Demystifying the Federal Home Loan Banks:

... specific requirements. Perhaps as importantly, expert FHLBank staff is available to consult with members about these features. They can discuss not only the market implications, but the accounting consequences as well. As employees of a member-owned cooperative, their only goal is to tailor a soluti ...

... specific requirements. Perhaps as importantly, expert FHLBank staff is available to consult with members about these features. They can discuss not only the market implications, but the accounting consequences as well. As employees of a member-owned cooperative, their only goal is to tailor a soluti ...

Speech - Europa.eu

... Second, it would become more expensive for global financial institutions to comply with different legal requirements. Third, regulatory differences would give financial institutions incentives to engage in regulatory arbitrage. This can lead to an accumulation of under-regulated activities and put t ...

... Second, it would become more expensive for global financial institutions to comply with different legal requirements. Third, regulatory differences would give financial institutions incentives to engage in regulatory arbitrage. This can lead to an accumulation of under-regulated activities and put t ...

DFSA Publishes Findings of Trade Finance Review in DIFC

... published a Trade Finance Report detailing key findings of a review of trade finance activities carried out in and from the Dubai International Financial Centre (DIFC). The review assessed the quality of systems and controls, in particular measures to mitigate trade-based money laundering risks, at ...

... published a Trade Finance Report detailing key findings of a review of trade finance activities carried out in and from the Dubai International Financial Centre (DIFC). The review assessed the quality of systems and controls, in particular measures to mitigate trade-based money laundering risks, at ...

Maximize your wealth. Live the life you want.

... Save at double the rate of non-advised households (8.6% annual savings vs. 4.3%)* Have, on average, four times more investable assets than those with no advisor** Take charge of your financial future. We can help you develop a more disciplined approach to saving and investing. * CIRANO, An Econometr ...

... Save at double the rate of non-advised households (8.6% annual savings vs. 4.3%)* Have, on average, four times more investable assets than those with no advisor** Take charge of your financial future. We can help you develop a more disciplined approach to saving and investing. * CIRANO, An Econometr ...

Commission rings changes for 4th Anti- money

... take administrative measures to achieve the objectives of Article 67 TFEU as regards the preventing and combating of terrorism. These measures would put in place common standards on the assets to be frozen, identify which actors are to be involved and which remedies and safeguards apply. As part of ...

... take administrative measures to achieve the objectives of Article 67 TFEU as regards the preventing and combating of terrorism. These measures would put in place common standards on the assets to be frozen, identify which actors are to be involved and which remedies and safeguards apply. As part of ...

Lecture 5 Keynes and Recession

... Structure of Economy is sound Unemployment is voluntary Prick the bubble of housing Problem is now recession is in third year UK forecast growth 0.5 per cent Destruction of GDP equivalent to 5 per cent ...

... Structure of Economy is sound Unemployment is voluntary Prick the bubble of housing Problem is now recession is in third year UK forecast growth 0.5 per cent Destruction of GDP equivalent to 5 per cent ...

11-08-2016 Presidential Elections

... becomes serious, (In my opinion it already has.), both taxes and spending have to be addressed. Regardless how this election turns out, it will not be the end of the world. We are not beyond the point in time where the government’s spending can be brought back into line with revenues. While it may r ...

... becomes serious, (In my opinion it already has.), both taxes and spending have to be addressed. Regardless how this election turns out, it will not be the end of the world. We are not beyond the point in time where the government’s spending can be brought back into line with revenues. While it may r ...

Full Text [PDF 67KB]

... ignored by financial institutions of the major economies. For example, over the last few years, Japanese financial institutions have taken pains to ensure stable funding of dollars as they expanded their overseas activities. Even so, they still depend on foreign exchange swaps for some portion of th ...

... ignored by financial institutions of the major economies. For example, over the last few years, Japanese financial institutions have taken pains to ensure stable funding of dollars as they expanded their overseas activities. Even so, they still depend on foreign exchange swaps for some portion of th ...

Individual Financial Planning

... 2. Recognize relationships among financial documents and money management activities, create a system for maintaining personal financial records, develop a personal balance sheet and cash flow statement, create and implement a budget, and calculate savings needed to achieve financial goals. 3. Desc ...

... 2. Recognize relationships among financial documents and money management activities, create a system for maintaining personal financial records, develop a personal balance sheet and cash flow statement, create and implement a budget, and calculate savings needed to achieve financial goals. 3. Desc ...

2.2 - Financial Markets Relevant to Business

... businesses to raise funds by providing a marketplace where securities of companies can be bought and sold. This function is carried out in both the primary and secondary markets. Primary markets are concerned with the formation of new securities. For example, when a company is formed and the shares ...

