Are Stocks Expensive? - Zevin Asset Management

... forecast of the future is highly uncertain and risks abound to this relatively calm outlook. At the moment Japan is treading a dangerous course in raising the value-added tax while its domestic economy is still weak. In China the plan to transition the economy towards more household consumption and ...

... forecast of the future is highly uncertain and risks abound to this relatively calm outlook. At the moment Japan is treading a dangerous course in raising the value-added tax while its domestic economy is still weak. In China the plan to transition the economy towards more household consumption and ...

Slide 1

... • A market is a place where buyers and sellers come together to conduct a transaction together • Markets left to operate freely have a good chance of operating efficiently • By operating efficiently, business costs can be kept low in order to improve profits • In this way, the market ensures that th ...

... • A market is a place where buyers and sellers come together to conduct a transaction together • Markets left to operate freely have a good chance of operating efficiently • By operating efficiently, business costs can be kept low in order to improve profits • In this way, the market ensures that th ...

Wholesale Market - Danish Energy Association

... The Danish Energi Association supports the EC in their suggestion. We believe that all products which are needed to operate the power system – frequency or non-frequency – must be procured in market places. If not there is a risk that valuable assets will close, because owners do not see price signa ...

... The Danish Energi Association supports the EC in their suggestion. We believe that all products which are needed to operate the power system – frequency or non-frequency – must be procured in market places. If not there is a risk that valuable assets will close, because owners do not see price signa ...

Perfect Competition – Economics of Competitive Markets

... of persuasive marketing and advertising. In every industry we can find examples of asymmetric information where the seller knows more about quality of good than buyer – a frequently quoted example is the market for second-hand cars! The real world is one in which negative and positive externalities ...

... of persuasive marketing and advertising. In every industry we can find examples of asymmetric information where the seller knows more about quality of good than buyer – a frequently quoted example is the market for second-hand cars! The real world is one in which negative and positive externalities ...

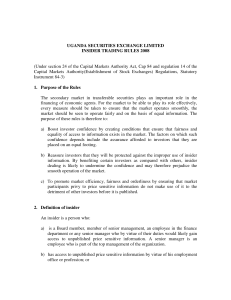

USE Insider Trading Rules-2009

... equality of access to information exists in the market. The factors on which such confidence depends include the assurance afforded to investors that they are placed on an equal footing. b) Reassure investors that they will be protected against the improper use of insider information. By benefiting ...

... equality of access to information exists in the market. The factors on which such confidence depends include the assurance afforded to investors that they are placed on an equal footing. b) Reassure investors that they will be protected against the improper use of insider information. By benefiting ...

Learning Goals

... pay it, and considering that any trader can either put in a limit or market order and so, in equilibrium, would be indifferent between the two, it must be the case that the net costs for the two types of trades are equal. Hence l-s = s+m, or s = (l-m)/2 That is, the bid-ask spread (i.e. the differen ...

... pay it, and considering that any trader can either put in a limit or market order and so, in equilibrium, would be indifferent between the two, it must be the case that the net costs for the two types of trades are equal. Hence l-s = s+m, or s = (l-m)/2 That is, the bid-ask spread (i.e. the differen ...

Firms and Financial Markets

... – If you only have limited amount of money and want to spread them in may different stocks. • If the idea of mutual funds is for the benefit of diversification, then the idea of an ETF comes from standardization and securitization – through securitization, one gains access to a much wider investor b ...

... – If you only have limited amount of money and want to spread them in may different stocks. • If the idea of mutual funds is for the benefit of diversification, then the idea of an ETF comes from standardization and securitization – through securitization, one gains access to a much wider investor b ...

Mortgage crisis in the US, economic slowdown in Europe

... The IMF reported that in 2003, the bulk of mortgage financings had a "prime confirming" status, and that the percentage had fallen to 36% in 2006, while 21% had a subprime status and 25% were rated Alt-A, i.e. low ...

... The IMF reported that in 2003, the bulk of mortgage financings had a "prime confirming" status, and that the percentage had fallen to 36% in 2006, while 21% had a subprime status and 25% were rated Alt-A, i.e. low ...

