Market Risk Management guideline for Co

... the CFI retail bond, might be affected by increasing or decreasing returns on their investments b) Equity risk: - If the price of equities listed and traded on the major stock exchanges changes, then the CFI balance sheet may be affected by a fall in the value of its equities or bonds. Even if equit ...

... the CFI retail bond, might be affected by increasing or decreasing returns on their investments b) Equity risk: - If the price of equities listed and traded on the major stock exchanges changes, then the CFI balance sheet may be affected by a fall in the value of its equities or bonds. Even if equit ...

Lei, Noussair, and Plott: Non-Speculative Bubbles in Experimental

... • Two possible explanations for the occurrence of bubbles are the “speculative hypothesis” and the “active participation hypothesis.” In the first, traders are hoping to take advantage of irrational individuals or other speculators to make a large profit through capital gains. In other words, they a ...

... • Two possible explanations for the occurrence of bubbles are the “speculative hypothesis” and the “active participation hypothesis.” In the first, traders are hoping to take advantage of irrational individuals or other speculators to make a large profit through capital gains. In other words, they a ...

Estimation of efficiency to foreign economic activity of enterprise

... transport costs, the customs duties, detour of non- tariff barriers, and also economy of industrial expenses (cost of raw materials, energy, wages, deductions on social insurance, etc Detour-обход Notable economic gains-Ощутимые экономические выгоды ...

... transport costs, the customs duties, detour of non- tariff barriers, and also economy of industrial expenses (cost of raw materials, energy, wages, deductions on social insurance, etc Detour-обход Notable economic gains-Ощутимые экономические выгоды ...

Document

... firm size, industry affiliation, ownership concentration, ownership type, and financial performance), and stock market’s specific factors (tick size)), were significantly affected the relative bid-ask spread in ASE except the industry affiliation variable. Also, the cross-sectional variation in spre ...

... firm size, industry affiliation, ownership concentration, ownership type, and financial performance), and stock market’s specific factors (tick size)), were significantly affected the relative bid-ask spread in ASE except the industry affiliation variable. Also, the cross-sectional variation in spre ...

2.03-PowerPoint

... Shareholders have partial ownership in the corporation Corporations are permitted to sell stock to raise capital for the corporation Shareholders may receive dividend payments from the corporation ...

... Shareholders have partial ownership in the corporation Corporations are permitted to sell stock to raise capital for the corporation Shareholders may receive dividend payments from the corporation ...

Directive 6: Market Information

... automated trading systems. This is conditional upon the participant using the price data exclusively for trading on SIX Swiss Exchange markets, confirmation of which must be provided by the compliance officer. ...

... automated trading systems. This is conditional upon the participant using the price data exclusively for trading on SIX Swiss Exchange markets, confirmation of which must be provided by the compliance officer. ...

How did the stock market work?

... The stock market was where shares of companies were sold. There were a number of stock markets across America. The largest one was the New York Stock Market situated on Wall Street. ...

... The stock market was where shares of companies were sold. There were a number of stock markets across America. The largest one was the New York Stock Market situated on Wall Street. ...

from the full article

... balanced funds annual returns have varied between minus 12% and plus 18% over the last nearly seven years with an average after tax annual return of between five and six percent. This is a similar average return for the average KiwiSaver growth funds, only here the range of results (minus 18% to plu ...

... balanced funds annual returns have varied between minus 12% and plus 18% over the last nearly seven years with an average after tax annual return of between five and six percent. This is a similar average return for the average KiwiSaver growth funds, only here the range of results (minus 18% to plu ...

Investments & the Stock Market PowerPoint

... Shareholders have partial ownership in the corporation Corporations are permitted to sell stock to raise capital for the corporation Shareholders may receive dividend payments from the corporation ...

... Shareholders have partial ownership in the corporation Corporations are permitted to sell stock to raise capital for the corporation Shareholders may receive dividend payments from the corporation ...

ARE INVESTORS MORE HOMO SAPIENS RATHER

... The concept of efficiency is crucial in economics. Widely, rational allocation of resources is attributed to efficiency of that market. Eugene Fama, a Nobel - prize winner, introduced for the very first time this concept in financial markets, which would bring the most debated and discussed theory i ...

... The concept of efficiency is crucial in economics. Widely, rational allocation of resources is attributed to efficiency of that market. Eugene Fama, a Nobel - prize winner, introduced for the very first time this concept in financial markets, which would bring the most debated and discussed theory i ...

Edition 2 - 2017 - VZD Capital Management

... the US economy is improving and making progress toward its objectives of full employment and price stability. Interest rates remain low by historic standards and ...

... the US economy is improving and making progress toward its objectives of full employment and price stability. Interest rates remain low by historic standards and ...

Chapter 2

... sale of debt or equity in the primary market. To underwrite a new security issue, the investment banker buys the entire issue at a guaranteed price from the issuing firm and resells the securities to institutional investors and the public. ...

... sale of debt or equity in the primary market. To underwrite a new security issue, the investment banker buys the entire issue at a guaranteed price from the issuing firm and resells the securities to institutional investors and the public. ...

