Recovered File 1

... time (principal) when the time from contract to maturity is fixed and predetermined; presented as a percentage of the face value. Example: I borrowed $100 from my son and have agreed to pay him $110 in exactly one year. What is the interest rate? Answer: Maturity time is exactly one year, it is fixe ...

... time (principal) when the time from contract to maturity is fixed and predetermined; presented as a percentage of the face value. Example: I borrowed $100 from my son and have agreed to pay him $110 in exactly one year. What is the interest rate? Answer: Maturity time is exactly one year, it is fixe ...

Account Stated CLE slideshow 10-22

... “But where the account stated is based in part upon transactions which are illegal and void, and this is shown in defense to the action thereon, we regard it as clear that the consideration for the debtor's express or implied promise to pay the balance appearing to be due is then tainted with illega ...

... “But where the account stated is based in part upon transactions which are illegal and void, and this is shown in defense to the action thereon, we regard it as clear that the consideration for the debtor's express or implied promise to pay the balance appearing to be due is then tainted with illega ...

Practice Exam Solutions

... effects.) Stockbrokers should not “sell dividends,” meaning to urge investors to buy a stock just before a dividend is paid, or sell just after it is paid. ...

... effects.) Stockbrokers should not “sell dividends,” meaning to urge investors to buy a stock just before a dividend is paid, or sell just after it is paid. ...

The Term Structure of Interest Rates

... Investors react to expectations of future inflation rather than current actual inflation Expect rates to rise then want a higher return After inflation has peaked, interest rates can continue to increase because investors reacting to the expected future inflation (even if future expectations not ...

... Investors react to expectations of future inflation rather than current actual inflation Expect rates to rise then want a higher return After inflation has peaked, interest rates can continue to increase because investors reacting to the expected future inflation (even if future expectations not ...

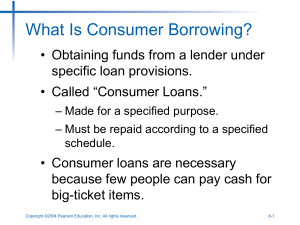

Loan Intrest

... • Obtaining funds from a lender under specific loan provisions. • Called “Consumer Loans.” – Made for a specified purpose. – Must be repaid according to a specified schedule. ...

... • Obtaining funds from a lender under specific loan provisions. • Called “Consumer Loans.” – Made for a specified purpose. – Must be repaid according to a specified schedule. ...

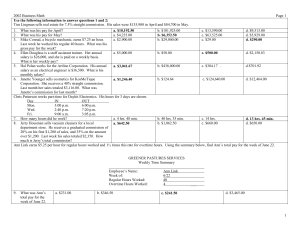

Day IN OUT

... Use the following information to answer questions 24 and 25: On July 5, Lucy Schamburgh had a balance of $594.62 in her savings account. On that day she deposited $240 and the teller also credited $9.28 in interest to her account. 24. What is her new balance? 25. On July 15, she deposited checks for ...

... Use the following information to answer questions 24 and 25: On July 5, Lucy Schamburgh had a balance of $594.62 in her savings account. On that day she deposited $240 and the teller also credited $9.28 in interest to her account. 24. What is her new balance? 25. On July 15, she deposited checks for ...

52111imp - Aberdeenshire Council

... Inflation is expected to remain slightly below the Monetary Policy Committee’s (MPC) target range for several months. However, the MPC has recently taken the view that the recovery in the world economy has become more broadly based than previously. This, combined with concerns over house price infla ...

... Inflation is expected to remain slightly below the Monetary Policy Committee’s (MPC) target range for several months. However, the MPC has recently taken the view that the recovery in the world economy has become more broadly based than previously. This, combined with concerns over house price infla ...

1 Solutions to End-of-Chapter Problems in

... seems very unlikely to happen in the real world). A negative real rate would occur if the expected rate of price inflation were greater than the nominal rate of interest. For example, suppose ðet = 10% and it = 8%. Then rt = -2.0% (approximately). In this case lenders are effectively paying borrower ...

... seems very unlikely to happen in the real world). A negative real rate would occur if the expected rate of price inflation were greater than the nominal rate of interest. For example, suppose ðet = 10% and it = 8%. Then rt = -2.0% (approximately). In this case lenders are effectively paying borrower ...

Determinants of Interest Rates

... • The interest rate for each bond with a different maturity is determined by the demand for and supply of that bond • Investors have preferences for bonds of one maturity over another • If investors have short desired holding periods and generally prefer bonds with shorter maturities that have less ...

... • The interest rate for each bond with a different maturity is determined by the demand for and supply of that bond • Investors have preferences for bonds of one maturity over another • If investors have short desired holding periods and generally prefer bonds with shorter maturities that have less ...

Practice Problems for FE 486B – Thursday, February 2, 2012 1

... Drawing the yield curve will show a flat yield curve for the first two years. After year 2, the yield curve is upward sloping. b) Redo part (a) with term premiums. Assume the term premium for an n-year bond, τn, is (n/2) percent. For example, the premium for a four-year bond is (4/2)% = 2%. The inte ...

... Drawing the yield curve will show a flat yield curve for the first two years. After year 2, the yield curve is upward sloping. b) Redo part (a) with term premiums. Assume the term premium for an n-year bond, τn, is (n/2) percent. For example, the premium for a four-year bond is (4/2)% = 2%. The inte ...

Document

... the impact of inflation on past investments or on investors. r = i - Pa, where the annual "realized" rate of return from past securities purchases, r, equals the annual nominal rate minus the actual annual rate of inflation. With ever-increasing rates of inflation, investors' inflation premiums, Pe ...

... the impact of inflation on past investments or on investors. r = i - Pa, where the annual "realized" rate of return from past securities purchases, r, equals the annual nominal rate minus the actual annual rate of inflation. With ever-increasing rates of inflation, investors' inflation premiums, Pe ...

Chapter 22 Monetary Policy Strategy

... Chose of target should depend upon where the disturbance in the economy is coming from: Financial sector--- interest rates Real Sector—MS Assume disturbance is in the financial sector—real sector held constant Assume set (LM o ) money supply at a given level—therefore no change in the supply of mon ...

... Chose of target should depend upon where the disturbance in the economy is coming from: Financial sector--- interest rates Real Sector—MS Assume disturbance is in the financial sector—real sector held constant Assume set (LM o ) money supply at a given level—therefore no change in the supply of mon ...

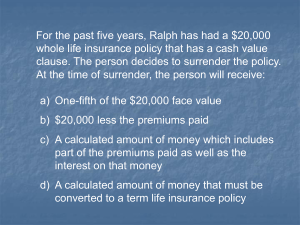

- Seckman High School

... • Each week make rent payments • When a certain amount of payments have been made, you own the item. • Disadvantage: total price of item is higher than if you had bought it outright. • If you decide not to buy, no refunds of any payments. Personal Finance ...

... • Each week make rent payments • When a certain amount of payments have been made, you own the item. • Disadvantage: total price of item is higher than if you had bought it outright. • If you decide not to buy, no refunds of any payments. Personal Finance ...

History of pawnbroking

This history is partially outdated for developments in the 20th centuryThe history of pawnbroking began in the earliest ages of the world. Lending money on portable security is one of the oldest professions.