Falling US Mortgage Rates

... Economic jitters have pushed mortgage rates back down to levels not seen since July. That's good news both for procrastinators who missed out on last year's refinancing boom and for home buyers looking to keep costs down. Rates on 30-year fixed rate mortgages currently average 5.82 percent, accordin ...

... Economic jitters have pushed mortgage rates back down to levels not seen since July. That's good news both for procrastinators who missed out on last year's refinancing boom and for home buyers looking to keep costs down. Rates on 30-year fixed rate mortgages currently average 5.82 percent, accordin ...

More... - Kevin Kavakeb

... rising by 1% is equivalent to the home price falling by 10%. Historically when interest rates have gone up they have gone up fast. It is not uncommon for there to be a 1% hike in a matter of months. Here are some common fixed-rate questions you may be asking yourself. What does a Fixed Rate mean? Th ...

... rising by 1% is equivalent to the home price falling by 10%. Historically when interest rates have gone up they have gone up fast. It is not uncommon for there to be a 1% hike in a matter of months. Here are some common fixed-rate questions you may be asking yourself. What does a Fixed Rate mean? Th ...

Everett mortgage email e-mail

... which. Airport Commerce Center - 11630 Airport Road, Everett, WA. This 12,257 SF Industrial is for lease on LoopNet.com. Great S Everett location: corner of Hwy 99 and. Yahoo makes it easy to enjoy what matters most in your world. Best in class Yahoo Mail, breaking local, national and global news, f ...

... which. Airport Commerce Center - 11630 Airport Road, Everett, WA. This 12,257 SF Industrial is for lease on LoopNet.com. Great S Everett location: corner of Hwy 99 and. Yahoo makes it easy to enjoy what matters most in your world. Best in class Yahoo Mail, breaking local, national and global news, f ...

Interest rates on mortgages 2. Fixed Rate Mortgage

... Types of mortgages Offset Mortgages Example: You have a mortgage of a £100,000 and have a savings account with £8,000 and £2,000 in a current account. For the purpose of calculating interest, the £100,000 is offset by the £10,000 worth of savings, so in effect you only pay interest on £90,000 of yo ...

... Types of mortgages Offset Mortgages Example: You have a mortgage of a £100,000 and have a savings account with £8,000 and £2,000 in a current account. For the purpose of calculating interest, the £100,000 is offset by the £10,000 worth of savings, so in effect you only pay interest on £90,000 of yo ...

Real estate terms and definitions

... Pre-paids/Escrow Account Deposits: These costs are for the payment of taxes and/or insurance and other items that must be made at settlement to set up an escrow account. The lender is not allowed to collect more than a set amount. Principal: The principal is the amount borrowed for a loan. If the am ...

... Pre-paids/Escrow Account Deposits: These costs are for the payment of taxes and/or insurance and other items that must be made at settlement to set up an escrow account. The lender is not allowed to collect more than a set amount. Principal: The principal is the amount borrowed for a loan. If the am ...

Final Residential RE Seminar

... bureaus which were primarily established with the purpose of supporting banking supervision. •The demand for information by financial institutions on the one side and the pressure from the bank supervisors to improve risk management practices on the other, led to several initiatives in the Africa re ...

... bureaus which were primarily established with the purpose of supporting banking supervision. •The demand for information by financial institutions on the one side and the pressure from the bank supervisors to improve risk management practices on the other, led to several initiatives in the Africa re ...

Why you need to shop around for a mortgage

... for the best terms to suit their personal financial situation. “For instance, some lenders are offering incredibly low interest rates at the moment—as low as 2.74 per cent for a fiveyear fixed term,” she notes. “A client may see this rate and not ask any further questions only to find out later tha ...

... for the best terms to suit their personal financial situation. “For instance, some lenders are offering incredibly low interest rates at the moment—as low as 2.74 per cent for a fiveyear fixed term,” she notes. “A client may see this rate and not ask any further questions only to find out later tha ...

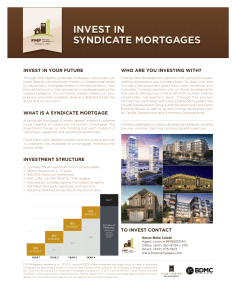

invest in syndicate mortgages

... Why invest through Syndicate Mortgages? A syndicate mortgage allows you to invest directly in Canada’s real estate development and construction industry. You will not receive shares or units that can change in value. Instead your principal is secured against the property/land while you enjoy steady ...

... Why invest through Syndicate Mortgages? A syndicate mortgage allows you to invest directly in Canada’s real estate development and construction industry. You will not receive shares or units that can change in value. Instead your principal is secured against the property/land while you enjoy steady ...

Mortgages

... PMI payments are added to the monthly mortgage payments. One way to reduce the length of the mortgage is to add one extra principle payment per year. Some lenders do this by taking bi-weekly payments from the borrower. Doing this cuts seven and a half years off your mortgage. Because the mortgage is ...

