John Hancock International Value ADR Strategy

... Manulife Asset Management (US) LLC is a wholly owned subsidiary of Manulife Financial Corporation (Manulife Financial) and is affiliated with several US based and non-US based investment advisers which are also subsidiaries or affiliates of Manulife Financial. Manulife AM (US) and certain of our aff ...

... Manulife Asset Management (US) LLC is a wholly owned subsidiary of Manulife Financial Corporation (Manulife Financial) and is affiliated with several US based and non-US based investment advisers which are also subsidiaries or affiliates of Manulife Financial. Manulife AM (US) and certain of our aff ...

STOCK - Classifications

... • Stocks that move up or down in sync with the business cycle. • Earnings and stock prices will increase or decrease with changes in the business conditions or cycle. Examples – Automobile, Housing, Steel, and Industrial Equipment companies. ...

... • Stocks that move up or down in sync with the business cycle. • Earnings and stock prices will increase or decrease with changes in the business conditions or cycle. Examples – Automobile, Housing, Steel, and Industrial Equipment companies. ...

MBS Total Return Fund

... SEMPER MBS TOTAL RETURN FUND c/o U.S. Bancorp Fund Services, LLC P.O. Box 701 ...

... SEMPER MBS TOTAL RETURN FUND c/o U.S. Bancorp Fund Services, LLC P.O. Box 701 ...

PIMCO VIT Income Portfolio — Advisor Class

... Instruments of varying maturities, which may be represented by forwards or derivatives such as options, futures contracts or swap agreements. "Fixed Income Instruments" include bonds, debt securities and other similar instruments issued by various U.S. and non-U.S. public- or private-sector entities ...

... Instruments of varying maturities, which may be represented by forwards or derivatives such as options, futures contracts or swap agreements. "Fixed Income Instruments" include bonds, debt securities and other similar instruments issued by various U.S. and non-U.S. public- or private-sector entities ...

KCEE ECONOMICS/FINANCIAL LITERACY LESSON Title: Stock

... money, but the rest he would borrow from a broker. In the 1920s, the buyer only had to put down 10 to 20 percent of his own money and thus borrowed 80 to 90 percent of the cost of the stock. ...

... money, but the rest he would borrow from a broker. In the 1920s, the buyer only had to put down 10 to 20 percent of his own money and thus borrowed 80 to 90 percent of the cost of the stock. ...

The Summary of Financials Explained

... This is an indicator of how the stock market assesses the company and enables potential investors to form an opinion on whether the expected future earnings make the share a worthwhile investment. In this week’s financials, BTI has a P/E ratio of 9.8 calculated as: Market price per share ($75.00) di ...

... This is an indicator of how the stock market assesses the company and enables potential investors to form an opinion on whether the expected future earnings make the share a worthwhile investment. In this week’s financials, BTI has a P/E ratio of 9.8 calculated as: Market price per share ($75.00) di ...

Annual Disclosure Statement

... must contact them for a margin call to be valid, and that we cannot liquidate securities or other assets in their account(s) to meet the call unless we have contacted them first. This is not the case. We will attempt to notify you of margin calls, but we are not required to do so. However, even if w ...

... must contact them for a margin call to be valid, and that we cannot liquidate securities or other assets in their account(s) to meet the call unless we have contacted them first. This is not the case. We will attempt to notify you of margin calls, but we are not required to do so. However, even if w ...

Meanwhile, Jassim Alseddiqi, Chairman of SHUAA Capital, said

... investment climate in the Emirate and creating a business environment that is both competitive and flexible.” ...

... investment climate in the Emirate and creating a business environment that is both competitive and flexible.” ...

On Market Makers` Contribution to Trading Efficiency in Options

... and buy-sell spreads dropped by 35%. (2) As a result, efficiency of trading in euro-shekel options increased. We found that deviations from a parity of call and put option prices declined significantly by 12% and the well-known asymmetry in option prices (skewness) declined by 30%. We also found tha ...

