Companies and their products

... of the products, or actually owns the company. These are known as Parent Companies, and will be KEY to the Stock Market. Write down Parent Companies & Ticker Symbol (if traded). ...

... of the products, or actually owns the company. These are known as Parent Companies, and will be KEY to the Stock Market. Write down Parent Companies & Ticker Symbol (if traded). ...

rainbow trading corporation spyglass trading. lp

... • Substantial directional moved based on skewed market psychology • Lost profit when directional bias is correct • Potential loss in any given position can significantly exceed potential gain • Highly intense, requires constant monitoring, and may generate higher trading costs ...

... • Substantial directional moved based on skewed market psychology • Lost profit when directional bias is correct • Potential loss in any given position can significantly exceed potential gain • Highly intense, requires constant monitoring, and may generate higher trading costs ...

Edition 2 - 2017 - VZD Capital Management

... headlines, we hope you gain a deeper understanding of VZD Capital Management’s investment philosophy, using the value of the company and current market dynamics to guide our investment decisions. Our job is not only to attempt to separate fact from fiction but, even more importantly, to remain acute ...

... headlines, we hope you gain a deeper understanding of VZD Capital Management’s investment philosophy, using the value of the company and current market dynamics to guide our investment decisions. Our job is not only to attempt to separate fact from fiction but, even more importantly, to remain acute ...

Ch 14 Problems - U of L Class Index

... 1- Suppose today is January 1, 2007; MAM Industries issued a 20-year bond with a 9% coupon and a $1,000 face value, payable on January 1, 2027. The bond now sells for $915. Use this bond to determine the firm’s after-tax cost of debt. Assume a 34% tax rate. (6.6%) 2- MAM Industries just declared a d ...

... 1- Suppose today is January 1, 2007; MAM Industries issued a 20-year bond with a 9% coupon and a $1,000 face value, payable on January 1, 2027. The bond now sells for $915. Use this bond to determine the firm’s after-tax cost of debt. Assume a 34% tax rate. (6.6%) 2- MAM Industries just declared a d ...

Securities Markets

... defined group of stocks over a period of time Do not include dividends and therefore generally understate total returns However, price changes are primary way to describe the performance of equity markets ...

... defined group of stocks over a period of time Do not include dividends and therefore generally understate total returns However, price changes are primary way to describe the performance of equity markets ...

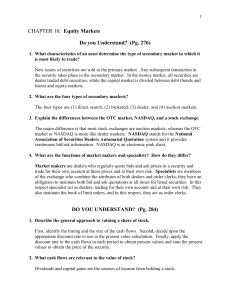

CHAPTER 10: Equity Markets

... Market makers are dealers who regularly quote bids and ask prices in a security and trade for their own account at these prices and at their own risk. Specialists are members of the exchange who combine the attributes of both dealers and order clerks; they have an obligation to maintain both bid and ...

... Market makers are dealers who regularly quote bids and ask prices in a security and trade for their own account at these prices and at their own risk. Specialists are members of the exchange who combine the attributes of both dealers and order clerks; they have an obligation to maintain both bid and ...

It`s Probably a Bad Idea to Sell Stocks Because You Fear Trump

... First, much of the movement in stocks has little to do with what the president of the United States does. It would be silly to credit Bill Clinton with the dot-com boom that took place during his presidency, or to blame George W. Bush for the collapse of it. But even when the action in Washington i ...

... First, much of the movement in stocks has little to do with what the president of the United States does. It would be silly to credit Bill Clinton with the dot-com boom that took place during his presidency, or to blame George W. Bush for the collapse of it. But even when the action in Washington i ...

Parliamentary Elections and Frontier Stock Markets: Evidence from

... Justin Robinson, Faculty of Social Sciences, The University of the West Indies, Cave Hill Campus, Bridgetown BB11000, Barbados; Tel.: 1-246-4174279; Fax: 1-246-4389104; Email: ...

... Justin Robinson, Faculty of Social Sciences, The University of the West Indies, Cave Hill Campus, Bridgetown BB11000, Barbados; Tel.: 1-246-4174279; Fax: 1-246-4389104; Email: ...

