NBER WORKING PAPER SERIES DEMAND-BASED OPTION PRICING Nicolae Garleanu Lasse Heje Pedersen

... in zero net supply, a representative investor holds no options. We reconcile this finding for dealers who have significant short index option positions. Intuitively, an investor will short index options, but only a finite number of options. Hence, while a standardutility investor may not be marginal ...

... in zero net supply, a representative investor holds no options. We reconcile this finding for dealers who have significant short index option positions. Intuitively, an investor will short index options, but only a finite number of options. Hence, while a standardutility investor may not be marginal ...

Reservation bid and ask prices for options and covered

... structured products issued to retail investors. Specifically, we build a general model of reservation bid and ask prices8 for options for investors with an arbitrary portfolio of vanilla options written on a single underlying asset with a single maturity date who hedges optimally, thereby incurring ...

... structured products issued to retail investors. Specifically, we build a general model of reservation bid and ask prices8 for options for investors with an arbitrary portfolio of vanilla options written on a single underlying asset with a single maturity date who hedges optimally, thereby incurring ...

Integrated annual report and group annual financial statements

... Hyprop’s sustainable value creation is linked to our approach to ethical leadership and how we employ our six capitals (financial, operational/manufactured, intellectual, human, social and relationship, and natural). This integrated annual report is a holistic presentation of the group’s performance ...

... Hyprop’s sustainable value creation is linked to our approach to ethical leadership and how we employ our six capitals (financial, operational/manufactured, intellectual, human, social and relationship, and natural). This integrated annual report is a holistic presentation of the group’s performance ...

Emerging Equity Markets in a Globalizing World

... difference is South Korea, which accounts for 2.2% of global equity market capitalization. In the FTSE global index, South Korea is a “developed” market, whereas MSCI puts South Korea in the “emerging” market group. There are other smaller differences. The different approaches to including South Kor ...

... difference is South Korea, which accounts for 2.2% of global equity market capitalization. In the FTSE global index, South Korea is a “developed” market, whereas MSCI puts South Korea in the “emerging” market group. There are other smaller differences. The different approaches to including South Kor ...

Does Academic Research Destroy Stock Return Predictability?*

... learn from the publication. Cochrane (1999) explains that if predictability reflects risk it is likely to persist: “Even if the opportunity is widely publicized, investors will not change their portfolio decisions, and the relatively high average return will remain.” Cochrane’s logic follows Muth’s ...

... learn from the publication. Cochrane (1999) explains that if predictability reflects risk it is likely to persist: “Even if the opportunity is widely publicized, investors will not change their portfolio decisions, and the relatively high average return will remain.” Cochrane’s logic follows Muth’s ...

1Q17 Results Presentation

... If adjusted to the same number of days as Q3 and Q4 2016, the NII would be €507M, 1.4% up vs. 3Q 2016… ...

... If adjusted to the same number of days as Q3 and Q4 2016, the NII would be €507M, 1.4% up vs. 3Q 2016… ...

Evaluation of Managerial Techniques: NPV and IRR

... financial management. Thus, what we need to know is how to tell whether a particular investment will achieve that. Frequently, financial managers use the common techniques are NPV or IRR. In this research work is to analyze which technique is most useful for the managers. ...

... financial management. Thus, what we need to know is how to tell whether a particular investment will achieve that. Frequently, financial managers use the common techniques are NPV or IRR. In this research work is to analyze which technique is most useful for the managers. ...

Why were there fire sales of mortgage

... have developed the ability to assess the securities being sold. When natural buyers are on the sidelines, investors who bid for the assets are less knowledgeable about them and do not have a natural demand for them. Therefore, these investors will only buy them if they sell at enough of a discount. ...

... have developed the ability to assess the securities being sold. When natural buyers are on the sidelines, investors who bid for the assets are less knowledgeable about them and do not have a natural demand for them. Therefore, these investors will only buy them if they sell at enough of a discount. ...

ppt

... produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. ...

... produced by the Market Technicians Association Educational Foundation based on the detailed class notes of Charles Kirkpatrick II, CMT Copyright © 2010. All rights are reserved. ...

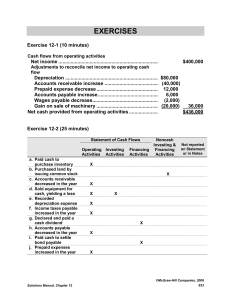

Cash flows from operating activities

... Depreciation expense ...................................................58,600 Gain on sale of plant assets ........................................ (2,000) Net cash provided by operating activities .................. Cash flows from investing activities Cash received from sale of equip. (Note 1) .. ...

... Depreciation expense ...................................................58,600 Gain on sale of plant assets ........................................ (2,000) Net cash provided by operating activities .................. Cash flows from investing activities Cash received from sale of equip. (Note 1) .. ...

Citigroup ERISA Litigation

... An eligible individual account plan is a defined contribution plan that is “(i) a profit-sharing, stock bonus, thrift, or savings plan; (ii) an employee stock ownership plan; or (iii) a money purchase plan which . . . [is] invested primarily in qualifying employer securities.” 29 U.S.C. § 1107(d)(3) ...

