Temi di Discussione

... As indicated in the variable description file, this question does not apply to outright owners or rent free occupiers. Therefore homeowners without a mortgage should not answer this question. By selecting homeowners who answer, we are able to identify households with a mortgage. ...

... As indicated in the variable description file, this question does not apply to outright owners or rent free occupiers. Therefore homeowners without a mortgage should not answer this question. By selecting homeowners who answer, we are able to identify households with a mortgage. ...

Location Efficient Mortgages: Is the Rationale

... that LEMs will not exacerbate mortgage default. Since repayment histories for LEMs will not be available for several years, we use an indirect test based on the following logic. If it is true, as LEMs advocates claim, that homeowners in location efficient areas can safely be allowed to violate tradi ...

... that LEMs will not exacerbate mortgage default. Since repayment histories for LEMs will not be available for several years, we use an indirect test based on the following logic. If it is true, as LEMs advocates claim, that homeowners in location efficient areas can safely be allowed to violate tradi ...

PPT

... • In Kreglinger v New Patagonia Meat & Cold Storage Co [1914] AC 25 the New Patagonia Meat & Cold Storage Co Ltd carried on a business of preserving meat. Kreglinger carried on business as wool brokers and agreed to lend to New Patagonia the sum of £10,000.00 for a period of 5 years with a proviso t ...

... • In Kreglinger v New Patagonia Meat & Cold Storage Co [1914] AC 25 the New Patagonia Meat & Cold Storage Co Ltd carried on a business of preserving meat. Kreglinger carried on business as wool brokers and agreed to lend to New Patagonia the sum of £10,000.00 for a period of 5 years with a proviso t ...

An Introduction To Interest Rate Hedging

... products may find their way into residential real estate. Now that homeowners and “flippers” have learned that markets can go down as well as up, they may want to hedge their bets on real estate ...

... products may find their way into residential real estate. Now that homeowners and “flippers” have learned that markets can go down as well as up, they may want to hedge their bets on real estate ...

FRAUD: When gross negligence is not enough

... There is a high bar for proving deceit. It is a difficult task which can have devastating reputational consequences and should not be embarked upon lightly. Overcoming the causation hurdle is often very difficult for a claimant to do. This is particularly so in the age of modern communication. E-mai ...

... There is a high bar for proving deceit. It is a difficult task which can have devastating reputational consequences and should not be embarked upon lightly. Overcoming the causation hurdle is often very difficult for a claimant to do. This is particularly so in the age of modern communication. E-mai ...

Money Adviser Pack Update – Summary of main changes

... should be reviewed as part of the holistic money advice offered and factored into the CFS. If it is not possible to negotiate or maintain agreed payments with the charging order this may trigger an application for order for sale - the homeowner will need to be aware of this risk. Managing unsecured ...

... should be reviewed as part of the holistic money advice offered and factored into the CFS. If it is not possible to negotiate or maintain agreed payments with the charging order this may trigger an application for order for sale - the homeowner will need to be aware of this risk. Managing unsecured ...

Access to Refinancing and Mortgage Interest Rates

... borrowers by lowering their interest costs. In the household sector, where housing debt represents the largest financial obligation, mortgage loans serve as a key conduit for lower interest rates. In countries where mortgage contracts typically take the form of adjustable rate loans (ARMs), the tran ...

... borrowers by lowering their interest costs. In the household sector, where housing debt represents the largest financial obligation, mortgage loans serve as a key conduit for lower interest rates. In countries where mortgage contracts typically take the form of adjustable rate loans (ARMs), the tran ...

Primer on Proposed New Regulatory Capital Framework

... Company holds $175 million of cash and investments as of June 30, 2016 and has access to a $100 million credit facility that is undrawn. These resources could be used to enhance the capital of Genworth Canada. As a result, the Company expects to be compliant with the new framework upon its implement ...

... Company holds $175 million of cash and investments as of June 30, 2016 and has access to a $100 million credit facility that is undrawn. These resources could be used to enhance the capital of Genworth Canada. As a result, the Company expects to be compliant with the new framework upon its implement ...

New Trends in Mortgage Fraud - National Crime Prevention Council

... Alicia was proud to be a homeowner, diligently making her mortgage payments each month. When she lost her job in 2009 she fell behind in her payments. Shortly afterwards, Alicia received a brochure from a company offering loan modification services. The company claimed to be affiliated with the gove ...

... Alicia was proud to be a homeowner, diligently making her mortgage payments each month. When she lost her job in 2009 she fell behind in her payments. Shortly afterwards, Alicia received a brochure from a company offering loan modification services. The company claimed to be affiliated with the gove ...

