Sukuk: The Sharia Fixed Income Alternative Strategy

... grew exponentially in 2011–13, with total cumulative sukuk issued exceeding USD 336.0bn, whereas the total cumulative sukuk issuance over a 20-year period up to 2010 totaled USD 201.6bn. • Sukuk are increasingly being used as a substitute for corporate bonds and floating rate notes as sukuk share s ...

... grew exponentially in 2011–13, with total cumulative sukuk issued exceeding USD 336.0bn, whereas the total cumulative sukuk issuance over a 20-year period up to 2010 totaled USD 201.6bn. • Sukuk are increasingly being used as a substitute for corporate bonds and floating rate notes as sukuk share s ...

The Aggregate Demand for Treasury Debt

... securities such as corporate bonds, causing the yield on Treasuries to fall further below corporate bond rates, and the bond spread to widen. The opposite applies when the stock of debt is high. Variation in the supply of Treasury securities traces out a downward sloping demand curve for Treasuries ...

... securities such as corporate bonds, causing the yield on Treasuries to fall further below corporate bond rates, and the bond spread to widen. The opposite applies when the stock of debt is high. Variation in the supply of Treasury securities traces out a downward sloping demand curve for Treasuries ...

Global Intangible Financial Tracker 2016 An annual

... business, not just the balance sheet, to turn risk into opportunity in the face of rapid change and huge complexity. With continued importance being placed on the value of intangible assets, and with intangible value representing an ever-growing part of an organisation’s enterprise value, accounting ...

... business, not just the balance sheet, to turn risk into opportunity in the face of rapid change and huge complexity. With continued importance being placed on the value of intangible assets, and with intangible value representing an ever-growing part of an organisation’s enterprise value, accounting ...

How expensive are cost savings?

... public-private partnerships offer real benefits through higher productive efficiency at the project level. It is against this background that the paper analyses the microeconomic pros and cons of public-private partnerships by identifying the sources of both higher benefits and higher costs associated wi ...

... public-private partnerships offer real benefits through higher productive efficiency at the project level. It is against this background that the paper analyses the microeconomic pros and cons of public-private partnerships by identifying the sources of both higher benefits and higher costs associated wi ...

Option value-improving resource allocation efficiency

... the willingness to pay associated with current use, means that these preferences will not be considered by the profit-seeking firm. Therefore, if total revenue is not sufficient to cover total costs, the firm will either seek to adjust its operation to lower costs or it will close down. The two extr ...

... the willingness to pay associated with current use, means that these preferences will not be considered by the profit-seeking firm. Therefore, if total revenue is not sufficient to cover total costs, the firm will either seek to adjust its operation to lower costs or it will close down. The two extr ...

AMERCO /NV/ (Form: 10-Q, Received: 11/05/2014

... wholly-owned subsidiaries and ARCOA risk retention group (“ARCOA”). Property and Casualty Insurance provides loss adjusting and claims handling for U-Haul through regional offices across North America. Property and Casualty Insurance also underwrites components of the Safemove, Safetow, Safemove Plu ...

... wholly-owned subsidiaries and ARCOA risk retention group (“ARCOA”). Property and Casualty Insurance provides loss adjusting and claims handling for U-Haul through regional offices across North America. Property and Casualty Insurance also underwrites components of the Safemove, Safetow, Safemove Plu ...

Behavioral Portfolio Theory

... Lopes (1987) developed SP/A theory, a psychological theory of choice un? der uncertainty. SP/A theory is a general choice framework rather than a theory of portfolio choice. However, SP/A theory can be regarded as an extension of Arzac's version of the safety-first portfolio model. In SP/A theory, t ...

... Lopes (1987) developed SP/A theory, a psychological theory of choice un? der uncertainty. SP/A theory is a general choice framework rather than a theory of portfolio choice. However, SP/A theory can be regarded as an extension of Arzac's version of the safety-first portfolio model. In SP/A theory, t ...

Is the Investment-Uncertainty Link Really Elusive?