THe NK Approach to Exchange Rate Policy Analysis: Looking Forward

... 1. Equity prices and real housing prices strongly co-move 2. Real ex. rates and housing prices (very) positively correlated 3. Real ex. rates and equity prices positively correlated, but less ...

... 1. Equity prices and real housing prices strongly co-move 2. Real ex. rates and housing prices (very) positively correlated 3. Real ex. rates and equity prices positively correlated, but less ...

Marketing 504

... Customers don’t know what they want Customer relations are problems for the marketing dept Customer data are a control mechanism and channels are conduits New accounts (conquests) are what matters ...

... Customers don’t know what they want Customer relations are problems for the marketing dept Customer data are a control mechanism and channels are conduits New accounts (conquests) are what matters ...

Great Depression - Overview

... company is worth investing in. If the company shows low profits, most investors will stay away until something changes. Sometimes people hold on to their stocks, hoping a bull market allows them to make a greater profit. In a bear market, investors will often sell off their shares in order to avoid ...

... company is worth investing in. If the company shows low profits, most investors will stay away until something changes. Sometimes people hold on to their stocks, hoping a bull market allows them to make a greater profit. In a bear market, investors will often sell off their shares in order to avoid ...

Introduction to Financial Markets, Institutions, and Systems Learning

... there is a continual desire to improve both the operational effectiveness of markets—along with ensuring that fairness and ethics play a key part in the overall approach that financial institutions use when dealing within our society as a whole. Read the following article: Go to your favorite search ...

... there is a continual desire to improve both the operational effectiveness of markets—along with ensuring that fairness and ethics play a key part in the overall approach that financial institutions use when dealing within our society as a whole. Read the following article: Go to your favorite search ...

Marketing 504

... Customers don’t know what they want Customer relations are problems for the marketing dept Customer data are a control mechanism and channels are conduits New accounts (conquests) are what matters ...

... Customers don’t know what they want Customer relations are problems for the marketing dept Customer data are a control mechanism and channels are conduits New accounts (conquests) are what matters ...

AGENDA ITEM

... prospective end 2006 price earnings ratio of 13.6, the US of 15.0 and Eurozone of 13.0. This could allow western markets to make further progress during the first half of 2006, supported by artificially low bond yields, but the UK market could encounter technical resistance around 6000 on the FTSE 1 ...

... prospective end 2006 price earnings ratio of 13.6, the US of 15.0 and Eurozone of 13.0. This could allow western markets to make further progress during the first half of 2006, supported by artificially low bond yields, but the UK market could encounter technical resistance around 6000 on the FTSE 1 ...

2. Case Study - Emma Perfect, Lux Assure Ltd

... 73/100 One cited estimate claims the CI market could be worth $ 5bn although the timescale is not indicated….The market dynamics could have focussed more on market growth and competitors….A return on investment should have been quantified. What is not presented is evidence to provide confidence that ...

... 73/100 One cited estimate claims the CI market could be worth $ 5bn although the timescale is not indicated….The market dynamics could have focussed more on market growth and competitors….A return on investment should have been quantified. What is not presented is evidence to provide confidence that ...

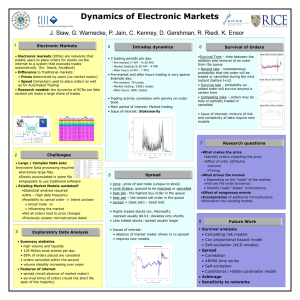

SciDAC Poster: INCITE

... • Trading activity correlates with activity on order book • Main period of interest: Market trading • Issue of interest: Stationarity ...

... • Trading activity correlates with activity on order book • Main period of interest: Market trading • Issue of interest: Stationarity ...

Commission Vice Chairman James Cawley

... periods, and (4) lack of any clear description of a consumer education program. Moreover, UGI continues to charge demand charges to a number of larger C&I ...

... periods, and (4) lack of any clear description of a consumer education program. Moreover, UGI continues to charge demand charges to a number of larger C&I ...

Capacity Markets Are Not the Optimal Means to Determine a

... every MW is paid the same, regardless of technology, fuel access, age, emissions, etc. • 98% of the new MW in 2013 and 96% in 2014 required a long-term contract, ownership, or financial hedge. ...

... every MW is paid the same, regardless of technology, fuel access, age, emissions, etc. • 98% of the new MW in 2013 and 96% in 2014 required a long-term contract, ownership, or financial hedge. ...

Hannah Capital Markets Proposal April 2006 Economic History

... government, so French railway companies raised a lot of fixed interest capital and only limited equities. Second, the regulatory regimes and technical and market conditions for railways were by the 1890s sufficiently distinctive that, except in America, where railroads routinely defaulted, investors ...

... government, so French railway companies raised a lot of fixed interest capital and only limited equities. Second, the regulatory regimes and technical and market conditions for railways were by the 1890s sufficiently distinctive that, except in America, where railroads routinely defaulted, investors ...

Slide 1

... risks of climate change has figured prominently on the international agenda A variety of approaches are being implemented to reduce carbon emissions. ...

... risks of climate change has figured prominently on the international agenda A variety of approaches are being implemented to reduce carbon emissions. ...