41% - Bank Of India

... Priority Sector Credit & Rural Development Department, Head Office, Star House, Mumbai. ...

... Priority Sector Credit & Rural Development Department, Head Office, Star House, Mumbai. ...

G-SIIs - Home.BARCLAYS

... (BCBS) establish a framework to identify Global Systemically Important Institutions (G-SIIs), defined as those financial institutions that could be expected to have the greatest impact on the global financial system and the global economy, should they fail. G-SIIs are required to hold an additional ...

... (BCBS) establish a framework to identify Global Systemically Important Institutions (G-SIIs), defined as those financial institutions that could be expected to have the greatest impact on the global financial system and the global economy, should they fail. G-SIIs are required to hold an additional ...

20 June 2017 Swanson: Stocks and Bonds: Two Markets Telling

... the stock and bond markets have begun to tell very different tales. Stocks have moved up unblinkingly, and bond prices have moved up as well, driving yields lower. The bond market is telling a story of lower growth and lower inflation ahead. But no one’s told this slowdown story to the stock market. ...

... the stock and bond markets have begun to tell very different tales. Stocks have moved up unblinkingly, and bond prices have moved up as well, driving yields lower. The bond market is telling a story of lower growth and lower inflation ahead. But no one’s told this slowdown story to the stock market. ...

Comment on a National Securities Regulator

... persons. Both are national self-regulatory organizations (“SROs”) which obtain their regulatory jurisdiction in each province by that province’s securities commission. What that means is that each provincial securities commission enters into a recognition Order or similar instrument, setting out the ...

... persons. Both are national self-regulatory organizations (“SROs”) which obtain their regulatory jurisdiction in each province by that province’s securities commission. What that means is that each provincial securities commission enters into a recognition Order or similar instrument, setting out the ...

Taking shadow banking out of the shadows to create sustainable

... Authorities recognise that as the banking system is reformed to become more resilient, activity can be pushed into the shadows. New regulatory requirements on banks create incentives to move activities to other parts of the financial system where they are not subject to the same prudential standards ...

... Authorities recognise that as the banking system is reformed to become more resilient, activity can be pushed into the shadows. New regulatory requirements on banks create incentives to move activities to other parts of the financial system where they are not subject to the same prudential standards ...

International financial and foreign exchange markets Tentative

... FX market efficiency and the art of exchange rate forecasting (A. Ziliotto) Theoretical overview and available empirical evidence: could there be profitable trading strategies? Textbook chapter: XVI The infrastructure of international finance: historical evolution and current situation (G. Schlitzer ...

... FX market efficiency and the art of exchange rate forecasting (A. Ziliotto) Theoretical overview and available empirical evidence: could there be profitable trading strategies? Textbook chapter: XVI The infrastructure of international finance: historical evolution and current situation (G. Schlitzer ...

「M2+債券型基金」統計數之編製說明

... institutions and the definition of the monetary aggregate M2 in the CBC’s Financial Statistics Monthly will be modified, with details explained as follows. 1. Categorization of financial institutions The financial institutions in the Financial Statistics Monthly will be re-grouped in order to modify ...

... institutions and the definition of the monetary aggregate M2 in the CBC’s Financial Statistics Monthly will be modified, with details explained as follows. 1. Categorization of financial institutions The financial institutions in the Financial Statistics Monthly will be re-grouped in order to modify ...

Security Analysis and Portfolio Management

... duration i.e. more than a year is called as capital market. In a capital market various financial institutions raise money from individuals and invest it for a longer period. ...

... duration i.e. more than a year is called as capital market. In a capital market various financial institutions raise money from individuals and invest it for a longer period. ...

Regulatory Analyst, Derivatives

... An understanding of Alberta and North American power, gas and/or crude markets terminology and current energy trading practices, market trends and marketplace terminology is considered an asset. ...

... An understanding of Alberta and North American power, gas and/or crude markets terminology and current energy trading practices, market trends and marketplace terminology is considered an asset. ...

STRENGTHENING THE FINANCIAL SYSTEM

... composition of payments reflects longer as well as shorter-term risks; and firms to disclose clear, comprehensive, and timely information about compensation. Supervisors will assess firms’ policies as part of their overall assessment of their soundness. Where necessary they will intervene with res ...

