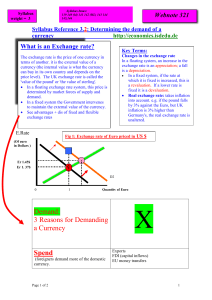

Demand for a currency - yELLOWSUBMARINER.COM

... Foreigners saving in Domestic country because interest rates are attractively high More interest = more income earned Currency speculator BUYS currency hoping to See the value of the currency rise in the future. Look at George Soros story in webnote 324 ...

... Foreigners saving in Domestic country because interest rates are attractively high More interest = more income earned Currency speculator BUYS currency hoping to See the value of the currency rise in the future. Look at George Soros story in webnote 324 ...

Petrodollar recycling as a predictive means of conflict assessment

... First of all, in order to understand the way how the so-called petrodollar recycling system works, it’s important to review the most significant financial events of the 20th century’s second half. Based on COHEN (2002), current events can be led back to a very important event of the year 1944 when t ...

... First of all, in order to understand the way how the so-called petrodollar recycling system works, it’s important to review the most significant financial events of the 20th century’s second half. Based on COHEN (2002), current events can be led back to a very important event of the year 1944 when t ...

3.E Money in the European Union High School Lesson Plan

... manipulate and transform units appropriately when multiplying or dividing quantities. Materials needed: Euro Coins PowerPoint Currency Exchange Worksheet Why the euro? Via Europa Current exchange rate information, which can be found at websites including: http://money.cnn.com/data/currencies/ ...

... manipulate and transform units appropriately when multiplying or dividing quantities. Materials needed: Euro Coins PowerPoint Currency Exchange Worksheet Why the euro? Via Europa Current exchange rate information, which can be found at websites including: http://money.cnn.com/data/currencies/ ...

1005Edwards_Euro

... • The primary objective of the ECB is to maintain price stability within the Eurozone, or in other words to keep inflation low!! ...

... • The primary objective of the ECB is to maintain price stability within the Eurozone, or in other words to keep inflation low!! ...

International Finance

... – Investment in business, real estate, stocks and bonds (these are often put in what is called the Financial Account) – Other financial transactions – for example, cross border bank accounts. ...

... – Investment in business, real estate, stocks and bonds (these are often put in what is called the Financial Account) – Other financial transactions – for example, cross border bank accounts. ...

AP Macro 5-3 Foreign Exchange

... Mexico buys tractors from Canada Canada sells syrup t the U.S. Japan buys Fireworks from Mexico ...

... Mexico buys tractors from Canada Canada sells syrup t the U.S. Japan buys Fireworks from Mexico ...

Capital Flows, Balance of Payments, and the Foreign Exchange

... Differences in investment opportunities – Countries with rapid economic growth have higher demand for capital, so they offer higher returns International differences in savings rates, including budget balance ...

... Differences in investment opportunities – Countries with rapid economic growth have higher demand for capital, so they offer higher returns International differences in savings rates, including budget balance ...

Study Guide for Midterm

... production factors, and harmonized rules: European Union) Be able to define: money, foreign exchange, exchange rate, spot exchange rate, forward rate. Also bid, offer, and spread Understand how rates are set under fixed/pegged and floating rates Understand the concept of currency hedging; know that ...

... production factors, and harmonized rules: European Union) Be able to define: money, foreign exchange, exchange rate, spot exchange rate, forward rate. Also bid, offer, and spread Understand how rates are set under fixed/pegged and floating rates Understand the concept of currency hedging; know that ...

PowerPoint

... currencies' include Australia, New Zealand and Canada as well as some East Asia countries that are rich in natural resources Clements and Fry (2008) found that spillovers from commodities to currencies contributed less than 1% to the volatility of currencies, while spillovers from currencies to comm ...

... currencies' include Australia, New Zealand and Canada as well as some East Asia countries that are rich in natural resources Clements and Fry (2008) found that spillovers from commodities to currencies contributed less than 1% to the volatility of currencies, while spillovers from currencies to comm ...

