Aramis NSC

... We are actively working with our clients to ensure a migration strategy with minimum interruptions to market participants ...

... We are actively working with our clients to ensure a migration strategy with minimum interruptions to market participants ...

Market Failure - Economics @ Tallis

... • Imperfect information meaning merit goods are underproduced and demerit goods are over-produced • The private sector being unable to supply important public and quasi-public goods • Market dominance by monopolies • Immobility of factors of production causes unemployment and productive inefficiency ...

... • Imperfect information meaning merit goods are underproduced and demerit goods are over-produced • The private sector being unable to supply important public and quasi-public goods • Market dominance by monopolies • Immobility of factors of production causes unemployment and productive inefficiency ...

Pepall_chpt_001 - Blackwell Publishing

... – Experiment with penalty for price-fixing (Chapter 15) – Examine the impact of advertising (Chapter 21) ...

... – Experiment with penalty for price-fixing (Chapter 15) – Examine the impact of advertising (Chapter 21) ...

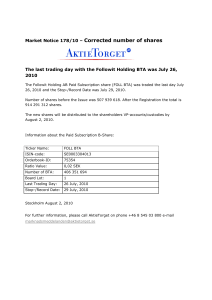

Market Notice 178/10 – Corrected number of shares

... The last trading day with the Followit Holding BTA was July 26, ...

... The last trading day with the Followit Holding BTA was July 26, ...

Definition Business Buyer Behavior

... Business Buyer Behavior: The buying behavior of organizations that buy goods and services for use in the production of other products and services that are sold, rented, or supplied to others. Also included are retailing and wholesaling firms that acquire goods for the purpose of reselling or re ...

... Business Buyer Behavior: The buying behavior of organizations that buy goods and services for use in the production of other products and services that are sold, rented, or supplied to others. Also included are retailing and wholesaling firms that acquire goods for the purpose of reselling or re ...

Profit Maximization, Perfect Competition (Version 2)

... we first have to lay out the assumptions of the model: A1. Price Taking A2. Product Homogeneity A3. Free Entry and Exit with infinitely many potential entrants A1 gives us the supply curve for each individual seller. A2 tells us that they are selling in the exact same market. Finally, A3 tells us th ...

... we first have to lay out the assumptions of the model: A1. Price Taking A2. Product Homogeneity A3. Free Entry and Exit with infinitely many potential entrants A1 gives us the supply curve for each individual seller. A2 tells us that they are selling in the exact same market. Finally, A3 tells us th ...

[Business Communication]

... 1. Receive accounting reports and other information about the company from electronic information services 2. Gather information through conversations with company executives and visits to company facilities and competitors 3. Results of their analyses are combined into analysts’ reports. ...

... 1. Receive accounting reports and other information about the company from electronic information services 2. Gather information through conversations with company executives and visits to company facilities and competitors 3. Results of their analyses are combined into analysts’ reports. ...

CAPITAL MARKET MASTER PLAN - Securities and Exchange

... Current size limits relevance and role in the national economic development Average size of Only a fraction of the GDP – 27% the capital markets of peer Limited representation on the NSE of the key sectors in the broad economies relative to GDP economy – Telecommunications, Oil and Gas, Agricu ...

... Current size limits relevance and role in the national economic development Average size of Only a fraction of the GDP – 27% the capital markets of peer Limited representation on the NSE of the key sectors in the broad economies relative to GDP economy – Telecommunications, Oil and Gas, Agricu ...

Function of Financial Markets

... Another benefit made possible by the low transaction costs of financial institutions is that they can help reduce the exposure of investors to risk - that is, uncertainty about the returns investors will earn on assets. Financial intermediaries do this through the process known as risk sharing: They ...

... Another benefit made possible by the low transaction costs of financial institutions is that they can help reduce the exposure of investors to risk - that is, uncertainty about the returns investors will earn on assets. Financial intermediaries do this through the process known as risk sharing: They ...

