Final Exam Solutions - uc

... The key equilibrium condition in the goods/financial are supply of goods equals demand (Y = C+I+G) or Saving =investment. The interest rate adjusts so that the demand for loanable funds (for investment) in the financial market equals the supply (saving). b) A fall in M will cause P to fall, real GDP ...

... The key equilibrium condition in the goods/financial are supply of goods equals demand (Y = C+I+G) or Saving =investment. The interest rate adjusts so that the demand for loanable funds (for investment) in the financial market equals the supply (saving). b) A fall in M will cause P to fall, real GDP ...

Press Release on results of monetary policy management and

... the international financial market combining with appropriately adjusting VND interest rate in the interbank market, selling and buying foreign currencies to make intervention in the market, promulgating regulations to prevent the hoarding and speculation of foreign currencies. The SBV’s measures ar ...

... the international financial market combining with appropriately adjusting VND interest rate in the interbank market, selling and buying foreign currencies to make intervention in the market, promulgating regulations to prevent the hoarding and speculation of foreign currencies. The SBV’s measures ar ...

Chapter 7

... • Give applicant a statement of denial reasons. • Include the name of the federal agency that can be contacted if the applicant feels discriminated against. • If denial is based on information contained in the applicant’s credit report, inform applicant of the right to receive a free copy of the rep ...

... • Give applicant a statement of denial reasons. • Include the name of the federal agency that can be contacted if the applicant feels discriminated against. • If denial is based on information contained in the applicant’s credit report, inform applicant of the right to receive a free copy of the rep ...

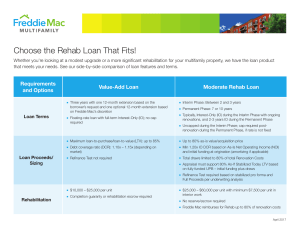

Mod Rehab vs Value-Add Chart

... Whether you’re looking at a modest upgrade or a more significant rehabilitation for your multifamily property, we have the loan product that meets your needs. See our side-by-side comparison of loan features and terms. ...

... Whether you’re looking at a modest upgrade or a more significant rehabilitation for your multifamily property, we have the loan product that meets your needs. See our side-by-side comparison of loan features and terms. ...

Document

... What affects interest rates? The factors are largely macro economic in nature –Demand/Supply of money: When economic growth is high, demand for money increases, pushing the interest rates up and vice versa. Government Borrowing and Fiscal Deficit : Since the government is the biggest borrower in th ...

... What affects interest rates? The factors are largely macro economic in nature –Demand/Supply of money: When economic growth is high, demand for money increases, pushing the interest rates up and vice versa. Government Borrowing and Fiscal Deficit : Since the government is the biggest borrower in th ...

ACCT 410 W4Di4 Capital Assets Debt Service Capital Assets Debt

... — that is, by carrying a particular program. Many not-for-profit organizations argue to the requirement that pledges be recognized as revenue because only upon the receipt of donation it will be available for expenditure. Therefore, they oppose that the entity’s financial statements leave the impres ...

... — that is, by carrying a particular program. Many not-for-profit organizations argue to the requirement that pledges be recognized as revenue because only upon the receipt of donation it will be available for expenditure. Therefore, they oppose that the entity’s financial statements leave the impres ...

Answers to Chapter 22 Questions

... d. The FIs in parts (a) and (c) are exposed to interest rate declines (positive repricing gap), while the FI in part (b) is exposed to interest rate increases. The FI in part (c) has the least amount of interest rate risk exposure since the absolute value of the repricing gap is the lowest, while th ...

... d. The FIs in parts (a) and (c) are exposed to interest rate declines (positive repricing gap), while the FI in part (b) is exposed to interest rate increases. The FI in part (c) has the least amount of interest rate risk exposure since the absolute value of the repricing gap is the lowest, while th ...

Five (easy) ways to prepare for rising interest rates

... With the Fed poised to start ramping rates, portfolios on both sides of the border will soon face a new market turbulence. John Heinzl is the dividend investor for Globe Investor's Strategy Lab1. Follow his contributions here2. You can see his model portfolio here3. We've heard the warnings for year ...

... With the Fed poised to start ramping rates, portfolios on both sides of the border will soon face a new market turbulence. John Heinzl is the dividend investor for Globe Investor's Strategy Lab1. Follow his contributions here2. You can see his model portfolio here3. We've heard the warnings for year ...

homework 3

... 19. Hyperinflation usually starts when: A. people start spending too much money. B. firms demand higher and higher prices for their goods. C. governments are forced to print money to finance their spending. D. fiscal deficits are small. Answer: C 20. According to the classical dichotomy, which of th ...

... 19. Hyperinflation usually starts when: A. people start spending too much money. B. firms demand higher and higher prices for their goods. C. governments are forced to print money to finance their spending. D. fiscal deficits are small. Answer: C 20. According to the classical dichotomy, which of th ...

chap5

... not vary too much over time, changes in the nominal interest rate will simply track changes in the inflation rate. However, this assumes that the inflation rate is easy to predict. Changes in the money supply are the primary determinant of the inflation rate and unfortunately, changes in the money ...

... not vary too much over time, changes in the nominal interest rate will simply track changes in the inflation rate. However, this assumes that the inflation rate is easy to predict. Changes in the money supply are the primary determinant of the inflation rate and unfortunately, changes in the money ...

DOCX - World bank documents

... 5. However, the quality of HSB loan portfolio is better than the average of the system. The NPL ratio in HSB stood at 1.2%, which compares to 6.17% in the banking sector3. Funding is basically based on deposits (HRK 6.2bn, of which 98% are time deposits), representing 85% of total liabilities and ca ...

... 5. However, the quality of HSB loan portfolio is better than the average of the system. The NPL ratio in HSB stood at 1.2%, which compares to 6.17% in the banking sector3. Funding is basically based on deposits (HRK 6.2bn, of which 98% are time deposits), representing 85% of total liabilities and ca ...

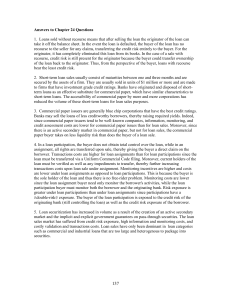

Answers to Chapter 24 Questions

... secured by the assets of a firm. They are usually sold in units of $1 million or more and are made to firms that have investment grade credit ratings. Banks have originated and disposed of shortterm loans as an effective substitute for commercial paper, which have similar characteristics to short-te ...

... secured by the assets of a firm. They are usually sold in units of $1 million or more and are made to firms that have investment grade credit ratings. Banks have originated and disposed of shortterm loans as an effective substitute for commercial paper, which have similar characteristics to short-te ...

History of pawnbroking

This history is partially outdated for developments in the 20th centuryThe history of pawnbroking began in the earliest ages of the world. Lending money on portable security is one of the oldest professions.