Public and Private Capital Markets are Not Substitutes

... organize their companies around customer needs. For instance, rather than have customers contact sales or marketing representatives directly as they do in public companies, many private companies have customers contact the owner-manager directly, who then involves the appropriate personnel. Finally, ...

... organize their companies around customer needs. For instance, rather than have customers contact sales or marketing representatives directly as they do in public companies, many private companies have customers contact the owner-manager directly, who then involves the appropriate personnel. Finally, ...

Asymmetric Information and Financial Crises: A Historical

... One way that lenders can reduce the adverse selection problem in debt markets is to have the borrower provide collateral for the loan. Thus, if the borrower defaults on the loan, the lender can take title to the collateral and sell it to make up the loss. Note that if the collateral is of good enoug ...

... One way that lenders can reduce the adverse selection problem in debt markets is to have the borrower provide collateral for the loan. Thus, if the borrower defaults on the loan, the lender can take title to the collateral and sell it to make up the loss. Note that if the collateral is of good enoug ...

Response to HMT consultation on tax deductibility of

... Re: Tax Deductibility of Corporate Interest Expense: Consultation We are writing on behalf of the British Private Equity and Venture Capital Association (the "BVCA"), which is the industry body and public policy advocate for the private equity and venture capital industry in the UK. With a membershi ...

... Re: Tax Deductibility of Corporate Interest Expense: Consultation We are writing on behalf of the British Private Equity and Venture Capital Association (the "BVCA"), which is the industry body and public policy advocate for the private equity and venture capital industry in the UK. With a membershi ...

Impact Investing: How does it make a difference?

... percent returns to investors the fund manager decided to raise a second fund, which invested in a company that sets up water purification plants in rural villages. The plants are owned by the local community and operated by the installation company, which sells the purified water to the village at a ...

... percent returns to investors the fund manager decided to raise a second fund, which invested in a company that sets up water purification plants in rural villages. The plants are owned by the local community and operated by the installation company, which sells the purified water to the village at a ...

chapter outline

... the newspaper. Calculate your holdings of each security based on current prices. What objectives do you have for this portfolio? Was it chosen to maximize short-term gains, long-term stability, or some other objective? Explain how each of the following economic events would affect the value of your ...

... the newspaper. Calculate your holdings of each security based on current prices. What objectives do you have for this portfolio? Was it chosen to maximize short-term gains, long-term stability, or some other objective? Explain how each of the following economic events would affect the value of your ...

Black Swans and Market Timing

... As shown in panel A, over the 29,190 trading days (107 years) of the Dow’s history considered in the exhibit, the daily (arithmetic and geometric) mean return and standard deviation were 0.02% and 1.07%. The maximum and minimum daily returns were 15.34% and –22.61%, the latter on Black Monday. The c ...

... As shown in panel A, over the 29,190 trading days (107 years) of the Dow’s history considered in the exhibit, the daily (arithmetic and geometric) mean return and standard deviation were 0.02% and 1.07%. The maximum and minimum daily returns were 15.34% and –22.61%, the latter on Black Monday. The c ...

A guide to your with-profits investment and how we manage

... Shares (or equities) are shares in companies listed on stock exchanges around the world. As shares can rise and fall in value very easily, equities are riskier than most other investments. However, they usually offer the greatest chance of higher returns over the long term. In our With-Profit Fund t ...

... Shares (or equities) are shares in companies listed on stock exchanges around the world. As shares can rise and fall in value very easily, equities are riskier than most other investments. However, they usually offer the greatest chance of higher returns over the long term. In our With-Profit Fund t ...

Paper - Yale Economics

... nobles; this would lead to faster growth and a more rapid structural transformation. Financial frictions make his impossible: the banking sector is small and relatively inefficient, and the stock market is hamstrung by government restrictions. Prejudice also plays a role, as the nobility shied away ...

... nobles; this would lead to faster growth and a more rapid structural transformation. Financial frictions make his impossible: the banking sector is small and relatively inefficient, and the stock market is hamstrung by government restrictions. Prejudice also plays a role, as the nobility shied away ...

debt into growth: how sovereign debt accelerated the first industrial

... nobles; this would lead to faster growth and a more rapid structural transformation. Financial frictions make his impossible: the banking sector is small and relatively inefficient, and the stock market is hamstrung by government restrictions. Prejudice also plays a role, as the nobility shied away ...

... nobles; this would lead to faster growth and a more rapid structural transformation. Financial frictions make his impossible: the banking sector is small and relatively inefficient, and the stock market is hamstrung by government restrictions. Prejudice also plays a role, as the nobility shied away ...

ch1 -

... • Pure arbitrage; arbitrage is taking advantage of a mispricing between two markets by simultaneously buying and selling the same commodity. Spot futures arbitrage is a common example. • Risk arbitrage; taking advantage of a real or perceived mispricing based on some not happen information; the trad ...

... • Pure arbitrage; arbitrage is taking advantage of a mispricing between two markets by simultaneously buying and selling the same commodity. Spot futures arbitrage is a common example. • Risk arbitrage; taking advantage of a real or perceived mispricing based on some not happen information; the trad ...