AN ANALYSIS OF GLOBAL HFT REGULATION Motivations, Market

... Divergent (or “fairness”) goals. These goals are not necessarily shared by traders, exchanges, and regulators. They include perceptions of “fairness” and the generation of tax revenue. Particular regulatory strategies and tactics proposed to accomplish divergent goals include slowing down or elimina ...

... Divergent (or “fairness”) goals. These goals are not necessarily shared by traders, exchanges, and regulators. They include perceptions of “fairness” and the generation of tax revenue. Particular regulatory strategies and tactics proposed to accomplish divergent goals include slowing down or elimina ...

Chapter 10 - Corporate Strategy

... (* Note: also in list of favorable factors – must do these well ! ) ...

... (* Note: also in list of favorable factors – must do these well ! ) ...

A common factor analysis for the US and the German stock markets

... series by taking natural logarithms. ...

... series by taking natural logarithms. ...

Does Equity Derivatives Trading Affect the Systematic Risk of the

... has been written on the volatility effects of futures trading. Numerous empirical studies have found that beta estimates can be biased because of nonsynchronous trading and market frictions such as thin trading, trading delays, and price adjustment delays. This can cause the beta estimate to be bias ...

... has been written on the volatility effects of futures trading. Numerous empirical studies have found that beta estimates can be biased because of nonsynchronous trading and market frictions such as thin trading, trading delays, and price adjustment delays. This can cause the beta estimate to be bias ...

T No Theory? No Evidence? No Problem!

... grain-producer and loaf eater, there has stepped in a “parasite” between them, robbing them both. ...

... grain-producer and loaf eater, there has stepped in a “parasite” between them, robbing them both. ...

388 kb PowerPoint presentation

... foreign financing, either through direct loans from mother companies abroad or loans from foreign banks, or through issues of debt securities and GDRs/ADRs on external capital markets. 5. The future of stock markets in accession countries has not yet been decided. One possible solution is integratio ...

... foreign financing, either through direct loans from mother companies abroad or loans from foreign banks, or through issues of debt securities and GDRs/ADRs on external capital markets. 5. The future of stock markets in accession countries has not yet been decided. One possible solution is integratio ...

Buyside Traders Want SEC to Press Exchanges and Dark Pools for

... In his letter to the SEC, Tierney said the buyside believes "the Commission should strive to provide additional transparency and a more standardized disclosure process.” At least one buyside trader agreed. Cheryl Cargie, head trader at Ariel Investments, said: "We definitely want more clarity on the ...

... In his letter to the SEC, Tierney said the buyside believes "the Commission should strive to provide additional transparency and a more standardized disclosure process.” At least one buyside trader agreed. Cheryl Cargie, head trader at Ariel Investments, said: "We definitely want more clarity on the ...

Slide 1 - OECD.org

... R – own funds at book value of the non-traded public sector market enterprise (the part that is held by government); K – multiplier market value/own funds at book value of a similar enterprise on TA stock exchange; E – proportion between multipliers own funds at book value/annual net profit in enter ...

... R – own funds at book value of the non-traded public sector market enterprise (the part that is held by government); K – multiplier market value/own funds at book value of a similar enterprise on TA stock exchange; E – proportion between multipliers own funds at book value/annual net profit in enter ...

Networks in Finance and Economics

... Banks, through weekly auctions. •EVERY BANK must DEPOSIT to NATIONAL CENTRAL BANK the 2% of all deposits and debts issued in the last two years. This reserves are supposed to help in the case of liquidity shocks •2% value fluctuates in time and it is recomputed every month. Banks sell and buy liquid ...

... Banks, through weekly auctions. •EVERY BANK must DEPOSIT to NATIONAL CENTRAL BANK the 2% of all deposits and debts issued in the last two years. This reserves are supposed to help in the case of liquidity shocks •2% value fluctuates in time and it is recomputed every month. Banks sell and buy liquid ...

