Slices - personal.kent.edu

... Line of credit – prearranged agreement with a bank that allows the firm to borrow up to a certain amount on a short-term basis Committed – formal legal arrangement that may require a commitment fee and generally has a floating interest rate Non-committed – informal agreement with a bank that is ...

... Line of credit – prearranged agreement with a bank that allows the firm to borrow up to a certain amount on a short-term basis Committed – formal legal arrangement that may require a commitment fee and generally has a floating interest rate Non-committed – informal agreement with a bank that is ...

Tiffany and Co. Competitive Analysis Team 6 Jessica Aragon Raynee Bradley

... does not work in Tiffany’s favor because it shows a low cash flow from sales, which constricts the company’s flexibility in cash and drive potential investors away. Reasons for this low ratio is fewer customers coming in or not receiving payment of accounts as quickly as expected. ...

... does not work in Tiffany’s favor because it shows a low cash flow from sales, which constricts the company’s flexibility in cash and drive potential investors away. Reasons for this low ratio is fewer customers coming in or not receiving payment of accounts as quickly as expected. ...

Capital Structure Decision

... Maneuverability refers to the firm ability to either increasing or decreasing its sources of funds in response to changes in the need of funds on while designing the capital structure it should not loose site of the future impact of its present financial plan. For example if the firm has exhausted i ...

... Maneuverability refers to the firm ability to either increasing or decreasing its sources of funds in response to changes in the need of funds on while designing the capital structure it should not loose site of the future impact of its present financial plan. For example if the firm has exhausted i ...

MAGELLAN HEALTH INC - Nasdaq`s INTEL Solutions

... cannot vote them for you and as a result, your shares will remain unvoted. Therefore, it is very important that you direct the vote of your shares on all items, including the election of directors, by filling out and returning a proxy card. Such broker non-votes are not considered to be entitled to ...

... cannot vote them for you and as a result, your shares will remain unvoted. Therefore, it is very important that you direct the vote of your shares on all items, including the election of directors, by filling out and returning a proxy card. Such broker non-votes are not considered to be entitled to ...

Cash Flow Disruptions

... Failure to keep track of money may cause a business to fail. By not monitoring its cash—measuring it, investing it, borrowing it, and collecting it—an otherwise profitable operation can erode into insolvency. Without proper cash flow, a company cannot pay its bills on time, which may injure its cred ...

... Failure to keep track of money may cause a business to fail. By not monitoring its cash—measuring it, investing it, borrowing it, and collecting it—an otherwise profitable operation can erode into insolvency. Without proper cash flow, a company cannot pay its bills on time, which may injure its cred ...

мυнαммαd нαѕηαιη ѕαdιq - vuZs Virtual University Community

... Which of the following statement is the best representative of vertical analysis? Vertical analysis in the income statement causes all accounts to be related as a percentage of net income. Vertical analysis in the balance sheet causes all accounts to be related as a percentage of total assets. Perce ...

... Which of the following statement is the best representative of vertical analysis? Vertical analysis in the income statement causes all accounts to be related as a percentage of net income. Vertical analysis in the balance sheet causes all accounts to be related as a percentage of total assets. Perce ...

Order Exposure and Liquidity Coordination

... (i.e., overbidding). Our key results are therefore driven by the interaction of both mechanisms, liquidity competition in the primary exchange and order flow attraction from latent investors. A central finding of our study is that due to mis-coordination (large) hidden orders can significantly harm ...

... (i.e., overbidding). Our key results are therefore driven by the interaction of both mechanisms, liquidity competition in the primary exchange and order flow attraction from latent investors. A central finding of our study is that due to mis-coordination (large) hidden orders can significantly harm ...

Conflicts of Interest in the Financial Services Industry

... Recent corporate scandals and the dramatic decline in the stock market since March 2000 have increased concerns about conflicts of interest in which agents who were supposed to provide the investing public with reliable information had incentives to hide the truth in order to further their own goals ...

... Recent corporate scandals and the dramatic decline in the stock market since March 2000 have increased concerns about conflicts of interest in which agents who were supposed to provide the investing public with reliable information had incentives to hide the truth in order to further their own goals ...

