Pro athletes must use caution to avoid financial

... An SEC complaint filed in February said Atwater invested $2.8 million of his own money in IMA, and the Journal said he helped raise about $15 million from his NFL friends, including Blaine Bishop, Terrell Davis and Rod Smith. In 2002 the NFLPA established the “Registered Financial Advisor Program.” ...

... An SEC complaint filed in February said Atwater invested $2.8 million of his own money in IMA, and the Journal said he helped raise about $15 million from his NFL friends, including Blaine Bishop, Terrell Davis and Rod Smith. In 2002 the NFLPA established the “Registered Financial Advisor Program.” ...

THE FINANCIAL TREND MONITORING SYSTEM

... organizational response to adverse conditions by reducing services, increasing efficiency, raising taxes, or taking some other appropriate action. This assumes that public officials have enough notice of the problem, understand its nature and magnitude, know what to do and are willing to do it. Unde ...

... organizational response to adverse conditions by reducing services, increasing efficiency, raising taxes, or taking some other appropriate action. This assumes that public officials have enough notice of the problem, understand its nature and magnitude, know what to do and are willing to do it. Unde ...

Systemic Risk and the Financial Crisis: A Primer

... A rapid rise in the share of nonprime loans, especially nonprime loans with unconventional terms, was a key feature of the mortgage market during the housing boom. Nonprime loans increased from 9 percent of new mortgage originations in 2001 to 40 percent in 2006 (DiMartino and Duca, 2007). Most nonp ...

... A rapid rise in the share of nonprime loans, especially nonprime loans with unconventional terms, was a key feature of the mortgage market during the housing boom. Nonprime loans increased from 9 percent of new mortgage originations in 2001 to 40 percent in 2006 (DiMartino and Duca, 2007). Most nonp ...

Attachment 1 : Liberalization of Securities Business Licensing

... able to exercise their own judgments whether to operate every type of securities businesses within one entity or among separate subsidiaries depending on types of products or groups of customers. ...

... able to exercise their own judgments whether to operate every type of securities businesses within one entity or among separate subsidiaries depending on types of products or groups of customers. ...

personal finance - Mentor High School

... • Describe how insurance and other riskmanagement strategies protect against financial loss • Design a plan for earning, spending, saving, and investing • Explain how to use money-management tools available from financial institutions ...

... • Describe how insurance and other riskmanagement strategies protect against financial loss • Design a plan for earning, spending, saving, and investing • Explain how to use money-management tools available from financial institutions ...

Dear Colleague - Oakland County

... generation. 4.1.6 Risk Management- Develop a risk management plan that uses a combination of avoidance, reduction, retention, and transfer (insurance). ...

... generation. 4.1.6 Risk Management- Develop a risk management plan that uses a combination of avoidance, reduction, retention, and transfer (insurance). ...

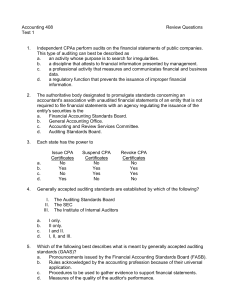

Test 1, Review Questions

... review agreements with financial institutions for restrictions on cash balances. b. understand the accounting principles and practices of the entity's industry. c. inquire of key personnel concerning related parties and subsequent events. d. perform ratio analyses of the financial data of comparable ...

... review agreements with financial institutions for restrictions on cash balances. b. understand the accounting principles and practices of the entity's industry. c. inquire of key personnel concerning related parties and subsequent events. d. perform ratio analyses of the financial data of comparable ...

Presentation to the 18th Annual Hyman P. Minsky Conference on... World Economies—“Meeting the Challenges of the Financial Crisis”

... investors tried to raise returns by increasing leverage and sacrificing liquidity through shortterm—sometimes overnight—debt financing. Simultaneously, new and fancy methods of financial engineering allowed widespread and complex securitization of many types of assets, most famously in subprime len ...

... investors tried to raise returns by increasing leverage and sacrificing liquidity through shortterm—sometimes overnight—debt financing. Simultaneously, new and fancy methods of financial engineering allowed widespread and complex securitization of many types of assets, most famously in subprime len ...

Role of Financial Institutions - We can offer most test bank and

... Financial intermediaries are needed to facilitate the exchange of funds between surplus and deficit units. They have the information to provide this service and can even repackage deposits to provide the amount of funds that borrowers desire. 4. Efficient Markets. Explain the meaning of efficient ma ...

... Financial intermediaries are needed to facilitate the exchange of funds between surplus and deficit units. They have the information to provide this service and can even repackage deposits to provide the amount of funds that borrowers desire. 4. Efficient Markets. Explain the meaning of efficient ma ...

Mitchel Gorecki Urban Economics The Perfect Storm The

... restriction on credit harmed more than it helped, escalating the current economic issues into an all out crisis. This was done by showing that the increased restrictions imposed additional costs to lending, ultimately decreasing the supply of loans and tanking the economy. There were three primary ...

... restriction on credit harmed more than it helped, escalating the current economic issues into an all out crisis. This was done by showing that the increased restrictions imposed additional costs to lending, ultimately decreasing the supply of loans and tanking the economy. There were three primary ...

Development of Benchmarks and Regulatory Commissions

... instead of cash outgo basis) in the state generating sector and to enable them to enter into a PPA with the Licensee viz. the Transmission Corporation of Andhra Pradesh (APTransco); Both sets of action required developing benchmarks. The long term prevailing PPAs (25 years) were on a ‘take or pay’ b ...

... instead of cash outgo basis) in the state generating sector and to enable them to enter into a PPA with the Licensee viz. the Transmission Corporation of Andhra Pradesh (APTransco); Both sets of action required developing benchmarks. The long term prevailing PPAs (25 years) were on a ‘take or pay’ b ...

Ethics of the Financial Professional

... 10. Web Challenge #1: If financial professionals are compensated when they take risks (in hopes of a big win and a big pay day), we shouldn’t be surprised when they do so. Therefore, a lot of attention has been paid to how we motivate and compensate financial professionals, especially CEOs and other ...

... 10. Web Challenge #1: If financial professionals are compensated when they take risks (in hopes of a big win and a big pay day), we shouldn’t be surprised when they do so. Therefore, a lot of attention has been paid to how we motivate and compensate financial professionals, especially CEOs and other ...

PDF - EMM Wealth Management

... inevitably leads to capital flowing toward riskier, high-yielding assets such as belowinvestment-grade corporate bonds, bank loans, securitized products and niche financing products, causing spreads to tighten. Such an environment also allows financing to leak to borrowers that were previously seen ...

... inevitably leads to capital flowing toward riskier, high-yielding assets such as belowinvestment-grade corporate bonds, bank loans, securitized products and niche financing products, causing spreads to tighten. Such an environment also allows financing to leak to borrowers that were previously seen ...

Day 1 — Wednesday, 10 April 2013 - Asia Pacific Financial Market

... legitimate regulatory objectives (such as financial stability and consumer protection) — in banking, insurance, wealth management and securities markets? ...

... legitimate regulatory objectives (such as financial stability and consumer protection) — in banking, insurance, wealth management and securities markets? ...

PDF Download

... Some of these lessons are shared by many other institutions and scholars. Intermediaries that, like banks, engage in maturity transformation and are exposed to liquidity runs should be subject to the same principles of regulation and supervision as banks. Regulation and supervision is motivated by t ...

... Some of these lessons are shared by many other institutions and scholars. Intermediaries that, like banks, engage in maturity transformation and are exposed to liquidity runs should be subject to the same principles of regulation and supervision as banks. Regulation and supervision is motivated by t ...