Chapter 22 - SanyigoHistory

... A loan to purchase real estate is called a mortgage. A trust deed is similar to a mortgage; it is a debt security instrument that shows as a lien against property. Payments on a mortgage or trust deed are made over an extended period, such as 15 or 30 years. Monthly loan payments include principal a ...

... A loan to purchase real estate is called a mortgage. A trust deed is similar to a mortgage; it is a debt security instrument that shows as a lien against property. Payments on a mortgage or trust deed are made over an extended period, such as 15 or 30 years. Monthly loan payments include principal a ...

How the Affluent Manage Home Equity to Safely and Conservatively

... of the mortgage. We can only conclude they are operating on outdated knowledge from previous generations when there were few options other than the 30 year fixed mortgage. Wealthy Americans, those with the ability to pay off their mortgage but refuse to do so, understand how to make their mortgage wo ...

... of the mortgage. We can only conclude they are operating on outdated knowledge from previous generations when there were few options other than the 30 year fixed mortgage. Wealthy Americans, those with the ability to pay off their mortgage but refuse to do so, understand how to make their mortgage wo ...

Rebalancing the housing and mortgage markets – critical issues

... While there have been a number of government policy initiatives, primarily aimed at easing the market downturn and seeking to promote housing market and economic recovery, there is much less clarity in respect of medium and longer term government housing policies. In this context the purpose of this ...

... While there have been a number of government policy initiatives, primarily aimed at easing the market downturn and seeking to promote housing market and economic recovery, there is much less clarity in respect of medium and longer term government housing policies. In this context the purpose of this ...

mortgage loan terms - Yorkshire Building Society

... 6.5 Interest on Charges. If you do not pay the Charge within 7 days of the date we tell you it is payable then we may add it to your Loan Account. Where we add to your Loan Account Charges which have been properly incurred by us under, or stated in, the Offer, the mortgage conditions or these Terms w ...

... 6.5 Interest on Charges. If you do not pay the Charge within 7 days of the date we tell you it is payable then we may add it to your Loan Account. Where we add to your Loan Account Charges which have been properly incurred by us under, or stated in, the Offer, the mortgage conditions or these Terms w ...

§ 45-36

... mortgagee, obligee, beneficiary or other responsible party written notice of his intention to bring an action pursuant to this section. Upon receipt of this notice, the mortgagee, obligee, beneficiary or other responsible party shall have 30 days, in addition to the initial 60-day period, to fulfill ...

... mortgagee, obligee, beneficiary or other responsible party written notice of his intention to bring an action pursuant to this section. Upon receipt of this notice, the mortgagee, obligee, beneficiary or other responsible party shall have 30 days, in addition to the initial 60-day period, to fulfill ...

529 - Supreme Court of Canada Judgments

... The relevant sections of the Land Titles Act are sections 50, 54 and 55. 50. After a certificate of title has been granted for any land, no instrument shall be effectual to pass any estate or interest in such land (except a leasehold interest for three years or for a less period) or render such land ...

... The relevant sections of the Land Titles Act are sections 50, 54 and 55. 50. After a certificate of title has been granted for any land, no instrument shall be effectual to pass any estate or interest in such land (except a leasehold interest for three years or for a less period) or render such land ...

New Hampshire Security Instrument for Bond

... obtains title to the Mortgaged Property pursuant to this Instrument (by virtue of a foreclosure sale, a deed in lieu of foreclosure or otherwise), and such party is also, or subsequently becomes, the holder of the Financing Agreement with respect to the Bonds and the Bond Mortgage, such party’s titl ...

... obtains title to the Mortgaged Property pursuant to this Instrument (by virtue of a foreclosure sale, a deed in lieu of foreclosure or otherwise), and such party is also, or subsequently becomes, the holder of the Financing Agreement with respect to the Bonds and the Bond Mortgage, such party’s titl ...

- Seckman High School

... making a payment using a money order? 4. What is the difference between a cashiers check and a personal check? 5. What is a prepayment penalty? Why might you still wish to pay off a loan early, even when there is a prepayment penalty? Slide 14 ...

... making a payment using a money order? 4. What is the difference between a cashiers check and a personal check? 5. What is a prepayment penalty? Why might you still wish to pay off a loan early, even when there is a prepayment penalty? Slide 14 ...

The Renewable Heat Incentive: a reformed and refocused scheme

... As with solar panels, lenders will want to ensure that leases meet their requirements; in particular lenders will want to know that no security of tenure arises. Since there is no standard form lease these are likely to be considered on a case by case basis at present, which is time consuming and re ...