... shed light on the smoothness of investment to changes in interest rate.5 It is widely known that firms face uncertainty over many dimensions. For example, there is uncertainty about firms’ output prices, demand and costs, uncertainty about wages, interest rates and exchange rates, not to mention un ...

... shed light on the smoothness of investment to changes in interest rate.5 It is widely known that firms face uncertainty over many dimensions. For example, there is uncertainty about firms’ output prices, demand and costs, uncertainty about wages, interest rates and exchange rates, not to mention un ...

Investment Opportunities, Free-Cash-Flow, and the Market Values of

... As additional evidence, I examine the effect of an exogenous shock following the enactment of the American Jobs Creation Act of 2004, which provided a one-time tax holiday for firms repatriating cash. The results indicate that firms with poor investment opportunities abroad experienced significant p ...

... As additional evidence, I examine the effect of an exogenous shock following the enactment of the American Jobs Creation Act of 2004, which provided a one-time tax holiday for firms repatriating cash. The results indicate that firms with poor investment opportunities abroad experienced significant p ...

Corruption`s Impact on Liquidity, Investment

... commerce) and, at other levels, corruption might be harmful (thus, putting sand in the wheels of an economy). Most importantly, in contrast to our study, none of these papers investigate the effects of firm level corruption on liquidity, execution risk, foreign portfolio investments, and cost of equ ...

... commerce) and, at other levels, corruption might be harmful (thus, putting sand in the wheels of an economy). Most importantly, in contrast to our study, none of these papers investigate the effects of firm level corruption on liquidity, execution risk, foreign portfolio investments, and cost of equ ...

Debt Valuation, Renegotiation, and Optimal Dividend Policy

... our model is the presence of proportional and fixed costs of liquidation. We endogenize both the reorganization boundary and the optimal sharing rule between equity and debt holders upon default. We illustrate our framework with a Nash solution to the bargaining problem between lenders and borrowers ...

... our model is the presence of proportional and fixed costs of liquidation. We endogenize both the reorganization boundary and the optimal sharing rule between equity and debt holders upon default. We illustrate our framework with a Nash solution to the bargaining problem between lenders and borrowers ...

Hedging With Futures Contract

... inconsistent with the mean-variance framework. Since the selection of a hedge ratio is dependent on the hedgers’ objective in the hedging position, this will be different for various participants in the carbon market. For example, investors not only desire to protect the investment portfolio from ca ...

... inconsistent with the mean-variance framework. Since the selection of a hedge ratio is dependent on the hedgers’ objective in the hedging position, this will be different for various participants in the carbon market. For example, investors not only desire to protect the investment portfolio from ca ...

Is It Time for an Infrastructure Push?

... and where there is economic slack and monetary accommodation, there is a strong case for increasing public infrastructure investment. Moreover, evidence from advanced economies suggests that an increase in public investment that is debt financed could have larger output effects than one that is budg ...

... and where there is economic slack and monetary accommodation, there is a strong case for increasing public infrastructure investment. Moreover, evidence from advanced economies suggests that an increase in public investment that is debt financed could have larger output effects than one that is budg ...

DOC - Investor Relations

... qualified by all such risk factors and other cautionary statements, which could cause the Company's actual Condition and Results to differ materially from those estimated or desired and included in the Company's forward-looking statements or other information. Although the Company believes that its ...

... qualified by all such risk factors and other cautionary statements, which could cause the Company's actual Condition and Results to differ materially from those estimated or desired and included in the Company's forward-looking statements or other information. Although the Company believes that its ...

Scarcity, Risk Premiums and the Pricing of Commodity Futures

... The most immediate way to reconcile the two types of models is by assuming that the commodity of interest can be stored over an arbitrarily long time period and is always available in a sufficient positive quantity. The RP and CY models would be perfectly consistent; the current spot price of the co ...

... The most immediate way to reconcile the two types of models is by assuming that the commodity of interest can be stored over an arbitrarily long time period and is always available in a sufficient positive quantity. The RP and CY models would be perfectly consistent; the current spot price of the co ...

