Financial Planning Process Can Help Baby Boomers Realize

... Michael Collie is a Certified Financial Planner™ and president of Collie Financial Planning, Inc. (www.colliefp.com), a Fee-Only financial planning and investment advisory firm located at One Town Square Blvd, Suite 346, in Asheville. He can be reached at [email protected] or (828)654-8830. Coll ...

... Michael Collie is a Certified Financial Planner™ and president of Collie Financial Planning, Inc. (www.colliefp.com), a Fee-Only financial planning and investment advisory firm located at One Town Square Blvd, Suite 346, in Asheville. He can be reached at [email protected] or (828)654-8830. Coll ...

Designating Systemically Important Financial Institutions

... right track, although there is a great deal that cannot be judged yet. The rules focus on the right set of sources of systemic risk and they recognize the need to carefully consider the specific facts and to apply considered judgment to questions that are inherently somewhat subjective. It makes sen ...

... right track, although there is a great deal that cannot be judged yet. The rules focus on the right set of sources of systemic risk and they recognize the need to carefully consider the specific facts and to apply considered judgment to questions that are inherently somewhat subjective. It makes sen ...

Globalization, emerging market economies and currency crisis in Asia:

... uncontrolled domestic credit growth. This has created significant problems in the financial sectors, which increasingly intermediated domestic and foreign funds into less productive use. Financial institutions in Thailand, Malaysia and Indonesia were progressively exposed to booming property sectors ...

... uncontrolled domestic credit growth. This has created significant problems in the financial sectors, which increasingly intermediated domestic and foreign funds into less productive use. Financial institutions in Thailand, Malaysia and Indonesia were progressively exposed to booming property sectors ...

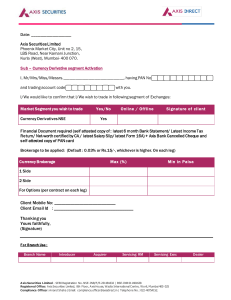

Client Email Id : Thanking you Yours faithfu

... I/We would like to confirm that I/We wish to trade in following segment of Exchanges: Market Segment you wish to trade Currency Derivatives NSE ...

... I/We would like to confirm that I/We wish to trade in following segment of Exchanges: Market Segment you wish to trade Currency Derivatives NSE ...

vinergy resources ltd. - Canadian Securities Exchange

... together with the consolidated financial statements for the year ended February 28, 2015 and the related notes attached thereto. These consolidated financial statements and MD&A include the results of operations and cash flows for the year ended February 28, 2015 and the reader must be aware that hi ...

... together with the consolidated financial statements for the year ended February 28, 2015 and the related notes attached thereto. These consolidated financial statements and MD&A include the results of operations and cash flows for the year ended February 28, 2015 and the reader must be aware that hi ...

THE SUB-PRIME MORTGAGE MESS Kevin M. Bahr, Ph.D

... (DIDMCA) effectively eliminated states' interest rate ceilings on home mortgages where the lender has a first lien. As a result, lenders could charge higher interest rates to borrowers with low credit scores. This allowed interest rates to increase high enough to compensate the lender for the risk o ...

... (DIDMCA) effectively eliminated states' interest rate ceilings on home mortgages where the lender has a first lien. As a result, lenders could charge higher interest rates to borrowers with low credit scores. This allowed interest rates to increase high enough to compensate the lender for the risk o ...

Financial Services & Public Policy Alert June 2009

... In addition, the SEC would have clear authority to require robust, ongoing reporting by ABS issuers. Under current law, a registered offering of ABS triggers a reporting obligation, but the reporting obligation is normally suspended because of an exception in the law. Implementing the proposal may i ...

... In addition, the SEC would have clear authority to require robust, ongoing reporting by ABS issuers. Under current law, a registered offering of ABS triggers a reporting obligation, but the reporting obligation is normally suspended because of an exception in the law. Implementing the proposal may i ...

We put a price tag on just how much money the finance sector has

... What has the flawed financial system cost the U.S. economy? How much have American families, taxpayers, and businesses been "overcharged" as a result of these questionable financial activities? The following findings —with all figures in inflation adjusted dollars—are from “Overcharged: The High Cos ...

