UNITED STATES SECURITIES AND EXCHANGE COMMISSION

... with an existing shareholder (the “Investor”), pursuant to which the Company agreed to issue and sell to the Investor in a private placement (the “Private Placement”), an aggregate of 3,325,236 common shares (the “Shares’) of the Company, nominal value €0.01 per share (the “Common Shares”), for an a ...

... with an existing shareholder (the “Investor”), pursuant to which the Company agreed to issue and sell to the Investor in a private placement (the “Private Placement”), an aggregate of 3,325,236 common shares (the “Shares’) of the Company, nominal value €0.01 per share (the “Common Shares”), for an a ...

Changes in Director`s Interest (S135)

... 420,000 ordinary shares of RM1.00 each representing 0.09% of the issued and paidup share capital of HIB. This announcement complies with Paragraphs 14.06 and 14.09 of the Main Market Listing Requirements of Bursa Malaysia Securities Berhad. This announcement is dated 17 January 2017. ...

... 420,000 ordinary shares of RM1.00 each representing 0.09% of the issued and paidup share capital of HIB. This announcement complies with Paragraphs 14.06 and 14.09 of the Main Market Listing Requirements of Bursa Malaysia Securities Berhad. This announcement is dated 17 January 2017. ...

INVESTMENT STRATEGY UPDATE

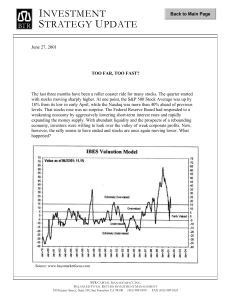

... Several methods of valuing stocks are based upon the relationship between forward corporate earnings estimates and bond yields. The IBES valuation model, shown above, is one such valuation gauge. It compares the earnings yield (twelve months forward earnings/price) to the yield of the ten-year Trea ...

... Several methods of valuing stocks are based upon the relationship between forward corporate earnings estimates and bond yields. The IBES valuation model, shown above, is one such valuation gauge. It compares the earnings yield (twelve months forward earnings/price) to the yield of the ten-year Trea ...

September 2015: (Not) - Dana Investment Advisors

... 4) Telling their bigger stock brokerage firms and mutual funds to buy stocks This is not free enterprise. This is big government trying to control the economy and the stock market. This does not work as we found out in the 1930’s and since 2008 (more on that later). These actions will only delay the ...

... 4) Telling their bigger stock brokerage firms and mutual funds to buy stocks This is not free enterprise. This is big government trying to control the economy and the stock market. This does not work as we found out in the 1930’s and since 2008 (more on that later). These actions will only delay the ...

Print Stock Gifting Instructions Here

... assets and donating the cash proceeds, is one of the best and easiest ways to give more! A charitable contribution of long-term appreciated securities, i.e. stocks, bonds and/or mutual funds that have realized significant appreciation over time, is one of the most tax-efficient of all ways to give. ...

... assets and donating the cash proceeds, is one of the best and easiest ways to give more! A charitable contribution of long-term appreciated securities, i.e. stocks, bonds and/or mutual funds that have realized significant appreciation over time, is one of the most tax-efficient of all ways to give. ...

[CO 03/826] Market related records: Australian financial

... ASIC Australian Securities & Investments Commission ...

... ASIC Australian Securities & Investments Commission ...

INTRODUCTION TO

... Dividends can now only be paid out of actually realized gains : It will reduce both the quantum of dividends ...

... Dividends can now only be paid out of actually realized gains : It will reduce both the quantum of dividends ...

NETWORK HOLDINGS INTERNATIONAL INC (Form: 3/A, Received: 04/21

... Establishment of the discriminatory share price, the reporting owner has determined to issue as previously filed in the SEC Form 3, 10,000,000 shares common stock upon the completion of Visual Frontier, Inc., (VFTR) corporate restructuring notwithstanding all like industry comparable share structure ...

