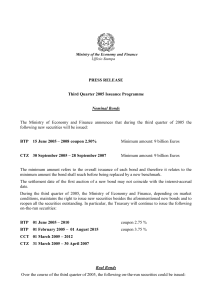

Third Quarter 2005 Issuance Programme

... CCT 01 March 2005 – 2012 CTZ 31 March 2005 – 30 April 2007 ...

... CCT 01 March 2005 – 2012 CTZ 31 March 2005 – 30 April 2007 ...

Clinical Data, Inc. Prices Public Offering of Common

... Clinical Data, Inc. Prices Public Offering of Common Stock NEWTON, Mass. – June 9, 2010 – Clinical Data, Inc. (NASDAQ: CLDA) today announced that it has raised gross proceeds of approximately $27.8 million through the public offering of 1,945,576 newly issued shares of its common stock at a price of ...

... Clinical Data, Inc. Prices Public Offering of Common Stock NEWTON, Mass. – June 9, 2010 – Clinical Data, Inc. (NASDAQ: CLDA) today announced that it has raised gross proceeds of approximately $27.8 million through the public offering of 1,945,576 newly issued shares of its common stock at a price of ...

Telefónica, SA

... Further to Relevant Events notices published on March 2, 2016 in relation to the issue by TELEFÓNICA of equity-linked bonds (the “Bonds”), via its wholly-owned subsidiary Telefónica Participaciones, S.A.U. (the “Issuer”), we hereby announce that the reference price of the TELEFÓNICA shares for the p ...

... Further to Relevant Events notices published on March 2, 2016 in relation to the issue by TELEFÓNICA of equity-linked bonds (the “Bonds”), via its wholly-owned subsidiary Telefónica Participaciones, S.A.U. (the “Issuer”), we hereby announce that the reference price of the TELEFÓNICA shares for the p ...

Section 1: 8-K

... A cautionary note about forward-looking statements: This Current Report may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements can include statements about estimated cost savings, plans and objectives for fut ...

... A cautionary note about forward-looking statements: This Current Report may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements can include statements about estimated cost savings, plans and objectives for fut ...

Enron Episode - Buy, buy, buy

... were under pressure to be positive. "It was unspoken, unwritten, but there was a strong presumption on the part of the investment banks that if they were ever going to do any business with Enron, the analyst had to have a 'strong buy' recommendation on the stock," says Olson, of Sanders Morris Har ...

... were under pressure to be positive. "It was unspoken, unwritten, but there was a strong presumption on the part of the investment banks that if they were ever going to do any business with Enron, the analyst had to have a 'strong buy' recommendation on the stock," says Olson, of Sanders Morris Har ...

... bonds can still yield 3 - 4.5%, while lower quality high yield corporate bonds can yield 6-8% depending on ratings. An investment in a basket of corporate bonds (or bond funds) can be structured to pay monthly interest income / dividends and set up to be transferred to an investor's checking account ...

Mirae Asset Securities (USA) Inc.

... ▪ Mirae Asset Daewoo Co., Ltd. is publicly traded on the KOSPI (KRX: 006800) is rated Baa2 long term by Moody’s. ▪ We have successfully completed FINRA’s CMA process to become self-clearing. ▪ To capitalize itself to conduct the new businesses, the parent made an equity capital infusion into the U.S ...

... ▪ Mirae Asset Daewoo Co., Ltd. is publicly traded on the KOSPI (KRX: 006800) is rated Baa2 long term by Moody’s. ▪ We have successfully completed FINRA’s CMA process to become self-clearing. ▪ To capitalize itself to conduct the new businesses, the parent made an equity capital infusion into the U.S ...

CREF Money Market

... or other borrower may not be able to make timely principal, interest, or settlement payments on an obligation. In this event, the issuer of a fixed-income security may have its credit rating downgraded or defaulted, which may reduce the potential for income and value of the portfolio. Income: The in ...

... or other borrower may not be able to make timely principal, interest, or settlement payments on an obligation. In this event, the issuer of a fixed-income security may have its credit rating downgraded or defaulted, which may reduce the potential for income and value of the portfolio. Income: The in ...

