STOCKS

... Job seekers line up to register at a City of Miami job fair in Miami, Tuesday, Jan. 26, 2010. Florida's unemployment rate hit 11.8 percent, the highest in Florida in almost 35 years. Nearly 1,087,000 workers were searching for a paycheck in ...

... Job seekers line up to register at a City of Miami job fair in Miami, Tuesday, Jan. 26, 2010. Florida's unemployment rate hit 11.8 percent, the highest in Florida in almost 35 years. Nearly 1,087,000 workers were searching for a paycheck in ...

Capital Markets in Egypt

... - Strengthening insider-trading rules - Derivative instruments: provide hedging tools & help increase liquidity -- general principles of law provide legal basis (although no specific legal framework exist under Egyptian law) ...

... - Strengthening insider-trading rules - Derivative instruments: provide hedging tools & help increase liquidity -- general principles of law provide legal basis (although no specific legal framework exist under Egyptian law) ...

投影片 1

... • Might be both positive and negative • If γ is large enough, then E (RNT − RA) > 0 and noise traders prevail • This is because noise traders are more optimistic and take more risk • But by construction EUA > EUNT ...

... • Might be both positive and negative • If γ is large enough, then E (RNT − RA) > 0 and noise traders prevail • This is because noise traders are more optimistic and take more risk • But by construction EUA > EUNT ...

Is it time to change SOX? Solongo Batbaatar MA0N0228

... SOX impact on Market Efficiency • In 2002, the market value of the Wilshire 5000 for all public companies in US, stood at $10.5 trillion. • By April 2007, the value of the Wilshire 5000 was 14.5 trillion ...

... SOX impact on Market Efficiency • In 2002, the market value of the Wilshire 5000 for all public companies in US, stood at $10.5 trillion. • By April 2007, the value of the Wilshire 5000 was 14.5 trillion ...

It`s Probably a Bad Idea to Sell Stocks Because You Fear Trump

... First, much of the movement in stocks has little to do with what the president of the United States does. It would be silly to credit Bill Clinton with the dot-com boom that took place during his presidency, or to blame George W. Bush for the collapse of it. But even when the action in Washington i ...

... First, much of the movement in stocks has little to do with what the president of the United States does. It would be silly to credit Bill Clinton with the dot-com boom that took place during his presidency, or to blame George W. Bush for the collapse of it. But even when the action in Washington i ...

slides - Nicole Immorlica

... This paper: is there a natural non-centralized process? Can we avoid the “invisible auctioneer?” ...

... This paper: is there a natural non-centralized process? Can we avoid the “invisible auctioneer?” ...

Efficient Markets Today - The University of Chicago Booth School of

... At its heart, the efficient markets theory says that prices should equal expected discounted cashflows. In the early days, the “expected” part took center stage: Researchers focused on the “efficient” incorporation of information into prices. Since the early 1980s, however, our focus has been much m ...

... At its heart, the efficient markets theory says that prices should equal expected discounted cashflows. In the early days, the “expected” part took center stage: Researchers focused on the “efficient” incorporation of information into prices. Since the early 1980s, however, our focus has been much m ...

Document

... – Look at relation between individual stock and market. – Constructs portfolios based on stock’s β (‘beta’), the amount by which the stock reacts to the market – It says that the more you risk, the more you expect to be paid – It says that the most important risk investor face is the general state o ...

... – Look at relation between individual stock and market. – Constructs portfolios based on stock’s β (‘beta’), the amount by which the stock reacts to the market – It says that the more you risk, the more you expect to be paid – It says that the most important risk investor face is the general state o ...

Chapter 12.2 notes - Effingham County Schools

... • Consistency – invest consistently over long periods of time ...

... • Consistency – invest consistently over long periods of time ...

The Walrasian Model`s Assumptions

... as if its own actions will not affect prices. We might expect this to hold, for example, if there are many buyers and sellers in each market. How many? Some empirical evidence suggests that the number doesn’t have to be very large, perhaps as few as five or ten on each side of the market in many cas ...

... as if its own actions will not affect prices. We might expect this to hold, for example, if there are many buyers and sellers in each market. How many? Some empirical evidence suggests that the number doesn’t have to be very large, perhaps as few as five or ten on each side of the market in many cas ...

financial market rules for regulated markets

... to ensure that due notice of events and specified information is provided to the Authority for the proper fulfilment of its regulatory functions prescribed in the Act in relation to Regulated Markets. These Financial Market Rules also transpose certain provisions of the Markets in Financial Instrume ...

... to ensure that due notice of events and specified information is provided to the Authority for the proper fulfilment of its regulatory functions prescribed in the Act in relation to Regulated Markets. These Financial Market Rules also transpose certain provisions of the Markets in Financial Instrume ...

Q1 2009 Market Commentary (Excerpt)

... We are witnessing a market manipulation on an epic scale. The institutions that were desperate sellers with the S&P500 crashing below 700 are now equally desperate buyers at S&P 850! Now, as before in the Fall of 2008, bad news is “good news” to be bought, and good news causes “dancing in the aisles ...

