Stock Market, Economic Performance, And Presidential Elections

... information from 1900 to 2008 across 27 administrations with 15 of them Republican and 12 Democratic. Table 1 summarizes the DJI closing price of selected dates in each election year’s November and December around the Election Day since 1900. All data is publicly available; DJI was extracted from Bl ...

... information from 1900 to 2008 across 27 administrations with 15 of them Republican and 12 Democratic. Table 1 summarizes the DJI closing price of selected dates in each election year’s November and December around the Election Day since 1900. All data is publicly available; DJI was extracted from Bl ...

RTF - OTC Markets

... Passive Strategy/Index Risk: The Fund is managed with a passive investment strategy, attempting to track the performance of an unmanaged index of securities, regardless of the current or projected performance of the Index or of the actual securities comprising the Index. This differs from an activel ...

... Passive Strategy/Index Risk: The Fund is managed with a passive investment strategy, attempting to track the performance of an unmanaged index of securities, regardless of the current or projected performance of the Index or of the actual securities comprising the Index. This differs from an activel ...

Using Markets to Inform Policy: The Case of the Iraq War

... Tradesports is arguably easier, and Tradesports does not limit individual investments to $500 as Iowa does. The most important difference, however, is clientéle. Tradesports offers primarily contracts on sporting events, but it markets itself as a trading exchange in contingent commodities rather t ...

... Tradesports is arguably easier, and Tradesports does not limit individual investments to $500 as Iowa does. The most important difference, however, is clientéle. Tradesports offers primarily contracts on sporting events, but it markets itself as a trading exchange in contingent commodities rather t ...

commercial market outlook 2017

... Choosing to sell through a broker is the best, most effective way of ensuring that not only does your business sell, but that it reaches the right buyer. With many options available, it’s important to research which brokers have a proven track record of success within the sector. Look for a broker t ...

... Choosing to sell through a broker is the best, most effective way of ensuring that not only does your business sell, but that it reaches the right buyer. With many options available, it’s important to research which brokers have a proven track record of success within the sector. Look for a broker t ...

The Causal Effects of Short-Selling Bans

... discontinuities in short-selling activity are up to 20% (40%) of the mean (median) shortselling activity for all short-eligible firms in Hong Kong. Despite this, we find that these short-selling bans have no effect on stock prices or market quality. Stock returns, volatility, bid-ask spreads, and c ...

... discontinuities in short-selling activity are up to 20% (40%) of the mean (median) shortselling activity for all short-eligible firms in Hong Kong. Despite this, we find that these short-selling bans have no effect on stock prices or market quality. Stock returns, volatility, bid-ask spreads, and c ...

Northern Trust

... wealth management firms would like to be “trusted advisor” to their clients Especially transaction providers like B/D want to get into “advice” to increase asset stickiness FP, advisory, data integration tools ...

... wealth management firms would like to be “trusted advisor” to their clients Especially transaction providers like B/D want to get into “advice” to increase asset stickiness FP, advisory, data integration tools ...

THE DETERMINANTS OF CORPORATE CAPITAL STRUCTURE

... According to the static trade off theory, firms will acquire more debt to prevent managers from wasting cash free flows gained from profits. High level of profit will also allow firms to have higher debt capacity and further easing the obtainment of debt. So, a positive relationship between Profitab ...

... According to the static trade off theory, firms will acquire more debt to prevent managers from wasting cash free flows gained from profits. High level of profit will also allow firms to have higher debt capacity and further easing the obtainment of debt. So, a positive relationship between Profitab ...

ppt - AAII

... can tolerate based on their own ability and willingness to take risk Investor’s Second Portfolio Objective Structure their portfolio to generate an acceptable level of return without exceeding the risk threshold ...

... can tolerate based on their own ability and willingness to take risk Investor’s Second Portfolio Objective Structure their portfolio to generate an acceptable level of return without exceeding the risk threshold ...

Table 1: Granger Causality Testing between Prices and Volumes

... temporal asymmetry is evident if trading volume responds significantly differently to positive lagged price changes than to negative lagged price changes. Testing for temporal asymmetry is important due to the implications of its existence on the trading actions and investment strategies of market p ...

... temporal asymmetry is evident if trading volume responds significantly differently to positive lagged price changes than to negative lagged price changes. Testing for temporal asymmetry is important due to the implications of its existence on the trading actions and investment strategies of market p ...

AEC-90: The American Private Enterprise System

... • Capitalism refers to a market economy with resources owned primarily by private individuals and groups. • Socialism refers to an economy that depends heavily on the government to plan and make economic decisions and to own and control important economic resources. • Communism describes a socialist ...

... • Capitalism refers to a market economy with resources owned primarily by private individuals and groups. • Socialism refers to an economy that depends heavily on the government to plan and make economic decisions and to own and control important economic resources. • Communism describes a socialist ...

Interpreting Farm Financial Ratios

... Liquidity is a measure of how well a farm can pay its debt (the portion due within one year) and other expenses in the coming year. The ratios that measure liquidity are current ratio and working capital. These two ratios can help determine if there is enough cash to cover upcoming expenses. The cur ...

... Liquidity is a measure of how well a farm can pay its debt (the portion due within one year) and other expenses in the coming year. The ratios that measure liquidity are current ratio and working capital. These two ratios can help determine if there is enough cash to cover upcoming expenses. The cur ...

Summary Prospectus - Select Sector SPDRs

... Passive Strategy/Index Risk: The Fund is managed with a passive investment strategy, attempting to track the performance of an unmanaged index of securities, regardless of the current or projected performance of the Index or of the actual securities comprising the Index. This differs from an activel ...

