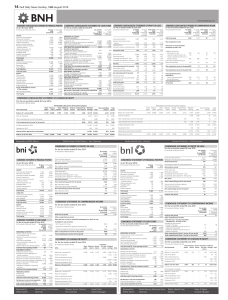

14 Gulf Daily News Sunday, 14th August 2016

... Items that are or may be reclassified subsequently to profit or loss: Available-for-sale securities: - Net change in fair value - Impairment transferred to profit or loss - Transfer to statement of profit or loss on disposal of securities Share of other comprehensive income of equity accounted inves ...

... Items that are or may be reclassified subsequently to profit or loss: Available-for-sale securities: - Net change in fair value - Impairment transferred to profit or loss - Transfer to statement of profit or loss on disposal of securities Share of other comprehensive income of equity accounted inves ...

BBY Conference Presentation 14 Sept 2010

... Salt demand typically grows with GDP however growth above this will come from: Progressive benefits from Bajool refinery capital upgrades which will reduce freight and manufacturing costs in F11 and F12 Reopening of Port Alma field in 2009 will reduce salt costs in F11, F12 and F13 New Indon ...

... Salt demand typically grows with GDP however growth above this will come from: Progressive benefits from Bajool refinery capital upgrades which will reduce freight and manufacturing costs in F11 and F12 Reopening of Port Alma field in 2009 will reduce salt costs in F11, F12 and F13 New Indon ...

Australian Journal of Basic and Applied Sciences A Conceptual

... improve profits. (Soekarno, S. and D.A. Azhari, 2009; Humaida, B.S., 2012) found that profitability ratio has positively related to firm distress. Furthermore, (Keasey, K., R. Watson, 1991) in their study stated that insolvency ratio of insurance firms is strongly related to Net Profit Margin (NPM) ...

... improve profits. (Soekarno, S. and D.A. Azhari, 2009; Humaida, B.S., 2012) found that profitability ratio has positively related to firm distress. Furthermore, (Keasey, K., R. Watson, 1991) in their study stated that insolvency ratio of insurance firms is strongly related to Net Profit Margin (NPM) ...

Assessing Discount Rate for a Project Financed Entirely with Equity

... Risk free rate (Rf) is represented only by income return gained by investors for 10, 20 or 30-year constant maturity bonds. Total return includes also capital gain return, which implies some risk and it is not appropriate for riskless asset. Market risk premium (RPm) used for assessing discount rate ...

... Risk free rate (Rf) is represented only by income return gained by investors for 10, 20 or 30-year constant maturity bonds. Total return includes also capital gain return, which implies some risk and it is not appropriate for riskless asset. Market risk premium (RPm) used for assessing discount rate ...

download

... • Reports the resources (assets), obligations (liabilities), and residual ownership claims (equity) of a company. • Facilitates analysis of the company’s ability to: – meet short-term obligations (liquidity). – pay all debts as due (solvency). ...

... • Reports the resources (assets), obligations (liabilities), and residual ownership claims (equity) of a company. • Facilitates analysis of the company’s ability to: – meet short-term obligations (liquidity). – pay all debts as due (solvency). ...

Webtrader Business Terms For Securities Trading

... Client in case of extraordinary circumstances, which shall include without limitation the circumstances set out in clause 13. A Client cannot enter an order into the Trading Platform on conditions fully or partially identical to another unexecuted trade entered into the Trading Platform system by th ...

... Client in case of extraordinary circumstances, which shall include without limitation the circumstances set out in clause 13. A Client cannot enter an order into the Trading Platform on conditions fully or partially identical to another unexecuted trade entered into the Trading Platform system by th ...

chapter 11 part 2 savings class notes

... rewards. In general, the higher the potential return, the higher the risk of loss. Although some funds are less risky than others, all funds have some level of risk - it's never possible to diversify away all risk. This is a fact for all investments. Each fund has a predetermined investment objectiv ...

... rewards. In general, the higher the potential return, the higher the risk of loss. Although some funds are less risky than others, all funds have some level of risk - it's never possible to diversify away all risk. This is a fact for all investments. Each fund has a predetermined investment objectiv ...