Problem set 11 - The University of Chicago Booth School of Business

... rises with the square root of horizon. Is the implication that stocks are better for long-run investors in this situation right? (e) What considerations are left out of this problem that might tilt the optimum towards stocks for longer horizon investors? (Note, not necessary to do the problem. Where ...

... rises with the square root of horizon. Is the implication that stocks are better for long-run investors in this situation right? (e) What considerations are left out of this problem that might tilt the optimum towards stocks for longer horizon investors? (Note, not necessary to do the problem. Where ...

What are stocks? - Buncombe County Schools

... • Shareholders have partial ownership in the corporation • Corporations are permitted to sell stock to raise capital for the corporation • Shareholders may receive dividend payments from the corporation ...

... • Shareholders have partial ownership in the corporation • Corporations are permitted to sell stock to raise capital for the corporation • Shareholders may receive dividend payments from the corporation ...

Profit-oriented pricing

... 10. Introductory stage: The product life cycle stage when the product first appears in the marketplace 11. Law of supply and demand: Economic principle which states that the supply of a good or service will increase when demand is great and decrease when demand is low 12. Market price: Actual price ...

... 10. Introductory stage: The product life cycle stage when the product first appears in the marketplace 11. Law of supply and demand: Economic principle which states that the supply of a good or service will increase when demand is great and decrease when demand is low 12. Market price: Actual price ...

The Role of Financial Markets and Institutions(1)

... Investor receives dividends if declared Capital gain/loss when sold No maturity date—need market to sell ...

... Investor receives dividends if declared Capital gain/loss when sold No maturity date—need market to sell ...

Electricity Markets Market Power Definition Monopoly Power

... contrary to what occurs in forward markets Withholding in forward markets means only arbitrage But in the long-run, RT price levels are reflected in forward price Expected forward prices play a role when assessing the profitability of RT price distortions That role depends on how next period s contr ...

... contrary to what occurs in forward markets Withholding in forward markets means only arbitrage But in the long-run, RT price levels are reflected in forward price Expected forward prices play a role when assessing the profitability of RT price distortions That role depends on how next period s contr ...

International financial and foreign exchange markets Tentative

... FX market efficiency and the art of exchange rate forecasting (A. Ziliotto) Theoretical overview and available empirical evidence: could there be profitable trading strategies? Textbook chapter: XVI The infrastructure of international finance: historical evolution and current situation (G. Schlitzer ...

... FX market efficiency and the art of exchange rate forecasting (A. Ziliotto) Theoretical overview and available empirical evidence: could there be profitable trading strategies? Textbook chapter: XVI The infrastructure of international finance: historical evolution and current situation (G. Schlitzer ...

Lessons from the Financial Crisis

... In September 2008, several events, including a run on money market funds, nationalization of AIG, Fannie Mae, and Freddie Mac, and particularly the collapse of Lehman Brothers, trigger a massive financial crisis. Banks balance sheets contract because of massive losses on assets and withdrawal of sho ...

... In September 2008, several events, including a run on money market funds, nationalization of AIG, Fannie Mae, and Freddie Mac, and particularly the collapse of Lehman Brothers, trigger a massive financial crisis. Banks balance sheets contract because of massive losses on assets and withdrawal of sho ...

NSE/CMTR/34693 Date

... Members are requested to note that the change in the market lot for the above mentioned security shall be effective from May 22, 2017. Further, members are advised to load the updated security.gz/nnf_security.gz file in the trading application before trading on May 22, 2017. These files can be obtai ...

... Members are requested to note that the change in the market lot for the above mentioned security shall be effective from May 22, 2017. Further, members are advised to load the updated security.gz/nnf_security.gz file in the trading application before trading on May 22, 2017. These files can be obtai ...

Data Mining BS/MS Project

... allow investing companies to thrive • Identifying attributes that correlate with success in the stock market may lead to finding causation – If causes of success can be controlled, the economy can be pushed in a good direction ...

