The Electricity Commission invites submissions on

... 2005 is an Election Year and politicians should take note of consumer interests. There is a general feeling by consumers, especially domestic consumers, that the only heavily regulated part of the industry is their investment in lines companies and there is strong opinion that they are being ripped ...

... 2005 is an Election Year and politicians should take note of consumer interests. There is a general feeling by consumers, especially domestic consumers, that the only heavily regulated part of the industry is their investment in lines companies and there is strong opinion that they are being ripped ...

“Defining Financial Stability, and Some Policy Implications of Applying the Definition”

... times, the financial intermediary can provide depositors or investors access to their funds with little or no notice, because the intermediary draws its funds from a diversified set of depositors (with varied financial needs) who are unlikely – again, in normal economic times – to all demand their f ...

... times, the financial intermediary can provide depositors or investors access to their funds with little or no notice, because the intermediary draws its funds from a diversified set of depositors (with varied financial needs) who are unlikely – again, in normal economic times – to all demand their f ...

Box B: Banks` Exposures to Inner

... in default events where the value of the properties is insufficient to cover the debt outstanding. Australian mortgage lending has historically had very low default rates – around ½ per cent – and had high levels of collateralisation. In Sydney in particular, a very large price fall would be require ...

... in default events where the value of the properties is insufficient to cover the debt outstanding. Australian mortgage lending has historically had very low default rates – around ½ per cent – and had high levels of collateralisation. In Sydney in particular, a very large price fall would be require ...

Ch 11: 1.1

... price either the next day or within a few days. Repos are short-term loans with the securities serving as collateral. Leverage is the financing of investments by borrowing rather than using capital. Investment banks became more reliant on repo financing and more highly leveraged because by the 1990s ...

... price either the next day or within a few days. Repos are short-term loans with the securities serving as collateral. Leverage is the financing of investments by borrowing rather than using capital. Investment banks became more reliant on repo financing and more highly leveraged because by the 1990s ...

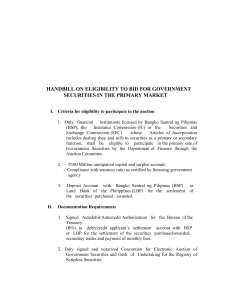

handbill on eligibility to bid for government securities in the primary

... accounts of a financial institution. CAPITAL means the paid-in capital and surplus account. SURPLUS means the excess of the assets over the liabilities and paid-in capital of the financial institutions but excluding the reserves set aside for valuation purposes and reserves for liabilities and defer ...

... accounts of a financial institution. CAPITAL means the paid-in capital and surplus account. SURPLUS means the excess of the assets over the liabilities and paid-in capital of the financial institutions but excluding the reserves set aside for valuation purposes and reserves for liabilities and defer ...

Symposium on Mobilizing Sustainable Investments: Making Private

... 1. The finance symposium, co-hosted by the UNEP Inquiry and the UNEP Finance Initiative, aims to showcase that the financial system both globally and nationally is at an exciting nexus for playing an active role in sustainable development and in the implementation of the Sustainable Development Goal ...

... 1. The finance symposium, co-hosted by the UNEP Inquiry and the UNEP Finance Initiative, aims to showcase that the financial system both globally and nationally is at an exciting nexus for playing an active role in sustainable development and in the implementation of the Sustainable Development Goal ...

public_bodies

... The Framework Programme decision clearly indicates in footnote 4 in Annex III that additional cost is a possibility and can be offered “subject to specific conditions [to] specific legal entities, particularly public bodies, [who] will receive funding of up to 100% of their marginal/additional costs ...

... The Framework Programme decision clearly indicates in footnote 4 in Annex III that additional cost is a possibility and can be offered “subject to specific conditions [to] specific legal entities, particularly public bodies, [who] will receive funding of up to 100% of their marginal/additional costs ...

Laura Piatti - CeRP - Collegio Carlo Alberto

... • Can be in the future much more developed because of the new rules regarding the payout phase of the public system and for the expected growth of the complementary system • Considering the MWR analysis, presents fair prices covering the component due to the cost of adverse selection, but it shows v ...

... • Can be in the future much more developed because of the new rules regarding the payout phase of the public system and for the expected growth of the complementary system • Considering the MWR analysis, presents fair prices covering the component due to the cost of adverse selection, but it shows v ...

Exari`s Investment Banking Solution

... and Consumer Protection Act and re- cent FSA regulations, institutions that trade in complex financial products are looking for ways to document and manage the high risks inherent in the business. The 2008 global financial crisis exposed serious documentation, risk and collateral management problems ...

... and Consumer Protection Act and re- cent FSA regulations, institutions that trade in complex financial products are looking for ways to document and manage the high risks inherent in the business. The 2008 global financial crisis exposed serious documentation, risk and collateral management problems ...

FINANCE - power point presentation

... 1. Statements of changes in financial position can be prepared using either a source and uses format or an activity format, with both providing essentially equivalent information. 2. A statement of sources and uses of funds is derived by comparing the balance sheet of a firm at two different points ...

... 1. Statements of changes in financial position can be prepared using either a source and uses format or an activity format, with both providing essentially equivalent information. 2. A statement of sources and uses of funds is derived by comparing the balance sheet of a firm at two different points ...

Mortgage-Related Securities

... interest rate tied to market levels. Fannie Mae ARMs Fannie Mae offers an adjustable rate mortgage-backed securities program. A Fannie Mae-backed ARM is supported by a pool of ARMs that share the same index and other similar contract features. These ARM securities bear a pass-through rate or accrual ...

... interest rate tied to market levels. Fannie Mae ARMs Fannie Mae offers an adjustable rate mortgage-backed securities program. A Fannie Mae-backed ARM is supported by a pool of ARMs that share the same index and other similar contract features. These ARM securities bear a pass-through rate or accrual ...

press release

... Since the launch of its DLT initiative in September 2015, R3 has grown from a staff of eight finance and technology veterans with nine bank members to a global team of over 110 professionals serving over 80 global financial institutions and regulators on six continents. The company’s work is further ...

... Since the launch of its DLT initiative in September 2015, R3 has grown from a staff of eight finance and technology veterans with nine bank members to a global team of over 110 professionals serving over 80 global financial institutions and regulators on six continents. The company’s work is further ...

The Origins of the Financial Crisis

... the near equivalent by selling “credit default swaps” (CDS), which were similar to monocline insurance in principle but different in risk, as CDS sellers put up very little capital to back their transactions. These new innovations enabled Wall Street to do for subprime mortgages what it had already ...

... the near equivalent by selling “credit default swaps” (CDS), which were similar to monocline insurance in principle but different in risk, as CDS sellers put up very little capital to back their transactions. These new innovations enabled Wall Street to do for subprime mortgages what it had already ...

Global Securities Finance Fixed Income Repo

... the repo market, transacting on specific securities either because they have failed to receive securities that they are due to make delivery on - they have deliberately sold a security short and are using the loan to deliver against this position - or they hold securities in high demand. The secur ...

... the repo market, transacting on specific securities either because they have failed to receive securities that they are due to make delivery on - they have deliberately sold a security short and are using the loan to deliver against this position - or they hold securities in high demand. The secur ...

How to prepare yourself for a Quants job in the financial market?

... option pricing, risk neutral measure. Exotic options: barrier options, lookback options and Asian options. Free boundary value pricing models: American options, reset options. ...

... option pricing, risk neutral measure. Exotic options: barrier options, lookback options and Asian options. Free boundary value pricing models: American options, reset options. ...