Guessing the Probability of a Currency Crisis

... appreciation of the currency, weak domestic economic growth, rising unemployment, an adverse terms-of-trade shock, a deteriorating current account balance, excessive domestic credit expansion, banking-system difficulties, unsustainably large government budget deficits, overly expansionary monetary p ...

... appreciation of the currency, weak domestic economic growth, rising unemployment, an adverse terms-of-trade shock, a deteriorating current account balance, excessive domestic credit expansion, banking-system difficulties, unsustainably large government budget deficits, overly expansionary monetary p ...

Ch 6 MCQs File

... C) reductions in foreign holdings of U.S. assets D) U.S hoarding of foreign currencies 4) Which of the following would give rise to a debit in the balance of payments? A) foreign purchases of U.S. assets B) dividends earned from foreign companies C) dividends paid to foreigners D) direct investment ...

... C) reductions in foreign holdings of U.S. assets D) U.S hoarding of foreign currencies 4) Which of the following would give rise to a debit in the balance of payments? A) foreign purchases of U.S. assets B) dividends earned from foreign companies C) dividends paid to foreigners D) direct investment ...

The Korean Financial Crisis - The Centre for Independent Studies

... many commentators into declaring market failure. This article argues to the contrary, focusing on the government failure which caused the South Korean financial crisis. Adam Smith argued that governments are unable to manage the economy, a prediction confirmed by the Asian financial crisis. Peter Dr ...

... many commentators into declaring market failure. This article argues to the contrary, focusing on the government failure which caused the South Korean financial crisis. Adam Smith argued that governments are unable to manage the economy, a prediction confirmed by the Asian financial crisis. Peter Dr ...

Document

... people no longer believe a country can maintain a fixed exchange rate above the equilibrium rate: –the supply of the currency increases, –demand for it decreases, and –the country must use up its reserves of dollars and other key currencies even faster in order to maintain the fixed rate. ...

... people no longer believe a country can maintain a fixed exchange rate above the equilibrium rate: –the supply of the currency increases, –demand for it decreases, and –the country must use up its reserves of dollars and other key currencies even faster in order to maintain the fixed rate. ...

Regional Symposium: Policies and Environment Conducive to

... the region like the euro is for the euro zone economies. Economies would not be prevented from having exchange rate arrangements considered to be necessary or desirable for their own economies' monetary or other economic conditions. Their domestic currencies would adjust against the APECCU according ...

... the region like the euro is for the euro zone economies. Economies would not be prevented from having exchange rate arrangements considered to be necessary or desirable for their own economies' monetary or other economic conditions. Their domestic currencies would adjust against the APECCU according ...

MONETARY POLICY AND THE DEBATE ABOUT MONETARY

... • The Fed has much more independence than most government agencies. • The Fed does not rely on Congress for appropriations. • Its governors serve 14 year terms and cannot be reappointed. ...

... • The Fed has much more independence than most government agencies. • The Fed does not rely on Congress for appropriations. • Its governors serve 14 year terms and cannot be reappointed. ...

Fed Policy Liftoff and Emerging Markets

... economy, all else equal, the debt servicing cost rises with the size of external and internal imbalances. In particular, increases in overall debt obligations or declines in the resources available to pay them off typically jeopardize the perception among global investors that a country will be able ...

... economy, all else equal, the debt servicing cost rises with the size of external and internal imbalances. In particular, increases in overall debt obligations or declines in the resources available to pay them off typically jeopardize the perception among global investors that a country will be able ...

(I) Relative PPP

... • So a deficit can be closed by either the traditional trade channel (net exports), or • Closed by revaluation effects • NB: depreciation works in same direction ...

... • So a deficit can be closed by either the traditional trade channel (net exports), or • Closed by revaluation effects • NB: depreciation works in same direction ...

3. The Great Depression

... During 1928 – US: speculative boom on financial markets, by US politicians and bankers considered as unhealthy • FED strongly contracted money supply • The aim was to stabilize the financial markets • Belief that impact on output will be mild • It became clear that there will be a break on the stock ...