... Passive Strategy/Index Risk: The Fund is managed with a passive investment strategy, attempting to track the performance of an unmanaged index of securities, regardless of the current or projected performance of the Index or of the actual securities comprising the Index. This differs from an activel ...

self-study questions

... a) by liquidity. b) by importance. c) by longevity. d) alphabetically. Ans: a Response A: Correct! Response B: Current assets should be listed in order of liquidity, or in order of how quickly they are expected to be converted into cash. Response C: Current assets should be listed in order of liquid ...

... a) by liquidity. b) by importance. c) by longevity. d) alphabetically. Ans: a Response A: Correct! Response B: Current assets should be listed in order of liquidity, or in order of how quickly they are expected to be converted into cash. Response C: Current assets should be listed in order of liquid ...

Private_Lending_Presentation_Apartments

... Why would people sell their apartments at such a deep discount? Would I be investing in a piece of property or ∞Infinite Returns LLC∞? Is the investment secured? What kind of paperwork do I get? What happens if you get hit by a bus? Infinite Returns, LLC ...

... Why would people sell their apartments at such a deep discount? Would I be investing in a piece of property or ∞Infinite Returns LLC∞? Is the investment secured? What kind of paperwork do I get? What happens if you get hit by a bus? Infinite Returns, LLC ...

investment management of banks

... • When the yield curve slopes upward, as a bond approaches maturity or “rolls down the yield curve”, it is valued at successively lower yields and higher prices. • Using this strategy, a bond is held for a period of time as it appreciates in price and is sold before maturity to realize the gain. As ...

... • When the yield curve slopes upward, as a bond approaches maturity or “rolls down the yield curve”, it is valued at successively lower yields and higher prices. • Using this strategy, a bond is held for a period of time as it appreciates in price and is sold before maturity to realize the gain. As ...

21_EFM06-HoChienwei-Determinants of Direct Stock Holding

... Dynamics. Haliassos & Bertaut (1995) found positive relationship between stock market participation and labor income as well as financial net worth. Income and financial assets are significant for marginal investors, suggesting that economic downturns could seriously affect participation decisions o ...

... Dynamics. Haliassos & Bertaut (1995) found positive relationship between stock market participation and labor income as well as financial net worth. Income and financial assets are significant for marginal investors, suggesting that economic downturns could seriously affect participation decisions o ...

Municipal Bond Fund Report

... Meanwhile, the number of job openings reached a series high of 6 million in April. This could indicate a mismatch between the job seeker skills and job requirements. While the labor force participation rate has stabilized slightly below 63%, the number of people working part-time for economic reas ...

... Meanwhile, the number of job openings reached a series high of 6 million in April. This could indicate a mismatch between the job seeker skills and job requirements. While the labor force participation rate has stabilized slightly below 63%, the number of people working part-time for economic reas ...

Large Cap Research Equity

... There is no guarantee the Portfolio’s investment strategy will be successful. Investing involves risk, and an investment in the Portfolio could lose money. The Portfolio’s principal risks include: ...

... There is no guarantee the Portfolio’s investment strategy will be successful. Investing involves risk, and an investment in the Portfolio could lose money. The Portfolio’s principal risks include: ...

Daily Commodity Report as on Wednesday, July 12

... Copper on MCX settled up 0.88% at 382.6 after a rapid build-up of inventories that has weighed on the market since late June halted and workers voted to strike at a mine in Chile, raising supply concerns. Prices had slipped nearly 3 percent since late June as stocks in LME-registered warehouses rose ...

... Copper on MCX settled up 0.88% at 382.6 after a rapid build-up of inventories that has weighed on the market since late June halted and workers voted to strike at a mine in Chile, raising supply concerns. Prices had slipped nearly 3 percent since late June as stocks in LME-registered warehouses rose ...

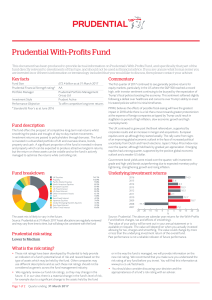

Prudential With

... The performance figures shown are overall annualised returns for contributions made on the dates specified. The returns include both regular and final bonuses added to a benefit paid at normal retirement date, but make no allowance for any applicable initial charges, allocation rates or early cash i ...

... The performance figures shown are overall annualised returns for contributions made on the dates specified. The returns include both regular and final bonuses added to a benefit paid at normal retirement date, but make no allowance for any applicable initial charges, allocation rates or early cash i ...

National Accounting and the Business Cycle in Germany 1851 – 1913

... using results of more recent historical research, most importantly the estimates of the capital stock. An important issue in business cycle measurement is the employed methodology. To get a business cycle from a univariate time series like NNP, one needs to decompose the data into a trend component ...

... using results of more recent historical research, most importantly the estimates of the capital stock. An important issue in business cycle measurement is the employed methodology. To get a business cycle from a univariate time series like NNP, one needs to decompose the data into a trend component ...

Investment and Spending Policy Community Colleges of New

... classes. However, the diversification benefits of combining various equity components should enhance the overall portfolio risk-return profile. Domestic equity specialist managers are permitted to invest in domestically traded equity securities and, where appropriate, domestic fixed income securitie ...

... classes. However, the diversification benefits of combining various equity components should enhance the overall portfolio risk-return profile. Domestic equity specialist managers are permitted to invest in domestically traded equity securities and, where appropriate, domestic fixed income securitie ...

CHAPTER 1

... 1. Buying a home is not about return on investment. It is about family or household security, opportunity, and other irreplaceable intangibles. As a person who understands the meaning of investment, how would you answer this assertion? Solution: The purchase of a home is an investment because the de ...

... 1. Buying a home is not about return on investment. It is about family or household security, opportunity, and other irreplaceable intangibles. As a person who understands the meaning of investment, how would you answer this assertion? Solution: The purchase of a home is an investment because the de ...