... We are witnessing a market manipulation on an epic scale. The institutions that were desperate sellers with the S&P500 crashing below 700 are now equally desperate buyers at S&P 850! Now, as before in the Fall of 2008, bad news is “good news” to be bought, and good news causes “dancing in the aisles ...

Bovespa

... Cross border trading Issuers and investors are expanding their horizons beyond their home markets ...

... Cross border trading Issuers and investors are expanding their horizons beyond their home markets ...

Diapositiva 1

... We need to take a closer look at how competition takes place in financial markets: ...

... We need to take a closer look at how competition takes place in financial markets: ...

12-1

... make money • They do mean that, on average, you will earn a return that is appropriate for the risk undertaken and there is not a bias in prices that can be exploited to earn excess returns • Market efficiency will not protect you from wrong choices if you do not diversify – you still don’t want to ...

... make money • They do mean that, on average, you will earn a return that is appropriate for the risk undertaken and there is not a bias in prices that can be exploited to earn excess returns • Market efficiency will not protect you from wrong choices if you do not diversify – you still don’t want to ...

Hot Weather, Hot Market We`ve had some beautiful weather here on

... We’ve had some beautiful weather here on the coast recently and as the temperature’s warmed up, so too has the property market. Our education seminar last week was bursting at the seams with people craving investment information, attracted by local property prices that are up to 30% or 40% below the ...

... We’ve had some beautiful weather here on the coast recently and as the temperature’s warmed up, so too has the property market. Our education seminar last week was bursting at the seams with people craving investment information, attracted by local property prices that are up to 30% or 40% below the ...

A MicroEconomic Justification for Capacity Markets

... Other markets, Texas and MISO, are using an “energy only” construct for resource adequacy. Proponents of this market structure often point to “economic efficiency” of markets and that regulatory inference in that market from the construction of a capacity market is not economically efficient. This p ...

... Other markets, Texas and MISO, are using an “energy only” construct for resource adequacy. Proponents of this market structure often point to “economic efficiency” of markets and that regulatory inference in that market from the construction of a capacity market is not economically efficient. This p ...

02_riskreturn_ch12

... Efficient markets do not mean that you can’t make money They do mean that, on average, you will earn a return that is appropriate for the risk undertaken and there is not a bias in prices that can be exploited to earn excess returns Market efficiency will not protect you from wrong choices if you do ...

... Efficient markets do not mean that you can’t make money They do mean that, on average, you will earn a return that is appropriate for the risk undertaken and there is not a bias in prices that can be exploited to earn excess returns Market efficiency will not protect you from wrong choices if you do ...

chapter 10

... return per period over multiple periods • The geometric average will be less than the arithmetic average unless all the returns are equal • Which is better? • The arithmetic average is overly optimistic for long horizons • The geometric average is overly pessimistic for short horizons • So the answe ...

... return per period over multiple periods • The geometric average will be less than the arithmetic average unless all the returns are equal • Which is better? • The arithmetic average is overly optimistic for long horizons • The geometric average is overly pessimistic for short horizons • So the answe ...

Chapter 12 - U of L Class Index

... Efficient markets do not mean that you can’t make money They do mean that, on average, you will earn a return that is appropriate for the risk undertaken and there is not a bias in prices that can be exploited to earn excess returns Market efficiency will not protect you from wrong choices if you do ...

... Efficient markets do not mean that you can’t make money They do mean that, on average, you will earn a return that is appropriate for the risk undertaken and there is not a bias in prices that can be exploited to earn excess returns Market efficiency will not protect you from wrong choices if you do ...

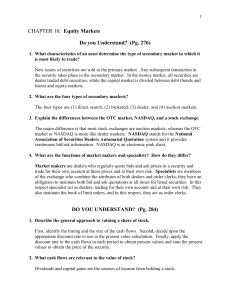

CHAPTER 10: Equity Markets

... Market makers are dealers who regularly quote bids and ask prices in a security and trade for their own account at these prices and at their own risk. Specialists are members of the exchange who combine the attributes of both dealers and order clerks; they have an obligation to maintain both bid and ...

... Market makers are dealers who regularly quote bids and ask prices in a security and trade for their own account at these prices and at their own risk. Specialists are members of the exchange who combine the attributes of both dealers and order clerks; they have an obligation to maintain both bid and ...

Gleadell Market Report

... placing Russian wheat cheaper than French. The move higher in the US and EU will do little to improve export prospects, at a time when exports are running well behind projections. The world has too much wheat and currency, specific short covering or farm retention are currently supporting the market ...

... placing Russian wheat cheaper than French. The move higher in the US and EU will do little to improve export prospects, at a time when exports are running well behind projections. The world has too much wheat and currency, specific short covering or farm retention are currently supporting the market ...

Financial Health- Understanding the Market

... Basics I Learned 1. Stockbrokers are salesmen 2. There are two types of traders Fundamental Traders Technical traders 3. How stock market functions 4. Simply economics of supply and demand 5. Stock market is slow to move up and fast to move down ...

... Basics I Learned 1. Stockbrokers are salesmen 2. There are two types of traders Fundamental Traders Technical traders 3. How stock market functions 4. Simply economics of supply and demand 5. Stock market is slow to move up and fast to move down ...