... What has the flawed financial system cost the U.S. economy? How much have American families, taxpayers, and businesses been "overcharged" as a result of these questionable financial activities? The following findings —with all figures in inflation adjusted dollars—are from “Overcharged: The High Cos ...

FIN 331 Real Estate

... risky for the borrower? Attractive to the lender? 6. What are Home Equity Loans? 7. When would it be a good idea to refinance a loan? 8. Who is most likely to use a reverse mortgage? ...

... risky for the borrower? Attractive to the lender? 6. What are Home Equity Loans? 7. When would it be a good idea to refinance a loan? 8. Who is most likely to use a reverse mortgage? ...

Market Commentary July 5, 2011

... The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate o ...

... The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate o ...

Asia Business Conference 2014 Keynote Address by Masamichi Kono

... apply to cross border transactions and activities of market participants. The content and timing of implementation have diverged across jurisdictions, and deference to other regulators has become a necessity to avoid unnecessary burdens on businesses and to prevent market fragmentation. Since the c ...

... apply to cross border transactions and activities of market participants. The content and timing of implementation have diverged across jurisdictions, and deference to other regulators has become a necessity to avoid unnecessary burdens on businesses and to prevent market fragmentation. Since the c ...

Batten the Hatches

... Home Price Index, we’re down about 34 percent in the last six years. To help millions of conventional borrowers, HARP was rolled out with much fanfare. One notable departure from the standard underwriting criteria was that an eligible borrower could have an LTV of up to 125 percent. There was also a ...

... Home Price Index, we’re down about 34 percent in the last six years. To help millions of conventional borrowers, HARP was rolled out with much fanfare. One notable departure from the standard underwriting criteria was that an eligible borrower could have an LTV of up to 125 percent. There was also a ...

Function of Financial Markets

... Financial markets (bond and stock markets) and financial intermediaries (banks, insurance companies, pension funds) have the basic function of getting people such as you and Walter together by moving funds from those who have a surplus of funds (Walter) to those who have a shortage of funds (you). ...

... Financial markets (bond and stock markets) and financial intermediaries (banks, insurance companies, pension funds) have the basic function of getting people such as you and Walter together by moving funds from those who have a surplus of funds (Walter) to those who have a shortage of funds (you). ...

Pioneer Investments Presentation Template

... the case of both assets and liabilities and in relation of the single instruments. ...

... the case of both assets and liabilities and in relation of the single instruments. ...

IOSR Journal of Economics and Finance (IOSR-JEF)

... withdraw money from savings accounts with the expectation that the value of those assets will drop.This paper analyses what the key characteristics of certain specific financial crises were and identifies the common traits of most of the financial crises which occurred in the past century. Before th ...

... withdraw money from savings accounts with the expectation that the value of those assets will drop.This paper analyses what the key characteristics of certain specific financial crises were and identifies the common traits of most of the financial crises which occurred in the past century. Before th ...

Terms of Reference for the Audit Committee Purpose Composition

... The committee consists of at least three independent commissioners. Each member is financially literate, and independent of the internal and external auditors. At least one member has accounting or other relevant financial management expertise. The committee meets at least four times a year, and oth ...

... The committee consists of at least three independent commissioners. Each member is financially literate, and independent of the internal and external auditors. At least one member has accounting or other relevant financial management expertise. The committee meets at least four times a year, and oth ...

Optimal Portfolios under Worst Case Scenarios

... assume that investors only look at the distributional properties of strategies and do not care about the states of the world in which the cash-flows are received. In a very interesting paper Dybvig (1988a, 1988b) essentially showed that in these instances optimal portfolios are decreasing in the sta ...

... assume that investors only look at the distributional properties of strategies and do not care about the states of the world in which the cash-flows are received. In a very interesting paper Dybvig (1988a, 1988b) essentially showed that in these instances optimal portfolios are decreasing in the sta ...

UDK 336.76 Development mechanisms of the financial market of

... In recent years, the stock market was characterized by low liquidity due to the lack of highquality financial instruments, as well as the general stable trend to the decline of volumes in inner organized stock market. Actually bank loans are more often used as sources of funding by issuers, and as a ...

... In recent years, the stock market was characterized by low liquidity due to the lack of highquality financial instruments, as well as the general stable trend to the decline of volumes in inner organized stock market. Actually bank loans are more often used as sources of funding by issuers, and as a ...