Focusing on Long-Term Return Objectives in a Low Return World

... assumptions used by many today. Investors in a situation like the one contemplated above have three options: ...

... assumptions used by many today. Investors in a situation like the one contemplated above have three options: ...

Things you have to know about Data mining

... - Anomaly detection (Outlier/change/deviation detection) – The identification of unusual data records, that might be interesting or data errors that require further investigation. - Association rule learning (Dependency modelling) – Searches for relationships between variables. For example a superma ...

... - Anomaly detection (Outlier/change/deviation detection) – The identification of unusual data records, that might be interesting or data errors that require further investigation. - Association rule learning (Dependency modelling) – Searches for relationships between variables. For example a superma ...

MS DOC - University of Nairobi

... • Markets play a role in the exchange of ownership for livestock resources destined for breeding, fattening and slaughter. • Markets acts as a hub for a bigger network which can enhance disease spread to other production systems and farms. • A clear understanding on how markets operate and weaknesse ...

... • Markets play a role in the exchange of ownership for livestock resources destined for breeding, fattening and slaughter. • Markets acts as a hub for a bigger network which can enhance disease spread to other production systems and farms. • A clear understanding on how markets operate and weaknesse ...

Economic Influences on the Stock Market

... gross domestic product, or GDP. GDP measures the total income in an economy earned domestically, including the income earned by foreign-owned factors of production (Mankiw, 1997). GDP is important to the stock market in that it serves as a measure of the health of the economy. As a rational stock m ...

... gross domestic product, or GDP. GDP measures the total income in an economy earned domestically, including the income earned by foreign-owned factors of production (Mankiw, 1997). GDP is important to the stock market in that it serves as a measure of the health of the economy. As a rational stock m ...

Emerging Market Overview_March 2016

... Investments entail risks. The value of investments and any income received from them can go down as well as up, and investors may not get back the full amount invested. Past performance is not an indicator or a guarantee of future performance. Currency fluctuations may affect the value of overseas i ...

... Investments entail risks. The value of investments and any income received from them can go down as well as up, and investors may not get back the full amount invested. Past performance is not an indicator or a guarantee of future performance. Currency fluctuations may affect the value of overseas i ...

Title of Presentation Here

... “Today's claims payment secures tomorrow’s new business” DELIVERY ALLIANCES Speed – immediate payment Convenience – near the customer Seamless service – one call “money or the box” ...

... “Today's claims payment secures tomorrow’s new business” DELIVERY ALLIANCES Speed – immediate payment Convenience – near the customer Seamless service – one call “money or the box” ...

Some Lessons from Capital Market History

... If the market is weak form efficient, then investors cannot earn abnormal returns by trading on market information Implies that technical analysis will not lead to abnormal returns Empirical evidence indicates that markets are generally weak form efficient ...

... If the market is weak form efficient, then investors cannot earn abnormal returns by trading on market information Implies that technical analysis will not lead to abnormal returns Empirical evidence indicates that markets are generally weak form efficient ...

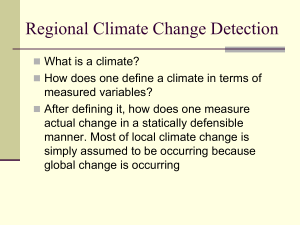

Climate Change

... Take a weather site and say it has 100 years of data for all 12 months and pick a variable like max temperature. Use all 100 months of January to compose the average max. For each month then in each year, compute the Z-score for that month/year Z-Score = (x - µ) / ...

... Take a weather site and say it has 100 years of data for all 12 months and pick a variable like max temperature. Use all 100 months of January to compose the average max. For each month then in each year, compute the Z-score for that month/year Z-Score = (x - µ) / ...

Investing In Canadian Dividend Stocks

... Common stocks such as those given in Table 1 are a starting point for constructing a diversified portfolio of high-yielding Canadian blue-chip companies. Another indicator of good quality dividend stocks is the frequency and amount by which they increase their dividends. Purchasing these stocks at a ...

... Common stocks such as those given in Table 1 are a starting point for constructing a diversified portfolio of high-yielding Canadian blue-chip companies. Another indicator of good quality dividend stocks is the frequency and amount by which they increase their dividends. Purchasing these stocks at a ...

Stocks - Northwest ISD Moodle

... Price Earning (PE) Ratio – price of one share of stock divided by the corporation’s earnings per share of stock outstanding over the last 12 months. ...

... Price Earning (PE) Ratio – price of one share of stock divided by the corporation’s earnings per share of stock outstanding over the last 12 months. ...

Market sentiment

Market sentiment is the general prevailing attitude of investors as to anticipated price development in a market. This attitude is the accumulation of a variety of fundamental and technical factors, including price history, economic reports, seasonal factors, and national and world events.For example, if investors expect upward price movement in the stock market, the sentiment is said to be bullish. On the contrary, if the market sentiment is bearish, most investors expect downward price movement. Market sentiment is usually considered as a contrarian indicator: what most people expect is a good thing to bet against. Market sentiment is used because it is believed to be a good predictor of market moves, especially when it is more extreme. Very bearish sentiment is usually followed by the market going up more than normal, and vice versa.Mutual fund flows are very useful.Market sentiment is monitored with a variety of technical and statistical methods such as the number of advancing versus declining stocks and new highs versus new lows comparisons. A large share of overall movement of an individual stock has been attributed to market sentiment The stock market's demonstration of the situation is often described as all boats float or sink with the tide, in the popular Wall Street phrase ""the trend is your friend"".Market sentiment, as such, might be acquired from more than one sentiment analytical tool. For example there could be just simple extraction of movement on stock exchange and validly called market sentiment. Another tool is to extract the news and media information based on their polarity. Yet another sub-subject might be community sentiment about the market movements (blogs, forums).In the last decade, investors are also known to measure market sentiment through the use of news analytics, which include sentiment analysis on textual stories about companies and sectors.The Acertus Market Sentiment Indicator (AMSI) is one indicator of market sentiment. AMSI incorporates five variables. In descending order of weight in the indicator they are Price/Earnings Ratio, a measure of stock market valuations; price momentum, a measure of market psychology; Realized Volatility, a measure of recent historical risk; High Yield Bond Returns, a measure of credit risk; and the TED Spread, a measure of systemic financial risk. Each of these factors provides a measure of market sentiment through a unique lens, and together they may offer a more robust indicator of market sentiment.Additional indicators exist to measure the sentiment specifically of retail Forex market investors. Though the Forex market is decentralized (not traded on a central exchange), various retail Forex brokerage firms publish positioning ratios (similar to the Put/Call ratio) and other data regarding their own clients' trading behavior. Since most retail currency traders are unsuccessful, measures of Forex market sentiment are typically used as contrarian indicators.