... businesses to raise funds by providing a marketplace where securities of companies can be bought and sold. This function is carried out in both the primary and secondary markets. Primary markets are concerned with the formation of new securities. For example, when a company is formed and the shares ...

The Rise and Fall of Subprime Mortgages

... crucial development that fostered subprime lending growth. Traditionally, banks made prime mortgages funded with deposits from savers. By the 1980s and 1990s, the need for deposits had eased as mortgage lenders created a new way for funds to flow from savers and investors to prime borrowers through ...

... crucial development that fostered subprime lending growth. Traditionally, banks made prime mortgages funded with deposits from savers. By the 1980s and 1990s, the need for deposits had eased as mortgage lenders created a new way for funds to flow from savers and investors to prime borrowers through ...

Actuarial and Financial Models

... techniques will be studied. Attention is paid to the underlying assumptions of the models and how to evaluate their applicability in practice. The recently developed techniques and models that will be considered are not only attractive from a theoretical point of view, but they are also effective in ...

... techniques will be studied. Attention is paid to the underlying assumptions of the models and how to evaluate their applicability in practice. The recently developed techniques and models that will be considered are not only attractive from a theoretical point of view, but they are also effective in ...

Investors and Markets

... see a scenario within any kind of realm of reason that would see us losing a dollar in any of those transactions” – Joseph J. Cassano, President, August, 2007 ...

... see a scenario within any kind of realm of reason that would see us losing a dollar in any of those transactions” – Joseph J. Cassano, President, August, 2007 ...

Colorado Springs Press Release

... services practice – Resolute Investment Advisors, LLC (RIA). The managing partners of this new group are Todd Baker and Brad Harvey, formerly of UBS Financial Services. Both Todd and Brad have been working in the financial services industry for over 20 years and were determined to open an independen ...

... services practice – Resolute Investment Advisors, LLC (RIA). The managing partners of this new group are Todd Baker and Brad Harvey, formerly of UBS Financial Services. Both Todd and Brad have been working in the financial services industry for over 20 years and were determined to open an independen ...

Module1.1

... To understand • an economy’s financial system • how it finances the economy • how it oversees the economy’s money supply Does this by facilitating the movement of money from where it is in excess to where it is most needed (to help economy prosper). Also, to understand ...

... To understand • an economy’s financial system • how it finances the economy • how it oversees the economy’s money supply Does this by facilitating the movement of money from where it is in excess to where it is most needed (to help economy prosper). Also, to understand ...

Cross-Currents (2012-Dec) - Assante Wealth Management

... The term ‘fiscal’ refers to government spending and taxation policies. Fiscal policy can be ‘tight’, when the government decreases spending or increases taxes, or it can be ‘loose’ when the government spends more or taxes less. The ‘fiscal cliff’ is a series of spending cuts and tax increases totali ...

... The term ‘fiscal’ refers to government spending and taxation policies. Fiscal policy can be ‘tight’, when the government decreases spending or increases taxes, or it can be ‘loose’ when the government spends more or taxes less. The ‘fiscal cliff’ is a series of spending cuts and tax increases totali ...

1 - TestbankU

... you use: a credit union, a pension fund, or an investment bank? You would likely use a credit union if you were a member, since their primary business is consumer loans. In some cases it is possible to borrow directly from pension funds, but it can come with high borrowing costs and tax implications ...

... you use: a credit union, a pension fund, or an investment bank? You would likely use a credit union if you were a member, since their primary business is consumer loans. In some cases it is possible to borrow directly from pension funds, but it can come with high borrowing costs and tax implications ...

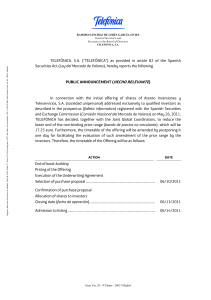

TELEFÓNICA, S.A. (“TELEFÓNICA”) as provided in article 82 of the

... solicitation or sale is unlawful. The information contained in this Communication is being disclosed in accordance with Rule 135c under the U.S. Securities Act of 1933, as amended (the "Securities Act"), for securities which have not been, and will not be, registered under the Securities Act or the ...

... solicitation or sale is unlawful. The information contained in this Communication is being disclosed in accordance with Rule 135c under the U.S. Securities Act of 1933, as amended (the "Securities Act"), for securities which have not been, and will not be, registered under the Securities Act or the ...

![Full Text [PDF 67KB]](http://s1.studyres.com/store/data/017928079_1-9c531ce11d4ce380303c6a2d80a8e5ce-300x300.png)