Debt Refinancing and Equity Returns

... with leverage within each refinancing tertile. Furthermore, the difference in returns of highand low-leverage firms increases as the refinancing intensity increases (i.e. debt maturities become shorter). These findings are consistent with the notion that shareholders demand a premium for holding hi ...

... with leverage within each refinancing tertile. Furthermore, the difference in returns of highand low-leverage firms increases as the refinancing intensity increases (i.e. debt maturities become shorter). These findings are consistent with the notion that shareholders demand a premium for holding hi ...

When Does Information Asymmetry Affect the Cost of

... In this paper we explore further this possibility by introducing a proxy for the level of competition in a firm’s shares. While financial market competition is a well accepted economic concept, it has no natural proxy in market data. This problem notwithstanding, we use the number of investors in a ...

... In this paper we explore further this possibility by introducing a proxy for the level of competition in a firm’s shares. While financial market competition is a well accepted economic concept, it has no natural proxy in market data. This problem notwithstanding, we use the number of investors in a ...

Decimalization, trading costs, and information transmission between

... AMEX started to trade in decimals on this date, but their corresponding index futures continued to trade in their original tick sizes. This offers an opportunity to test the impact of changes in tick size empirically. ETFs are index funds or trusts that are listed and traded intraday on an exchange. ...

... AMEX started to trade in decimals on this date, but their corresponding index futures continued to trade in their original tick sizes. This offers an opportunity to test the impact of changes in tick size empirically. ETFs are index funds or trusts that are listed and traded intraday on an exchange. ...

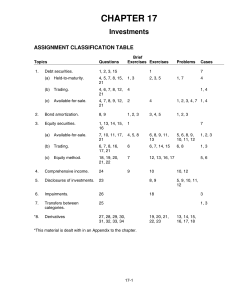

Download attachment

... loans receivable are not debt securities because they do not meet the definition of a security. An equity security is described as a security representing an ownership interest such as common, preferred, or other capital stock. It also includes rights to acquire or dispose of an ownership interest a ...

... loans receivable are not debt securities because they do not meet the definition of a security. An equity security is described as a security representing an ownership interest such as common, preferred, or other capital stock. It also includes rights to acquire or dispose of an ownership interest a ...

Equity and Bond Ownership in America, 2008

... 1989 and 2001, but have since tapered off. In the fi rst quarter of 2008, 47 percent of U.S. households (54.5 million) owned equities and/or bonds. The overall ownership rate in 2008 is still much higher than it was in 1989. » Willingness to take risks has dropped among both younger and older househ ...

... 1989 and 2001, but have since tapered off. In the fi rst quarter of 2008, 47 percent of U.S. households (54.5 million) owned equities and/or bonds. The overall ownership rate in 2008 is still much higher than it was in 1989. » Willingness to take risks has dropped among both younger and older househ ...

Uncertainty and consumer durables adjustment

... inactive is valuable when deviations from frictionless optimum levels are likely to be erased soon by volatile exogenous developments rather than by costly action. This theoretical perspective is applicable to many adjustment decisions (including labor demand, investment, inventories, and cash balan ...

... inactive is valuable when deviations from frictionless optimum levels are likely to be erased soon by volatile exogenous developments rather than by costly action. This theoretical perspective is applicable to many adjustment decisions (including labor demand, investment, inventories, and cash balan ...

PROSPECTUS SUN LIFE OF CANADA PROSPERITY DOLLAR

... stock and in the investment of the proceeds of these sales in fixed income instruments denominated in US Dollars issued by the Philippine government, other major economies, or corporations operating therein. The Company’s foreign investments may either be purchased directly or through one or more se ...

... stock and in the investment of the proceeds of these sales in fixed income instruments denominated in US Dollars issued by the Philippine government, other major economies, or corporations operating therein. The Company’s foreign investments may either be purchased directly or through one or more se ...