2.03-PowerPoint

... Shareholders have partial ownership in the corporation Corporations are permitted to sell stock to raise capital for the corporation Shareholders may receive dividend payments from the corporation ...

... Shareholders have partial ownership in the corporation Corporations are permitted to sell stock to raise capital for the corporation Shareholders may receive dividend payments from the corporation ...

prognoses - Sid Klein Global Strategy

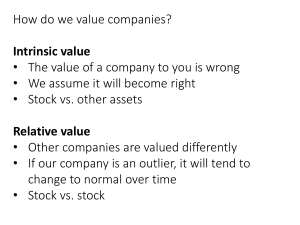

... small part of the world’s capital markets, it is often beneficial to have a significant portion of assets in foreign investments. Past history has shown that in most years, U.S. markets have outperformed Canadian markets. WHAT IS VALUE INVESTING? Value investing is the art of finding and selecting s ...

... small part of the world’s capital markets, it is often beneficial to have a significant portion of assets in foreign investments. Past history has shown that in most years, U.S. markets have outperformed Canadian markets. WHAT IS VALUE INVESTING? Value investing is the art of finding and selecting s ...

Stocks, Bonds, And Futures

... the purchase or sell by using NASDAQ • Call other brokers that might have clients that want the same stock ...

... the purchase or sell by using NASDAQ • Call other brokers that might have clients that want the same stock ...

Stocks

... reaches a set level (special form of limit order) • Buy stop order: an order to buy a stock when it reaches a set level • Sell stop order: an order to sell a stock when it reaches a set level ...

... reaches a set level (special form of limit order) • Buy stop order: an order to buy a stock when it reaches a set level • Sell stop order: an order to sell a stock when it reaches a set level ...

DIRECTIONS - Seizert Capital Partners

... The market volatility in the first half of the year has been driven by a number of destabilizing forces. Investors are paying attention to several market influences, including political rhetoric, “dot plot” speculation on the Fed’s future actions, terrorism, slow worldwide economic growth, geopoliti ...

... The market volatility in the first half of the year has been driven by a number of destabilizing forces. Investors are paying attention to several market influences, including political rhetoric, “dot plot” speculation on the Fed’s future actions, terrorism, slow worldwide economic growth, geopoliti ...

STOCKS

... Job seekers line up to register at a City of Miami job fair in Miami, Tuesday, Jan. 26, 2010. Florida's unemployment rate hit 11.8 percent, the highest in Florida in almost 35 years. Nearly 1,087,000 workers were searching for a paycheck in ...

... Job seekers line up to register at a City of Miami job fair in Miami, Tuesday, Jan. 26, 2010. Florida's unemployment rate hit 11.8 percent, the highest in Florida in almost 35 years. Nearly 1,087,000 workers were searching for a paycheck in ...

Are Stocks Expensive? - Zevin Asset Management

... One valuation measure compares the cost of buying a share of the S&P 500 index to the average annual earnings from the previous ten years. Using this metric, stocks are expensive. The average price of the S&P index over the past 130 years was $16.50 while today’s price is $25.44 (see chart). Not sur ...

... One valuation measure compares the cost of buying a share of the S&P 500 index to the average annual earnings from the previous ten years. Using this metric, stocks are expensive. The average price of the S&P index over the past 130 years was $16.50 while today’s price is $25.44 (see chart). Not sur ...

File

... The Chickens – chickens are afraid to lose anything. They invest in safe things like bonds or mutual funds. The Pigs – pigs are high-risk investors. They want to make a killing in a short time. Unfortunately, they are usually led to the slaughter. ...

... The Chickens – chickens are afraid to lose anything. They invest in safe things like bonds or mutual funds. The Pigs – pigs are high-risk investors. They want to make a killing in a short time. Unfortunately, they are usually led to the slaughter. ...

How Stocks Promote Growth

... 12.1.4 Evaluate the role of private property as an incentive in conserving and improving scarce resources, including renewable and nonrenewable natural resources. ...

... 12.1.4 Evaluate the role of private property as an incentive in conserving and improving scarce resources, including renewable and nonrenewable natural resources. ...