Exchange-Rate Systems and Currency Crises

... • To foreign savers investing in domestic assets • To domestic savers investing in foreign assets • Also known as exchange controls ...

... • To foreign savers investing in domestic assets • To domestic savers investing in foreign assets • Also known as exchange controls ...

One market, One Money

... jurisdiction. The creation of a trade balance, of Central Banks and especially of a free internal market are the result of this stage that, within the history of economic thought, was defined as the era of the mercantile system. It was only at the end of the 19th Century, when industrial revolution ...

... jurisdiction. The creation of a trade balance, of Central Banks and especially of a free internal market are the result of this stage that, within the history of economic thought, was defined as the era of the mercantile system. It was only at the end of the 19th Century, when industrial revolution ...

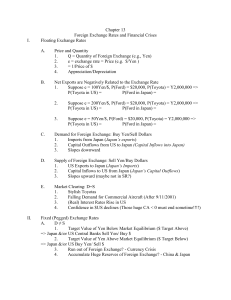

Chapter 13 - Montana State University

... saving) => capital inflows, and thus high value of $US is fault of US: NX = S-I ...

... saving) => capital inflows, and thus high value of $US is fault of US: NX = S-I ...

Why great power demands great responsibility By Fai

... The impact of monetary policy adopted by advanced economies is transmitted to the financial markets of less developed countries through short-term international capital movements, where portfolio and speculative flows of capital can distort the intrinsic value of currencies. The effect is particular ...

... The impact of monetary policy adopted by advanced economies is transmitted to the financial markets of less developed countries through short-term international capital movements, where portfolio and speculative flows of capital can distort the intrinsic value of currencies. The effect is particular ...

Problem 12

... 1939). Contrast the pre – World War I and interwar periods. Explain the difference is exchange rate behavior in the two periods. (It is not enough to say that currencies were fixed to gold in the pre – war period. Rather, why did the gold standard “work” before 1914 and why could it not be restored ...

... 1939). Contrast the pre – World War I and interwar periods. Explain the difference is exchange rate behavior in the two periods. (It is not enough to say that currencies were fixed to gold in the pre – war period. Rather, why did the gold standard “work” before 1914 and why could it not be restored ...

The US Dollar, IMF and the Global Financial Crisis

... Difficulty in raising monetary gold price (1) 1. Equity problem: Central banks of rich countries hold largest share of world’s monetary gold stock. In 1970, of $ 41 billion monetary gold stock, developed countries held $ 35.7 billion, which is 87% – so raising gold price makes rich, richer. 2. Poli ...

... Difficulty in raising monetary gold price (1) 1. Equity problem: Central banks of rich countries hold largest share of world’s monetary gold stock. In 1970, of $ 41 billion monetary gold stock, developed countries held $ 35.7 billion, which is 87% – so raising gold price makes rich, richer. 2. Poli ...

Purchasing Power Parity

... differed in two markets would necessarily converge. • According to the theory of purchasingpower parity, a currency must have the same purchasing power in all countries and exchange rates move to ensure that. ...

... differed in two markets would necessarily converge. • According to the theory of purchasingpower parity, a currency must have the same purchasing power in all countries and exchange rates move to ensure that. ...

Exchange Rate Management

... Suppose that Europe was following an irresponsible monetary policy (excessive money growth). If the US was pegging to the Euro, we would be forced into the same irresponsible behavior! ...

... Suppose that Europe was following an irresponsible monetary policy (excessive money growth). If the US was pegging to the Euro, we would be forced into the same irresponsible behavior! ...

Balance of Payments

... 2. Mexico buys tractors from Canada 3. Canada sells syrup t the U.S. 4. Japan buys Fireworks from Mexico For all these transactions, there are different national currencies. Each country must be paid in their own currency The buyer (importer) must exchange their currency for that of the sellers (exp ...

... 2. Mexico buys tractors from Canada 3. Canada sells syrup t the U.S. 4. Japan buys Fireworks from Mexico For all these transactions, there are different national currencies. Each country must be paid in their own currency The buyer (importer) must exchange their currency for that of the sellers (exp ...

CHAP1.WP (Word5)

... 10. Canada’s current account to GDP ratio ranged from –4% to 3% over the period, and on net was marginally positive, but close to zero. The moderate CA surplus in the last few years (1999–2003) certainly reduced the net debt, but was not sufficient. Over that period, the Canadian dollar depreciated ...

... 10. Canada’s current account to GDP ratio ranged from –4% to 3% over the period, and on net was marginally positive, but close to zero. The moderate CA surplus in the last few years (1999–2003) certainly reduced the net debt, but was not sufficient. Over that period, the Canadian dollar depreciated ...

Legal and Institutional Aspects of the International Monetary System

... procedures, had to adjust to the new system and the simplicity of the rule of law prescribing the par value standard. The book demonstrates that a complete description of the three elements (the international monetary system, the IMF, and international monetary law) is like analyzing three Boulian l ...

... procedures, had to adjust to the new system and the simplicity of the rule of law prescribing the par value standard. The book demonstrates that a complete description of the three elements (the international monetary system, the IMF, and international monetary law) is like analyzing three Boulian l ...

World Trade Organization (WTO)

... “noncommercial risk,” so developing countries will attract FDI; and provide conciliation and arbitration of disputes between governments and foreign investors ...

... “noncommercial risk,” so developing countries will attract FDI; and provide conciliation and arbitration of disputes between governments and foreign investors ...

Chapter 10 The Determination of Exchange Rates

... maintain their exchange-rate regimes, but they must communicate those choices to the IMF. A. From Pegged to Floating Currencies The IMF now recognizes several categories of exchange-rate regimes that begin with pegging (fixing) the rate for one currency to that of another (or to a basket of currenci ...

