NBER WORKING PAPER SERIES QUALITATIVE EASING: Roger E.A. Farmer

... Central banks throughout the world have recently engaged in two kinds of unconventional monetary policies: quantitative easing (QE), which is “an increase in the size of the balance sheet of the central bank through an increase it is monetary liabilities”, and qualitative easing (QuaE) which is “a s ...

... Central banks throughout the world have recently engaged in two kinds of unconventional monetary policies: quantitative easing (QE), which is “an increase in the size of the balance sheet of the central bank through an increase it is monetary liabilities”, and qualitative easing (QuaE) which is “a s ...

ME - Ch. 8: Monopoly

... reducing the quantity supplied and increasing the price. 12. In short run, there may be economic loss (or of course economic profit) but in long run there will be positive (greater than zero) economic profit. 13. Although monopoly is usually regulated by government, our focus now is on how monopoly ...

... reducing the quantity supplied and increasing the price. 12. In short run, there may be economic loss (or of course economic profit) but in long run there will be positive (greater than zero) economic profit. 13. Although monopoly is usually regulated by government, our focus now is on how monopoly ...

What`s New - Global Financial Data

... by 97%, a collapse even worse than that which occurred in the United States between 1929 and 1932. Even with a tenfold recovery between 1922 and 1929, the German stock index was still 29.6% below its level in May 1918. Those countries that had their economies tied to Germany suffered similar, if les ...

... by 97%, a collapse even worse than that which occurred in the United States between 1929 and 1932. Even with a tenfold recovery between 1922 and 1929, the German stock index was still 29.6% below its level in May 1918. Those countries that had their economies tied to Germany suffered similar, if les ...

bosch limited code of practices and procedures for fair

... care. Unanticipated questions may be taken on notice and a considered response given later. If the answer includes unpublished price sensitive information, a public announcement should be made before responding. (iv) Simultaneous release of information When any meeting is organised with analysts, a ...

... care. Unanticipated questions may be taken on notice and a considered response given later. If the answer includes unpublished price sensitive information, a public announcement should be made before responding. (iv) Simultaneous release of information When any meeting is organised with analysts, a ...

Code for fair disclosure - Indraprastha Gas Limited

... Company Secretary shall be responsible for prompt public disclosure of UPSI i.e. to Stock Exchanges that would impact price discovery, so as to ensure uniform and universal dissemination of UPSI to avoid selective disclosure. In the event of inadvertent selective disclosure of UPSI, prompt action wi ...

... Company Secretary shall be responsible for prompt public disclosure of UPSI i.e. to Stock Exchanges that would impact price discovery, so as to ensure uniform and universal dissemination of UPSI to avoid selective disclosure. In the event of inadvertent selective disclosure of UPSI, prompt action wi ...

Why Has Swedish Stock Market Volatility Increased?

... tends to be high also during the nearest future. This observation has received much attention from the finance profession due to its implications for asset pricing and portfolio management. The changing volatility and in particular its persistence, however, also has potential macroeconomic implicati ...

... tends to be high also during the nearest future. This observation has received much attention from the finance profession due to its implications for asset pricing and portfolio management. The changing volatility and in particular its persistence, however, also has potential macroeconomic implicati ...

Corso di Economia e Organizzazione

... The good or service produced is unique, there are no substitutes (perfect differentiation); ...

... The good or service produced is unique, there are no substitutes (perfect differentiation); ...

Quiz 12

... The short-run market supply curve is the horizontal sum of each firm’s a. marginal cost curve above its average cost curve. b. marginal cost curve above its average variable cost curve. c. individual short run supply curve. d. both b and c. ...

... The short-run market supply curve is the horizontal sum of each firm’s a. marginal cost curve above its average cost curve. b. marginal cost curve above its average variable cost curve. c. individual short run supply curve. d. both b and c. ...

PDF

... disconnected from market can be only a mere coincidence. Yet, there exists evidences (Boussard and Gerard,1994) of positive links between price stability and production growth everywhere in the world. Thus, both observation and theory suggest that price stability could lead to a more efficient agric ...

... disconnected from market can be only a mere coincidence. Yet, there exists evidences (Boussard and Gerard,1994) of positive links between price stability and production growth everywhere in the world. Thus, both observation and theory suggest that price stability could lead to a more efficient agric ...

Lecture #10

... Hydro fringe can release all water just in one period, may restrict market power further Essentially a dynamic game, reduces the possibilities of strategic shifting of water Quite complex to find solutions to dynamic gaming ...

... Hydro fringe can release all water just in one period, may restrict market power further Essentially a dynamic game, reduces the possibilities of strategic shifting of water Quite complex to find solutions to dynamic gaming ...

OCA - Federation of European Securities Exchanges

... What should be the regulatory response to globalisation? Do we need a “world regulator”? The case-by case-approach • Historically, derivative exchanges have benefited from the CFTC’s no-action letter regime • No retail investor protection concerns A new multilateral approach? • The SEC’s expected c ...

... What should be the regulatory response to globalisation? Do we need a “world regulator”? The case-by case-approach • Historically, derivative exchanges have benefited from the CFTC’s no-action letter regime • No retail investor protection concerns A new multilateral approach? • The SEC’s expected c ...

A Random Walk Down Wall Street Seventh Edition

... What literary forms dominate the financial press during the upswing and downswing of major market moves? These are some of the many questions we will examine in this class. Moreover, we will analyze the rhetorical forms and techniques used to justify fundamental analysis, technical analysis, value i ...