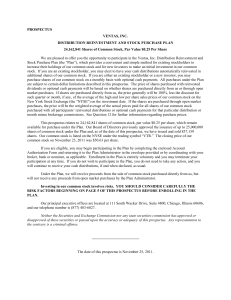

PROSPECTUS VENTAS, INC. DISTRIBUTION

... purchases, the price will be the weighted average of the actual prices paid for all shares of our common stock purchased with all participants’ reinvested distributions or optional cash payments for that particular distribution or month minus brokerage commissions. See Question 12 for further inform ...

... purchases, the price will be the weighted average of the actual prices paid for all shares of our common stock purchased with all participants’ reinvested distributions or optional cash payments for that particular distribution or month minus brokerage commissions. See Question 12 for further inform ...

GENERAL ELECTRIC CO (Form: 10-K405, Received: 03

... Company's products include, but are not limited to, lamps and other lighting products; major appliances for the home; industrial automation products and components; motors; electrical distribution and control equipment; locomotives; power generation and delivery products; nuclear reactors, nuclear p ...

... Company's products include, but are not limited to, lamps and other lighting products; major appliances for the home; industrial automation products and components; motors; electrical distribution and control equipment; locomotives; power generation and delivery products; nuclear reactors, nuclear p ...

Expiration Day Effects of the EURO STOXX 50 Index Futures and

... underlying index. These effects are known in the literature as expiration day effects. Several empirical studies have reported significant volume, price and volatility effects around the expiration of index futures and options. The most common explanations include the unwinding of delta positions as ...

... underlying index. These effects are known in the literature as expiration day effects. Several empirical studies have reported significant volume, price and volatility effects around the expiration of index futures and options. The most common explanations include the unwinding of delta positions as ...

Market Implied Costs of Bankruptcy

... produc on. We also find specific evidence that firms might benefit from bankruptcy. Bankruptcy can be profitable for firms that have weak corporate governance, an entrenched management, employ their assets less efficiently than their industry peers, or have defined benefit pension plans in place. Finally, ban ...

... produc on. We also find specific evidence that firms might benefit from bankruptcy. Bankruptcy can be profitable for firms that have weak corporate governance, an entrenched management, employ their assets less efficiently than their industry peers, or have defined benefit pension plans in place. Finally, ban ...

WPX ENERGY, INC. (Form: 424B2, Received: 01/17

... necessarily complete. If the SEC’s rules and regulations require that an agreement or document be filed as an exhibit to the registration statement, please see that agreement or document for a complete description of the related matters. You should also read and carefully consider the information in ...

... necessarily complete. If the SEC’s rules and regulations require that an agreement or document be filed as an exhibit to the registration statement, please see that agreement or document for a complete description of the related matters. You should also read and carefully consider the information in ...

1 Plaintiff`s First Amended Consolidated Class Action Complaint 01

... mortgage financing for long-term healthcare facilities to qualified operators and serves additional healthcare facilities, including assisted living and acute care facilities. Financing for such investments is provided by borrowings under the Company's revolving line ofcredit, private placements or ...

... mortgage financing for long-term healthcare facilities to qualified operators and serves additional healthcare facilities, including assisted living and acute care facilities. Financing for such investments is provided by borrowings under the Company's revolving line ofcredit, private placements or ...

NBER WORKING PAPER SERIES AND CAPITAL STRUCTURE

... characterization of firms’ default policies. Risk prices for small consumption shocks depend on the conditional volatility of consumption growth. Risk prices for large shocks depend on their frequency, size, and persistence. With recursive preferences, investors are concerned with news about future ...

... characterization of firms’ default policies. Risk prices for small consumption shocks depend on the conditional volatility of consumption growth. Risk prices for large shocks depend on their frequency, size, and persistence. With recursive preferences, investors are concerned with news about future ...

Cowen Group, Inc. - Investor Overview

... Litigation Reform Act of 1995. In some cases, you can identify these statements by forward-looking terms such as “may,” “might,” “will,” “would,” “could,” “should,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “project,” “possible,” “potential,” “intend,” “seek” or “continue,” t ...

... Litigation Reform Act of 1995. In some cases, you can identify these statements by forward-looking terms such as “may,” “might,” “will,” “would,” “could,” “should,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “project,” “possible,” “potential,” “intend,” “seek” or “continue,” t ...