... and buy-sell spreads dropped by 35%. (2) As a result, efficiency of trading in euro-shekel options increased. We found that deviations from a parity of call and put option prices declined significantly by 12% and the well-known asymmetry in option prices (skewness) declined by 30%. We also found tha ...

Monte-Carlo simulation with Black-Scholes

... The Greeks measure the sensitivity to change of the option price under a slight change of a single parameter while holding the other parameters fixed. Formally, they are partial derivatives of the option price with respect to the independent variables. The Greeks give the investor a better idea of h ...

... The Greeks measure the sensitivity to change of the option price under a slight change of a single parameter while holding the other parameters fixed. Formally, they are partial derivatives of the option price with respect to the independent variables. The Greeks give the investor a better idea of h ...

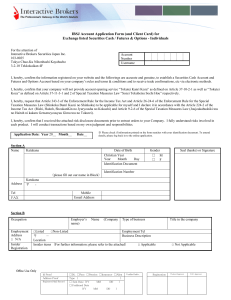

IBSJ Account Application Form (and Client Card) for Exchange listed

... Customers are responsible for protecting the secrecy of their usernames and passwords, and they will be responsible for trades entered by third parties using their usernames and passwords. In the event trades are confirmed by IB as executed, and they are later cancelled by an exchange, trading netwo ...

... Customers are responsible for protecting the secrecy of their usernames and passwords, and they will be responsible for trades entered by third parties using their usernames and passwords. In the event trades are confirmed by IB as executed, and they are later cancelled by an exchange, trading netwo ...

C-68 - IIROC

... situation where "the security" in which a member firm and its clients have a high exposure, substantially decreases (long positions) or increases (short positions) in value in a relative short period of time. The rule is not designed to inhibit the member firm from making a business decision to take ...

... situation where "the security" in which a member firm and its clients have a high exposure, substantially decreases (long positions) or increases (short positions) in value in a relative short period of time. The rule is not designed to inhibit the member firm from making a business decision to take ...

BANK OF NOVA SCOTIA (Form: FWP, Received: 10

... You will have no rights of a holder of the securities represented by the Market Measure, and you will not be entitled to receive securities or dividends or other distributions by the issuers of those securities. Your return on the notes may be affected by factors affecting the international securiti ...

... You will have no rights of a holder of the securities represented by the Market Measure, and you will not be entitled to receive securities or dividends or other distributions by the issuers of those securities. Your return on the notes may be affected by factors affecting the international securiti ...

Investments Lecture Notes

... that the investor can exert a controlling influence over the investee. An investor who owns more than 50% of a company's voting stock has control over the investee. This investor can dominate all other shareholders in electing the corporation's board of directors and has control over the investee's ...

... that the investor can exert a controlling influence over the investee. An investor who owns more than 50% of a company's voting stock has control over the investee. This investor can dominate all other shareholders in electing the corporation's board of directors and has control over the investee's ...

File: Ch04, Chapter 4 Securities Markets Type: Multiple Choice 1

... d) Electronic Communications Networks Ans: D EASY Response: ECNs are rapidly growing, but so far are much less important than NYSE, AMEX, or NASDAQ in terms of overall trading volume. Section: The Secondary Markets. ...

... d) Electronic Communications Networks Ans: D EASY Response: ECNs are rapidly growing, but so far are much less important than NYSE, AMEX, or NASDAQ in terms of overall trading volume. Section: The Secondary Markets. ...

binarynvest

... The Financial Services and Markets Authority (FSMA) warns the public against the activities of Binarynvest, a company that offers highly risky investment instruments in Belgium without complying with Belgian financial legislation. Binarynvest is not an authorized investment firm or credit institutio ...

... The Financial Services and Markets Authority (FSMA) warns the public against the activities of Binarynvest, a company that offers highly risky investment instruments in Belgium without complying with Belgian financial legislation. Binarynvest is not an authorized investment firm or credit institutio ...

