Mini Case (p.45) A. Why is corporate finance important to all

... their own interests, and not on behalf of the owners. Some methods can consist of offering stock options to management incentivizing growth. Corporate governance is the “set of rules that control the company’s behavior towards its directors, managers, employees, shareholders, creditors, customers, c ...

... their own interests, and not on behalf of the owners. Some methods can consist of offering stock options to management incentivizing growth. Corporate governance is the “set of rules that control the company’s behavior towards its directors, managers, employees, shareholders, creditors, customers, c ...

15-2

... • Interest rate on bonds is usually higher to compensate the investor for holding a less liquid obligation. ...

... • Interest rate on bonds is usually higher to compensate the investor for holding a less liquid obligation. ...

Netainment valuations 090103

... and related companies. Some On-Line Casino’s were also listed in these exchanges. The stock market indexes also reflect the market’s assessment of future economic prospects of its participants, and the economy in general. The NASDAQ and AIM indexes reflected a somewhat cautious and relatively negati ...

... and related companies. Some On-Line Casino’s were also listed in these exchanges. The stock market indexes also reflect the market’s assessment of future economic prospects of its participants, and the economy in general. The NASDAQ and AIM indexes reflected a somewhat cautious and relatively negati ...

Snímek 1

... signing of a purchase agreement between the buyer and seller (of asset) the seller changes his behavior in such a way that the probabilites (risk) used by the buyer to determine the terms of the purchase agreement are no ...

... signing of a purchase agreement between the buyer and seller (of asset) the seller changes his behavior in such a way that the probabilites (risk) used by the buyer to determine the terms of the purchase agreement are no ...

Block 3 - Webcourses

... Current liability – payable within one year Long-term Liability – Payable after one year Accounts payable - Amounts owed for products or services purchased on account Short-term notes payable - used to borrow cash or purchase asset and due within one year Unearned revenue - Business receives cash be ...

... Current liability – payable within one year Long-term Liability – Payable after one year Accounts payable - Amounts owed for products or services purchased on account Short-term notes payable - used to borrow cash or purchase asset and due within one year Unearned revenue - Business receives cash be ...

Significant pullback in market presents opportunities

... The concept was first recognized in the 1930s by Benjamin Graham, who classified stocks as either high or low quality. Mr Graham found that the greatest losses resulted not from buying quality at an excessively high price, but from buying low quality at a price that seemed good value. Another celebr ...

... The concept was first recognized in the 1930s by Benjamin Graham, who classified stocks as either high or low quality. Mr Graham found that the greatest losses resulted not from buying quality at an excessively high price, but from buying low quality at a price that seemed good value. Another celebr ...

L04: Homework Assignment

... increasing in value, this is usually reflected in an increase in the price per share of the stock. Bonds are used by the U.S. Government to raise money. When a bond is issued, the government promises to pay the purchase price of the bond plus an additional amount as interest at some future date (whe ...

... increasing in value, this is usually reflected in an increase in the price per share of the stock. Bonds are used by the U.S. Government to raise money. When a bond is issued, the government promises to pay the purchase price of the bond plus an additional amount as interest at some future date (whe ...

Chapter 14: Introduction to Corporate Finance

... Book Value vs. Market Value Book value is a backward looking measure. It tells us how much capital the firm has raised from shareholders in the past. It does not measure the value that shareholders place on those shares today. The market value of the firm is forward looking, it depends on the future ...

... Book Value vs. Market Value Book value is a backward looking measure. It tells us how much capital the firm has raised from shareholders in the past. It does not measure the value that shareholders place on those shares today. The market value of the firm is forward looking, it depends on the future ...

Stock Valuation

... Preferred stock is a hybrid having some features similar to debt and other features similar to equity. - Claim on assets and cash flow senior to common stock - As equity security, dividend payments are not tax deductible for the corporation. - For tax reasons, straight preferred stock held mostly by ...

... Preferred stock is a hybrid having some features similar to debt and other features similar to equity. - Claim on assets and cash flow senior to common stock - As equity security, dividend payments are not tax deductible for the corporation. - For tax reasons, straight preferred stock held mostly by ...

Last year will not be easily forgotten

... The amount of liquidity added to the money supply via bailouts and stimulus plans will invariably lead to inflation down the road. For now, risk aversion and concerns about deflation are keeping Treasury bond yields very low. The government has also made clear that it is supportive of low rates, so ...

... The amount of liquidity added to the money supply via bailouts and stimulus plans will invariably lead to inflation down the road. For now, risk aversion and concerns about deflation are keeping Treasury bond yields very low. The government has also made clear that it is supportive of low rates, so ...

The State of the Nigerian Economy

... recording the 9th consecutive month of rise in prices Increases were recorded in most of the key divisions that make up the CPI Major increase recorded in the food and core sub-indices High energy prices and imported inflation The rise highlights the macroeconomic uncertainty and high cost o ...