Stock market boom and the productivity gains of the 1990s

... relationship can go in both directions, in this paper we will emphasize the channel going from asset prices to labor productivity. Financing boom for new firms: Figure 4 illustrates the financing boom for new firms with the evolution of the Nasdaq composite index and the amount of venture capital i ...

... relationship can go in both directions, in this paper we will emphasize the channel going from asset prices to labor productivity. Financing boom for new firms: Figure 4 illustrates the financing boom for new firms with the evolution of the Nasdaq composite index and the amount of venture capital i ...

Hybrid Securities: A Basic Look at Monthly Income Preferred

... however, is unavailable to corporate investors who invest in MIPS, which in turn makes them more favorable to individual investors. Table 1 summarizes the rates of return on MIPS in comparison to corporate bonds and conventional preferred stock with a comparable rating from Standard & Poor’s for bot ...

... however, is unavailable to corporate investors who invest in MIPS, which in turn makes them more favorable to individual investors. Table 1 summarizes the rates of return on MIPS in comparison to corporate bonds and conventional preferred stock with a comparable rating from Standard & Poor’s for bot ...

Will my portfolio give me an inflation plus return?

... The lowest rolling monthly five year return for the balanced strategy was 1% over the five years ended September 1992 (circled on Figure 1). Over the same period, in line with its touted defensiveness, the conservative strategy recorded a higher real return of 5.5%, reflecting very strong nominal bo ...

... The lowest rolling monthly five year return for the balanced strategy was 1% over the five years ended September 1992 (circled on Figure 1). Over the same period, in line with its touted defensiveness, the conservative strategy recorded a higher real return of 5.5%, reflecting very strong nominal bo ...

FAQ Structured Investment

... You will be given a set of Investment Agreement, Product Highlight Sheet or Product Disclosure Sheet and Risk Disclosure Statement. 14. What is Pre-Investment Cooling-off Period? You are allowed to terminate the contract and obtain a refund of the monies paid within 3 Kuala Lumpur banking days after ...

... You will be given a set of Investment Agreement, Product Highlight Sheet or Product Disclosure Sheet and Risk Disclosure Statement. 14. What is Pre-Investment Cooling-off Period? You are allowed to terminate the contract and obtain a refund of the monies paid within 3 Kuala Lumpur banking days after ...

Assessing High House Prices: Bubbles, Fundamentals and

... In this paper, we explain how to assess the state of house prices— both whether there is a bubble and what underlying factors support housing demand—in a way that is grounded in economic theory. In doing so, we correct four common fallacies about the costliness of the housing market. First, the pric ...

... In this paper, we explain how to assess the state of house prices— both whether there is a bubble and what underlying factors support housing demand—in a way that is grounded in economic theory. In doing so, we correct four common fallacies about the costliness of the housing market. First, the pric ...

Capture the Rebound Potential - CSOP Asset Management Limited

... Mercantile Exchange (the “NYMEX”). Investment in the Sub-Fund is only suitable to those investors who are in a financial position to assume the risks involved in futures investments. • Futures investments are subject to certain key risks including leverage, counterparty and liquidity risks. Movemen ...

... Mercantile Exchange (the “NYMEX”). Investment in the Sub-Fund is only suitable to those investors who are in a financial position to assume the risks involved in futures investments. • Futures investments are subject to certain key risks including leverage, counterparty and liquidity risks. Movemen ...

Dynamic predictor selection and order splitting in a limit order

... The second contribution made by the current study is that we model a limit order market by relaxing the restrictive assumptions otherwise imposed in previous theoretical studies on limit order markets; additionally, we investigate the relation between the more realistic setup and the empirical feat ...

... The second contribution made by the current study is that we model a limit order market by relaxing the restrictive assumptions otherwise imposed in previous theoretical studies on limit order markets; additionally, we investigate the relation between the more realistic setup and the empirical feat ...