... An eligible individual account plan is a defined contribution plan that is “(i) a profit-sharing, stock bonus, thrift, or savings plan; (ii) an employee stock ownership plan; or (iii) a money purchase plan which . . . [is] invested primarily in qualifying employer securities.” 29 U.S.C. § 1107(d)(3) ...

Lessons for the Young Economist

... Creative and careful thinkers throughout human history have developed various disciplines for studying the world. Each discipline (or subject) offers its own perspective as history unfolds before us. For a complete education, the student must become acquainted with some of the most ...

... Creative and careful thinkers throughout human history have developed various disciplines for studying the world. Each discipline (or subject) offers its own perspective as history unfolds before us. For a complete education, the student must become acquainted with some of the most ...

Self-Study Guide to Hedging with Livestock Futures

... ever result in actual delivery of the physical commodity. The great majority of futures contracts are closed out, or “offset” prior to delivery by taking an opposite position in the same contract and delivery month. In other words, if someone initially buys a futures contract for a specific product ...

... ever result in actual delivery of the physical commodity. The great majority of futures contracts are closed out, or “offset” prior to delivery by taking an opposite position in the same contract and delivery month. In other words, if someone initially buys a futures contract for a specific product ...

FORM 10-Q - Investor Overview

... Litigation Reform Act of 1995. In some cases, you can identify these statements by forward-looking terms such as “may,” “might,” “will,” “would,” “could,” “should,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “project,” “possible,” “potential,” “intend,” “seek” or “continue,” t ...

... Litigation Reform Act of 1995. In some cases, you can identify these statements by forward-looking terms such as “may,” “might,” “will,” “would,” “could,” “should,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “project,” “possible,” “potential,” “intend,” “seek” or “continue,” t ...

IMPROVING THE EFFICIENCY OF THE ANGEL FINANCE MARKET

... As will be discussed in greater detail below, entrepreneurs founding these rapid-growth start-ups will typically be required to seek outside equity financing in order to fund their ventures. The media has focused predominantly on the role of institutional venture capital (“VC”) funds in providing th ...

... As will be discussed in greater detail below, entrepreneurs founding these rapid-growth start-ups will typically be required to seek outside equity financing in order to fund their ventures. The media has focused predominantly on the role of institutional venture capital (“VC”) funds in providing th ...

SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C.

... hydraulic actuation products. The Company is affected by the level of expenditures for defense and space programs and the level of production of commercial and general aviation aircraft. The Company's aerospace products are sold directly to the U. S. government, aircraft manufacturers and commercial ...

... hydraulic actuation products. The Company is affected by the level of expenditures for defense and space programs and the level of production of commercial and general aviation aircraft. The Company's aerospace products are sold directly to the U. S. government, aircraft manufacturers and commercial ...

Short Selling Risk - Rady School of Management

... is the quantity of shares loaned out as a percentage of Loan Supply. Finally, Loan Fee, often referred to as specialness, is the cost of borrowing a share in basis points per annum. We use Loan Fee and Utilization to define two measures of short selling risk. The first measure, Fee Risk, is the nat ...

... is the quantity of shares loaned out as a percentage of Loan Supply. Finally, Loan Fee, often referred to as specialness, is the cost of borrowing a share in basis points per annum. We use Loan Fee and Utilization to define two measures of short selling risk. The first measure, Fee Risk, is the nat ...

ISSUE OF DEBENTURES A debenture is a written

... Where S= Lump sum required to redeem debentures; a = equal amount to be appropriated annually; n = number of years; r = interest rate 3. Redemption by Purchase of the Debentures in the Open Market: under this method, the company, at its option, purchases the debentures in the open market particularl ...

... Where S= Lump sum required to redeem debentures; a = equal amount to be appropriated annually; n = number of years; r = interest rate 3. Redemption by Purchase of the Debentures in the Open Market: under this method, the company, at its option, purchases the debentures in the open market particularl ...

Dealers` Hedging of Interest Rate Options in the U.S. Dollar Fixed

... the yield curve to generate trading demand that is high relative to turnover volume in the more liquid trading instruments. Dealers then face a risk management tradeoff between reducing price risk or incurring the liquidity costs of immediately rebalancing their hedge positions. However, only very l ...

... the yield curve to generate trading demand that is high relative to turnover volume in the more liquid trading instruments. Dealers then face a risk management tradeoff between reducing price risk or incurring the liquidity costs of immediately rebalancing their hedge positions. However, only very l ...

0000897101-15-000290 - Investor Relations

... purchase a hearing aid, consolidation at the retail level and inconveniences in the distribution channel. These factors have created the opportunity for alternative care models, such as the value hearing aid (VHA) channel and personal sound amplifier (PSAP) channel. The VHA channel is outcome based ...

... purchase a hearing aid, consolidation at the retail level and inconveniences in the distribution channel. These factors have created the opportunity for alternative care models, such as the value hearing aid (VHA) channel and personal sound amplifier (PSAP) channel. The VHA channel is outcome based ...