Multiple Choice

... Hugh, an engineer for Innovative Corporation, learns that Innovative has developed a computer chip to triple the speed of any computer. Hugh buys 1,000 shares of Innovative stock. He tells Jan, who buys 500 shares. After the new chip is announced publicly, the price of Innovative stock increases. Hu ...

... Hugh, an engineer for Innovative Corporation, learns that Innovative has developed a computer chip to triple the speed of any computer. Hugh buys 1,000 shares of Innovative stock. He tells Jan, who buys 500 shares. After the new chip is announced publicly, the price of Innovative stock increases. Hu ...

TTSE Rule 405 - Price Stabilisation Amended April 19th 2010

... This proposal seeks to amend the price band for daily price movements from 10% to 15%. Increasing the price band to 15% would allow investors to place orders within a wider price band making them more attractive to the market which should result in an increase in market activity and more flexible an ...

... This proposal seeks to amend the price band for daily price movements from 10% to 15%. Increasing the price band to 15% would allow investors to place orders within a wider price band making them more attractive to the market which should result in an increase in market activity and more flexible an ...

Securities Firms and Investment Banks

... Prior to NSMIA, regulated by SEC and states. Regulate trading activities such as shelf registration ...

... Prior to NSMIA, regulated by SEC and states. Regulate trading activities such as shelf registration ...

securities investment services

... as a recommendation or investment advice, to buy or sell any financial product or service. Some investment products are not suitable for everyone. Investors should carefully consider whether such trading is suitable in light of his investment experience, objectives and financial status. Investment i ...

... as a recommendation or investment advice, to buy or sell any financial product or service. Some investment products are not suitable for everyone. Investors should carefully consider whether such trading is suitable in light of his investment experience, objectives and financial status. Investment i ...

Market Buzz - Penny Stocks – Two Common Fallacies

... penny stocks and that there is a positive correlation between the number of stocks a person owns and his or her returns. Investors who have fallen into the trap of the first fallacy believe Wal-Mart, Microsoft, and many other large companies were once penny stocks that have appreciated to high dolla ...

... penny stocks and that there is a positive correlation between the number of stocks a person owns and his or her returns. Investors who have fallen into the trap of the first fallacy believe Wal-Mart, Microsoft, and many other large companies were once penny stocks that have appreciated to high dolla ...

The New Landscape for Business Startups and Their Investors

... • Any advertising for a crowdfunding offering, as well as the offering itself, must be done through a registered portal. However, the funding portal is strictly an intermediary; it may not offer investment advice or recommendations, hold or manage investors' funds, pay its staff commissions on the s ...

... • Any advertising for a crowdfunding offering, as well as the offering itself, must be done through a registered portal. However, the funding portal is strictly an intermediary; it may not offer investment advice or recommendations, hold or manage investors' funds, pay its staff commissions on the s ...

Consumer Advisory

... nation. Customers are solicited by an individual or a business through mailings, email, and phone calls, promising some sort of prize (airline tickets, free vacation, gift certificate, iPad, etc.) But a “free prize” might not actually be free…or a prize. Marketing gimmicks such as these may require ...

... nation. Customers are solicited by an individual or a business through mailings, email, and phone calls, promising some sort of prize (airline tickets, free vacation, gift certificate, iPad, etc.) But a “free prize” might not actually be free…or a prize. Marketing gimmicks such as these may require ...

Stocks Are Not The New Bonds

... economic inflection points. History has shown that markets often become the most euphoric at the most perilous point in the economic cycle. The current US economic expansion is now in its eighth year, while the average business cycle typically lasts five years. The stock market has historically peak ...

... economic inflection points. History has shown that markets often become the most euphoric at the most perilous point in the economic cycle. The current US economic expansion is now in its eighth year, while the average business cycle typically lasts five years. The stock market has historically peak ...

Name

... 1. When buying or selling stock on the New York Stock Exchange, who would execute your trade and how could you be assured that there will always be someone willing to buy if you are willing to sell or sell if you are willing to buy? ...