... PMI payments are added to the monthly mortgage payments. One way to reduce the length of the mortgage is to add one extra principle payment per year. Some lenders do this by taking bi-weekly payments from the borrower. Doing this cuts seven and a half years off your mortgage. Because the mortgage is ...

reported - protect consumer justice.org

... Lisa Lievanos, 46, of Fontana, who was convicted at trial of five felony counts, was sentenced by Judge Cooper to one year and one day in prison. According to court documents and the evidence presented at Lievanos’ trial, ...

... Lisa Lievanos, 46, of Fontana, who was convicted at trial of five felony counts, was sentenced by Judge Cooper to one year and one day in prison. According to court documents and the evidence presented at Lievanos’ trial, ...

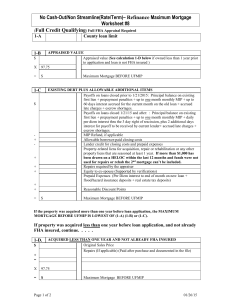

No Cash-Out/Non Streamline(Rate/Term)– Refinance Maximum

... Payoffs on loans closed prior to 1/21/2015: Principal balance on existing first lien + prepayment penalties + up to one month monthly MIP + up to 60 days interest accrued for the current month on the old loan + accrued late charges + escrow shortages. Payoffs on loans closed 1/21/15 and after: : Pri ...

... Payoffs on loans closed prior to 1/21/2015: Principal balance on existing first lien + prepayment penalties + up to one month monthly MIP + up to 60 days interest accrued for the current month on the old loan + accrued late charges + escrow shortages. Payoffs on loans closed 1/21/15 and after: : Pri ...

We need to solve the mortgage problem before interest rates rise

... weeks, and after five years of sitting at the rock-bottom level of 0.5 per cent, a gradual increase is expected from next year onwards. This has implications for the UK’s 8.4 million mortgagors, one in ten of whom risk being imprisoned by borrowing deals which are likely to make their repayments una ...

... weeks, and after five years of sitting at the rock-bottom level of 0.5 per cent, a gradual increase is expected from next year onwards. This has implications for the UK’s 8.4 million mortgagors, one in ten of whom risk being imprisoned by borrowing deals which are likely to make their repayments una ...

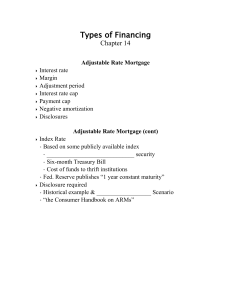

Adjustable Rate Mortgage

... Adjustment period Interest rate cap Payment cap Negative amortization Disclosures Adjustable Rate Mortgage (cont) ...

... Adjustment period Interest rate cap Payment cap Negative amortization Disclosures Adjustable Rate Mortgage (cont) ...

New Economic Bubbles

... (fixed rate loan paying back all principal & interest in 30 years) b) @ 8% = $734 X 4 = $2,936 per month for 30-years 7) $500,000 X 1.2% = $6,000 per year in taxes or $500 per month Full Payment for $500,000 home is $2,408 per month at 4.0% loan ...

... (fixed rate loan paying back all principal & interest in 30 years) b) @ 8% = $734 X 4 = $2,936 per month for 30-years 7) $500,000 X 1.2% = $6,000 per year in taxes or $500 per month Full Payment for $500,000 home is $2,408 per month at 4.0% loan ...

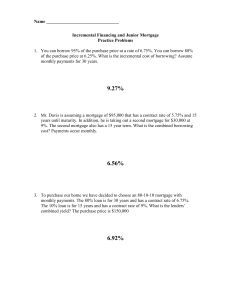

Adjustable Rate Mortgage

... assumable loan is $130,000. The contract rate is 4.5% and there are 180 remaining monthly payments. The current market rate on a 15-year loan is 9%. How much should she increase the asking price in order to capitalize the value of the assumable mortgage? ...

... assumable loan is $130,000. The contract rate is 4.5% and there are 180 remaining monthly payments. The current market rate on a 15-year loan is 9%. How much should she increase the asking price in order to capitalize the value of the assumable mortgage? ...

If you have Mortgage Interest “rate envy”, does it make sense to

... consumers are looking at some of the lowest rates in history, and many homeowners with existing fixed-term mortgages are experiencing some “rate envy” about today’s rock bottom rates. It may be worth a conversation about your options. Typically, we think of a fixed term mortgage as a non-negotiable ...

... consumers are looking at some of the lowest rates in history, and many homeowners with existing fixed-term mortgages are experiencing some “rate envy” about today’s rock bottom rates. It may be worth a conversation about your options. Typically, we think of a fixed term mortgage as a non-negotiable ...

Mortgage Loans

... • Low adjustable rate (ARM) mortgages with 5 and 7-year initial fixed rate periods • Jumbo mortgage options up to $1,000,000 loan amounts • Personal and local service provided by our Mortgage Representatives, including the processing of your application; and the servicing of most loans is kept at Qu ...

... • Low adjustable rate (ARM) mortgages with 5 and 7-year initial fixed rate periods • Jumbo mortgage options up to $1,000,000 loan amounts • Personal and local service provided by our Mortgage Representatives, including the processing of your application; and the servicing of most loans is kept at Qu ...