... Establishment of the discriminatory share price, the reporting owner has determined to issue as previously filed in the SEC Form 3, 10,000,000 shares common stock upon the completion of Visual Frontier, Inc., (VFTR) corporate restructuring notwithstanding all like industry comparable share structure ...

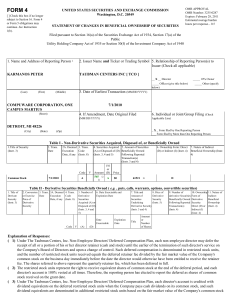

TAUBMAN CENTERS INC (Form: 4, Received: 07/01/2010 16:04:49)

... DETROIT, MI 48226 Signatures /s/ Donald J. Kunz, Attorney-in-Fact ...

... DETROIT, MI 48226 Signatures /s/ Donald J. Kunz, Attorney-in-Fact ...

Stocks - Northwest ISD Moodle

... stock market of a given nation— The most regularly quoted market indices are national indices composed of the stocks of large companies listed on a nation's largest stock exchanges, such as the American S&P 500, Japanese Nikkei 225, and the British FTSE 100 ...

... stock market of a given nation— The most regularly quoted market indices are national indices composed of the stocks of large companies listed on a nation's largest stock exchanges, such as the American S&P 500, Japanese Nikkei 225, and the British FTSE 100 ...

What Types of Financial Market Structures Exist

... auction. However, securities are traded on the floor of the exchange with the help of specialist traders who combine broker and dealer functions. The specialists broker trades but also stand ready to buy and sell stocks from personal inventories if buy and sell orders do not match up. Intermediation ...

... auction. However, securities are traded on the floor of the exchange with the help of specialist traders who combine broker and dealer functions. The specialists broker trades but also stand ready to buy and sell stocks from personal inventories if buy and sell orders do not match up. Intermediation ...

Factors That Affect the Rate of Return on an Investment

... – Registers member firms, writes rules to govern their behavior, examines them for compliance and disciplines those that fail to comply. – Largest private sector provider of financial regulatory services. – Has helped bring integrity to the markets and confidence in investors. H100 ...

... – Registers member firms, writes rules to govern their behavior, examines them for compliance and disciplines those that fail to comply. – Largest private sector provider of financial regulatory services. – Has helped bring integrity to the markets and confidence in investors. H100 ...

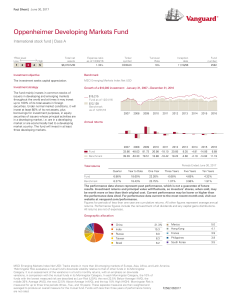

Oppenheimer Developing Markets Fund - Vanguard

... disruption of relations between China and its neighbors or trading partners could severely impact China’s export-based economy. Small Cap: Concentrating assets in small-capitalization stocks may subject the portfolio to the risk that those stocks underperform other capitalizations or the market as a ...

... disruption of relations between China and its neighbors or trading partners could severely impact China’s export-based economy. Small Cap: Concentrating assets in small-capitalization stocks may subject the portfolio to the risk that those stocks underperform other capitalizations or the market as a ...

Fund Details Ulland AUM : $200 million Strategy Assets : $140

... On April 1, 2002, Ulland Investment Advisors began offering the Defensive Growth style to a limited number of clients so that the style would be seasoned before being generally offered. Performance is shown on a time-weighted basis as calculated in Axys portfolio software. Performance is presented g ...

... On April 1, 2002, Ulland Investment Advisors began offering the Defensive Growth style to a limited number of clients so that the style would be seasoned before being generally offered. Performance is shown on a time-weighted basis as calculated in Axys portfolio software. Performance is presented g ...

January 5, 2016 Dear Friends, The Lerner Group believes that 2016

... HighTower Advisors, LLC, a registered investment advisor with the SEC. Securities are offered through HighTower Securities, LLC; advisory services are offered through HighTower Advisors, LLC. This is not an offer to buy or sell securities. No investment process is free of risk, and there is no guara ...