... 1. When buying or selling stock on the New York Stock Exchange, who would execute your trade and how could you be assured that there will always be someone willing to buy if you are willing to sell or sell if you are willing to buy? ...

Credit Unit

... A Broker is a person who is licensed to buy and sell stocks, provide investment advice, and collect a commission on each purchase or sale ...

... A Broker is a person who is licensed to buy and sell stocks, provide investment advice, and collect a commission on each purchase or sale ...

85 reasons why investors avoided the stock market:Layout 1.qxd

... 500 are trademarks of the McGraw-Hill Companies, Inc. 2 This is a hypothetical example used for illustrative purposes only. The lump sum investment in common stocks would have reflected the same stocks/weightings as represented in the S&P 500 Index. Additional ...

... 500 are trademarks of the McGraw-Hill Companies, Inc. 2 This is a hypothetical example used for illustrative purposes only. The lump sum investment in common stocks would have reflected the same stocks/weightings as represented in the S&P 500 Index. Additional ...

27 part ii item 5. market for the registrant`s common equity, related

... Our payment of dividends in the future will be determined by Danaher’s Board of Directors and will depend on business conditions, Danaher’s earnings and other factors Danaher’s Board deems relevant. For a description of the distribution of the issued and outstanding common stock of Fortive pursuant ...

... Our payment of dividends in the future will be determined by Danaher’s Board of Directors and will depend on business conditions, Danaher’s earnings and other factors Danaher’s Board deems relevant. For a description of the distribution of the issued and outstanding common stock of Fortive pursuant ...

- SlideBoom

... In case the movement takes place at or after 1 p.m. but before 2.30 p.m. there will be a trading halt for ½ hour. In case the movement takes place at or after 2.30 p.m. there will be no trading halt at the 10% level and the market will continue trading. In case of a 15% movement of either index, the ...

... In case the movement takes place at or after 1 p.m. but before 2.30 p.m. there will be a trading halt for ½ hour. In case the movement takes place at or after 2.30 p.m. there will be no trading halt at the 10% level and the market will continue trading. In case of a 15% movement of either index, the ...

November 2013 - Dana Investment Advisors

... would encourage more people to look for work and make our economy more productive. The Affordable Care Act enters into the employment number also. Employers are wrestling with the consequences of this act in making decisions on hiring full -time, part-time or job sharing employees. Another economic ...

... would encourage more people to look for work and make our economy more productive. The Affordable Care Act enters into the employment number also. Employers are wrestling with the consequences of this act in making decisions on hiring full -time, part-time or job sharing employees. Another economic ...

Market valuations, Janet Yellen and Nuke LaLoosh

... to mention that this situation may have been caused, at least in part, by the policies of the Federal Reserve Board, which she chairs. As Nuke LaLoosh would say, “That’s a real humdinger.” Most economists agree that former Chairman Bernanke and the Federal Reserve Board had their backs against the w ...

... to mention that this situation may have been caused, at least in part, by the policies of the Federal Reserve Board, which she chairs. As Nuke LaLoosh would say, “That’s a real humdinger.” Most economists agree that former Chairman Bernanke and the Federal Reserve Board had their backs against the w ...

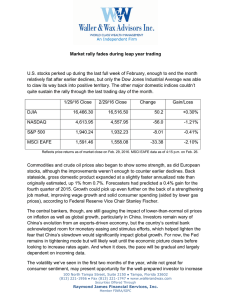

Market rally fades during leap year trading U.S. stocks perked up

... The MSCI EAFE (Europe, Australia, Far East) index is an unmanaged index that is generally considered representative of the international stock market. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and ...

... The MSCI EAFE (Europe, Australia, Far East) index is an unmanaged index that is generally considered representative of the international stock market. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and ...

short selling regulations

... capitalization and aggregate turnover referred to above on a combined basis so long as the stocks traded under different stock codes constitute securities of the same class of the issuer and the transfer of stocks between different stock codes is allowed. ...

... capitalization and aggregate turnover referred to above on a combined basis so long as the stocks traded under different stock codes constitute securities of the same class of the issuer and the transfer of stocks between different stock codes is allowed. ...

