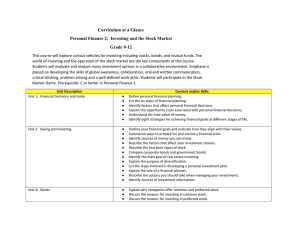

Curriculum at a Glance Personal Finance 2: Investing and the Stock

... Personal Finance 2: Investing and the Stock Market Grade 9-12 This course will explore various vehicles for investing including stocks, bonds, and mutual funds. The world of investing and the operation of the stock market are the key components of this course. Students will evaluate and analyze many ...

... Personal Finance 2: Investing and the Stock Market Grade 9-12 This course will explore various vehicles for investing including stocks, bonds, and mutual funds. The world of investing and the operation of the stock market are the key components of this course. Students will evaluate and analyze many ...

North Star Press Release - North Star Resource Group

... both individuals and businesses with the resources to create, preserve and protect their wealth. North Star has offices in seventeen states and has 150 financial advisors that work to provide financial security for clients. The firm offers a blend of stable and innovative products to provide clients ...

... both individuals and businesses with the resources to create, preserve and protect their wealth. North Star has offices in seventeen states and has 150 financial advisors that work to provide financial security for clients. The firm offers a blend of stable and innovative products to provide clients ...

Rare earth metals – will the next boom start here?

... Despite this track record of successful transactions and leverage to exploration, it seems few people are aware of Zimtu. The stock is tightly held with less than eight million shares outstanding and a market cap under $11 million. Yet the holdings in its portfolio alone are valued at more than $10 ...

... Despite this track record of successful transactions and leverage to exploration, it seems few people are aware of Zimtu. The stock is tightly held with less than eight million shares outstanding and a market cap under $11 million. Yet the holdings in its portfolio alone are valued at more than $10 ...

1Q17 FT Preferred Securities and Income Fact

... reimbursements, absent which performance would have been lower. *NAV represents the Fund’s net assets (assets less liabilities) divided by the Fund’s outstanding shares. **Pursuant to contract, First Trust has agreed to waive fees and/or pay fund expenses to prevent the net expense ratio of any clas ...

... reimbursements, absent which performance would have been lower. *NAV represents the Fund’s net assets (assets less liabilities) divided by the Fund’s outstanding shares. **Pursuant to contract, First Trust has agreed to waive fees and/or pay fund expenses to prevent the net expense ratio of any clas ...

Financial Statement Analysis and Security Valuation

... Amortized cost is based on the historical cost measurement rule and avoids manipulation in the financial statements. But historical cost does not capture any change in value since acquisition. Market prices give the change in value since acquisition. But (fair) market values can be biased if market ...

... Amortized cost is based on the historical cost measurement rule and avoids manipulation in the financial statements. But historical cost does not capture any change in value since acquisition. Market prices give the change in value since acquisition. But (fair) market values can be biased if market ...

The Stock Market

... • UEQ: How can JA Finance Park teaching you to use financial institutions to your benefit? ...

... • UEQ: How can JA Finance Park teaching you to use financial institutions to your benefit? ...

offensive selling – selling into strength

... Sharp Pullback and Fast Recovery to New Highs 1. Stock breaks sharply to its 10-week moving average line in one to three weeks, and then quickly rebounds to new highs in one to three weeks 2. The pullback typically occurs on relatively heavy volume, and the price action on the way down may be severe ...

... Sharp Pullback and Fast Recovery to New Highs 1. Stock breaks sharply to its 10-week moving average line in one to three weeks, and then quickly rebounds to new highs in one to three weeks 2. The pullback typically occurs on relatively heavy volume, and the price action on the way down may be severe ...

Information Disclosure and Market Quality

... Regulation Fair Disclosure Mandated that all publicly traded companies must disclose material information to all investors at the same time. The regulation sought to stamp out selective disclosure. Regulation FD changed fundamentally how companies communicate with investors, by bringing better ...

... Regulation Fair Disclosure Mandated that all publicly traded companies must disclose material information to all investors at the same time. The regulation sought to stamp out selective disclosure. Regulation FD changed fundamentally how companies communicate with investors, by bringing better ...

The future of corporate bond market liquidity

... markets, as broker-dealers would take the other side of customer trades and make a reasonable profit on that activity. This tended to reduce the volatility of markets, compared to situations where a broker-dealer needed to find another customer for a trade. The ability of Wall Street to fill this ro ...