... recording the 9th consecutive month of rise in prices Increases were recorded in most of the key divisions that make up the CPI Major increase recorded in the food and core sub-indices High energy prices and imported inflation The rise highlights the macroeconomic uncertainty and high cost o ...

Document

... Inflation rate – An economic statistic that tracks the increase in prices of goods and services over a period of time; usually calculated on a monthly or annual basis ...

... Inflation rate – An economic statistic that tracks the increase in prices of goods and services over a period of time; usually calculated on a monthly or annual basis ...

13 Law, finance, and growth

... Returns and risks – Mean return / st.dev. / Sharpe coefficient – Synchronicity of individual stock prices ...

... Returns and risks – Mean return / st.dev. / Sharpe coefficient – Synchronicity of individual stock prices ...

Global Macro Investment For Presentation at Yale U. October 22

... • On average, they make a little bit money; • FX economists have not performed better than the stock analysts; like the stock analysts, they are entertainers for the investment community. When it comes to predicting future spot exchange rates, Wall Street fundamental forecasters do worse than the fo ...

... • On average, they make a little bit money; • FX economists have not performed better than the stock analysts; like the stock analysts, they are entertainers for the investment community. When it comes to predicting future spot exchange rates, Wall Street fundamental forecasters do worse than the fo ...

The Discounted Cash Flow (DCF) Model -- Chart School

... cash flow of 3$ per share, then the shares would be valued at $30. An assumption must be made as to the level of the multiple over the next few years. If the multiple were 15, then the same company would be valued at $45. The multiple is usually based on earnings visibility, growth, business risk an ...

... cash flow of 3$ per share, then the shares would be valued at $30. An assumption must be made as to the level of the multiple over the next few years. If the multiple were 15, then the same company would be valued at $45. The multiple is usually based on earnings visibility, growth, business risk an ...

What`s Going On In Britain? – By Sandi Weaver

... June brought us a surprise twist when 52% of the folks in Britain decided to leave the European Union (EU). The 48% of Brits who wanted to stay in the EU weren’t too happy. Many attribute the possible loss of jobs to fresh immigrants as a chief factor swaying the vote. People can move about fairly f ...

... June brought us a surprise twist when 52% of the folks in Britain decided to leave the European Union (EU). The 48% of Brits who wanted to stay in the EU weren’t too happy. Many attribute the possible loss of jobs to fresh immigrants as a chief factor swaying the vote. People can move about fairly f ...

The Great Depression - What Crashed and Why?

... 5. What did it mean to buy stocks "on margin"? A. The stocks were bought at marginal prices and sold for big profits. B. Stocks were bought on credit and the loan paid off when the stock was sold. C. Buy and sell orders to traders were written in the margins of documents. D. The stocks were bought a ...

... 5. What did it mean to buy stocks "on margin"? A. The stocks were bought at marginal prices and sold for big profits. B. Stocks were bought on credit and the loan paid off when the stock was sold. C. Buy and sell orders to traders were written in the margins of documents. D. The stocks were bought a ...

Is it time to change SOX? Solongo Batbaatar MA0N0228

... SOX impact on Market Efficiency • In 2002, the market value of the Wilshire 5000 for all public companies in US, stood at $10.5 trillion. • By April 2007, the value of the Wilshire 5000 was 14.5 trillion ...

... SOX impact on Market Efficiency • In 2002, the market value of the Wilshire 5000 for all public companies in US, stood at $10.5 trillion. • By April 2007, the value of the Wilshire 5000 was 14.5 trillion ...

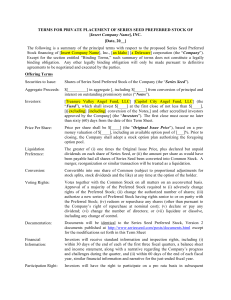

TERMS FOR PRIVATE PLACEMENT OF SERIES SEED

... within 30 days of the end of each of the first three fiscal quarters, a balance sheet and income statement, along with a narrative regarding the Company’s progress and challenges during the quarter, and (ii) within 60 days of the end of each fiscal year, similar financial information and narrative f ...

... within 30 days of the end of each of the first three fiscal quarters, a balance sheet and income statement, along with a narrative regarding the Company’s progress and challenges during the quarter, and (ii) within 60 days of the end of each fiscal year, similar financial information and narrative f ...

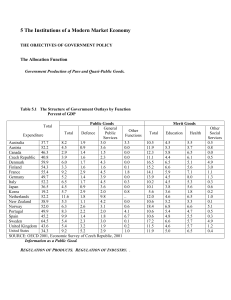

In chapter 1 we discussed in broad outline some of the institutions

... firms, which seemed to be a willing tool of the companies rather than an independent arbiter of a firm’s financial condition. The US government’s response has been to change the regulating framework. In the short-term chief executive officers are to be required to swear, under penalty of law, for th ...

... firms, which seemed to be a willing tool of the companies rather than an independent arbiter of a firm’s financial condition. The US government’s response has been to change the regulating framework. In the short-term chief executive officers are to be required to swear, under penalty of law, for th ...