Fourth Quarter 2016

... post-election. With these growth bursts and the anticipation of imminent rising rates, the bond market took a hit of 2.3% 2. We will discuss this further later in this report. Growth expectations based on Trump’s promises have led to a dramatic 12.5% jump in consumer sentiment in just two months to ...

... post-election. With these growth bursts and the anticipation of imminent rising rates, the bond market took a hit of 2.3% 2. We will discuss this further later in this report. Growth expectations based on Trump’s promises have led to a dramatic 12.5% jump in consumer sentiment in just two months to ...

Monetary Policy, Private Information, and

... These shocks are quantitatively important. For example, a shock of one standard deviation to private information about future U.S. interest rates is equivalent to almost 25 per cent of the standard deviation of the total factor driving weekly returns. A similar shock to private information about U.S ...

... These shocks are quantitatively important. For example, a shock of one standard deviation to private information about future U.S. interest rates is equivalent to almost 25 per cent of the standard deviation of the total factor driving weekly returns. A similar shock to private information about U.S ...

demand4

... • a change in pi (Dpi), other prices and budget remaining the same, result in a change in the quantity purchased of good i (Dxi) Individual Demand corresponds to the function that describes the relation between the price and the quantity of a good purchased by an individual maximising his satisfacti ...

... • a change in pi (Dpi), other prices and budget remaining the same, result in a change in the quantity purchased of good i (Dxi) Individual Demand corresponds to the function that describes the relation between the price and the quantity of a good purchased by an individual maximising his satisfacti ...

The course presents an introduction to financial intermediation and

... trading industry with special focus on: role of banks and stability of the banking system, market structures (trading sessions and execution systems), order properties (market, limit and stop orders), and market participants (retail investors, brokers, dealers, ...

... trading industry with special focus on: role of banks and stability of the banking system, market structures (trading sessions and execution systems), order properties (market, limit and stop orders), and market participants (retail investors, brokers, dealers, ...

ppt

... By the end of this course, you will have done, or be able to: • Understand why firms and nations seek out and benefit from international business activities. • Analyze and identify factors that cause exchange rates to change. • Identify the linkages between international financial prices. • Understa ...

... By the end of this course, you will have done, or be able to: • Understand why firms and nations seek out and benefit from international business activities. • Analyze and identify factors that cause exchange rates to change. • Identify the linkages between international financial prices. • Understa ...

rainbow trading corporation spyglass trading. lp

... short put or call • Later add a short of the opposite option • Little to no additional margin required • Risk needs to be low to be effective ...

... short put or call • Later add a short of the opposite option • Little to no additional margin required • Risk needs to be low to be effective ...

Situation analysis. In a marketing plan, situation

... There are many different types of marketing objectives that a company can set for itself. They can relate to issues including target markets, promotions, channels of distribution, and even the research and development of new products. A marketing plan may even include different sets of objectives f ...

... There are many different types of marketing objectives that a company can set for itself. They can relate to issues including target markets, promotions, channels of distribution, and even the research and development of new products. A marketing plan may even include different sets of objectives f ...

Access Charges, Reciprocal Compensation and Universal Service

... • phases: set-up, capacity, usage-sensitive ...

... • phases: set-up, capacity, usage-sensitive ...

Chapter 2

... • Threat of new entrants and more competition • Industry indicators Copyright © 2009 Pearson Education Canada ...

... • Threat of new entrants and more competition • Industry indicators Copyright © 2009 Pearson Education Canada ...

ch.11

... the market value of a mutual fund share found by dividing the net value of the fund by the number of shares issued ...

... the market value of a mutual fund share found by dividing the net value of the fund by the number of shares issued ...

here

... Recent events in the global financial markets suggest a need for a better understanding of financial institutions and, possibly, a different approach to their regulation. Whatever the outcome of the immediate crisis and response, a more sophisticated understanding of regulation—more empirically root ...

... Recent events in the global financial markets suggest a need for a better understanding of financial institutions and, possibly, a different approach to their regulation. Whatever the outcome of the immediate crisis and response, a more sophisticated understanding of regulation—more empirically root ...

Secondary Market Regulations of Government Bonds

... Over a yield curve ranging from 3% for 1 year to 8% for 10 years ...

... Over a yield curve ranging from 3% for 1 year to 8% for 10 years ...

During the 10 week period of the stock market simulation, the market

... commitment to keeping interest rates low for “an extended period of time” has provided for investor confidence which contributed to the dramatic spike in investment that has fueled a large portion of the economic recovery. While the economy is rebounding from the recession, improvements are still co ...

... commitment to keeping interest rates low for “an extended period of time” has provided for investor confidence which contributed to the dramatic spike in investment that has fueled a large portion of the economic recovery. While the economy is rebounding from the recession, improvements are still co ...

Do Financial Markets Support Innovation or Inequity William Lazonick

... o How important have the government-funded knowledge base and government subsidies been in financing the drug development process? o To what extent has the equity finance that has flowed into the biotech industry actually funded drug development? o If this equity finance did not fund innovation, the ...