... What literary forms dominate the financial press during the upswing and downswing of major market moves? These are some of the many questions we will examine in this class. Moreover, we will analyze the rhetorical forms and techniques used to justify fundamental analysis, technical analysis, value i ...

Gerhard Illing

... long-time highs, admittedly starting from an extremely low level. As noted in this years BIS annual report (2000, page 129), “the composition of borrowers that have tapped the euro bond market partly reflects the traditional structure of European finance, but partly also its changing profile”. Compa ...

... long-time highs, admittedly starting from an extremely low level. As noted in this years BIS annual report (2000, page 129), “the composition of borrowers that have tapped the euro bond market partly reflects the traditional structure of European finance, but partly also its changing profile”. Compa ...

Does Payment for Order Flow to Your Broker Help or Hurt You?

... In 1975, Congress directed the Securities and Exchange Commission (the regulator of stock exchanges in the United States) to “amend any restrictions which imposed an unnecessary or inappropriate burden on competition” between venues seeking to facilitate trades in NYSElisted securities. In response ...

... In 1975, Congress directed the Securities and Exchange Commission (the regulator of stock exchanges in the United States) to “amend any restrictions which imposed an unnecessary or inappropriate burden on competition” between venues seeking to facilitate trades in NYSElisted securities. In response ...

Far Horizon Investments - Penn State Smeal College of Business

... A large expected return, by itself, does not necessarily a good investment make. For instance, stocks, on average, have a higher expected return than bonds. Does that mean everybody should buy stocks and no one should hold bonds? The difference is that bonds are less risky than stocks. All other thi ...

... A large expected return, by itself, does not necessarily a good investment make. For instance, stocks, on average, have a higher expected return than bonds. Does that mean everybody should buy stocks and no one should hold bonds? The difference is that bonds are less risky than stocks. All other thi ...

Top margin 1

... powder coatings where it and Solutia have strong positions. But the competitive pressure from powerful competitors such as Dutch companies DSM and Akzo Nobel, Eastman of the US and TotalFinaElf’s Cray Valley, and the existence of large excess production capacity will prevent the creation of a domina ...

... powder coatings where it and Solutia have strong positions. But the competitive pressure from powerful competitors such as Dutch companies DSM and Akzo Nobel, Eastman of the US and TotalFinaElf’s Cray Valley, and the existence of large excess production capacity will prevent the creation of a domina ...

CH05

... • Some plans (approximately one third of Canada’s 70) offer 3 to 5% discount for share purchases • Therefore, it is possible to invest in the market without a stockbroker • A number of companies now sell shares directly to investors (e.g., Exxon allows investors to open a direct purchase account to ...

... • Some plans (approximately one third of Canada’s 70) offer 3 to 5% discount for share purchases • Therefore, it is possible to invest in the market without a stockbroker • A number of companies now sell shares directly to investors (e.g., Exxon allows investors to open a direct purchase account to ...

Transaction Costs, Trade Throughs, and Riskless Principal Trading

... The Truth About ODFs • The existence of one or more ODFs whose prices constrain trades will indeed decrease dealer profits, and they will withdraw. • But only because buy-side traders will be able to effectively offer liquidity to each other. • Cutting out the middleman saves costs. • Volumes will ...

... The Truth About ODFs • The existence of one or more ODFs whose prices constrain trades will indeed decrease dealer profits, and they will withdraw. • But only because buy-side traders will be able to effectively offer liquidity to each other. • Cutting out the middleman saves costs. • Volumes will ...

Competition promotes innovation and productivity

... Competition promotes innovation and productivity (3) Competition is in the interest of the consumers For firms competition means lot of stress and plenty of risks to loose money. Therefore firms try to restraint competition How can this be done? ...

... Competition promotes innovation and productivity (3) Competition is in the interest of the consumers For firms competition means lot of stress and plenty of risks to loose money. Therefore firms try to restraint competition How can this be done? ...

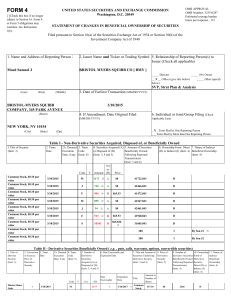

BRISTOL MYERS SQUIBB CO (Form: 4, Received

... /s/ Robert J. Wollin, attorney-in-fact for Samuel J. Moed ...

... /s/ Robert J. Wollin, attorney-in-fact for Samuel J. Moed ...

The Capital Asset Pricing model is based on the relationship

... formulae and not the Excel regression tool for this time) that expresses the XOM return as a linear function of the S&P 500 returns. Write down the estimated model. 1. Calculate the coefficient of determination, r2 of the regression, and correlation coefficient r between XOM and S&P returns. Explain ...

... formulae and not the Excel regression tool for this time) that expresses the XOM return as a linear function of the S&P 500 returns. Write down the estimated model. 1. Calculate the coefficient of determination, r2 of the regression, and correlation coefficient r between XOM and S&P returns. Explain ...

A Critique of Overreaction Effect in the Global Stock Markets over the

... Subsequent research by Fama and French (1988) and Poterba and Summers (1988) also finds results consistent with the predictability in stock returns, supporting the Debondt and Thaler (1985) findings. Fama and French reported in 1988 that 25% to 45% of the variations in monthly returns over a period ...

... Subsequent research by Fama and French (1988) and Poterba and Summers (1988) also finds results consistent with the predictability in stock returns, supporting the Debondt and Thaler (1985) findings. Fama and French reported in 1988 that 25% to 45% of the variations in monthly returns over a period ...