- Fairview High School

... A stock is a share of ownership in a corporation. Stock prices may change continuously. Though stocks offer the possibility of high rates of return on investment, they also carry a greater degree of risk. ...

... A stock is a share of ownership in a corporation. Stock prices may change continuously. Though stocks offer the possibility of high rates of return on investment, they also carry a greater degree of risk. ...

Document

... From 2-step process: 1) capacity auction 2) spot market, Now 1-step process: spot markets & integrated cross-border auction All local players play internationally; better liquidity, transparency ...

... From 2-step process: 1) capacity auction 2) spot market, Now 1-step process: spot markets & integrated cross-border auction All local players play internationally; better liquidity, transparency ...

The Stock Market

... On the left hand side of the screen you should see a menu. Click on “INTRODUCTION,” read the information on this page and answer any questions below that pertain to this information. Continue to click next after each section. 1. How did the Colonial Government, during the American Revolution, ra ...

... On the left hand side of the screen you should see a menu. Click on “INTRODUCTION,” read the information on this page and answer any questions below that pertain to this information. Continue to click next after each section. 1. How did the Colonial Government, during the American Revolution, ra ...

Can Asia`s financial markets continue to grow without AEV`s

... successful if they deliver cheaper, faster and smarter services than the incumbents, work with regulators and the market to bring changes that meet the needs of the markets today and tomorrow whilst protecting the needs of the investor and the structure and the integrity of the market……. ...

... successful if they deliver cheaper, faster and smarter services than the incumbents, work with regulators and the market to bring changes that meet the needs of the markets today and tomorrow whilst protecting the needs of the investor and the structure and the integrity of the market……. ...

Chapter One - Villanova University

... Because households and firms look at prices when deciding what to buy and sell, they unknowingly take into account the social costs of their actions. As a result, prices guide decision makers to reach outcomes that tend to maximize the welfare of society as a whole. ...

... Because households and firms look at prices when deciding what to buy and sell, they unknowingly take into account the social costs of their actions. As a result, prices guide decision makers to reach outcomes that tend to maximize the welfare of society as a whole. ...

Conventional Wisdom and the Impact of Market Volatility

... are new “demand” then the short positions for the same contracts are new “supply”? • In theory, no limit to the number of futures contracts that can be created at a given price level • Price changes as information changes not necessarily as trader positions change ...

... are new “demand” then the short positions for the same contracts are new “supply”? • In theory, no limit to the number of futures contracts that can be created at a given price level • Price changes as information changes not necessarily as trader positions change ...

Document

... – HEDGERS are traders who buy or sell to offset a risk exposure in the spot market – for example, a U.S. exporter will be paid in 30 days in a foreign currency ...

... – HEDGERS are traders who buy or sell to offset a risk exposure in the spot market – for example, a U.S. exporter will be paid in 30 days in a foreign currency ...

7.1_revision_quiz - econbus

... disguises from consumers the actual degree of concentration within the industry. This is certainly true in markets such as detergents, confectionery and household goods – it is an essential part of non-price competition. ...

... disguises from consumers the actual degree of concentration within the industry. This is certainly true in markets such as detergents, confectionery and household goods – it is an essential part of non-price competition. ...

Presentation

... Strong de-shaping for high feedback (L), but still significant difference after 8 rounds General persistence for low feedback (H) ...

... Strong de-shaping for high feedback (L), but still significant difference after 8 rounds General persistence for low feedback (H) ...

Economics 102 Spring 2012 Homework #2 Due 2/15/12 Directions

... Directions: The homework will be collected in a box before the lecture. Please place your name, TA name and section number on top of the homework (legibly). Make sure you write your name as it appears on your ID so that you can receive the correct grade. Please remember the section number for the se ...

... Directions: The homework will be collected in a box before the lecture. Please place your name, TA name and section number on top of the homework (legibly). Make sure you write your name as it appears on your ID so that you can receive the correct grade. Please remember the section number for the se ...

Investment Management

... He forecasts stock prices based on economic, industry and company statistics. The principal decision variables take the form of earning and dividends. He makes a judgement of the stock’s value with a risk –return. ...

... He forecasts stock prices based on economic, industry and company statistics. The principal decision variables take the form of earning and dividends. He makes a judgement of the stock’s value with a risk –return. ...

Competition and Regulation in Trading Arenas

... Glosten and Milgrom (1985) formalized this insight. They postulate an anonymous market in which a market maker posts a bid for one share, a price at which it is willing to buy, and an offer for one share, a price at which it is willing to sell. The market maker acts competitively and thus sets the b ...

... Glosten and Milgrom (1985) formalized this insight. They postulate an anonymous market in which a market maker posts a bid for one share, a price at which it is willing to buy, and an offer for one share, a price at which it is willing to sell. The market maker acts competitively and thus sets the b ...

SEC Form NELET-AF - Securities and Exchange Commission

... Form for Payment of Annual Fees and in the said Annexes is true, correct, current, accurate and complete. The undersigned Associated Persons/Compliance Officers undertake to attend Certification Seminars and take Certification Examinations, for Associated Persons/Compliance Officers, to be administe ...

... Form for Payment of Annual Fees and in the said Annexes is true, correct, current, accurate and complete. The undersigned Associated Persons/Compliance Officers undertake to attend Certification Seminars and take Certification Examinations, for Associated Persons/Compliance Officers, to be administe ...

