November 2005 Course FM/2 Examination 1. An insurance

... This question was not counted as it referred to concepts not covered in the syllabus. But let us go over the answers and treat this as a learning experience: A. Black-Scholes option pricing model: This is not in the syllabus of Course FM/2. My guess is that the “original intent” of the question crea ...

... This question was not counted as it referred to concepts not covered in the syllabus. But let us go over the answers and treat this as a learning experience: A. Black-Scholes option pricing model: This is not in the syllabus of Course FM/2. My guess is that the “original intent” of the question crea ...

Market Value of the Firm, Market Value of Equity

... to the key point that gross profit is independent of capital structure. That is what MM proved: market value of the firm is independent of capital structure. Equation (1) and equation (2) generalize MM’s proof. Since gross profit is independent of capital structure, the optimal capital structure can ...

... to the key point that gross profit is independent of capital structure. That is what MM proved: market value of the firm is independent of capital structure. Equation (1) and equation (2) generalize MM’s proof. Since gross profit is independent of capital structure, the optimal capital structure can ...

Trends and Determinants of US Farmland Values Since 1910

... delinquency rates of the previous farm crisis periods compare to current levels. Figure 3 (over page) shows the agricultural liquidity and solvency ratios for the US since 1960, and Figure 4 (over page) shows the agricultural loan delinquency rates since 1970. In particular, the debt service ratio m ...

... delinquency rates of the previous farm crisis periods compare to current levels. Figure 3 (over page) shows the agricultural liquidity and solvency ratios for the US since 1960, and Figure 4 (over page) shows the agricultural loan delinquency rates since 1970. In particular, the debt service ratio m ...

Deferred Fixed Annuities

... growth you would have $107,728 regardless of market volatility. The blue line shows the same investment in a short-term, non-fixed-interest-rate product (like a money market or savings account) during a five-year period of rising interest rates — in this case, an annual increase of 0.50%, which star ...

... growth you would have $107,728 regardless of market volatility. The blue line shows the same investment in a short-term, non-fixed-interest-rate product (like a money market or savings account) during a five-year period of rising interest rates — in this case, an annual increase of 0.50%, which star ...

Atlassian Case Study Answers and Discussion

... each year), and the “breakeven point” at which new customers become profitable. Broadly speaking, switching to subscription-based business models hurts accounting profits (Net Income) in the short-term because revenue must be recognized over a long time period, but many costs such as commissions are ...

... each year), and the “breakeven point” at which new customers become profitable. Broadly speaking, switching to subscription-based business models hurts accounting profits (Net Income) in the short-term because revenue must be recognized over a long time period, but many costs such as commissions are ...

Market Opportunities in Global Real Estate Securities

... fundamentals are moving in a positive direction in all sectors. Although turmoil in the Middle East and the disaster in Japan are reminders that exogenous events are always lurking, the global economy is generally performing well. The prospect of rising interest rates, which might impact property va ...

... fundamentals are moving in a positive direction in all sectors. Although turmoil in the Middle East and the disaster in Japan are reminders that exogenous events are always lurking, the global economy is generally performing well. The prospect of rising interest rates, which might impact property va ...

Talking point - P

... and potential return associated with each stage. Projects can range from safer, or “core”, to higher risk “value add” or “opportunistic”. Also infrastructure projects often have low transparency, influenced by the specific nature of each project and the high level of private transactions (infrastruc ...

... and potential return associated with each stage. Projects can range from safer, or “core”, to higher risk “value add” or “opportunistic”. Also infrastructure projects often have low transparency, influenced by the specific nature of each project and the high level of private transactions (infrastruc ...

NBER WORKING PAPER SERIES THE INTERNATIONAL ECONOMICS OF TRANSITIONAL GROWTH ——

... dollar of output not consumed by the Japanese government. Converted into savings rates, the 1978 Japanese savings rate out of output left over after government consumption was over 50 percent greater than that of the U.S. The composition of domestic investment with respect to residential versus non- ...

... dollar of output not consumed by the Japanese government. Converted into savings rates, the 1978 Japanese savings rate out of output left over after government consumption was over 50 percent greater than that of the U.S. The composition of domestic investment with respect to residential versus non- ...

NCI, Inc. (Form: 8-K, Received: 02/10/2016 16:12:52)

... federal government agencies, particularly within the U.S. Department of Defense, for substantially all of our revenue; a reduction in the overall U.S. Defense budget, volatility in spending authorizations for defense and Intelligence-related programs by the U.S. Federal Government or a shift in spen ...

... federal government agencies, particularly within the U.S. Department of Defense, for substantially all of our revenue; a reduction in the overall U.S. Defense budget, volatility in spending authorizations for defense and Intelligence-related programs by the U.S. Federal Government or a shift in spen ...

Is buy and hold dead - Richard Bernstein Advisors

... other than inflation-protected securities and STRIPS, with at least $1 billion in outstanding face value and a remaining term to final maturity of at least 15 years. US High Grade Corporates: BofA Merrill Lynch 15+ Year AAA-AA US Corporate Index. The BofA Merrill Lynch 15+ Year AAA-AA US Corporate I ...

... other than inflation-protected securities and STRIPS, with at least $1 billion in outstanding face value and a remaining term to final maturity of at least 15 years. US High Grade Corporates: BofA Merrill Lynch 15+ Year AAA-AA US Corporate Index. The BofA Merrill Lynch 15+ Year AAA-AA US Corporate I ...