Royal London Sterling Extra Yield Bond Fund

... and do not include portfolio transaction costs. Ongoing charges are the same for all investors. The charges you pay are used to pay the costs of running the fund. These charges reduce the potential growth of the investment. For more about charges, see the expenses section in the full Prospectus and ...

... and do not include portfolio transaction costs. Ongoing charges are the same for all investors. The charges you pay are used to pay the costs of running the fund. These charges reduce the potential growth of the investment. For more about charges, see the expenses section in the full Prospectus and ...

The Fossil Fuel Transition

... and hurdle rates. These can differ from IEA price assumptions even if based upon the IEA’s demand scenarios, depending on supply assumptions. Key indicators for the future project portfolio such as net present value (NPV), internal rates of return (IRR) and breakeven price curves. An indication of c ...

... and hurdle rates. These can differ from IEA price assumptions even if based upon the IEA’s demand scenarios, depending on supply assumptions. Key indicators for the future project portfolio such as net present value (NPV), internal rates of return (IRR) and breakeven price curves. An indication of c ...

Option Trading: Information or Differences of

... to those of the underlying stocks. They found that the trading ratio is related in cross-section to variables such as firm size and implied volatility. The trading ratio is higher around earnings announcements and its relation to returns seems to suggest that some portion of the option trading may p ...

... to those of the underlying stocks. They found that the trading ratio is related in cross-section to variables such as firm size and implied volatility. The trading ratio is higher around earnings announcements and its relation to returns seems to suggest that some portion of the option trading may p ...

Chapter 4

... a. Depreciation Expense: a non-cash expense that in theory creates a “fund” which will be used later to replace the worn-out asset. b. In actuality: it is a “tax shelter”. It reduces our taxable income. c. Assets are depreciated over their expected economic life to zero. Book Value = 0 d. However, e ...

... a. Depreciation Expense: a non-cash expense that in theory creates a “fund” which will be used later to replace the worn-out asset. b. In actuality: it is a “tax shelter”. It reduces our taxable income. c. Assets are depreciated over their expected economic life to zero. Book Value = 0 d. However, e ...

Valuing intangibles companies

... the list includes some conversion mechanisms that are more appropriate for IP than for uncodified knowledge, it is just as applicable to law firms and consulting firms as it is to technology companies. All knowledge companies comprise three major elements: intellectual capital and two forms of struc ...

... the list includes some conversion mechanisms that are more appropriate for IP than for uncodified knowledge, it is just as applicable to law firms and consulting firms as it is to technology companies. All knowledge companies comprise three major elements: intellectual capital and two forms of struc ...

Investment in Innovation and Fixed Assets: the effect of US tax

... Throughout the paper assumes a hierarchy of finance model of firm investment.4 Under strong assumptions the cost of capital should be independent of the type of capital used: the financial structure of the firm should be irrelevant to the value of the firm.5 These assumptions are: one, there is per ...

... Throughout the paper assumes a hierarchy of finance model of firm investment.4 Under strong assumptions the cost of capital should be independent of the type of capital used: the financial structure of the firm should be irrelevant to the value of the firm.5 These assumptions are: one, there is per ...

Stable Value Fund

... average interest rates over a period of several years, the fund’s income yield may remain above or stay below current market yields during some time periods. Income risk will be moderately high for the fund. Inflation Risk: The chance that fund returns will not keep pace with the cost of living. Mar ...

... average interest rates over a period of several years, the fund’s income yield may remain above or stay below current market yields during some time periods. Income risk will be moderately high for the fund. Inflation Risk: The chance that fund returns will not keep pace with the cost of living. Mar ...

Income Drawdown Plan - Home | Capita Financial

... Your Plan is made up of different types of investment assets. Any particular asset will give you a likely rate of return, whilst also carrying a certain level of risk. In general, the higher the rates of returns you can expect from an asset the more risk it will carry of falling in value as well. Th ...

... Your Plan is made up of different types of investment assets. Any particular asset will give you a likely rate of return, whilst also carrying a certain level of risk. In general, the higher the rates of returns you can expect from an asset the more risk it will carry of falling in value as well. Th ...