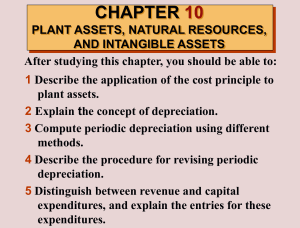

CHAPTER 10 PLANT ASSETS, NATURAL RESOURCES, AND

... Plant assets are recorded at cost in Invoice accordance with the cost principle. Cost consists of all expenditures necessary to acquire the asset and make it ready for its intended use. These costs include purchase price, freight costs, and installation costs. Expenditures that are not neces ...

... Plant assets are recorded at cost in Invoice accordance with the cost principle. Cost consists of all expenditures necessary to acquire the asset and make it ready for its intended use. These costs include purchase price, freight costs, and installation costs. Expenditures that are not neces ...

Transactions Costs and Capital Structure Choice: Evidence from

... large enough to plausibly explain leverage choices by most firms (Myers (1984), Shyam-Sunder and Myers (1995)). Transactions costs are potentially very important to financially distressed firms. The debt adjustments contemplated by these firms are quite large, and financial distress may have pushed ...

... large enough to plausibly explain leverage choices by most firms (Myers (1984), Shyam-Sunder and Myers (1995)). Transactions costs are potentially very important to financially distressed firms. The debt adjustments contemplated by these firms are quite large, and financial distress may have pushed ...

GLOBAL INSIGHT

... but, the later innings are approaching. Security selection and knowing what you own will be key. Broad-based opportunities will become less available, but selective ones will present themselves from among “BBB”-rated investment-grade and high-yield (nonenergy) corporates, fixed/float preferred secur ...

... but, the later innings are approaching. Security selection and knowing what you own will be key. Broad-based opportunities will become less available, but selective ones will present themselves from among “BBB”-rated investment-grade and high-yield (nonenergy) corporates, fixed/float preferred secur ...

Information Statement MNTRUST

... Term Series. The Term Series consists of separate portfolios of Permitted Investments (“Term Series Portfolios”). Each Term Series Portfolio consists of specifically identified investments with a fixed maturity. All Participants of the Fund are eligible to participate in any Term Series Portfolio. ...

... Term Series. The Term Series consists of separate portfolios of Permitted Investments (“Term Series Portfolios”). Each Term Series Portfolio consists of specifically identified investments with a fixed maturity. All Participants of the Fund are eligible to participate in any Term Series Portfolio. ...

class01

... Q. Does the arrangement between Bank A and Company A (i.e., the borrowing of Company B shares for one month) meet the little or no initial investment criterion of paragraph 6(b) of the Standard to qualify as a derivative instrument pursuant to the Standard? ...

... Q. Does the arrangement between Bank A and Company A (i.e., the borrowing of Company B shares for one month) meet the little or no initial investment criterion of paragraph 6(b) of the Standard to qualify as a derivative instrument pursuant to the Standard? ...

Stagnation nation? Australian investment in a low

... The first view centres on evidence that the ‘speed limit’ of advanced economies has fallen.a If the pace and scope of innovation and education slows, then productivity growth slows. For example, productivity grew fast in the US after the Second World War, faltered in the 1970s, revived briefly in th ...

... The first view centres on evidence that the ‘speed limit’ of advanced economies has fallen.a If the pace and scope of innovation and education slows, then productivity growth slows. For example, productivity grew fast in the US after the Second World War, faltered in the 1970s, revived briefly in th ...

New Activist Weapon-- The Rise of Delaware Appraisal

... trial usually involves a “battle of the experts” on both sides, with the burden ultimately on the court itself to make the determination of fair value, based on any methodology generally considered acceptable in the financial community. The methodology most often used by the court to determine going ...

... trial usually involves a “battle of the experts” on both sides, with the burden ultimately on the court itself to make the determination of fair value, based on any methodology generally considered acceptable in the financial community. The methodology most often used by the court to determine going ...