... maintain their exchange-rate regimes, but they must communicate those choices to the IMF. A. From Pegged to Floating Currencies The IMF now recognizes several categories of exchange-rate regimes that begin with pegging (fixing) the rate for one currency to that of another (or to a basket of currenci ...

Document

... - Small open economy would have rd = rw - Large open economy financial flows determined by rd and rw - Net exports a function of real exchange rate, NX = NX(R) ...

... - Small open economy would have rd = rw - Large open economy financial flows determined by rd and rw - Net exports a function of real exchange rate, NX = NX(R) ...

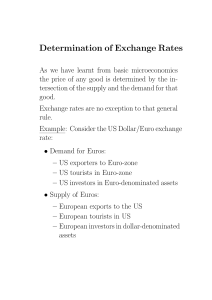

Determination of Exchange Rates

... • Sell foreign currency to buy local currency – local currency appreciates • Sell local currency to buy foreign currency – local currency depreciates Sterilized vs. Unsterilized intervention: • Unsterilized intervention: as in both examples above • Sterilized intervention: adjust the local money sup ...

... • Sell foreign currency to buy local currency – local currency appreciates • Sell local currency to buy foreign currency – local currency depreciates Sterilized vs. Unsterilized intervention: • Unsterilized intervention: as in both examples above • Sterilized intervention: adjust the local money sup ...

Aspen Institute Italia

... Under the Bretton Woods agreement, the availability of international liquidity, ultimately in the form of gold, was the binding criterion for fostering a country to adjust its external imbalances. The system broke up because the US did not have enough gold to finance its imbalances, and did not wan ...

... Under the Bretton Woods agreement, the availability of international liquidity, ultimately in the form of gold, was the binding criterion for fostering a country to adjust its external imbalances. The system broke up because the US did not have enough gold to finance its imbalances, and did not wan ...

The European Currency Crisis (1992

... Germany becomes free to set monetary policy for itself while the other countries have reduced control over monetary policy since they have to hold reserves and intervene when the exchange rate got too close to the edge of the band. It was believed that other Central Banks were not very good at keepi ...

... Germany becomes free to set monetary policy for itself while the other countries have reduced control over monetary policy since they have to hold reserves and intervene when the exchange rate got too close to the edge of the band. It was believed that other Central Banks were not very good at keepi ...

ECB vs Fed

... market liquidity, and signaling the next policy movement. Standard Facilities Minimum Reserves: Provide stability of money market interest rates. ...

... market liquidity, and signaling the next policy movement. Standard Facilities Minimum Reserves: Provide stability of money market interest rates. ...

The Fed vs. The ECB - Econometrics at Illinois

... market liquidity, and signaling the next policy movement. Standard Facilities Minimum Reserves: Provide stability of money market interest rates. ...

... market liquidity, and signaling the next policy movement. Standard Facilities Minimum Reserves: Provide stability of money market interest rates. ...

Document

... Increase in Demand for US Dollars in Europe, caused by greater capital flows from Europe → US. Fig 19-6, p. 563 ...

... Increase in Demand for US Dollars in Europe, caused by greater capital flows from Europe → US. Fig 19-6, p. 563 ...

The Importance of International Business

... North American Free Trade Agreement Worlds largest trading bloc, removed tariffs and other barriers to trade among the 3 North American nations. Caused many American firms to open in Mexico Unlike EU there is no universal monetary system or unrestricted movement of people among the countries EU ...

... North American Free Trade Agreement Worlds largest trading bloc, removed tariffs and other barriers to trade among the 3 North American nations. Caused many American firms to open in Mexico Unlike EU there is no universal monetary system or unrestricted movement of people among the countries EU ...

Great Depression

... damage to supply, reducing the level of potential output (scenario 2) or even its rate of growth (scenario 3). If so, the economy will never recoup its losses, even after spending picks up again. In a recession firms shed labour and mothball capital. If workers are left on the shelf too long, their ...

... damage to supply, reducing the level of potential output (scenario 2) or even its rate of growth (scenario 3). If so, the economy will never recoup its losses, even after spending picks up again. In a recession firms shed labour and mothball capital. If workers are left on the shelf too long, their ...

(X) – Updated September 10, 2014

... *Stock Market trying to put in short term high *Every oil rally has failed Avoid – *Gold, precious metals ...

... *Stock Market trying to put in short term high *Every oil rally has failed Avoid – *Gold, precious metals ...

ch 20 end of chapter answers

... 9. a. This is an enormous change. In order to bring it about, the Never-Never government would have to run an enormously expansionary monetary policy, reducing the real interest rate possibly to negative amounts and probably generating significant inflation. As far as trade policies are concerned, t ...

... 9. a. This is an enormous change. In order to bring it about, the Never-Never government would have to run an enormously expansionary monetary policy, reducing the real interest rate possibly to negative amounts and probably generating significant inflation. As far as trade policies are concerned, t ...

Gold standard tutorial for Econ 105, test #3 Congratulations! You

... that gold and exchange it for 1 pound, then you are essentially trading 16 dollars for one pound. You’ll never see anyone trade 15 dollars for one pound, because they would be getting a worse deal than if they used gold to exchange their money. Another important thing to notice is that gold is leav ...

... that gold and exchange it for 1 pound, then you are essentially trading 16 dollars for one pound. You’ll never see anyone trade 15 dollars for one pound, because they would be getting a worse deal than if they used gold to exchange their money. Another important thing to notice is that gold is leav ...