Key messages

... Trade channel (openness has increased) Remittances (World Bank estimates decline of 58 percent in 2009) FDI inflows (tripled in past 5 years: could drop this year by at least 20 percent) Aid flows (possibly) ...

... Trade channel (openness has increased) Remittances (World Bank estimates decline of 58 percent in 2009) FDI inflows (tripled in past 5 years: could drop this year by at least 20 percent) Aid flows (possibly) ...

what the dollar`s surge means to investors

... The information and opinions expressed herein are obtained from sources believed to be reliable, however their accuracy and completeness cannot be guaranteed. Opinions expressed are current as of the date of this publication and are subject to change. Certain statements contained within are forward- ...

... The information and opinions expressed herein are obtained from sources believed to be reliable, however their accuracy and completeness cannot be guaranteed. Opinions expressed are current as of the date of this publication and are subject to change. Certain statements contained within are forward- ...

On Some Unresolved Problems Of Monetary

... Concentrating on the first of these analytical methods, that of monetary base, research undertaken by myself, Aurelio Maccario and Chiara Oldani with the support of the Guido Carli Association, showed a clear relationship between the different types of derivatives contracts, including those of stock ...

... Concentrating on the first of these analytical methods, that of monetary base, research undertaken by myself, Aurelio Maccario and Chiara Oldani with the support of the Guido Carli Association, showed a clear relationship between the different types of derivatives contracts, including those of stock ...

Assaf Razin: The Next Stage of the Global Financial Crisis The

... the standard. The maintenance of a fixed parity with gold collided with the use of monetary policy to offset domestic unemployment during the first three years of the great depression. For this reason the US abandoned the gold standard under Roosevelt. Obviously, since the $ is floating vis-à-vis ot ...

... the standard. The maintenance of a fixed parity with gold collided with the use of monetary policy to offset domestic unemployment during the first three years of the great depression. For this reason the US abandoned the gold standard under Roosevelt. Obviously, since the $ is floating vis-à-vis ot ...

The Great Recession in Historical Context Peter Temin MIT

... resulted, revealing both the inaccuracy of the standard’s underlying assumptions and the strength of the economic policies based on those assumptions. In this context, the United States took over the position of leading international lender and exported massive amounts of capital to Germany in the ...

... resulted, revealing both the inaccuracy of the standard’s underlying assumptions and the strength of the economic policies based on those assumptions. In this context, the United States took over the position of leading international lender and exported massive amounts of capital to Germany in the ...

The World`s Reserve Currency A Gift and a Curse

... In July 1944, still in the midst of World War II, 730 delegates from all 44 Allied nations gathered in Bretton Woods, New Hampshire, for what later became known as the Bretton Woods Conference. The common goal was to avoid a repeat of the Great Depression through a greater level of cooperation among ...

... In July 1944, still in the midst of World War II, 730 delegates from all 44 Allied nations gathered in Bretton Woods, New Hampshire, for what later became known as the Bretton Woods Conference. The common goal was to avoid a repeat of the Great Depression through a greater level of cooperation among ...

Safety is our 1° commandment

... or the exchange of specific goods. • An embargo is usually created as a result of unfavorable political or economic circumstances between nations. • The restriction looks to isolate the country and create difficulties for its governing body, forcing it to act on the underlying issue. ...

... or the exchange of specific goods. • An embargo is usually created as a result of unfavorable political or economic circumstances between nations. • The restriction looks to isolate the country and create difficulties for its governing body, forcing it to act on the underlying issue. ...

PDF Download

... severely (and even to run current surpluses), some other countries in the global economy will have to find alternative sources of aggregate demand. These will not be easily generated unless some chronicallysurplus countries, which have been storing up reserves, are willing and able to reduce their o ...

... severely (and even to run current surpluses), some other countries in the global economy will have to find alternative sources of aggregate demand. These will not be easily generated unless some chronicallysurplus countries, which have been storing up reserves, are willing and able to reduce their o ...

B. Exchange Rates and the Foreign Exchange Market Exchange

... Can calculate one country’s prices in terms of the other country’s currency ...

... Can calculate one country’s prices in terms of the other country’s currency ...

How `Shock Therapy` Has Ruined Russia

... on currencies and the main cause of monetary instability. This exposes how a pseudo-technical argument cloaks the hypocrisy presiding over the so-called depoliticization ...

... on currencies and the main cause of monetary instability. This exposes how a pseudo-technical argument cloaks the hypocrisy presiding over the so-called depoliticization ...

The New Partnership for Africa’s Development (NEPAD) and

... Annual inflation rate < 9%. Central Bank credit to finance budget deficit <10% of previous year’s tax revenue. External reserves as months of imports ≥ 3 months. ...

... Annual inflation rate < 9%. Central Bank credit to finance budget deficit <10% of previous year’s tax revenue. External reserves as months of imports ≥ 3 months. ...

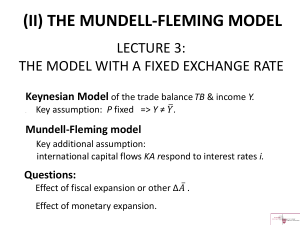

IS` i Y

... themselves with BoP surpluses during 2003-08 & 2010-13? • Strong economic performance (especially Asia) -- IS shifts right. • Easy monetary policy in US and other major industrialized countries (low i*) -- BP shifts down. ...

... themselves with BoP surpluses during 2003-08 & 2010-13? • Strong economic performance (especially Asia) -- IS shifts right. • Easy monetary policy in US and other major industrialized countries (low i*) -- BP shifts down. ...

Document

... The main rules of the Fiscal Compact are: National “debt brakes”/”golden rules”: The FC Member States commit to pass a national law or an amendment of the national constitution that limits the structural budget deficit to 0.5% of GDP, from which a deviation is only allowed in “exceptional circumst ...

