Pros and Cons of Capital Market

... set of investors and paying back to another set of investors. Eventually, following may be witnessed in a Ponzi scheme:The promoter vanishes, taking all the remaining investment money; The scheme collapses as the promoter starts having problems paying the promised returns . Pyramid Scheme:- The orga ...

... set of investors and paying back to another set of investors. Eventually, following may be witnessed in a Ponzi scheme:The promoter vanishes, taking all the remaining investment money; The scheme collapses as the promoter starts having problems paying the promised returns . Pyramid Scheme:- The orga ...

Stock Market Crash - Fern Creek US History

... • People bought a lot of stock on the hope it would climb in value • Buying on the margin- buying stock on credit with high interest that can be paid if you sell for profit • Worked for a while, couldn’t last, no real value ...

... • People bought a lot of stock on the hope it would climb in value • Buying on the margin- buying stock on credit with high interest that can be paid if you sell for profit • Worked for a while, couldn’t last, no real value ...

CP World History (Unit 7, #2)

... i. one vote per share owned to elect board of directors 2. _______________________________-- gives shareholders share of profits, no voting rights i. investors get ________________________ ___________________________, paid off first if company closed ii. dividends do not increase if stock increases ...

... i. one vote per share owned to elect board of directors 2. _______________________________-- gives shareholders share of profits, no voting rights i. investors get ________________________ ___________________________, paid off first if company closed ii. dividends do not increase if stock increases ...

DAINAM Securities

... at 580 points. It was the first time since March,VNIndex broke its resistance around the MA200 line. Liquidity, volume and candlestick structure all indicated that cash flows are strongly poured into the market. Profit taking pressure has been quickly absorbed and ...

... at 580 points. It was the first time since March,VNIndex broke its resistance around the MA200 line. Liquidity, volume and candlestick structure all indicated that cash flows are strongly poured into the market. Profit taking pressure has been quickly absorbed and ...

JETBLUE AIRWAYS CORP (Form: 3, Received: 03/02

... /s/ Eileen McCarthy by power of attorney for Stephen J. Priest ...

... /s/ Eileen McCarthy by power of attorney for Stephen J. Priest ...

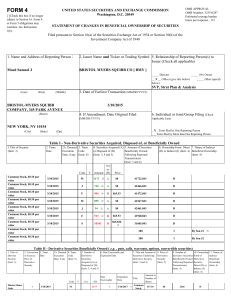

UNITED THERAPEUTICS Corp (Form: 4, Received: 02/13/2017 17

... Exercise price and number of shares/awards has been adjusted to reflect the issuer's two-for-one stock split on September 22, 2009. This transaction was executed in multiple trades at prices ranging from $163.70 to $164.67. The price reported above reflects the weighted average price. The reporting ...

... Exercise price and number of shares/awards has been adjusted to reflect the issuer's two-for-one stock split on September 22, 2009. This transaction was executed in multiple trades at prices ranging from $163.70 to $164.67. The price reported above reflects the weighted average price. The reporting ...

02.11.2016 Issue of Debt NOT FOR DISTRIBUTION, DIRECTLY OR

... the account or benefit of, U.S. persons (as such term is defined in Regulation S under the Securities Act), except pursuant to an exemption from the registration requirements of the Securities Act. No public offering of securities will be made in the United States or in any other jurisdiction where ...

... the account or benefit of, U.S. persons (as such term is defined in Regulation S under the Securities Act), except pursuant to an exemption from the registration requirements of the Securities Act. No public offering of securities will be made in the United States or in any other jurisdiction where ...

Human Ethical Decisions: Good People Doing Bad Things

... favor of their client and • ignored (e.g. failed to assimilate) information about the target that was relevant but inconsistent with their client’s interest. • The accountant’s were unable to adjust their thinking even after monetary rewards were included that should have adjusted their analysis.[Ba ...

... favor of their client and • ignored (e.g. failed to assimilate) information about the target that was relevant but inconsistent with their client’s interest. • The accountant’s were unable to adjust their thinking even after monetary rewards were included that should have adjusted their analysis.[Ba ...

English

... Act 2000 (Financial Promotion) Order 2005 (as amended) (the "Order") or (iii) who fall within article 49(2)(a) to (d) ("high net worth companies, unincorporated associations etc.") of the Order (all such persons together being referred to as "Relevant Persons"). Any investment or investment activity ...

... Act 2000 (Financial Promotion) Order 2005 (as amended) (the "Order") or (iii) who fall within article 49(2)(a) to (d) ("high net worth companies, unincorporated associations etc.") of the Order (all such persons together being referred to as "Relevant Persons"). Any investment or investment activity ...

30snotePkg

... People do not know what to do – do you wait and hope it recovers or do you sell (and take your losses?) There was a panic on October 29, 1929 that stocks were going to plummet – lots of people ___________________________________. _____________________________________________________ _____________ ...

... People do not know what to do – do you wait and hope it recovers or do you sell (and take your losses?) There was a panic on October 29, 1929 that stocks were going to plummet – lots of people ___________________________________. _____________________________________________________ _____________ ...

Savings and Investment

... clerk. Then a floor reporter – an employee of the exchange – collects the information about the transaction and inputs it into the ticker system. 5. The sale appears on the price board, and a confirmation is relayed back to your account executive, who then notifies you of the completed transaction. ...

... clerk. Then a floor reporter – an employee of the exchange – collects the information about the transaction and inputs it into the ticker system. 5. The sale appears on the price board, and a confirmation is relayed back to your account executive, who then notifies you of the completed transaction. ...