Pre-Appointment Forms - GCSB Investment Center

... In order to make your “Retirement Profile” personal and accurate, you will need to have the following information when we get together: 1. Recent pay stub(s) so we can accurately calculate current income. 2. Current balances of any Retirement Accounts which are specifically earmarked for retirement ...

... In order to make your “Retirement Profile” personal and accurate, you will need to have the following information when we get together: 1. Recent pay stub(s) so we can accurately calculate current income. 2. Current balances of any Retirement Accounts which are specifically earmarked for retirement ...

Invesco Core Plus Bond Fund investment philosophy and process

... Portfolio management sits at the center of the investment process. The objective of portfolio manager is to monetize the macro and credit investment research recommendations in the most appropriate manner for the Fund. The portfolio management team incorporates the various inputs on economic formati ...

... Portfolio management sits at the center of the investment process. The objective of portfolio manager is to monetize the macro and credit investment research recommendations in the most appropriate manner for the Fund. The portfolio management team incorporates the various inputs on economic formati ...

Investments

... available for sale with a previous fair vale of $9,700, and transfers them into the held-to-maturity category when the current market value of the debt securities is $9,500. Investment in Held-to-Maturity Debt ...

... available for sale with a previous fair vale of $9,700, and transfers them into the held-to-maturity category when the current market value of the debt securities is $9,500. Investment in Held-to-Maturity Debt ...

O novo mercado ea regulamentação

... At present, there is a project within the National Congress to reform the Corporate Law, aimed at adapting it to the changes that have occurred in the capital markets in recent decades The same project also seeks to strengthen the Brazilian Securities and Exchange Commission - CVM, giving it greater ...

... At present, there is a project within the National Congress to reform the Corporate Law, aimed at adapting it to the changes that have occurred in the capital markets in recent decades The same project also seeks to strengthen the Brazilian Securities and Exchange Commission - CVM, giving it greater ...

Crashing Hopes: The Great Depression

... economists debate the actual influence of this phenomenon on the stock market, it's conceivable that many people took out loans not only to buy cars, but also to buy stock. 4. Companies invested their over-production profits in new production. From 1925 on, industry was over-producing. In anticipati ...

... economists debate the actual influence of this phenomenon on the stock market, it's conceivable that many people took out loans not only to buy cars, but also to buy stock. 4. Companies invested their over-production profits in new production. From 1925 on, industry was over-producing. In anticipati ...

I. “Active” Small/Mid Cap US Equity (SMID) Should Play Second

... Because of their narrow focus, sector investments tend to be more volatile than investments that diversify across many sectors and companies. Investing in foreign emerging markets entails greater risks than those normally associated with domestic markets, such as political, currency, economic and ma ...

... Because of their narrow focus, sector investments tend to be more volatile than investments that diversify across many sectors and companies. Investing in foreign emerging markets entails greater risks than those normally associated with domestic markets, such as political, currency, economic and ma ...

High-frequency trading

... volumes and high speeds aiming to capture sometimes a fraction of a cent in profit on every trade. • HFT firms make up the low margins with incredibly high volumes of trades, frequently numbering in the millions. • HFT traders often use stimulus-response methods (rapid fire placement and then immedi ...

... volumes and high speeds aiming to capture sometimes a fraction of a cent in profit on every trade. • HFT firms make up the low margins with incredibly high volumes of trades, frequently numbering in the millions. • HFT traders often use stimulus-response methods (rapid fire placement and then immedi ...

1. Without the participation of financial intermediaries in financial

... 7. According to the segmented markets theory, if most investors suddenly preferred to invest in short term securities and most borrowers suddenly preferred to issue long term securities there would be (Points: 6) upward pressure on the price of long term securities. upward pressure on the price of s ...

... 7. According to the segmented markets theory, if most investors suddenly preferred to invest in short term securities and most borrowers suddenly preferred to issue long term securities there would be (Points: 6) upward pressure on the price of long term securities. upward pressure on the price of s ...