entrada - Bolsa de Madrid

... when the process to produce undisputable prices in our regulated equity markets is put at risk by artificial fragmentation structures. One of last year’s events that has most revived the debate about trading models has been the flash crash on 6 May. This incident led to an in-depth investigation by ...

... when the process to produce undisputable prices in our regulated equity markets is put at risk by artificial fragmentation structures. One of last year’s events that has most revived the debate about trading models has been the flash crash on 6 May. This incident led to an in-depth investigation by ...

Europe ex UK Smaller Companies Fund

... had an adverse impact on operating margins. We expect strong demand in the third quarter and retain our holding. The holding in Corbion was also detrimental during July, reversing some earlier gains. We believe that investors are failing to account for the value opportunity in the PLA business, whic ...

... had an adverse impact on operating margins. We expect strong demand in the third quarter and retain our holding. The holding in Corbion was also detrimental during July, reversing some earlier gains. We believe that investors are failing to account for the value opportunity in the PLA business, whic ...

flow of funds - WordPress.com

... A. Classification of financial market on basis of the nature of claim Claim is to ‘demand anything as a right’. If I hold – Debt market a debt instrument it means I hold the right to demand periodic interest payments and principal upon maturity, similarly if I hold a stock – Equity market I can dema ...

... A. Classification of financial market on basis of the nature of claim Claim is to ‘demand anything as a right’. If I hold – Debt market a debt instrument it means I hold the right to demand periodic interest payments and principal upon maturity, similarly if I hold a stock – Equity market I can dema ...

Monthly Seasonality in the New Zealand Stock Market

... result may be because New Zealand has the bitterest and rainiest season in August that may affect investor’s behavior. By contrast, June is the best month as 5 indices have significantly positive returns in this month. Table 3 reports the t-testing results of equation (2) for all the indices. It sho ...

... result may be because New Zealand has the bitterest and rainiest season in August that may affect investor’s behavior. By contrast, June is the best month as 5 indices have significantly positive returns in this month. Table 3 reports the t-testing results of equation (2) for all the indices. It sho ...

Changes to Result in Better Framework and Incentive Structure for

... The new MM model is designed to simplify and improve the quality of market making services. It focuses on registration and responsibility of Exchange Participants (EPs) for MM activities and will discontinue registration of third parties known as Registered Traders (see chart on next page). The main ...

... The new MM model is designed to simplify and improve the quality of market making services. It focuses on registration and responsibility of Exchange Participants (EPs) for MM activities and will discontinue registration of third parties known as Registered Traders (see chart on next page). The main ...

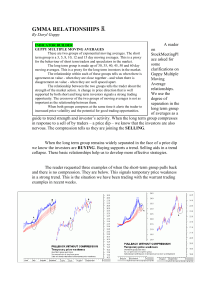

gmma relationships

... The relationship within each of these groups tells us when there is agreement on value - when they are close together - and when there is disagreement on value - when they are well spaced apart. The relationship between the two groups tells the trader about the strength of the market action. A chang ...

... The relationship within each of these groups tells us when there is agreement on value - when they are close together - and when there is disagreement on value - when they are well spaced apart. The relationship between the two groups tells the trader about the strength of the market action. A chang ...

Appendix 1 Money Market Scheme 19 July

... a) the Short-Term Money Market Fund has obtained a triple-A rating from an internationally recognised rating agency; or b) the management company or investment manager is engaged in the management, or has been engaged in the management, of a triple-A rated money market fund; or c) in circumstances, ...

... a) the Short-Term Money Market Fund has obtained a triple-A rating from an internationally recognised rating agency; or b) the management company or investment manager is engaged in the management, or has been engaged in the management, of a triple-A rated money market fund; or c) in circumstances, ...

Market sentiment

Market sentiment is the general prevailing attitude of investors as to anticipated price development in a market. This attitude is the accumulation of a variety of fundamental and technical factors, including price history, economic reports, seasonal factors, and national and world events.For example, if investors expect upward price movement in the stock market, the sentiment is said to be bullish. On the contrary, if the market sentiment is bearish, most investors expect downward price movement. Market sentiment is usually considered as a contrarian indicator: what most people expect is a good thing to bet against. Market sentiment is used because it is believed to be a good predictor of market moves, especially when it is more extreme. Very bearish sentiment is usually followed by the market going up more than normal, and vice versa.Mutual fund flows are very useful.Market sentiment is monitored with a variety of technical and statistical methods such as the number of advancing versus declining stocks and new highs versus new lows comparisons. A large share of overall movement of an individual stock has been attributed to market sentiment The stock market's demonstration of the situation is often described as all boats float or sink with the tide, in the popular Wall Street phrase ""the trend is your friend"".Market sentiment, as such, might be acquired from more than one sentiment analytical tool. For example there could be just simple extraction of movement on stock exchange and validly called market sentiment. Another tool is to extract the news and media information based on their polarity. Yet another sub-subject might be community sentiment about the market movements (blogs, forums).In the last decade, investors are also known to measure market sentiment through the use of news analytics, which include sentiment analysis on textual stories about companies and sectors.The Acertus Market Sentiment Indicator (AMSI) is one indicator of market sentiment. AMSI incorporates five variables. In descending order of weight in the indicator they are Price/Earnings Ratio, a measure of stock market valuations; price momentum, a measure of market psychology; Realized Volatility, a measure of recent historical risk; High Yield Bond Returns, a measure of credit risk; and the TED Spread, a measure of systemic financial risk. Each of these factors provides a measure of market sentiment through a unique lens, and together they may offer a more robust indicator of market sentiment.Additional indicators exist to measure the sentiment specifically of retail Forex market investors. Though the Forex market is decentralized (not traded on a central exchange), various retail Forex brokerage firms publish positioning ratios (similar to the Put/Call ratio) and other data regarding their own clients' trading behavior. Since most retail currency traders are unsuccessful, measures of Forex market sentiment are typically used as contrarian indicators.