I_Ch03

... Initial Public Offerings (首次公開募股) The most complicated public offering because the issuing firm is usually new and not wellknown to investors After the preparation of the prospectus, – Roadshows (巡迴發表會) to promote the new securities To provide information about the offering and generate interest am ...

... Initial Public Offerings (首次公開募股) The most complicated public offering because the issuing firm is usually new and not wellknown to investors After the preparation of the prospectus, – Roadshows (巡迴發表會) to promote the new securities To provide information about the offering and generate interest am ...

international financial markets

... no net transfer of capital from one country to another. Feldstein argues that the segmented nature of the world capital market is confirmed by the strong, homecountry bias of institutional portfolios. Only 10 per cent of the value of assets in the 500 largest institutional portfolios in the world is ...

... no net transfer of capital from one country to another. Feldstein argues that the segmented nature of the world capital market is confirmed by the strong, homecountry bias of institutional portfolios. Only 10 per cent of the value of assets in the 500 largest institutional portfolios in the world is ...

###Market Failure - PowerPoint Presentation###

... Tell me again why the market was so great? •Invisible hand as “supercomputer” •Price Rationing: • Productive efficiency—output with lowest possible cost (how to produce) • Allocative efficiency—goods and services most wanted by society (what to produce) ...

... Tell me again why the market was so great? •Invisible hand as “supercomputer” •Price Rationing: • Productive efficiency—output with lowest possible cost (how to produce) • Allocative efficiency—goods and services most wanted by society (what to produce) ...

Securities Markets Primary Versus Secondary Markets How

... Commission: fee paid to broker for making the transaction Spread: Spread: cost of trading with dealer – Bid: Bid: price dealer will buy from you – Ask: Ask: price dealer will sell to you – Spread: Spread: ask - bid ...

... Commission: fee paid to broker for making the transaction Spread: Spread: cost of trading with dealer – Bid: Bid: price dealer will buy from you – Ask: Ask: price dealer will sell to you – Spread: Spread: ask - bid ...

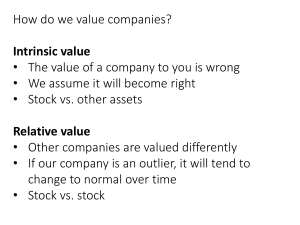

Relative value

... Issues in Using Enterprise Value Multiples EV = Market Value of Stock + Debt – Cash – Investments Justified EV/EBITDA • Positively related to FCFF growth • Positively related to ROIC • Negatively related to WACC ...

... Issues in Using Enterprise Value Multiples EV = Market Value of Stock + Debt – Cash – Investments Justified EV/EBITDA • Positively related to FCFF growth • Positively related to ROIC • Negatively related to WACC ...

CESifo Working Paper Series

... No information is available on who traded at the Swiss stock exchange during WWII. But as we have mentioned before, even if we knew who the actual traders were, it would remain unclear whose money they invested and therefore who their clients were. Given the high degree of openness of the Swiss fina ...

... No information is available on who traded at the Swiss stock exchange during WWII. But as we have mentioned before, even if we knew who the actual traders were, it would remain unclear whose money they invested and therefore who their clients were. Given the high degree of openness of the Swiss fina ...

A Multiple Lender Approach to Understanding Supply and Search in

... stock market as we know it -- is so opaque that even the insiders can get ripped off. …. Last week, the government brought criminal charges against former stock loan employees at a number of brokerage firms, among them Morgan Stanley and A. G. Edwards. Because the market prices were so obscure, the ...

... stock market as we know it -- is so opaque that even the insiders can get ripped off. …. Last week, the government brought criminal charges against former stock loan employees at a number of brokerage firms, among them Morgan Stanley and A. G. Edwards. Because the market prices were so obscure, the ...

Professor Venkatesh Panchapagesan

... sometimes leading them, that is intended to reinforce concepts we learn through real world applications. Also as a capstone project, students will critically evaluate a current market-related issue from the perspective of different stakeholders, including that of regulators, and learn to make decisi ...

... sometimes leading them, that is intended to reinforce concepts we learn through real world applications. Also as a capstone project, students will critically evaluate a current market-related issue from the perspective of different stakeholders, including that of regulators, and learn to make decisi ...

Efficient market hypothesis: is the Croatian stock market as (in

... U.S. is not a puzzle if one takes into account a number of problems related with the design of empirical tests and interpretation of their results. The common denominator of numerous formulations of the Efficient Market Hypothesis (EMH) is the idea that investors cannot beat the market in the long ru ...

... U.S. is not a puzzle if one takes into account a number of problems related with the design of empirical tests and interpretation of their results. The common denominator of numerous formulations of the Efficient Market Hypothesis (EMH) is the idea that investors cannot beat the market in the long ru ...

2 - JustAnswer

... stockholders receive if their stock is cumulative and nonparticipating? (b) As of 12/31/11, it is desired to distribute $400,000 in dividends. How much will the preferred stockholders receive if their stock is cumulative and participating up to 11% in total? (c) On 12/31/11, the preferred stockholde ...

... stockholders receive if their stock is cumulative and nonparticipating? (b) As of 12/31/11, it is desired to distribute $400,000 in dividends. How much will the preferred stockholders receive if their stock is cumulative and participating up to 11% in total? (c) On 12/31/11, the preferred stockholde ...

Overview

... previous research, with very low incremental information being provided by lagged oil prices. This suggests that some results in previous literature may be a result of failing to model dynamics thoroughly. ...

... previous research, with very low incremental information being provided by lagged oil prices. This suggests that some results in previous literature may be a result of failing to model dynamics thoroughly. ...