The role of a financial transaction tax in sustainable finance

... arbitrageur and speculator to determine the speculative trading proportion. But realistically, identifying the transaction purpose is almost impossible. To understand the amount of speculative trading, trading volume of the outstanding contracts and deep OTM options can be used as indirect indicator ...

... arbitrageur and speculator to determine the speculative trading proportion. But realistically, identifying the transaction purpose is almost impossible. To understand the amount of speculative trading, trading volume of the outstanding contracts and deep OTM options can be used as indirect indicator ...

ETF`s – Top 5 portfolio strategy considerations

... An ETF is an open-ended index fund, listed on an exchange, which invests in shares, fixed income, cash, alternative assets, currencies and commodities across global regions, sectors and asset classes. Typically, ETFs invest in a range of shares that replicate an index, either physically or synthetic ...

... An ETF is an open-ended index fund, listed on an exchange, which invests in shares, fixed income, cash, alternative assets, currencies and commodities across global regions, sectors and asset classes. Typically, ETFs invest in a range of shares that replicate an index, either physically or synthetic ...

Funding Constraints, Market Liquidity, and Financial Crises

... The American Civil War brought many changes to the US financial system. The US Congress passed the National Banking Acts of 1863, 1864, and 1865 that established a uniform currency, raised funds to fight the Civil War, and standardized the banking system. The legislation required banks to maintain a ...

... The American Civil War brought many changes to the US financial system. The US Congress passed the National Banking Acts of 1863, 1864, and 1865 that established a uniform currency, raised funds to fight the Civil War, and standardized the banking system. The legislation required banks to maintain a ...

New Frontier - listing - Business Plan (00142711

... Trevo, previously known as Arro ETF Management Limited, was incorporated in Mauritius on 9 November 2009 and its core business is related to strategic investments in a strategically selected group of assets. The Company has applied to be listed on the Stock Exchange of Mauritius under Chapter 18 of ...

... Trevo, previously known as Arro ETF Management Limited, was incorporated in Mauritius on 9 November 2009 and its core business is related to strategic investments in a strategically selected group of assets. The Company has applied to be listed on the Stock Exchange of Mauritius under Chapter 18 of ...

PCC Financial Ratios for Fiscal Years 2007-2016

... institution is debt free the denominator becomes zero and the Viability Ratio also becomes zero. This can adversely impact both the Viability Ratio and the CFI of the institution. This ratio is intended to answer the question: “Are debt resources managed strategically to advance the mission?” For fi ...

... institution is debt free the denominator becomes zero and the Viability Ratio also becomes zero. This can adversely impact both the Viability Ratio and the CFI of the institution. This ratio is intended to answer the question: “Are debt resources managed strategically to advance the mission?” For fi ...

MPDD W P

... needed to raise investment, accelerate productivity growth and raise per capita incomes. It was in the 1970s that the influence of marginalist economics resulted in an emphasis on improving the “efficiency” of investment and, therefore, in microeconomic policies involving a reduced role for regulati ...

... needed to raise investment, accelerate productivity growth and raise per capita incomes. It was in the 1970s that the influence of marginalist economics resulted in an emphasis on improving the “efficiency” of investment and, therefore, in microeconomic policies involving a reduced role for regulati ...

securities 101: handbook for law enforcement officials

... Financial fraud prosecutions are not the typical cases you probably handle on a routine basis. They are also not the type of case people normally associate with the word “crime”. Yet this type of criminal activity, if investigated correctly, can lead to felony convictions, prison sentences, and oppo ...

... Financial fraud prosecutions are not the typical cases you probably handle on a routine basis. They are also not the type of case people normally associate with the word “crime”. Yet this type of criminal activity, if investigated correctly, can lead to felony convictions, prison sentences, and oppo ...

Superneutrality of Money under Open Market Operations

... stock but is calculated from balance sheets and earnings statements that document central bank profits. Of course, this convention leaves the present value of seigniorage unaffected. Replacing helicopter money by open market operations, however, has an important impact on the timing of seigniorage, ...

... stock but is calculated from balance sheets and earnings statements that document central bank profits. Of course, this convention leaves the present value of seigniorage unaffected. Replacing helicopter money by open market operations, however, has an important impact on the timing of seigniorage, ...

Chapter 1

... with a normal distribution the probability that we end up with one standard deviation from the average is about 68% . with a normal distribution the probability that we end up with two standard deviation from the average is about 95% . with a normal distribution the probability that we end up ...

... with a normal distribution the probability that we end up with one standard deviation from the average is about 68% . with a normal distribution the probability that we end up with two standard deviation from the average is about 95% . with a normal distribution the probability that we end up ...

Accounting vs. Market-based Measures of Firm Performance

... compares a firm’s revenue and expenses; this is to find out if a profit (i.e. revenue exceeded expenses) or loss (i.e. expenses exceeded revenue) was made. In addition, the balance sheet offers a list of a firm’s assets and liabilities. It identifies in monetary terms what a firm owns (the assets), ...

... compares a firm’s revenue and expenses; this is to find out if a profit (i.e. revenue exceeded expenses) or loss (i.e. expenses exceeded revenue) was made. In addition, the balance sheet offers a list of a firm’s assets and liabilities. It identifies in monetary terms what a firm owns (the assets), ...