... HighTower Advisors, LLC, a registered investment advisor with the SEC. Securities are offered through HighTower Securities, LLC; advisory services are offered through HighTower Advisors, LLC. This is not an offer to buy or sell securities. No investment process is free of risk, and there is no guara ...

Investments

... For Large Issues, a Syndicate is Used Hot Issue Market - During some periods, over 50 news firms go public every month. - Many investors want these shares - Initial returns are high Who gets shares? - Those who want shares ask their broker. - When more shares are sought, than are being issued, prior ...

... For Large Issues, a Syndicate is Used Hot Issue Market - During some periods, over 50 news firms go public every month. - Many investors want these shares - Initial returns are high Who gets shares? - Those who want shares ask their broker. - When more shares are sought, than are being issued, prior ...

Case Study: Globalization of Finance and current financial crisis

... • American industries no longer compete against other “national” industries • The stateless corporation? ...

... • American industries no longer compete against other “national” industries • The stateless corporation? ...

Chapter12Review

... 1. Dividends are paid out of profits, and a. dividend payments must be approved by the firm’s board of directors. b. dividends are guaranteed. c. dividends are paid before a firm’s taxes are paid. d. dividends are usually paid twice a year. e. none of the above 2. By using the internet, it is possib ...

... 1. Dividends are paid out of profits, and a. dividend payments must be approved by the firm’s board of directors. b. dividends are guaranteed. c. dividends are paid before a firm’s taxes are paid. d. dividends are usually paid twice a year. e. none of the above 2. By using the internet, it is possib ...

Slide set 1

... (funding) to where they are needed • Macroeconomic view: blood circulation of national economy • Requires efficiency ensured also by means of regulation • Another regulatory objective: investor protection ...

... (funding) to where they are needed • Macroeconomic view: blood circulation of national economy • Requires efficiency ensured also by means of regulation • Another regulatory objective: investor protection ...

INSIDER TRADING RWM abides by national and local laws, rules

... INSIDER TRADING RWM abides by national and local laws, rules and regulations, including all applicable guidelines issued by the Philippine Stock Exchange (PSE). It is therefore illegal to buy or sell securities of any company, including RWM’s, based on material non-public information, unless exempte ...

... INSIDER TRADING RWM abides by national and local laws, rules and regulations, including all applicable guidelines issued by the Philippine Stock Exchange (PSE). It is therefore illegal to buy or sell securities of any company, including RWM’s, based on material non-public information, unless exempte ...

Convertibles During High Inflation

... Convertible bonds are interest-paying securities, similar to corporate bonds, in which investors have the option to turn the bonds into a predetermined number of shares. The hybrid nature of the securities offers investors the principal protection and income characteristics of bonds with the opport ...

... Convertible bonds are interest-paying securities, similar to corporate bonds, in which investors have the option to turn the bonds into a predetermined number of shares. The hybrid nature of the securities offers investors the principal protection and income characteristics of bonds with the opport ...

chapter two - Sigma Capital

... He may revoke transactions which violate the laws, its executive regulations and decrees related to their implementation, or which have been carried out with manipulated prices. He may also suspend the trading of a given security in case its continuing transactions causes harm to the market or to pa ...

... He may revoke transactions which violate the laws, its executive regulations and decrees related to their implementation, or which have been carried out with manipulated prices. He may also suspend the trading of a given security in case its continuing transactions causes harm to the market or to pa ...

Main Market – key eligibility criteria

... The Main Market is the London Stock Exchange’s flagship market for large, established companies and our regulated market for listed securities. Issuers of securities admitted to trading on the Main Market are also admitted to the UK Listing Authority’s Official List. There are two listing segments – ...

... The Main Market is the London Stock Exchange’s flagship market for large, established companies and our regulated market for listed securities. Issuers of securities admitted to trading on the Main Market are also admitted to the UK Listing Authority’s Official List. There are two listing segments – ...

![[CO 03/826] Market related records: Australian financial](http://s1.studyres.com/store/data/021195199_1-28b1e8af59968c79cd461506c5c1b913-300x300.png)