TCS Fraud Management Solution Consulting

... vulnerable to external fraud and potential misuse. This makes timely fraud prevention vital, for failure to give this area proper attention brings financial, reputational and punitive risks. With fraudsters becoming more sophisticated in their use of technology, you need an effective, holistic solut ...

... vulnerable to external fraud and potential misuse. This makes timely fraud prevention vital, for failure to give this area proper attention brings financial, reputational and punitive risks. With fraudsters becoming more sophisticated in their use of technology, you need an effective, holistic solut ...

Form: 6-K, Received: 02/26/2016 18:51:31

... jurisdiction. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act"), or any state securities laws and may not be offered or sold within the United States or to, or for the account or benefit of, "U.S. persons," ...

... jurisdiction. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act"), or any state securities laws and may not be offered or sold within the United States or to, or for the account or benefit of, "U.S. persons," ...

[TO BE PROVIDED BY HONG KONG INVESTORS] Letter of Hong

... securities of the Company registered in the placee's name or otherwise held by the place. For the purposes of this paragraph 7, "directors", "substantial shareholders", "associates" and "connected persons" shall have the meaning ascribed to them in Rules 1.01 and 14A.11 of the Rules Governing the Li ...

... securities of the Company registered in the placee's name or otherwise held by the place. For the purposes of this paragraph 7, "directors", "substantial shareholders", "associates" and "connected persons" shall have the meaning ascribed to them in Rules 1.01 and 14A.11 of the Rules Governing the Li ...

The Potential for Tax-Advantaged Income From Preferred Securities

... Preferred funds may invest in below investment-grade securities and unrated securities judged to be below investment-grade by the Advisor. Below investment-grade securities or equivalent unrated securities generally involve greater volatility of price and risk of loss of income and principal, and ma ...

... Preferred funds may invest in below investment-grade securities and unrated securities judged to be below investment-grade by the Advisor. Below investment-grade securities or equivalent unrated securities generally involve greater volatility of price and risk of loss of income and principal, and ma ...

FSI Statement on Introduction of Senate Regulatory Reform

... Harmonization of broker-dealer and investment adviser oversight should also include elimination of costly duplication and overlap of regulation that undermines investor protection. “This provision is a reasonable compromise that will ensure that the interests of all stakeholders in this debate, but ...

... Harmonization of broker-dealer and investment adviser oversight should also include elimination of costly duplication and overlap of regulation that undermines investor protection. “This provision is a reasonable compromise that will ensure that the interests of all stakeholders in this debate, but ...

The Stock Market Game

... The NASDAQ is the largest electronic stock market in the US. When it began trading in 1971, it was the world’s first electronic marketplace. Transactions take place on a virtual platform. Investors at remote locations all over the world buy and sell shares on a virtual platform. Both the NASDAQ and ...

... The NASDAQ is the largest electronic stock market in the US. When it began trading in 1971, it was the world’s first electronic marketplace. Transactions take place on a virtual platform. Investors at remote locations all over the world buy and sell shares on a virtual platform. Both the NASDAQ and ...

General Information

... At the end of the reporting quarter, the amount of publicly traded corporate debt securities at a face value comprised 48.9 million lats, compared to 43.9 million lats on 30 September 2003, incl. bonds in the amount of 19.9 million lats and mortgage bonds in the amount of 29 million lats. In the rep ...

... At the end of the reporting quarter, the amount of publicly traded corporate debt securities at a face value comprised 48.9 million lats, compared to 43.9 million lats on 30 September 2003, incl. bonds in the amount of 19.9 million lats and mortgage bonds in the amount of 29 million lats. In the rep ...

PROFIT WARNING

... (“TH”) (Stock Code: 3886). As at 30 June 2017, the Group held 120,000,000 shares of TH as available-for-sale investment, representing approximately 1.6% of its issued shares. The Group recorded an impairment loss on its investment in the shares of TH of approximately HK$62.8 million for 1H 2017. The ...