Stocks and Bonds - NUS Investment Society

... change without notice. No part of this publication may be reproduced in any form, or referred to in any other publication, without express written permission. Information contained herein has been obtained from sources believed to be reliable, but is not guaranteed. This article is distributed for e ...

... change without notice. No part of this publication may be reproduced in any form, or referred to in any other publication, without express written permission. Information contained herein has been obtained from sources believed to be reliable, but is not guaranteed. This article is distributed for e ...

Document

... spread in the Amman Stock Exchange. Daily trading data for 50 selected companies, during a 6 years’ time period from 2001 to 2006, was collected from ASE publications. The suggested explanatory variables (security's specific factors: stock price, price volatility, trading volume, number of trades), ...

... spread in the Amman Stock Exchange. Daily trading data for 50 selected companies, during a 6 years’ time period from 2001 to 2006, was collected from ASE publications. The suggested explanatory variables (security's specific factors: stock price, price volatility, trading volume, number of trades), ...

Firms and Financial Markets

... private start-up companies when they are first founded. – For example, Venture capital firm, Kleiner Perkins Caufield & Byers (KPCB) was involved in the initial financing of Google. 2. Leveraged buyout firms acquire established firms that typically have not been performing very well with the objecti ...

... private start-up companies when they are first founded. – For example, Venture capital firm, Kleiner Perkins Caufield & Byers (KPCB) was involved in the initial financing of Google. 2. Leveraged buyout firms acquire established firms that typically have not been performing very well with the objecti ...

Disclaimer for pop-up in front of Admission

... offering prospectus as that term is understood pursuant to art. 652s or art. 1156 of the Swiss Code of Obligations. The Company has not applied for a listing of the securities on the SWX Swiss Exchange or any other exchange or regulated securities market in Switzerland, and consequently, the informa ...

... offering prospectus as that term is understood pursuant to art. 652s or art. 1156 of the Swiss Code of Obligations. The Company has not applied for a listing of the securities on the SWX Swiss Exchange or any other exchange or regulated securities market in Switzerland, and consequently, the informa ...

Stock Market Tycoons

... the world. Share holders, are people who buy parts of a company call shares to help companies grow. If a share holder buys part of a company and that company is successful, the shareholder will make money on the stocks. In this project, students will work with company stocks to determine if they win ...

... the world. Share holders, are people who buy parts of a company call shares to help companies grow. If a share holder buys part of a company and that company is successful, the shareholder will make money on the stocks. In this project, students will work with company stocks to determine if they win ...

BRISTOL MYERS SQUIBB CO (Form: 4, Received

... /s/ Robert J. Wollin, attorney-in-fact for Samuel J. Moed ...

... /s/ Robert J. Wollin, attorney-in-fact for Samuel J. Moed ...

How to Make Millions in the Stock Market

... theory is that all asset prices reflect their true value based on all currently available information. If an asset or share of stock was truly undervalued, investors would step in, buy shares, and bid up the stock price until it was accurately valued. The converse is also true: ...

... theory is that all asset prices reflect their true value based on all currently available information. If an asset or share of stock was truly undervalued, investors would step in, buy shares, and bid up the stock price until it was accurately valued. The converse is also true: ...

India`s Capital Market - Learning Financial Management

... price discovery in the secondary markets. ...

... price discovery in the secondary markets. ...

מכתב כללי ממונה

... the offer of the EB bonds in Israel and stipulating special taxation regulations pertaining to the bank. According to the proposed amendment the EB can offer securities, including by way of trade registration on the stock exchange, that do not impart voting rights or membership in the bank and which ...

... the offer of the EB bonds in Israel and stipulating special taxation regulations pertaining to the bank. According to the proposed amendment the EB can offer securities, including by way of trade registration on the stock exchange, that do not impart voting rights or membership in the bank and which ...

Topic Foreign investors investing in Brazilian mortgage

... resell it is allowed to exist; and (vi) the issuer must evidence in the public offering documents its commitment (or the originator’s or assignor’s, in case of issuance of Brazilian mortgage securities) to use the proceeds raised with the issuance of the securities in one or more specific investment ...

... resell it is allowed to exist; and (vi) the issuer must evidence in the public offering documents its commitment (or the originator’s or assignor’s, in case of issuance of Brazilian mortgage securities) to use the proceeds raised with the issuance of the securities in one or more specific investment ...

Global Securities Finance Fixed Income Repo

... • ‘Cash-driven’ institutions seek to borrow securities as collateral in Repo Rates are determined by dynamic market forces and may cash financing arrangements as a collateralized investment. change as market conditions dictate. The cash lender is not seeking specific securities and will generally ...

... • ‘Cash-driven’ institutions seek to borrow securities as collateral in Repo Rates are determined by dynamic market forces and may cash financing arrangements as a collateralized investment. change as market conditions dictate. The cash lender is not seeking specific securities and will generally ...

securities trading policy

... The restrictions in this policy apply to dealings in Securities by or on behalf of a director or Executive of the Company or any spouse or child of any of them and any other dealing in which they are directly or indirectly interested. For this purpose: Executive means the CEO, any direct executive r ...

... The restrictions in this policy apply to dealings in Securities by or on behalf of a director or Executive of the Company or any spouse or child of any of them and any other dealing in which they are directly or indirectly interested. For this purpose: Executive means the CEO, any direct executive r ...