ENTSOG response to THINK public consultation

... “Chain-link-products” are a capacity allocation issue, not primarily a tariff issue. In the CAM network code, ENTSOG does not foresee a linking of auctions, because it is discriminatory in nature (capacities would be tailored to those who can use a certain route and exclude other system users compet ...

... “Chain-link-products” are a capacity allocation issue, not primarily a tariff issue. In the CAM network code, ENTSOG does not foresee a linking of auctions, because it is discriminatory in nature (capacities would be tailored to those who can use a certain route and exclude other system users compet ...

Agricultural Marketing CONCEPT PAPER ON REFORMS IN

... various states market regulation act for direct marketing ( chapter : Establishment of Markets ) Conserted efforts have not been made to promote the direct sales by the farmers to consumers or retailers without involving any intermediary in between . In a country like ours there are large numbers of ...

... various states market regulation act for direct marketing ( chapter : Establishment of Markets ) Conserted efforts have not been made to promote the direct sales by the farmers to consumers or retailers without involving any intermediary in between . In a country like ours there are large numbers of ...

Asia Business Conference 2014 Keynote Address by Masamichi Kono

... we need to be mindful that some types of shadow banking play important roles in promoting financial inclusion and supporting growth in Asia. In this regard, we must admit that we do not necessarily have a holistic view of the cumulative impact on the markets of the G20 regulatory reform measures tak ...

... we need to be mindful that some types of shadow banking play important roles in promoting financial inclusion and supporting growth in Asia. In this regard, we must admit that we do not necessarily have a holistic view of the cumulative impact on the markets of the G20 regulatory reform measures tak ...

Download attachment

... Some types of money market instruments are common to most countries (although their use may be more or less) and other types are more country specific. * term deposits (termijndeposito’s): deposit accounts with banks or other financial institutions having fixed maturity, nontradable, no withdrawals, ...

... Some types of money market instruments are common to most countries (although their use may be more or less) and other types are more country specific. * term deposits (termijndeposito’s): deposit accounts with banks or other financial institutions having fixed maturity, nontradable, no withdrawals, ...

Efficiency, non-linearity and chaos: evidences from BRICS foreign

... Noman and Ahmed (2008) investigated the weak-form efficiency for foreign exchange markets in seven SAARC countries for the period from 1985 to 2005. They employed variance ratio test of Lo and MacKinlay (1988) and Chow-Denning joint variance ratio test (1993). Their study failed to reject the null h ...

... Noman and Ahmed (2008) investigated the weak-form efficiency for foreign exchange markets in seven SAARC countries for the period from 1985 to 2005. They employed variance ratio test of Lo and MacKinlay (1988) and Chow-Denning joint variance ratio test (1993). Their study failed to reject the null h ...

Characterization of foreign exchange market using the threshold

... We started with the model-1, a very simple model. Considering why the model-1 differs from real market data, we added two effects to the model-1, which are feedback effects. One ...

... We started with the model-1, a very simple model. Considering why the model-1 differs from real market data, we added two effects to the model-1, which are feedback effects. One ...

R14-Chp-00-2-1D-CPA Rev-Sec 61-121-165-1001-1031

... 3. (CPAM91#23) In a "like-kind" exchange of an investment asset for a similar asset that will also be held as an investment, no taxable gain or loss will be recognized on the transaction if both assets are: Partnership interests. a. Convertible debentures. c. b. Convertible preferred stock. d. Renta ...

... 3. (CPAM91#23) In a "like-kind" exchange of an investment asset for a similar asset that will also be held as an investment, no taxable gain or loss will be recognized on the transaction if both assets are: Partnership interests. a. Convertible debentures. c. b. Convertible preferred stock. d. Renta ...

![[Business Communication]](http://s1.studyres.com/store/data/019415784_1-ce36fb3f425a6ddeee29c0708b32d6a8-300x300.png)