... o How important have the government-funded knowledge base and government subsidies been in financing the drug development process? o To what extent has the equity finance that has flowed into the biotech industry actually funded drug development? o If this equity finance did not fund innovation, the ...

Martial law`s end may spur foreign flows

... Thailand remains a top destination for Japanese investment, Mr Prinn says. ...

... Thailand remains a top destination for Japanese investment, Mr Prinn says. ...

Incentive to reduce milk production – why now and why at

... some producers to actually increase production, speculating on a positive effect on milk prices of the scheme. There is also a broader free rider problem as developments in the EU are not isolated from the world market, meaning that producers in other regions can take advantage of lower volumes in E ...

... some producers to actually increase production, speculating on a positive effect on milk prices of the scheme. There is also a broader free rider problem as developments in the EU are not isolated from the world market, meaning that producers in other regions can take advantage of lower volumes in E ...

Financial Accounting Theory

... 1.8 Role of Standard Setting (continued) • Standard setting mediates between conflicting interests of investors and managers – Investors want lots of useful information – Managers may object to releasing all the information ...

... 1.8 Role of Standard Setting (continued) • Standard setting mediates between conflicting interests of investors and managers – Investors want lots of useful information – Managers may object to releasing all the information ...

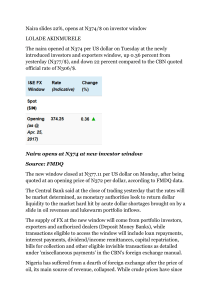

Naira opens at N374 at new investor window Source

... The new window closed at N377.11 per US dollar on Monday, after being quoted at an opening price of N372 per dollar, according to FMDQ data. The Central Bank said at the close of trading yesterday that the rates will be market determined, as monetary authorities look to return dollar liquidity to th ...

... The new window closed at N377.11 per US dollar on Monday, after being quoted at an opening price of N372 per dollar, according to FMDQ data. The Central Bank said at the close of trading yesterday that the rates will be market determined, as monetary authorities look to return dollar liquidity to th ...

POLICY: MARKET DISCLOSURE GENERAL PRINCIPLES 1.1 The

... the New Zealand Securities Markets Act 1988. As such this requires compliance with the most onerous of the disclosure obligations if there is more than one obligation that is applicable. ...

... the New Zealand Securities Markets Act 1988. As such this requires compliance with the most onerous of the disclosure obligations if there is more than one obligation that is applicable. ...

Information Disclosure and Market Quality

... Regulation Fair Disclosure Mandated that all publicly traded companies must disclose material information to all investors at the same time. The regulation sought to stamp out selective disclosure. Regulation FD changed fundamentally how companies communicate with investors, by bringing better ...

... Regulation Fair Disclosure Mandated that all publicly traded companies must disclose material information to all investors at the same time. The regulation sought to stamp out selective disclosure. Regulation FD changed fundamentally how companies communicate with investors, by bringing better ...

Regional Equity Market Integration in South America

... Pownall et. al found that the volume of trade of stocks of companies who voluntarily conformed to standard international practices was higher, as was their accounting quality ...

... Pownall et. al found that the volume of trade of stocks of companies who voluntarily conformed to standard international practices was higher, as was their accounting quality ...

addressing emerging risks in the nigerian

... The macroeconomic environment in Nigeria Nigeria’s economy is facing very challenging times Following over a decade of impressive above 7% growth rate, the economy has significantly slowed to only 2.82% in ...

... The macroeconomic environment in Nigeria Nigeria’s economy is facing very challenging times Following over a decade of impressive above 7% growth rate, the economy has significantly slowed to only 2.82% in ...

2.1 Mixed and Market Economies

... X Regulations can increase production costs and therefore reduce the profitability and supply of some goods and services X Public sector organizations may be inefficient and produce poor-quality goods and services because they do not have to make a profit X Some government spending may be for politi ...

... X Regulations can increase production costs and therefore reduce the profitability and supply of some goods and services X Public sector organizations may be inefficient and produce poor-quality goods and services because they do not have to make a profit X Some government spending may be for politi ...

During the application of the GBER (the Regulation) at national level

... During the application of the GBER (the Regulation) at national level, the following questions regarding the provisions of Art. 5 emerged. They are not interpreted in the FAQ and ECN-ET. Art. 5, par. 1 of the GBER stipulates that the Regulation shall apply only to aid in respect of which it is possi ...

... During the application of the GBER (the Regulation) at national level, the following questions regarding the provisions of Art. 5 emerged. They are not interpreted in the FAQ and ECN-ET. Art. 5, par. 1 of the GBER stipulates that the Regulation shall apply only to aid in respect of which it is possi ...

Market, Labour Market

... If demand exceeds supply, the price increases. If supply exceeds demand, the supplier decreases the prices to encourage customers to buy more. The price and quantity are inversely related. ...

... If demand exceeds supply, the price increases. If supply exceeds demand, the supplier decreases the prices to encourage customers to buy more. The price and quantity are inversely related. ...