Limited liability companies

... failures to discover the fraud seem strikingly similar to the failures for which such institutions were heavily fined in the US after the Enron collapse. ...

... failures to discover the fraud seem strikingly similar to the failures for which such institutions were heavily fined in the US after the Enron collapse. ...

Assissing Corporate Financial Distress in South Africa

... business because they were caught off guard and could not meet their financial obligations. This has increased the importance of understanding the reasons behind the collapse of a firm, as this will enable timely bankruptcy preventative action to be taken as precaution. Over the past fifty years pra ...

... business because they were caught off guard and could not meet their financial obligations. This has increased the importance of understanding the reasons behind the collapse of a firm, as this will enable timely bankruptcy preventative action to be taken as precaution. Over the past fifty years pra ...

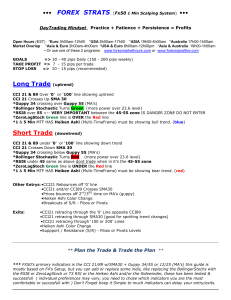

Long Trade (uptrend) Short Trade (downtrend)

... The Relative Strength Index Technical Indicator (RSI) is a price-following oscillator that ranges between 0 and 100. When Wilder introduced the Relative Strength Index, he recommended using a 14-day RSI. A popular method of analyzing the RSI is to look for a divergence in which the security is makin ...

... The Relative Strength Index Technical Indicator (RSI) is a price-following oscillator that ranges between 0 and 100. When Wilder introduced the Relative Strength Index, he recommended using a 14-day RSI. A popular method of analyzing the RSI is to look for a divergence in which the security is makin ...

$doc.title

... justified with tangible assets alone. If we redo the national accounts with intangible assets included, we can derive formulas that allow us to residually determine the value of these assets. The key assumption is that the after-tax returns on tangible and intangible capital are equal. We find that ...

... justified with tangible assets alone. If we redo the national accounts with intangible assets included, we can derive formulas that allow us to residually determine the value of these assets. The key assumption is that the after-tax returns on tangible and intangible capital are equal. We find that ...

Foreign Liquidity to Real Estate Market: Ripple Effect and Housing

... estate, and efficient portfolios with international real estate outperforming those without, hence indicating that international diversification appears to be important. With a new angle, this paper researches on international real estate acquisition from the recipient country’s perspective. It appe ...

... estate, and efficient portfolios with international real estate outperforming those without, hence indicating that international diversification appears to be important. With a new angle, this paper researches on international real estate acquisition from the recipient country’s perspective. It appe ...

Stock Market Liquidity, Financial Crisis and Quantitative Easing

... investigates possible impacts of US QE policy on Asian economies and financial markets finding a widespread impact on other economies as well as the U.S. The FED’s implementation of QE policy subsequent to the 2008-09 crisis aroused serious concerns in Asia regarding its possible impact in terms of ...

... investigates possible impacts of US QE policy on Asian economies and financial markets finding a widespread impact on other economies as well as the U.S. The FED’s implementation of QE policy subsequent to the 2008-09 crisis aroused serious concerns in Asia regarding its possible impact in terms of ...

CHAPTER 11: Input Demand: The Capital Market and the

... The investment process requires that the potential investor evaluate the expected flow of future productive services that an investment project will yield. ...

... The investment process requires that the potential investor evaluate the expected flow of future productive services that an investment project will yield. ...

Costing A series full syllabus test paper

... Q.38 A company makes one product, which has variable manufacturing costs of Rs 3.25 per unit and variable selling and administrative costs of Rs 1.17 per unit. Fixed manufacturing costs are Rs 42,300 per month and fixed selling and administrative costs are Rs 29,900 per month. The company wants to e ...

... Q.38 A company makes one product, which has variable manufacturing costs of Rs 3.25 per unit and variable selling and administrative costs of Rs 1.17 per unit. Fixed manufacturing costs are Rs 42,300 per month and fixed selling and administrative costs are Rs 29,900 per month. The company wants to e ...

File - Jason Murphy

... Give all answers in this question to the nearest whole currency unit. Ying and Ruby each have 5000 USD to invest. Ying invests his 5000 USD in a bank account that pays a nominal annual interest rate of 4.2 % compounded yearly. Ruby invests her 5000 USD in an account that offers a fixed interest of 2 ...

... Give all answers in this question to the nearest whole currency unit. Ying and Ruby each have 5000 USD to invest. Ying invests his 5000 USD in a bank account that pays a nominal annual interest rate of 4.2 % compounded yearly. Ruby invests her 5000 USD in an account that offers a fixed interest of 2 ...

The New Economy Business Model and Sustainable

... them compensation in the form of stock options, typically as a partial substitute for salaries, with the potential payoff being the high market value of the stock after an initial public offering or the private sale of the young firm to an established corporation. As these young companies grew, annu ...

... them compensation in the form of stock options, typically as a partial substitute for salaries, with the potential payoff being the high market value of the stock after an initial public offering or the private sale of the young firm to an established corporation. As these young companies grew, annu ...

THE RELATIONSHIP BETWEEN CONSUMER PRICE INDEX (CPI

... unoertain earnings prospects of listed companies to increase market risk. The majority of investors in the capital market sources of funds, their cost of capital are expected to depend largely on CPI. Rising CPI also often leads to the central bank to raise interest rates, tightening money supply, r ...

... unoertain earnings prospects of listed companies to increase market risk. The majority of investors in the capital market sources of funds, their cost of capital are expected to depend largely on CPI. Rising CPI also often leads to the central bank to raise interest rates, tightening money supply, r ...