... composition of payments reflects longer as well as shorter-term risks; and firms to disclose clear, comprehensive, and timely information about compensation. Supervisors will assess firms’ policies as part of their overall assessment of their soundness. Where necessary they will intervene with res ...

Financial Crisis of 2007–2010

... remaining between 10-15% in the eight years prior to 2006. Peter Wallison of the American Enterprise Institute has the crisis rooted directly in sub-prime lending by the GSEs. On 30 September 1999, The New York Times reported that the Clinton Administration pushed for sub-prime lending: “Fannie Mae, ...

... remaining between 10-15% in the eight years prior to 2006. Peter Wallison of the American Enterprise Institute has the crisis rooted directly in sub-prime lending by the GSEs. On 30 September 1999, The New York Times reported that the Clinton Administration pushed for sub-prime lending: “Fannie Mae, ...

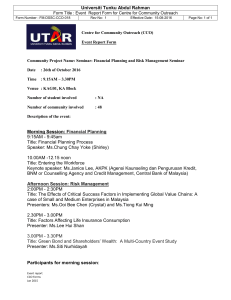

Financial Planning and Risk Management Seminar

... term (saving account, fixed deposits) or long term (stocks, bonds, mutual funds or unit trusts, real estate) based on personal financial goals and risk preferences; 6. Comparing, verifying the information accuracy before making any financial decisions – estimating the overall budget by incorporating ...

... term (saving account, fixed deposits) or long term (stocks, bonds, mutual funds or unit trusts, real estate) based on personal financial goals and risk preferences; 6. Comparing, verifying the information accuracy before making any financial decisions – estimating the overall budget by incorporating ...

Finance Slides 051915

... • Thus, you have to know something about accounting if you want to succeed in business. • It is almost impossible to understand business operations without being able to read and analyze accounting reports and financial statements. ...

... • Thus, you have to know something about accounting if you want to succeed in business. • It is almost impossible to understand business operations without being able to read and analyze accounting reports and financial statements. ...

Barron`s Top 1,200 Financial Advisors Financial Times Top 400

... Barron’s Top 1,200 Financial Advisors Financial Times Top 400 Advisors RBC Wealth Management has a long-standing tradition of responsible stewardship of client assets. It is a deeply held value you can always depend on. One of Wisconsin’s very own, John Larsen, is an outstanding example of this — so ...

... Barron’s Top 1,200 Financial Advisors Financial Times Top 400 Advisors RBC Wealth Management has a long-standing tradition of responsible stewardship of client assets. It is a deeply held value you can always depend on. One of Wisconsin’s very own, John Larsen, is an outstanding example of this — so ...

Lawrence G. McDonald

... major provision, but conferees did not accept the more strict language in the House bill that would require an audit every year. ...

... major provision, but conferees did not accept the more strict language in the House bill that would require an audit every year. ...

Dear «firstname - HD Vest Financial Services

... The point is that these are short-term issues. They may not preoccupy investors next quarter, next month, or even next week for all we know. (Remember the Greek debt crisis?) “This volatility is likely to remain with us, at least until the end of the year,” deVere Group CEO Nigel Green told TheStree ...

... The point is that these are short-term issues. They may not preoccupy investors next quarter, next month, or even next week for all we know. (Remember the Greek debt crisis?) “This volatility is likely to remain with us, at least until the end of the year,” deVere Group CEO Nigel Green told TheStree ...

Speech to the University of California San Diego Economics Roundtable

... investment. In the face of these adverse developments, the recent strength of spending data has been somewhat reassuring. The pace of consumer spending, in particular, has been surprisingly robust of late, fueled in part by tax rebates. The spending appeared to be broad-based, with the not-so-surpri ...

... investment. In the face of these adverse developments, the recent strength of spending data has been somewhat reassuring. The pace of consumer spending, in particular, has been surprisingly robust of late, fueled in part by tax rebates. The spending appeared to be broad-based, with the not-so-surpri ...

Chapter 13

... Investment represents demand for loanable funds The supply and demand for loanable funds depends on the real interest rate Equilibrium determines the real interest rate in the economy ...

... Investment represents demand for loanable funds The supply and demand for loanable funds depends on the real interest rate Equilibrium determines the real interest rate in the economy ...