4B - Brenda Spotton Visano

... (FIPA) in force October 1, 2014 and in place for a minimum of 31 years (to at least 2045) http://www.international.gc.ca/trade-agreements-accordscommerciaux/agr-acc/fipa-apie/china-chine.aspx?lang=eng ...

... (FIPA) in force October 1, 2014 and in place for a minimum of 31 years (to at least 2045) http://www.international.gc.ca/trade-agreements-accordscommerciaux/agr-acc/fipa-apie/china-chine.aspx?lang=eng ...

Lecture 10 - UTA Economics

... One way to look at the market for currency looks is to consider that it looks just like the market for refrigerators or watches. The demand curve shows how many units of a given currency are demanded at each and every price per unit. The supply curve shows how many units of a given currency are supp ...

... One way to look at the market for currency looks is to consider that it looks just like the market for refrigerators or watches. The demand curve shows how many units of a given currency are demanded at each and every price per unit. The supply curve shows how many units of a given currency are supp ...

Currency Considerations: Investing Through the

... markets is closer to a plus-sum game in which profit-driven investors are compensated by nonprofit-driven participants, such as central banks, sovereign wealth funds and, to a lesser extent, trading companies and tourists. To see this, note that about 70% of exchange rates are managed by governments ...

... markets is closer to a plus-sum game in which profit-driven investors are compensated by nonprofit-driven participants, such as central banks, sovereign wealth funds and, to a lesser extent, trading companies and tourists. To see this, note that about 70% of exchange rates are managed by governments ...

Basic Theories of the Balance of Payments

... If Y > A, then X – M > 0 or BOT > 0. If Y < A, then X – M < 0 or BOT < 0. Does devaluation always improve BOT? Recall: If Y = Y* Full employment level of ...

... If Y > A, then X – M > 0 or BOT > 0. If Y < A, then X – M < 0 or BOT < 0. Does devaluation always improve BOT? Recall: If Y = Y* Full employment level of ...

Lecture 12 (Read chapter 10)

... prepared for the Great Depression • The restoration of the gold standard in the early 1920s was costly for UK and Scandinavia which opted for pre-1914 gold parities leading to overvalued currencies and high unemployment and international reserve (gold) losses. France and US sterilized gold inflows. ...

... prepared for the Great Depression • The restoration of the gold standard in the early 1920s was costly for UK and Scandinavia which opted for pre-1914 gold parities leading to overvalued currencies and high unemployment and international reserve (gold) losses. France and US sterilized gold inflows. ...

Lecture 12 (Read chapter 10)

... prepared for the Great Depression • The restoration of the gold standard in the early 1920s was costly for UK and Scandinavia which opted for pre-1914 gold parities leading to overvalued currencies and high unemployment and international reserve (gold) losses. France and US sterilized gold inflows. ...

... prepared for the Great Depression • The restoration of the gold standard in the early 1920s was costly for UK and Scandinavia which opted for pre-1914 gold parities leading to overvalued currencies and high unemployment and international reserve (gold) losses. France and US sterilized gold inflows. ...

THE DEEP CAUSE OF THE GREAT FINANCIAL

... wanted to maintain the wartime blockade under a different name. They wanted to monitor, and control if need be, the move of goods in and out of Germany. In peacetime the only way to accomplish this was to replace multilateral with bilateral trade; to block the financing of world trade with short-ter ...

... wanted to maintain the wartime blockade under a different name. They wanted to monitor, and control if need be, the move of goods in and out of Germany. In peacetime the only way to accomplish this was to replace multilateral with bilateral trade; to block the financing of world trade with short-ter ...

Chapter 11

... Japan exports cars to the U.S. Car importers in the U.S. pay exporters in Japan, resulting in a surplus item in Japan’s balance of trade and a deficit in the U.S. balance of trade. If the total value of U.S. imports from Japan exceeds the total value of U.S. exports to Japan, then Japan will have a ...

