Stocks

... Blue-chip – large well known firms Growth – firms with growth above industry average (many times these are new firms) Income – Speculative – Defensive – stocks that tend not to be affected in economic swings Large caps - >$5 billion Small caps - <$1 billion ...

... Blue-chip – large well known firms Growth – firms with growth above industry average (many times these are new firms) Income – Speculative – Defensive – stocks that tend not to be affected in economic swings Large caps - >$5 billion Small caps - <$1 billion ...

2014 Headwinds, Tailwinds, Trends, Strategy

... This commentary contains opinions and analysis that are provided by the presenter for informational purposes only and should not be used as the primary basis for an investment decision. Please consider your individual investment objectives and risk tolerances before making investment decisions. Not ...

... This commentary contains opinions and analysis that are provided by the presenter for informational purposes only and should not be used as the primary basis for an investment decision. Please consider your individual investment objectives and risk tolerances before making investment decisions. Not ...

Beating the Best

... some asset at an agreed upon future time • The price that will be paid at this future date is called the exercise price of the option • The market price is the price you pay now for the privilege of buying or selling on or before the expiration date ...

... some asset at an agreed upon future time • The price that will be paid at this future date is called the exercise price of the option • The market price is the price you pay now for the privilege of buying or selling on or before the expiration date ...

Chapter 30 Reading Outline

... i. Define: Interest ii. Define: bank runs 1. How many banks failed in 1931 and 1932? 2. How many were out of business by 1933? ...

... i. Define: Interest ii. Define: bank runs 1. How many banks failed in 1931 and 1932? 2. How many were out of business by 1933? ...

Chap009

... Div N Div N 1 (1 g1 ) Div 0 (1 g1 ) N Div N 1 Div N (1 g 2 ) Div 0 (1 g1 ) N (1 g 2 ) ...

... Div N Div N 1 (1 g1 ) Div 0 (1 g1 ) N Div N 1 Div N (1 g 2 ) Div 0 (1 g1 ) N (1 g 2 ) ...

China`s Stock Crash Is Spurring a Shakeout in Shadow Banks

... The reversal has helped cull riskier lenders in China’s online market, which was surging before the equity rout wiped out more than $4 trillion. President Xi Jinping has already curbed traditional forms of unregulated funding -- such as trust loans -- as part of his effort to wean the economy from d ...

... The reversal has helped cull riskier lenders in China’s online market, which was surging before the equity rout wiped out more than $4 trillion. President Xi Jinping has already curbed traditional forms of unregulated funding -- such as trust loans -- as part of his effort to wean the economy from d ...

The Four Big Questions For Investors After `Black Monday

... added: "It is noteworthy how large the consensus is, amongst active players in the markets, to be negative on these asset classes...moreover, technically speaking, many of these assets have now reached "over-sold" levels. "Generally, these type of indicators can provide a contrarian signal, so a sho ...

... added: "It is noteworthy how large the consensus is, amongst active players in the markets, to be negative on these asset classes...moreover, technically speaking, many of these assets have now reached "over-sold" levels. "Generally, these type of indicators can provide a contrarian signal, so a sho ...

John Augustine, Chief Investment Strategist, Fifth Third

... John is based in Cincinnati as the Chief Investment Strategist for Fifth Third Asset Management, Inc., which has more than $20 billion in assets under management. He is a member of the Investment Policy Committee, Investment Strategy Team, Alternative Investments Team and Preferred Funds Selection T ...

... John is based in Cincinnati as the Chief Investment Strategist for Fifth Third Asset Management, Inc., which has more than $20 billion in assets under management. He is a member of the Investment Policy Committee, Investment Strategy Team, Alternative Investments Team and Preferred Funds Selection T ...

Should you be

... inflation and political and economic uncertainty: high interest rates. Swiss investors that earn negative interest on their cash are envious of our local bond interest rates of over 8%. Local listed property companies can also offer good yields and better growth compared to foreign property equivale ...