SECURITIES OPERATIONS

... Securities Act of 1933: must register new securities (exceptions) Securities Exchange Act of 1934; Establishes the SEC Commodities Exchange Act of 1936 Investment Advisors Act of 1940 Securities Investor Protection Corporation Act of 1970 Commodity Futures Trading Commission Act of 1974 Securities A ...

... Securities Act of 1933: must register new securities (exceptions) Securities Exchange Act of 1934; Establishes the SEC Commodities Exchange Act of 1936 Investment Advisors Act of 1940 Securities Investor Protection Corporation Act of 1970 Commodity Futures Trading Commission Act of 1974 Securities A ...

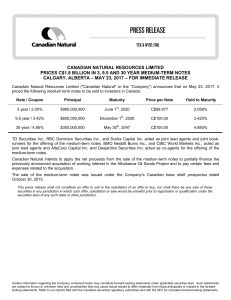

CANADIAN NATURAL RESOURCES LIMITED PRICES C$1.8

... Canadian Natural intends to apply the net proceeds from the sale of the medium-term notes to partially finance the previously announced acquisition of working interest in the Athabasca Oil Sands Project and to pay certain fees and expenses related to the acquisition. The sale of the medium-term note ...

... Canadian Natural intends to apply the net proceeds from the sale of the medium-term notes to partially finance the previously announced acquisition of working interest in the Athabasca Oil Sands Project and to pay certain fees and expenses related to the acquisition. The sale of the medium-term note ...

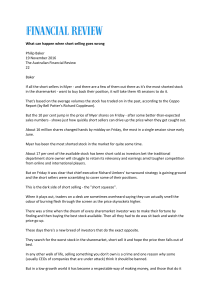

What can happen when short selling goes wrong Philip

... There was a time when the dream of every sharemarket investor was to make their fortune by finding and then buying the best stock available. Then all they had to do was sit back and watch the price go up. These days there's a new breed of investors that do the exact opposite. They search for the wor ...

... There was a time when the dream of every sharemarket investor was to make their fortune by finding and then buying the best stock available. Then all they had to do was sit back and watch the price go up. These days there's a new breed of investors that do the exact opposite. They search for the wor ...

Video Q and A for Episode Two of No

... 1. What is a stock? A stock is a share of ownership in a company; ownership in the company is equal to the number of shares owned by the shareholder relative to the total number of shares owned by all members. Stocks are often traded publicly. A publicly traded company issues stock that is traded on ...

... 1. What is a stock? A stock is a share of ownership in a company; ownership in the company is equal to the number of shares owned by the shareholder relative to the total number of shares owned by all members. Stocks are often traded publicly. A publicly traded company issues stock that is traded on ...

Blackstone Real Estate Income Trust, Inc.

... Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ...

... Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ...

ANALYZING SECURITIES INVESTMENT TRUSTS TRADED IN BIST

... ANALYZING SECURITIES INVESTMENT TRUSTS TRADED IN BIST VIA AHPPROMETHEE METHODOLOGY ...

... ANALYZING SECURITIES INVESTMENT TRUSTS TRADED IN BIST VIA AHPPROMETHEE METHODOLOGY ...

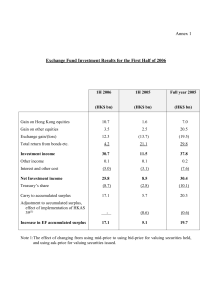

Scannell Wealth Report April 6, 2009 The Markets One

... the first quarter, the dollar strengthened 5% against the euro, 9% against the Japanese yen, and 4% against a trade-weighted basket of 16 currencies tracked by J.P. Morgan Chase, according to The Wall Street Journal. The dollar’s strength may confound its critics because of the theory of relativity. ...

... the first quarter, the dollar strengthened 5% against the euro, 9% against the Japanese yen, and 4% against a trade-weighted basket of 16 currencies tracked by J.P. Morgan Chase, according to The Wall Street Journal. The dollar’s strength may confound its critics because of the theory of relativity. ...