The Four Big Questions For Investors After `Black Monday

... by quantitative risk controls setting in across hedge funds, trading books, and dedicated quant strategies. After months of low volatility, a sudden spike has driven up the calculated risk in many strategies as heavy losses lead to a reduction in desired market exposure. "Market moves compelled othe ...

... by quantitative risk controls setting in across hedge funds, trading books, and dedicated quant strategies. After months of low volatility, a sudden spike has driven up the calculated risk in many strategies as heavy losses lead to a reduction in desired market exposure. "Market moves compelled othe ...

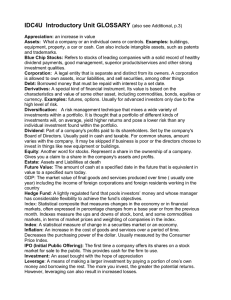

Penny Stocks: Low-priced stocks that typically sell

... dividend payments, good management, superior products/services and other strong investment qualities. Corporation: A legal entity that is separate and distinct from its owners. A corporation is allowed to own assets, incur liabilities, and sell securities, among other things Debt: Borrowed money tha ...

... dividend payments, good management, superior products/services and other strong investment qualities. Corporation: A legal entity that is separate and distinct from its owners. A corporation is allowed to own assets, incur liabilities, and sell securities, among other things Debt: Borrowed money tha ...

Electrode Placement for Chest Leads, V1 to V6

... Debtor: Entity issuing the bond. Creditor: Entity purchasing the bond. • The greater the company’s financial strength, the easier it is for the company to issue bonds. • Bonds are infrequently seen in the sport industry, but examples do exist. – For example, the New York Yankees and the New Jersey N ...

... Debtor: Entity issuing the bond. Creditor: Entity purchasing the bond. • The greater the company’s financial strength, the easier it is for the company to issue bonds. • Bonds are infrequently seen in the sport industry, but examples do exist. – For example, the New York Yankees and the New Jersey N ...

Data Science - LIACS Data Mining Group

... Less emphasis on algorithms More emphasis on ‘outreach’ Term Data Science is about 10 years old, very popular nowadays Many people reinvent themselves as Data Scientists data miners, statisticians, BI people, analysts, database developers ...

... Less emphasis on algorithms More emphasis on ‘outreach’ Term Data Science is about 10 years old, very popular nowadays Many people reinvent themselves as Data Scientists data miners, statisticians, BI people, analysts, database developers ...

Price discrimination Suppose a monopolist produces its output at a

... firm’s goal is to maximize profit by selecting the amount of output to sell in each market. Call these two amounts q1 and q2, with Q = q1 + q2. Let demand in the first market be given by P1 = f(q1) and in the second market by P2 = g(q2). The firm’s profit is the sum of price times quantity in each m ...

... firm’s goal is to maximize profit by selecting the amount of output to sell in each market. Call these two amounts q1 and q2, with Q = q1 + q2. Let demand in the first market be given by P1 = f(q1) and in the second market by P2 = g(q2). The firm’s profit is the sum of price times quantity in each m ...

Movie-theater company gets two thumbs down

... the stock recently dropped below $10 per share and most fair-value estimates stand at least twice that high, meaning any current buyer is getting the stock at what amounts to a half-off sale. So much for the good news. Cutting-room floor You can start the bad news with a simple economic analysis, on ...

... the stock recently dropped below $10 per share and most fair-value estimates stand at least twice that high, meaning any current buyer is getting the stock at what amounts to a half-off sale. So much for the good news. Cutting-room floor You can start the bad news with a simple economic analysis, on ...

Market sentiment

Market sentiment is the general prevailing attitude of investors as to anticipated price development in a market. This attitude is the accumulation of a variety of fundamental and technical factors, including price history, economic reports, seasonal factors, and national and world events.For example, if investors expect upward price movement in the stock market, the sentiment is said to be bullish. On the contrary, if the market sentiment is bearish, most investors expect downward price movement. Market sentiment is usually considered as a contrarian indicator: what most people expect is a good thing to bet against. Market sentiment is used because it is believed to be a good predictor of market moves, especially when it is more extreme. Very bearish sentiment is usually followed by the market going up more than normal, and vice versa.Mutual fund flows are very useful.Market sentiment is monitored with a variety of technical and statistical methods such as the number of advancing versus declining stocks and new highs versus new lows comparisons. A large share of overall movement of an individual stock has been attributed to market sentiment The stock market's demonstration of the situation is often described as all boats float or sink with the tide, in the popular Wall Street phrase ""the trend is your friend"".Market sentiment, as such, might be acquired from more than one sentiment analytical tool. For example there could be just simple extraction of movement on stock exchange and validly called market sentiment. Another tool is to extract the news and media information based on their polarity. Yet another sub-subject might be community sentiment about the market movements (blogs, forums).In the last decade, investors are also known to measure market sentiment through the use of news analytics, which include sentiment analysis on textual stories about companies and sectors.The Acertus Market Sentiment Indicator (AMSI) is one indicator of market sentiment. AMSI incorporates five variables. In descending order of weight in the indicator they are Price/Earnings Ratio, a measure of stock market valuations; price momentum, a measure of market psychology; Realized Volatility, a measure of recent historical risk; High Yield Bond Returns, a measure of credit risk; and the TED Spread, a measure of systemic financial risk. Each of these factors provides a measure of market sentiment through a unique lens, and together they may offer a more robust indicator of market sentiment.Additional indicators exist to measure the sentiment specifically of retail Forex market investors. Though the Forex market is decentralized (not traded on a central exchange), various retail Forex brokerage firms publish positioning ratios (similar to the Put/Call ratio) and other data regarding their own clients' trading behavior. Since most retail currency traders are unsuccessful, measures of Forex market sentiment are typically used as contrarian indicators.