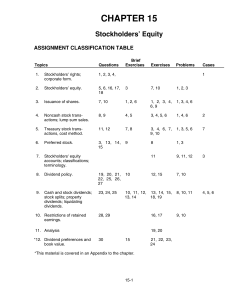

CHAPTER 15 Stockholders` Equity

... Research Bulletin No. 43 specifies that a distribution in excess of 20% to 25% of the number of shares previously outstanding would cause a material decrease in the market value. This is a characteristic of a stock split as opposed to a stock dividend, but, for legal reasons, the term “dividend” mus ...

... Research Bulletin No. 43 specifies that a distribution in excess of 20% to 25% of the number of shares previously outstanding would cause a material decrease in the market value. This is a characteristic of a stock split as opposed to a stock dividend, but, for legal reasons, the term “dividend” mus ...

Strategic Management: Text and Cases

... 2. Are there activities in our industry value chain presently being outsourced or performed independently by others that are a viable source of future profits? 3. Is there a high level of stability in the demand for the organization’s products? 4. How high is the proportion of additional production ...

... 2. Are there activities in our industry value chain presently being outsourced or performed independently by others that are a viable source of future profits? 3. Is there a high level of stability in the demand for the organization’s products? 4. How high is the proportion of additional production ...

The influence of investment intermediaries on the corporate sector

... property forms, is the separation of ownership and management functions. This provides the corporation as part of the corporate sector with undeniable advantages that favour its leading role in the economic growth, such as property liability limiting, which allows attracting a wide range of sharehol ...

... property forms, is the separation of ownership and management functions. This provides the corporation as part of the corporate sector with undeniable advantages that favour its leading role in the economic growth, such as property liability limiting, which allows attracting a wide range of sharehol ...

Competitive Analysis of On-line Securities Investment

... security in n days, which is referred to as the trading horizon (assume n ≥ 2 to avoid triviality). We also assume that, on each trading day, the security has only one price, which refers to the number of shares of the securities one unit capital could buy. After each price is realized, the investor ...

... security in n days, which is referred to as the trading horizon (assume n ≥ 2 to avoid triviality). We also assume that, on each trading day, the security has only one price, which refers to the number of shares of the securities one unit capital could buy. After each price is realized, the investor ...

Growth Strategies to Expand Role of Capital Market

... while greater internationalisation of domestic listed companies and additional foreign listings can facilitate a significant expansion in equity market capitalisation. It is estimated that internationalisation of the stockmarket can increase its potential size by 50% to RM3.6 trillion in 2020. In ad ...

... while greater internationalisation of domestic listed companies and additional foreign listings can facilitate a significant expansion in equity market capitalisation. It is estimated that internationalisation of the stockmarket can increase its potential size by 50% to RM3.6 trillion in 2020. In ad ...

Choice of Discount Rate - Mit - Massachusetts Institute of Technology

... Nominal Discount Rates. A forecast of nominal or market interest rates for 2007 based on the economic assumptions from the 2008 Budget are presented below. These nominal rates are to be used for discounting nominal flows, which are often encountered in lease-purchase analysis. Nominal Interest Rates ...

... Nominal Discount Rates. A forecast of nominal or market interest rates for 2007 based on the economic assumptions from the 2008 Budget are presented below. These nominal rates are to be used for discounting nominal flows, which are often encountered in lease-purchase analysis. Nominal Interest Rates ...

Chapter 15: Financial Statements and Year

... borrows money to buy equipment). Interest expense is a much ...

... borrows money to buy equipment). Interest expense is a much ...

www.catleylakeman.co.uk

... itself designed with the benefit of hindsight. The backtesting of performance differs from the actual performance because the investment strategy may be adjusted at any time, for any reason and can continue to be changed until desired or better performance results are achieved. Alternative modelling ...

... itself designed with the benefit of hindsight. The backtesting of performance differs from the actual performance because the investment strategy may be adjusted at any time, for any reason and can continue to be changed until desired or better performance results are achieved. Alternative modelling ...

Principles of Economics, Case and Fair,9e

... process thus involves not only estimating future benefits but also comparing them with the possible alternative uses of the funds required to undertake the project. At a minimum, those funds could earn interest in financial markets. ...

... process thus involves not only estimating future benefits but also comparing them with the possible alternative uses of the funds required to undertake the project. At a minimum, those funds could earn interest in financial markets. ...

money market fund

... Invests in investment grade domestic debt securities, taxable and tax-exempt, all US$ denominated; using yield curve, sector selection and security selection ...

... Invests in investment grade domestic debt securities, taxable and tax-exempt, all US$ denominated; using yield curve, sector selection and security selection ...

PDF

... slow capital formation slowed down structural change because it was limited by the self-financing ability of entrepreneurs. A second aspect of the Industrial Revolution that our framework sheds light on is the social change engendered by the Industrial Revolution. Britain’s nobility in 1700 held the ...

... slow capital formation slowed down structural change because it was limited by the self-financing ability of entrepreneurs. A second aspect of the Industrial Revolution that our framework sheds light on is the social change engendered by the Industrial Revolution. Britain’s nobility in 1700 held the ...

Debt into growth: How sovereign debt accelerated the first Industrial

... slow capital formation slowed down structural change because it was limited by the self-financing ability of entrepreneurs. A second aspect of the Industrial Revolution that our framework sheds light on is the social change engendered by the Industrial Revolution. Britain’s nobility in 1700 held the ...

... slow capital formation slowed down structural change because it was limited by the self-financing ability of entrepreneurs. A second aspect of the Industrial Revolution that our framework sheds light on is the social change engendered by the Industrial Revolution. Britain’s nobility in 1700 held the ...