... allow investing companies to thrive • Identifying attributes that correlate with success in the stock market may lead to finding causation – If causes of success can be controlled, the economy can be pushed in a good direction ...

PRINCIPLES OF INVESTMENT MAY 2012

... Money market securities are essentially IOUs issued by governments, financial institutions and large corporations. These instruments are very liquid and considered extraordinarily safe. Because they are extremely conservative, money market securities offer significantly lower returns than most other ...

... Money market securities are essentially IOUs issued by governments, financial institutions and large corporations. These instruments are very liquid and considered extraordinarily safe. Because they are extremely conservative, money market securities offer significantly lower returns than most other ...

Mini Case (p.45) A. Why is corporate finance important to all

... D. What should be the primary objective of managers? Manager’s primary objective is stockholder wealth maximization. Normatively, managers should always have the best interests of all stakeholders in mind with each decision they make on behalf of the firm. ...

... D. What should be the primary objective of managers? Manager’s primary objective is stockholder wealth maximization. Normatively, managers should always have the best interests of all stakeholders in mind with each decision they make on behalf of the firm. ...

Subscribe

... ANNUAL SUBSCRIPTION An annual subscription to the CBSA Flash Market Trend Report is included in the annual membership dues for service centers and suppliers. Research analysts may subscribe to the report for $199/year. Distribution is electronic. Payment must accompany this subscription form. Yes, ...

... ANNUAL SUBSCRIPTION An annual subscription to the CBSA Flash Market Trend Report is included in the annual membership dues for service centers and suppliers. Research analysts may subscribe to the report for $199/year. Distribution is electronic. Payment must accompany this subscription form. Yes, ...

Lecture 06.2

... – tend to become less efficient and innovative over time, • "complacent giants", do not have to be efficient or innovative to compete in the marketplace. ...

... – tend to become less efficient and innovative over time, • "complacent giants", do not have to be efficient or innovative to compete in the marketplace. ...

How Efficient Markets Undervalue Stocks: CAPM and ECMH under

... statistically greater chance of doing so again in the next period.' In other words, although most fund managers don't beat the market's return, those who do seem to be able to beat it with some 7 As Professors Brealey and Myers put it, efficient market theory teaches that investors should "trust mar ...

... statistically greater chance of doing so again in the next period.' In other words, although most fund managers don't beat the market's return, those who do seem to be able to beat it with some 7 As Professors Brealey and Myers put it, efficient market theory teaches that investors should "trust mar ...

The Stock Exchange Corner

... size and liquidity of the issue. In other markets good quality corporate bonds can have an interest rate about one percent more than a government bond (meaning that if the Government is borrowing at 5%, a good corporate issuer may borrow at 6%) Shares – which represent part ownership of a company – ...

... size and liquidity of the issue. In other markets good quality corporate bonds can have an interest rate about one percent more than a government bond (meaning that if the Government is borrowing at 5%, a good corporate issuer may borrow at 6%) Shares – which represent part ownership of a company – ...

Market outlook Indian markets witnessed a fall partly due to

... efficacy of global monetary easing. The money-pumping exercise had been leading to asset prices reflation but without a commensurate impact on real economy. Stagnant real incomes and rising income and wealth inequality in developed market led to increased discontentment among the population at large ...

... efficacy of global monetary easing. The money-pumping exercise had been leading to asset prices reflation but without a commensurate impact on real economy. Stagnant real incomes and rising income and wealth inequality in developed market led to increased discontentment among the population at large ...

Powerpoint document

... 1. Restoration of political power of capital and the plutocracy -- reminiscent of the 1920s; extreme inequality of income, wealth & life chances is obverse of wealth of plutocracy. 2. Disciplinary neo-liberalism extends power of capital and market discipline in social life; extension of markets is a ...

... 1. Restoration of political power of capital and the plutocracy -- reminiscent of the 1920s; extreme inequality of income, wealth & life chances is obverse of wealth of plutocracy. 2. Disciplinary neo-liberalism extends power of capital and market discipline in social life; extension of markets is a ...