... The main rules of the Fiscal Compact are: National “debt brakes”/”golden rules”: The FC Member States commit to pass a national law or an amendment of the national constitution that limits the structural budget deficit to 0.5% of GDP, from which a deviation is only allowed in “exceptional circumst ...

thgadvisers.com

... In the last 4 years US has indulged in massive money printing also called Quantitative Easing (QE), this has resulted in falling value of the US Dollar. Gold is bought and sold in U.S. dollars, so any decline in the value of the dollar causes the price of gold to rise. ...

... In the last 4 years US has indulged in massive money printing also called Quantitative Easing (QE), this has resulted in falling value of the US Dollar. Gold is bought and sold in U.S. dollars, so any decline in the value of the dollar causes the price of gold to rise. ...

Case studies in international macroeconomics - Ruhr

... central bank, and the financial system. Each group should work closely together in designing the adjustment program given the linkages among the sectors. You will jointly present the program, designed for avoiding a financial crisis. In the first session, the class will jointly identify the linkage ...

... central bank, and the financial system. Each group should work closely together in designing the adjustment program given the linkages among the sectors. You will jointly present the program, designed for avoiding a financial crisis. In the first session, the class will jointly identify the linkage ...

Balance of Payments

... 4. Changes in relative Interest RatesEx: US has a higher interest rate than Britain. British people want to put money in US banks Capital Flow increase towards the US British demand for U.S. dollars increases… British supply more pounds Pound-depreciates Dollar- appreciates ...

... 4. Changes in relative Interest RatesEx: US has a higher interest rate than Britain. British people want to put money in US banks Capital Flow increase towards the US British demand for U.S. dollars increases… British supply more pounds Pound-depreciates Dollar- appreciates ...

Is Europe an Optimum Currency Area?

... • He characterized an optimum currency area as a set of regions among which the propensity to migrate is high enough to ensure full employment when one of the regions faces an asymmetric shock. Other researchers extended the theory and identified additional criteria, such as capital mobility, region ...

... • He characterized an optimum currency area as a set of regions among which the propensity to migrate is high enough to ensure full employment when one of the regions faces an asymmetric shock. Other researchers extended the theory and identified additional criteria, such as capital mobility, region ...

Document

... If demand shifts from products of country B to products of country A, a depreciation of the B currency would restore external balance, relieve unemployment in B and contain inflation in A. "This is the most favourable case for flexible rates based on national currencies". But the continent (USA) is ...

... If demand shifts from products of country B to products of country A, a depreciation of the B currency would restore external balance, relieve unemployment in B and contain inflation in A. "This is the most favourable case for flexible rates based on national currencies". But the continent (USA) is ...

Monetary Policy Review – August 2007

... Reserve money targets, both in terms of end-month and monthly averages, for the first seven months of 2007, were comfortably achieved as a result of the continuation of tight monetary policy stance. The continuation of the tight monetary conditions would help achieving the reserve money targets by ...

... Reserve money targets, both in terms of end-month and monthly averages, for the first seven months of 2007, were comfortably achieved as a result of the continuation of tight monetary policy stance. The continuation of the tight monetary conditions would help achieving the reserve money targets by ...

The Canadian Dollar - Cold Lake Middle School

... among two or more countries to lower or eliminate taxes on goods or services coming from the other countries who are part of the agreement. ...

... among two or more countries to lower or eliminate taxes on goods or services coming from the other countries who are part of the agreement. ...

U.S. M P I W

... Henning, “The legal right of both the Fed and the Treasury to buy and sell foreign currencies is undisputed.”1 But, they go on to write, “The Treasury has nonetheless maintained its legal right to block Fed intervention on the grounds that the Secretary is the chief financial officer of the U.S. gov ...

... Henning, “The legal right of both the Fed and the Treasury to buy and sell foreign currencies is undisputed.”1 But, they go on to write, “The Treasury has nonetheless maintained its legal right to block Fed intervention on the grounds that the Secretary is the chief financial officer of the U.S. gov ...

Practice e answers for final

... 2. During the 1997-1998 Asian financial crisis, Indonesia, Korea, Malaysia, Korea suffered from speculative attacks on their currencies. Before the crisis, Korea had its currency (the won) pegged to the U.S. dollar. Except for Malaysia, these countries have since moved to floating exchange rates, an ...

... 2. During the 1997-1998 Asian financial crisis, Indonesia, Korea, Malaysia, Korea suffered from speculative attacks on their currencies. Before the crisis, Korea had its currency (the won) pegged to the U.S. dollar. Except for Malaysia, these countries have since moved to floating exchange rates, an ...

Study Problems The data for Study Problems 17-1 through 17

... 17-1. (Spot exchange rates) An American business needs to pay (a) 10,000 Canadian dollars, (b) 2 million yen, and (c) 50,000 Swiss francs to businesses abroad. What are the dollar payments to the respective countries? 17-2. (Spot exchange rates) An American business pays $10,000, $15,000, and $20,00 ...

... 17-1. (Spot exchange rates) An American business needs to pay (a) 10,000 Canadian dollars, (b) 2 million yen, and (c) 50,000 Swiss francs to businesses abroad. What are the dollar payments to the respective countries? 17-2. (Spot exchange rates) An American business pays $10,000, $15,000, and $20,00 ...

Turkish Crisis of 2001

... – Net Capital inflows of $15.2 billion in 2000 – Interest rate fell from 106% to 37% – Economic growth of 6.5% up from –6% in ...

... – Net Capital inflows of $15.2 billion in 2000 – Interest rate fell from 106% to 37% – Economic growth of 6.5% up from –6% in ...