... As with solar panels, lenders will want to ensure that leases meet their requirements; in particular lenders will want to know that no security of tenure arises. Since there is no standard form lease these are likely to be considered on a case by case basis at present, which is time consuming and re ...

Real Estate Retention Agreement 2.5" Margin

... In the case of any refinancing prior to the end of the Retention Period, an amount calculated by the Member via an FHLBI prescribed calculation and verified by the FHLBI, equal to a pro rata share of the direct Subsidy that financed the purchase, construction, or rehabilitation of the property, redu ...

... In the case of any refinancing prior to the end of the Retention Period, an amount calculated by the Member via an FHLBI prescribed calculation and verified by the FHLBI, equal to a pro rata share of the direct Subsidy that financed the purchase, construction, or rehabilitation of the property, redu ...

here - Resi Mortgage

... and I am excited about the future ahead” said Mr James. “As our business continues to grow under new ownership, we will ensure that our industry reputation as a trusted, valued and competitive mortgage lender is not only preserved, but enhanced for the benefit of our existing and future customers.” ...

... and I am excited about the future ahead” said Mr James. “As our business continues to grow under new ownership, we will ensure that our industry reputation as a trusted, valued and competitive mortgage lender is not only preserved, but enhanced for the benefit of our existing and future customers.” ...

ATTORNEY BIOGRAPHICAL profile of spencer P. scheer

... Mr. Scheer is a principal of SLG. He graduated from the University of Massachusetts (B.A., cum laude, 1980), and earned his Juris Doctor Degree from Empire College of Law (1983). After clerking for Alan Jaroslovsky ( Bankruptcy Judge, N Dist of CA), Mr. Scheer worked as Bankruptcy Administrator and ...

... Mr. Scheer is a principal of SLG. He graduated from the University of Massachusetts (B.A., cum laude, 1980), and earned his Juris Doctor Degree from Empire College of Law (1983). After clerking for Alan Jaroslovsky ( Bankruptcy Judge, N Dist of CA), Mr. Scheer worked as Bankruptcy Administrator and ...

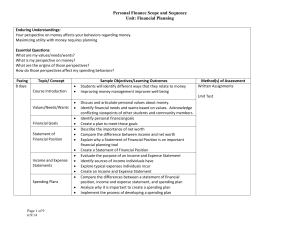

Personal Finance Scope and Sequence Unit: Financial Planning

... Outline the types of accounts and their features typically offered by banks Describe the difference between an ATM and a Debit card Write a check Endorse a check Reconcile a checkbook Calculate the future value of an account at a given interest rate, compounding period and term. Demonstrate mathemat ...

... Outline the types of accounts and their features typically offered by banks Describe the difference between an ATM and a Debit card Write a check Endorse a check Reconcile a checkbook Calculate the future value of an account at a given interest rate, compounding period and term. Demonstrate mathemat ...

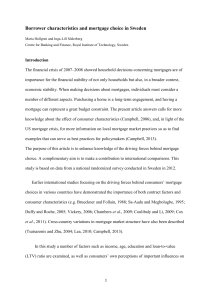

Borrower characteristics and mortgage choice in Sweden

... Studies on this topic are scarce. Moore (2003) investigated how consumers learned about managing their money. She found that the most important sources of knowledge were personal financial experiences (62 per cent). Devlin (2002) showed that having a previous mortgage was an important choice criteri ...

... Studies on this topic are scarce. Moore (2003) investigated how consumers learned about managing their money. She found that the most important sources of knowledge were personal financial experiences (62 per cent). Devlin (2002) showed that having a previous mortgage was an important choice criteri ...

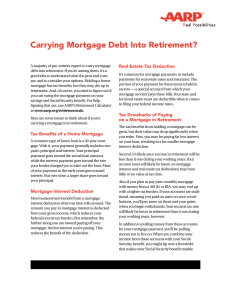

Carrying Mortgage Debt Into Retirement

... living mortgage free is a nice place to be. To see how much faster you can pay off your mortgage by making extra payments, check out AARP’s Mortgage Payoff Calculator at www.aarp.org/money. If you still have a long way to go before paying off your mortgage, you may continue to benefit from tax deduc ...

... living mortgage free is a nice place to be. To see how much faster you can pay off your mortgage by making extra payments, check out AARP’s Mortgage Payoff Calculator at www.aarp.org/money. If you still have a long way to go before paying off your mortgage, you may continue to benefit from tax deduc ...