... markets, as broker-dealers would take the other side of customer trades and make a reasonable profit on that activity. This tended to reduce the volatility of markets, compared to situations where a broker-dealer needed to find another customer for a trade. The ability of Wall Street to fill this ro ...

Institutional Suitability Certificate

... In connection with any recommended2 transaction or investment strategy by a registered broker-dealer, the undersigned acknowledges on behalf of the Institution named below that: I. It is an Institutional Account as defined in FINRA Rule 4512(c)3; II. It (1) is capable of evaluating investment risks ...

... In connection with any recommended2 transaction or investment strategy by a registered broker-dealer, the undersigned acknowledges on behalf of the Institution named below that: I. It is an Institutional Account as defined in FINRA Rule 4512(c)3; II. It (1) is capable of evaluating investment risks ...

stock exchange

... • How does the stock market work? – Stock, or shares in a company, are bought and sold on the stock market. – Stock brokers help individuals and businesses invest their money in the stock market. – Investors can keep track of the stock market by checking their local paper. When the market is doing w ...

... • How does the stock market work? – Stock, or shares in a company, are bought and sold on the stock market. – Stock brokers help individuals and businesses invest their money in the stock market. – Investors can keep track of the stock market by checking their local paper. When the market is doing w ...

Q1 2009 Market Commentary (Excerpt)

... is positively absurd and exasperating to watch. In this climate of market insanity, if the buying continues we could easily break through S&P500 900 level to the upside with the market going positive for the year, or we could stall in the 850-900 range and then sell off. However, in the short term, ...

... is positively absurd and exasperating to watch. In this climate of market insanity, if the buying continues we could easily break through S&P500 900 level to the upside with the market going positive for the year, or we could stall in the 850-900 range and then sell off. However, in the short term, ...

Stocks

... The Indices (index) • A collection of stocks—representative of the stock market – Dow Jones – 30 most significant stocks in the stock market – S&P 500 – 500 largest companies on the US stock market – NASDAQ Composite – all stocks on the ...

... The Indices (index) • A collection of stocks—representative of the stock market – Dow Jones – 30 most significant stocks in the stock market – S&P 500 – 500 largest companies on the US stock market – NASDAQ Composite – all stocks on the ...

First Bankers` Banc Securities, Inc.

... hierarchy, the categorization is based on the lowest level input that is significant to the fair value measurement. Assets and liabilities valued at fair value are categorized based on the inputs to the valuation techniques as follows: Level 1 – Inputs that utilize quoted prices (unadjusted) in acti ...

... hierarchy, the categorization is based on the lowest level input that is significant to the fair value measurement. Assets and liabilities valued at fair value are categorized based on the inputs to the valuation techniques as follows: Level 1 – Inputs that utilize quoted prices (unadjusted) in acti ...

ITEM

... by asset category, according to splits defined by cells A1 to A6 (example: EEA equity in local currency held in Life portfolio, for unit-linked fund) Distinction between life / non-life / health with life characteristics / health with non life characteristics / free assets / general (if no split) / ...

... by asset category, according to splits defined by cells A1 to A6 (example: EEA equity in local currency held in Life portfolio, for unit-linked fund) Distinction between life / non-life / health with life characteristics / health with non life characteristics / free assets / general (if no split) / ...

Obtained a Dominant Market Share of Stock Market Transactions by

... industry and successfully positioned itself as its dominant market leader. The company distinguishes itself through its dedication to the customer-centric principle, primarily by offering the industry’s lowest brokerage commissions level and best services. SBI E*TRADE SEURITIES ranks first among Jap ...

... industry and successfully positioned itself as its dominant market leader. The company distinguishes itself through its dedication to the customer-centric principle, primarily by offering the industry’s lowest brokerage commissions level and best services. SBI E*TRADE SEURITIES ranks first among Jap ...

2 - JustAnswer

... stockholders receive if their stock is cumulative and nonparticipating? (b) As of 12/31/11, it is desired to distribute $400,000 in dividends. How much will the preferred stockholders receive if their stock is cumulative and participating up to 11% in total? (c) On 12/31/11, the preferred stockholde ...

