File

... Unit 4 Saving and Investing 1. Compare consumer choices for saving and investing. 2. Explain the relationship be tween saving and investing. 3. Examine reasons for saving and investing, e.g., time value of money. 4. Compare the risk, return, liquidity, manageability, and tax aspects of investment ...

... Unit 4 Saving and Investing 1. Compare consumer choices for saving and investing. 2. Explain the relationship be tween saving and investing. 3. Examine reasons for saving and investing, e.g., time value of money. 4. Compare the risk, return, liquidity, manageability, and tax aspects of investment ...

How did the stock market work?

... The stock market was where shares of companies were sold. There were a number of stock markets across America. The largest one was the New York Stock Market situated on Wall Street. ...

... The stock market was where shares of companies were sold. There were a number of stock markets across America. The largest one was the New York Stock Market situated on Wall Street. ...

Document

... firm size, industry affiliation, ownership concentration, ownership type, and financial performance), and stock market’s specific factors (tick size)), were significantly affected the relative bid-ask spread in ASE except the industry affiliation variable. Also, the cross-sectional variation in spre ...

... firm size, industry affiliation, ownership concentration, ownership type, and financial performance), and stock market’s specific factors (tick size)), were significantly affected the relative bid-ask spread in ASE except the industry affiliation variable. Also, the cross-sectional variation in spre ...

Penny Stocks: Low-priced stocks that typically sell

... is allowed to own assets, incur liabilities, and sell securities, among other things Debt: Borrowed money that must be repaid with interest by a set date. Derivatives: A special kind of financial instrument. Its value is based on the characteristics and value of some other asset, including commoditi ...

... is allowed to own assets, incur liabilities, and sell securities, among other things Debt: Borrowed money that must be repaid with interest by a set date. Derivatives: A special kind of financial instrument. Its value is based on the characteristics and value of some other asset, including commoditi ...

Finance 450

... and estimated risk premiums • Shifting funds among different equity sectors and industries (sector rotation) or among investment styles (e.g., theme investing) to catch hot concepts before the market does • Stockpicking - individual issues ...

... and estimated risk premiums • Shifting funds among different equity sectors and industries (sector rotation) or among investment styles (e.g., theme investing) to catch hot concepts before the market does • Stockpicking - individual issues ...

Technical Analysis

... NOTE: Over the Counter Bulletin Board (OTCBB) is a regulated electronic trading service offered by the National Association of Securities Dealers (NASD) that shows real-time quotes, last-sale prices and volume information for over-the-counter (OTC) equity securities. Companies listed on this exchang ...

... NOTE: Over the Counter Bulletin Board (OTCBB) is a regulated electronic trading service offered by the National Association of Securities Dealers (NASD) that shows real-time quotes, last-sale prices and volume information for over-the-counter (OTC) equity securities. Companies listed on this exchang ...

1 REVISION 2 I WHAT ARE THE OPPOSITES? income

... 4. When does the bond mature/redeem? 5. After shares have been issued they can be traded on the secondary market at the stock exchange on which the company is selected/quoted. 6. They are planning to strip/split up the assets of that poorly- performing company. 7. Last year, profit before tax rose/r ...

... 4. When does the bond mature/redeem? 5. After shares have been issued they can be traded on the secondary market at the stock exchange on which the company is selected/quoted. 6. They are planning to strip/split up the assets of that poorly- performing company. 7. Last year, profit before tax rose/r ...

The Stock Exchange Corner

... Bonds – which are documents acknowledging a debt by the issuer of the bonds to the holders of the bonds - are valued by reference to the rate of interest paid to the holders of the bonds. The Government can raise money at the lowest rate of interest; publicly owned bodies may have to pay a little mo ...

... Bonds – which are documents acknowledging a debt by the issuer of the bonds to the holders of the bonds - are valued by reference to the rate of interest paid to the holders of the bonds. The Government can raise money at the lowest rate of interest; publicly owned bodies may have to pay a little mo ...

Data Mining BS/MS Project

... The red lines show real data for the 4 stocks, black lines show the decision tree’s predictions (y-axis represents the increase/decrease in stock value by percentage) ...

... The red lines show real data for the 4 stocks, black lines show the decision tree’s predictions (y-axis represents the increase/decrease in stock value by percentage) ...