... inflation and political and economic uncertainty: high interest rates. Swiss investors that earn negative interest on their cash are envious of our local bond interest rates of over 8%. Local listed property companies can also offer good yields and better growth compared to foreign property equivale ...

THE BEST OF THE VALIDEA HOT LIST – 2010

... To Buffett, growth and value aren't polar opposites; instead, the rate at which a company is growing is just one factor involved in determining the true value of a stock. A company can be growing like gangbusters, but if its shares are overpriced, or it is using large amounts of leverage to produce ...

... To Buffett, growth and value aren't polar opposites; instead, the rate at which a company is growing is just one factor involved in determining the true value of a stock. A company can be growing like gangbusters, but if its shares are overpriced, or it is using large amounts of leverage to produce ...

The Republican Presidents of the 1920s and the Causes of the

... you believe was the most significant cause of the Great Depression based on the last night’s reading ...

... you believe was the most significant cause of the Great Depression based on the last night’s reading ...

International Portfolio Investment

... Using exchange traded funds (ETFs) like WEBS and spiders, investors can trade a whole stock market index as if it were a single stock. Being open-end funds, WEBS trade at prices that are very close to their net asset values. In addition to single country index funds, investors can achieve global div ...

... Using exchange traded funds (ETFs) like WEBS and spiders, investors can trade a whole stock market index as if it were a single stock. Being open-end funds, WEBS trade at prices that are very close to their net asset values. In addition to single country index funds, investors can achieve global div ...

2. Case Study - Emma Perfect, Lux Assure Ltd

... should have been quantified. What is not presented is evidence to provide confidence that the company has the experience / knowledge to become a service provider… Dissemination is not covered….This section would have benefitted from a quantitative analysis of potential direct and indirect job creati ...

... should have been quantified. What is not presented is evidence to provide confidence that the company has the experience / knowledge to become a service provider… Dissemination is not covered….This section would have benefitted from a quantitative analysis of potential direct and indirect job creati ...

Section 2. Stock Market Crash and Great Depression Powerpoint File

... and by October 1929, the stock value was nearly 87 billion. Though some people lost jobs due to machinery in the assembly line, the unemployment rate was only below 4% By this time, wages increased 40% since ...

... and by October 1929, the stock value was nearly 87 billion. Though some people lost jobs due to machinery in the assembly line, the unemployment rate was only below 4% By this time, wages increased 40% since ...

FINANCIAL CRISIS

... Tulip Mania Government reaction Offered “honor contracts” (10%) Did not help, made the situation worst ...

... Tulip Mania Government reaction Offered “honor contracts” (10%) Did not help, made the situation worst ...

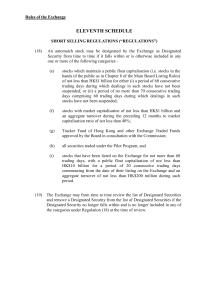

Amendments to the Rules of the Exchange in relation to the

... an aggregate turnover during the preceding 12 months to market capitalisation ratio of not less than 40%; ...

... an aggregate turnover during the preceding 12 months to market capitalisation ratio of not less than 40%; ...

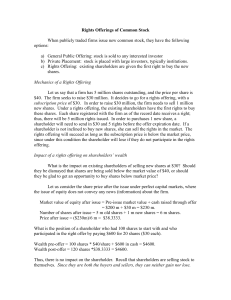

Rights Offerings of Common Stock

... understand from the above discussion that the discount in the subscription price neither benefits nor hurts shareholders. So why should stock prices fall at the time of the announcement of the rights offering? In the real world, there is information asymmetry between managers and investors. Investor ...

... understand from the above discussion that the discount in the subscription price neither benefits nor hurts shareholders. So why should stock prices fall at the time of the announcement of the rights offering? In the real world, there is information asymmetry between managers and investors. Investor ...