... During 1928 – US: speculative boom on financial markets, by US politicians and bankers considered as unhealthy • FED strongly contracted money supply • The aim was to stabilize the financial markets • Belief that impact on output will be mild • It became clear that there will be a break on the stock ...

Chapter 18. Openness in Goods

... reserves are foreign financial assets held by the central bank. For historical reasons, reserves include gold. An increase in reserves gets a negative sign in the financial account. Instructors may wish to explain how reserves fit into the balance of payments and to note that reserves affect the mon ...

... reserves are foreign financial assets held by the central bank. For historical reasons, reserves include gold. An increase in reserves gets a negative sign in the financial account. Instructors may wish to explain how reserves fit into the balance of payments and to note that reserves affect the mon ...

Chapter 15: Financial Markets and Expectations

... The official settlements balance is the change in a country’s official reserve holdings; it shows the change in the central bank’s foreign exchange reserves (or gold reserves). The three must sum to zero. A country running a current account deficit can pay for it by running a capital account su ...

... The official settlements balance is the change in a country’s official reserve holdings; it shows the change in the central bank’s foreign exchange reserves (or gold reserves). The three must sum to zero. A country running a current account deficit can pay for it by running a capital account su ...

The international role of currencies

... domestic currency terms and as a share of GDP. Conversely, following sharp devaluations – often associated with economic and financial stress – the foreign currency-denominated assets grow in domestic currency terms and liabilities are unaffected, improving the overall investment position when it i ...

... domestic currency terms and as a share of GDP. Conversely, following sharp devaluations – often associated with economic and financial stress – the foreign currency-denominated assets grow in domestic currency terms and liabilities are unaffected, improving the overall investment position when it i ...

Financial Statement Translation

... Automatically compute the translation gain or loss amount and report it to the Reporting Currency set of books. ...

... Automatically compute the translation gain or loss amount and report it to the Reporting Currency set of books. ...

The Euro Versus the Dollar: Will there be a Struggle for Dominance?

... depreciation at some fairly early point. Major dollar depreciations are nothing new: they have occurred about once per decade since the advent of generalized currency convertibility in the postwar period: in 1971-73, 1978-79, 1985-87 and 1994-95 (to the dollar’s all-time lows against the DM and yen) ...

... depreciation at some fairly early point. Major dollar depreciations are nothing new: they have occurred about once per decade since the advent of generalized currency convertibility in the postwar period: in 1971-73, 1978-79, 1985-87 and 1994-95 (to the dollar’s all-time lows against the DM and yen) ...

Currency Contracts, Pass-Through, and Devaluation

... balance in 1971. Large movements of short-term capital also occurred as anxiety over the dollar increased. The result was imposition of an import surcharge and suspension of gold convertibility by the United States on August 15, 1971. Throughout the fall of 1971, the dollar depreciated on foreign ex ...

... balance in 1971. Large movements of short-term capital also occurred as anxiety over the dollar increased. The result was imposition of an import surcharge and suspension of gold convertibility by the United States on August 15, 1971. Throughout the fall of 1971, the dollar depreciated on foreign ex ...

chapte r 4

... How exchange rates reach equilibrium? 1. Demand for a Currency a. derived from the local buyers who are willing and able to purchase foreign goods but who must convert their local currencies. b. An indirect relationship exists between the cost of foreign currency and amount demanded. c. Graphically, ...

... How exchange rates reach equilibrium? 1. Demand for a Currency a. derived from the local buyers who are willing and able to purchase foreign goods but who must convert their local currencies. b. An indirect relationship exists between the cost of foreign currency and amount demanded. c. Graphically, ...

Gold Supported By Cracks in Market Confidence

... mining when developed, or primarily invest in gold or silver. 3Safe haven is an investment that is expected to retain its value or even increase its value in times of market turbulence. 4Tail risk is a form of portfolio risk that arises when the possibility that an investment will move more than thr ...

... mining when developed, or primarily invest in gold or silver. 3Safe haven is an investment that is expected to retain its value or even increase its value in times of market turbulence. 4Tail risk is a form of portfolio risk that arises when the possibility that an investment will move more than thr ...