... stockholders receive if their stock is cumulative and nonparticipating? (b) As of 12/31/11, it is desired to distribute $400,000 in dividends. How much will the preferred stockholders receive if their stock is cumulative and participating up to 11% in total? (c) On 12/31/11, the preferred stockholde ...

Free Sample - Exam Test Bank Store

... associated with the sale rests with the investment bankers who will sustain a loss if the securities are unsold. This loss occurs either through a price reduction, which is necessary to move the unsold securities, or through borrowing the money to pay for the securities acquired from the issuing fir ...

... associated with the sale rests with the investment bankers who will sustain a loss if the securities are unsold. This loss occurs either through a price reduction, which is necessary to move the unsold securities, or through borrowing the money to pay for the securities acquired from the issuing fir ...

memorandum - Africa Newsroom

... with the aim of detecting market offences or any suspect behaviour (insider trading, price manipulation, dissemination of false or misleading information, use or communication of inside information), with market transactions monitored in real time. - Market player monitoring power COSUMAF has wide-r ...

... with the aim of detecting market offences or any suspect behaviour (insider trading, price manipulation, dissemination of false or misleading information, use or communication of inside information), with market transactions monitored in real time. - Market player monitoring power COSUMAF has wide-r ...

What Are Financial Intermediaries Paid For?

... is, banks, insurance companies, securities firms, investment banks, and mutual funds—are singled out for special regulatory attention. Saunders acknowledges this situation and wonders what makes the industry so different that such regulatory attention is necessary. Here is a summary of his findings. ...

... is, banks, insurance companies, securities firms, investment banks, and mutual funds—are singled out for special regulatory attention. Saunders acknowledges this situation and wonders what makes the industry so different that such regulatory attention is necessary. Here is a summary of his findings. ...

Financial institutions

... Maximize sales or market share. Minimize costs. Maximize profi ts. Maintain steady earnings growth ...

... Maximize sales or market share. Minimize costs. Maximize profi ts. Maintain steady earnings growth ...

C. Mon. Sept. 30--STOCK MARKET GAME PACKET FALL 2013

... An exchange-traded fund (or ETF) is an investment vehicle traded on stock exchanges, much like stocks. An ETF holds assets such as stocks or bonds and trades at approximately the same price as the net asset value of its underlying assets over the course of the trading day. ETFs may be attractive as ...

... An exchange-traded fund (or ETF) is an investment vehicle traded on stock exchanges, much like stocks. An ETF holds assets such as stocks or bonds and trades at approximately the same price as the net asset value of its underlying assets over the course of the trading day. ETFs may be attractive as ...

Paradox of Wealth - Helm Investment Management

... “best fit” regression, Bernstein shows the typical CAPE level rising from 13.6 in 1881 to 20.3 today. That might indicate that another stock crash is not necessarily imminent. But it also more gloomily predicts that long-term returns on U.S. stocks have diminished since the 19th century. The good ne ...

... “best fit” regression, Bernstein shows the typical CAPE level rising from 13.6 in 1881 to 20.3 today. That might indicate that another stock crash is not necessarily imminent. But it also more gloomily predicts that long-term returns on U.S. stocks have diminished since the 19th century. The good ne ...

20-Year Portfolio Performance Examining the past 20 years

... portfolios allocated more heavily to bonds. However, the higher returns of portfolios with large allocations to stocks are associated with much greater volatility (risk). Government bonds and Treasury bills are guaranteed by the full faith and credit of the United States government as to the timely ...

... portfolios allocated more heavily to bonds. However, the higher returns of portfolios with large allocations to stocks are associated with much greater volatility (risk). Government bonds and Treasury bills are guaranteed by the full faith and credit of the United States government as to the timely ...

docx - Investors - DanDrit Biotech USA, Inc.

... “Company”) completed public sales of an aggregate of 589,490 shares (the “Shares”) of the Company’s common stock, par value $0.0001 per share (the “Common Stock”), in a registered direct placement of the Company’s Common Stock at $5.00 per share, for gross proceeds of $2,947,450. The Shares were sol ...

... “Company”) completed public sales of an aggregate of 589,490 shares (the “Shares”) of the Company’s common stock, par value $0.0001 per share (the “Common Stock”), in a registered direct placement of the Company’s Common Stock at $5.00 per share, for gross proceeds of $2,947,450. The Shares were sol ...