... (“TH”) (Stock Code: 3886). As at 30 June 2017, the Group held 120,000,000 shares of TH as available-for-sale investment, representing approximately 1.6% of its issued shares. The Group recorded an impairment loss on its investment in the shares of TH of approximately HK$62.8 million for 1H 2017. The ...

doc - South Carolina Small Business Development Centers

... detailed business plan. You can find investors by contacting the investor directly or by contacting accountants, bankers, stockholders, venture capitalists, or investment clubs. Limited Stock Offering- Limited stock offering provides an opportunity for your company to raise significant amounts of eq ...

... detailed business plan. You can find investors by contacting the investor directly or by contacting accountants, bankers, stockholders, venture capitalists, or investment clubs. Limited Stock Offering- Limited stock offering provides an opportunity for your company to raise significant amounts of eq ...

Measuring Efficiency in Corporate Law: The Role of Shareholder

... entered US public capital markets by using reverse mergers, 260 in 2010 alone • Chinese companies accounted for 41 US IPOs in 2010, 1/3 of all US IPOs • Cultural and legal differences are creating regulatory and accounting issues ...

... entered US public capital markets by using reverse mergers, 260 in 2010 alone • Chinese companies accounted for 41 US IPOs in 2010, 1/3 of all US IPOs • Cultural and legal differences are creating regulatory and accounting issues ...

The Value of Early Investing

... How stocks are traded… • When a company first issues stocks, investors buy shares directly from the company in an initial public offering. After that, investors usually buy the stock from other investors who own it and wish to sell it. • The organized trading of stocks is known as the stock market. ...

... How stocks are traded… • When a company first issues stocks, investors buy shares directly from the company in an initial public offering. After that, investors usually buy the stock from other investors who own it and wish to sell it. • The organized trading of stocks is known as the stock market. ...

Investment Guidelines

... • Where products with underlying capital guarantees are chosen, i.e. Structured Notes, these will be permitted up to a maximum of 66% of the portfolio’s values, with no more than one quarter of the portfolio to be subject to the same issuer / guarantor default risk • Where no such capital guarantee ...

... • Where products with underlying capital guarantees are chosen, i.e. Structured Notes, these will be permitted up to a maximum of 66% of the portfolio’s values, with no more than one quarter of the portfolio to be subject to the same issuer / guarantor default risk • Where no such capital guarantee ...

Pro athletes must use caution to avoid financial

... investors out of at least $115 million. fund. According to the Journal, Wright partnered with former Atlanta anesthesiologists Nelson Bond and Fitz Harper, who helped win over fellow doctors. He also hired Steve Atwater, former Broncos football player, as an investment adviser. An SEC complaint file ...

... investors out of at least $115 million. fund. According to the Journal, Wright partnered with former Atlanta anesthesiologists Nelson Bond and Fitz Harper, who helped win over fellow doctors. He also hired Steve Atwater, former Broncos football player, as an investment adviser. An SEC complaint file ...

• Always deal with the market intermediaries registered with SEBI

... companies, its management, fundamentals and recent announcements made by them and various other disclosures made under various regulations. The sources of information are the websites of Exchanges and companies, databases of data vendor, business magazines etc. ...

... companies, its management, fundamentals and recent announcements made by them and various other disclosures made under various regulations. The sources of information are the websites of Exchanges and companies, databases of data vendor, business magazines etc. ...

DOC - Piedmont Office Realty Trust, Inc.

... Also, as part of our ongoing portfolio restructuring program, we sold one of our older properties located at 111 Sylvan Avenue in Englewood Cliffs, NJ for $55 million during the fourth quarter of 2010. Transfer Agent Change - From the time that Piedmont listed on the NYSE in February 2010, we have b ...

... Also, as part of our ongoing portfolio restructuring program, we sold one of our older properties located at 111 Sylvan Avenue in Englewood Cliffs, NJ for $55 million during the fourth quarter of 2010. Transfer Agent Change - From the time that Piedmont listed on the NYSE in February 2010, we have b ...

![[TO BE PROVIDED BY HONG KONG INVESTORS] Letter of Hong](http://s1.studyres.com/store/data/011247457_1-7ad2d7c8862abf73ac216623a0603c8d-300x300.png)