Derivatives and Volatility on Indian Stock Markets

... spot market, new information may be transmitted to the futures market more quickly. Thus, future markets provide an additional route by which information can be transmitted to the spot markets and therefore, increased spot market volatility may simply be a consequence of the more frequent arrival an ...

... spot market, new information may be transmitted to the futures market more quickly. Thus, future markets provide an additional route by which information can be transmitted to the spot markets and therefore, increased spot market volatility may simply be a consequence of the more frequent arrival an ...

Asset Allocation - Columbia Basin Foundation

... The maturity should be maintained at a level from 5% above to 5% below the duration of the Lehman Aggregate Bond Index. The core fixed income assets should emphasize quality. US Treasuries, Federal Agencies and Corporate issues with a minimum rating of investment grade are required. If a security ...

... The maturity should be maintained at a level from 5% above to 5% below the duration of the Lehman Aggregate Bond Index. The core fixed income assets should emphasize quality. US Treasuries, Federal Agencies and Corporate issues with a minimum rating of investment grade are required. If a security ...

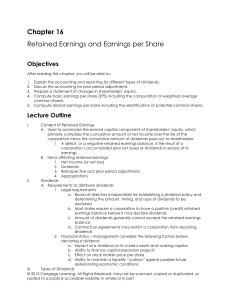

Wahlen_1e_IM_Ch16 (new window)

... b. Stock dividends or splits can change the shares outstanding i. Retroactive recognition for all comparative income statements presented 5. Why it matters a. Price/earnings ratio measures the market’s assessment of the future earnings potential of the company i. Higher ratios are generally interpre ...

... b. Stock dividends or splits can change the shares outstanding i. Retroactive recognition for all comparative income statements presented 5. Why it matters a. Price/earnings ratio measures the market’s assessment of the future earnings potential of the company i. Higher ratios are generally interpre ...

特別研究員の研究成果(論文)に対する謝金の取扱

... prudence. Thirdly, the pro cyclicality of the Basel capital requirement is strongly recognized and caused Japan to suffer for so long after the burst of the bubble in 1991. When the economy is faced with downturn, banks tend to lend less since their capital declines. Credit crunch was one of the cau ...

... prudence. Thirdly, the pro cyclicality of the Basel capital requirement is strongly recognized and caused Japan to suffer for so long after the burst of the bubble in 1991. When the economy is faced with downturn, banks tend to lend less since their capital declines. Credit crunch was one of the cau ...

Chapter 19 Savings and Investment Strategies

... Goal 3 Identify factors that affect the value of a stock. © 2012 Cengage Learning. All Rights Reserved. ...

... Goal 3 Identify factors that affect the value of a stock. © 2012 Cengage Learning. All Rights Reserved. ...

fair value hedges

... A. Derivatives are financial instruments that “derive” their values from some other security or index. (TA-1) B. They are extensively used to hedge against various risks, particularly interest rate risk. C. Hedging means taking a risk position that is opposite to an actual position that is exposed t ...

... A. Derivatives are financial instruments that “derive” their values from some other security or index. (TA-1) B. They are extensively used to hedge against various risks, particularly interest rate risk. C. Hedging means taking a risk position that is opposite to an actual position that is exposed t ...

Czarski_Gabriel_Nothaft

... • Higher median housing costs – Higher potential gains from longer search – Greater opportunity cost to landlords (more significant) ...

... • Higher median housing costs – Higher potential gains from longer search – Greater opportunity cost to landlords (more significant) ...

EDC? Not as easy as 1, 2, 3

... how this might look. Next, evaluate each EDC system against the requirements that it will need to complete. Rank the systems based on how well your requirements are met, putting more weight on more important factors. Put some intangibles in here such as corporate culture fit; those “soft” types of c ...

... how this might look. Next, evaluate each EDC system against the requirements that it will need to complete. Rank the systems based on how well your requirements are met, putting more weight on more important factors. Put some intangibles in here such as corporate culture fit; those “soft” types of c ...

0000355811-15-000053 - Gentex Investor Relations

... Investments (continued) provide increased consistency in how fair value determinations are made under various existing accounting standards that permit, or in some cases, require estimates of fair-market value. This standard also expanded financial statement disclosure requirements about a company’s ...

... Investments (continued) provide increased consistency in how fair value determinations are made under various existing accounting standards that permit, or in some cases, require estimates of fair-market value. This standard also expanded financial statement disclosure requirements about a company’s ...

euro high yield bond fund - Henderson Global Investors

... which it trades becomes unwilling or unable to meet its obligations to the Fund. Credit risk The value of a bond or money market security may fall if the financial health of the issuer weakens, or the market believes it may weaken. This risk is greater the lower the credit quality of the bond. Deriv ...

... which it trades becomes unwilling or unable to meet its obligations to the Fund. Credit risk The value of a bond or money market security may fall if the financial health of the issuer weakens, or the market believes it may weaken. This risk is greater the lower the credit quality of the bond. Deriv ...

ASX Options Ready for super funds and asset advisers

... The main risk of this strategy is that the share price increases strongly during the life of the option and since upside potential is capped, the portfolio misses out on share price gains that it otherwise could have made. For this reason, the buy write strategy is best employed during periods when ...

... The main risk of this strategy is that the share price increases strongly during the life of the option and since upside potential is capped, the portfolio misses out on share price gains that it otherwise could have made. For this reason, the buy write strategy is best employed during periods when ...