... Japan exports cars to the U.S. Car importers in the U.S. pay exporters in Japan, resulting in a surplus item in Japan’s balance of trade and a deficit in the U.S. balance of trade. If the total value of U.S. imports from Japan exceeds the total value of U.S. exports to Japan, then Japan will have a ...

Foreign Exchange

... Imagine a huge table with all the different currencies from every country This is the Foreign Exchange Market! Just like at a product market, you can’t take things without paying. If you demand one currency, you must supply your currency. Ex: If Canadians want Russian Rubles. The demand for Rubles i ...

... Imagine a huge table with all the different currencies from every country This is the Foreign Exchange Market! Just like at a product market, you can’t take things without paying. If you demand one currency, you must supply your currency. Ex: If Canadians want Russian Rubles. The demand for Rubles i ...

Ch 29 notes - Solon City Schools

... appreciated because ….. the dollar can now buy more yen • When exchange rate changes from 90 yen per dollar to 80 yen per dollar: the dollar has….. depreciated because …… the dollar can now buy less yen ...

... appreciated because ….. the dollar can now buy more yen • When exchange rate changes from 90 yen per dollar to 80 yen per dollar: the dollar has….. depreciated because …… the dollar can now buy less yen ...

Course Outline School of Business and Economics BUSN 6030/1

... 5. Explain why some governments intervene in international trade to restrict imports and promote exports. 6. Assess the costs and benefits of foreign direct investment to receiving and source countries. 7. Describe the history, current scope, and future prospects of the world’s most important region ...

... 5. Explain why some governments intervene in international trade to restrict imports and promote exports. 6. Assess the costs and benefits of foreign direct investment to receiving and source countries. 7. Describe the history, current scope, and future prospects of the world’s most important region ...

A Call for an “Asian Plaza”

... International Monetary Fund, and probably new groupings of key countries that reflect the rapidly evolving power structure of the global economy. First, there is now a substantial risk of a free fall of the dollar. Its sizable depreciation over the past six years has been gradual and orderly, and it ...

... International Monetary Fund, and probably new groupings of key countries that reflect the rapidly evolving power structure of the global economy. First, there is now a substantial risk of a free fall of the dollar. Its sizable depreciation over the past six years has been gradual and orderly, and it ...

The Mundell-Laffer Hypothesis-- a new view of the

... If monetary stimulation can increase production only by increasing someone's credit at the expense of someone else (a creditor who is paid off in inflated currency, a contractor who has agreed to supply goods and services at a fixed price, or a worker tied to a wage contract), the increased producti ...

... If monetary stimulation can increase production only by increasing someone's credit at the expense of someone else (a creditor who is paid off in inflated currency, a contractor who has agreed to supply goods and services at a fixed price, or a worker tied to a wage contract), the increased producti ...

International Finance

... the demand and supply of another. But it explains in a superficial sense. This simple explanation doesn’t tell us what factors underlie the demand for and supply of a currency. Some fundamental factors, such as inflation, productivity, interest rates, and government policies are quite important in e ...

... the demand and supply of another. But it explains in a superficial sense. This simple explanation doesn’t tell us what factors underlie the demand for and supply of a currency. Some fundamental factors, such as inflation, productivity, interest rates, and government policies are quite important in e ...

Lecture 3 - GEOCITIES.ws

... How big is the bond market? How long is the life of a bond? What is one risk of purchasing a bond? ...

... How big is the bond market? How long is the life of a bond? What is one risk of purchasing a bond? ...

Temas Públicos

... In addition, a higher industrial consolidation would appear, because moderation in costs generated by a higher operations scale will boost the concentration of production in less companies, each time bigger. ...

... In addition, a higher industrial consolidation would appear, because moderation in costs generated by a higher operations scale will boost the concentration of production in less companies, each time bigger. ...