Chapter 6

... low environmental standards in other countries to lower operating costs. Gives them free access to other markets. Stability is greatly increased by geographic diversity. E.g. Political upheavals or market fluctuations don’t effect them as badly. It is argued that drain of expertise (brain drain) has ...

... low environmental standards in other countries to lower operating costs. Gives them free access to other markets. Stability is greatly increased by geographic diversity. E.g. Political upheavals or market fluctuations don’t effect them as badly. It is argued that drain of expertise (brain drain) has ...

W - Johnston Financial

... You may remember the old line, “Is it a bird, is it a plan? No it’s Superman.” Well we have had a superhero bounce back in world stock markets from the very sharp falls of January and February. The question now is, are we in a 'V' shaped recovery or the second leg of a 'W' shaped movement that will ...

... You may remember the old line, “Is it a bird, is it a plan? No it’s Superman.” Well we have had a superhero bounce back in world stock markets from the very sharp falls of January and February. The question now is, are we in a 'V' shaped recovery or the second leg of a 'W' shaped movement that will ...

Broad Market Gains Power Historic Rally

... was at 2.531% Friday, down from 3% at the end of 2013. Many investors had thought the yield would rise, with bond prices—which move inversely to yields—expected to move lower amid stronger U.S. growth. The falling yield has driven many investors into stocks, bonds and commodities around the globe in ...

... was at 2.531% Friday, down from 3% at the end of 2013. Many investors had thought the yield would rise, with bond prices—which move inversely to yields—expected to move lower amid stronger U.S. growth. The falling yield has driven many investors into stocks, bonds and commodities around the globe in ...

Investing Options

... Medium risk/Medium return • Stock – Stock is a share of ownership in the assets and earnings of a company – core of America’s economic system ...

... Medium risk/Medium return • Stock – Stock is a share of ownership in the assets and earnings of a company – core of America’s economic system ...

What are stocks? - Buncombe County Schools

... • Shareholders have partial ownership in the corporation • Corporations are permitted to sell stock to raise capital for the corporation • Shareholders may receive dividend payments from the corporation ...

... • Shareholders have partial ownership in the corporation • Corporations are permitted to sell stock to raise capital for the corporation • Shareholders may receive dividend payments from the corporation ...

investment strategy update

... sufficient to provide the standard of living they desire? What kind of returns can they expect from the markets, going forward? To the latter we say, it’s a question of time horizon. Looking beyond the short-term bumps, we have a fair degree of conviction about stock and bond market returns over the ...

... sufficient to provide the standard of living they desire? What kind of returns can they expect from the markets, going forward? To the latter we say, it’s a question of time horizon. Looking beyond the short-term bumps, we have a fair degree of conviction about stock and bond market returns over the ...

The more things change...

... earned and to save, invest and try to get ahead that way. Whilst we know that central banks are attempting to restore growth to the global economy, it is paradoxical to say the least, that you are now paid (at least if you are a government) to borrow money rather than save it. (Never mind the small ...

... earned and to save, invest and try to get ahead that way. Whilst we know that central banks are attempting to restore growth to the global economy, it is paradoxical to say the least, that you are now paid (at least if you are a government) to borrow money rather than save it. (Never mind the small ...

Bovespa

... Exchanges in Latin America have an additional challenge: face the problem of low volume and, in consequence, the low scale of operations ...

... Exchanges in Latin America have an additional challenge: face the problem of low volume and, in consequence, the low scale of operations ...

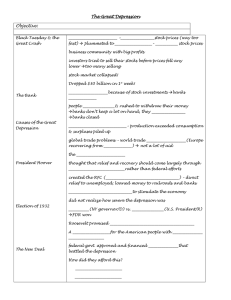

The Great Depression Objective:

... __________________________ –__________________stock prices (way too fast) plummeted to ____________________– ____________ stock prices business community with big profits investors tried to sell their stocks before prices fell any lower too many selling stock market collapsed! Dropped $30 billion ...

... __________________________ –__________________stock prices (way too fast) plummeted to ____________________– ____________ stock prices business community with big profits investors tried to sell their stocks before prices fell any lower too many selling stock market collapsed! Dropped $30 billion ...

Stock Market - ovient project

... company gets those proceeds. This adds to the company’s value, making the price of each stock rise a little. When people sell their stock, the price per share goes down a little, contrary to people buying shares. ...

... company gets those proceeds. This adds to the company’s value, making the price of each stock rise a little. When people sell their stock, the price per share goes down a little, contrary to people buying shares. ...