Exit Counseling Claflin University

... Example : $150,000 debt at 6.8% interest rate • Standard repayment: $1726.20 monthly for 120 payments • Extended repayment: – Fixed Payments: $694.07 monthly for 300 payments – Graduated Payments: Start at $566.67 and increase every two years to a maximum of $991.50 for 300 payments ...

... Example : $150,000 debt at 6.8% interest rate • Standard repayment: $1726.20 monthly for 120 payments • Extended repayment: – Fixed Payments: $694.07 monthly for 300 payments – Graduated Payments: Start at $566.67 and increase every two years to a maximum of $991.50 for 300 payments ...

CSS Slideshow for 1997-98 Counselor Workshops

... • Sign once during enrollment but may be used for multiple years • You will receive maximum Stafford funds each year, unless you cancel or decline a portion of the loan • DISCLOSURE STATEMENT • Received at first disbursement of each loan under the MPN ...

... • Sign once during enrollment but may be used for multiple years • You will receive maximum Stafford funds each year, unless you cancel or decline a portion of the loan • DISCLOSURE STATEMENT • Received at first disbursement of each loan under the MPN ...

Redline2011-00370 - Colorado Secretary of State

... due no later than the second regularly scheduled payment. The downpayment does not include any prepaid finance charges such as points. 13. "Finance Charge" is the dollar amount charged for credit. It includes interest and other costs, such as service charges, transaction charges, buyer's points, loa ...

... due no later than the second regularly scheduled payment. The downpayment does not include any prepaid finance charges such as points. 13. "Finance Charge" is the dollar amount charged for credit. It includes interest and other costs, such as service charges, transaction charges, buyer's points, loa ...

Cooking the Books Workbook - Association of Certified Fraud

... Manufactured Housing Dealer Manufactured housing is now considered real property. Buyers purchasing manufactured units can obtain permanent financing through mortgage loans rather than chattel loans from banks. Therefore, manufactured home dealers now participate as sellers in mortgage transactions. ...

... Manufactured Housing Dealer Manufactured housing is now considered real property. Buyers purchasing manufactured units can obtain permanent financing through mortgage loans rather than chattel loans from banks. Therefore, manufactured home dealers now participate as sellers in mortgage transactions. ...

department of regulatory agencies

... "amount financed," "finance charge,' and "schedule of payments" are agreed upon by the lender and the customer. 9. "Consumer credit" may be either closed-end or open-end credit. It is credit that is extended primarily for personal, family, or household purposes. It excludes business and agricultural ...

... "amount financed," "finance charge,' and "schedule of payments" are agreed upon by the lender and the customer. 9. "Consumer credit" may be either closed-end or open-end credit. It is credit that is extended primarily for personal, family, or household purposes. It excludes business and agricultural ...

6218 - Fannie Mae

... the liabilities or obligations of any other Person (except in connection with the Mortgage Loan, other mortgage loans that have been paid in full or collaterally assigned to Lender, including in connection with any Consolidation, Extension and Modification Agreement or similar instrument, or the Dis ...

... the liabilities or obligations of any other Person (except in connection with the Mortgage Loan, other mortgage loans that have been paid in full or collaterally assigned to Lender, including in connection with any Consolidation, Extension and Modification Agreement or similar instrument, or the Dis ...

Towards the Upturn of Residential Mortgage Markets: Which

... This study is part of the wide international debate about the global financial downturn and, as a first step, aims to provide in-depth analysis of residential mortgage market trends in some European countries. ...

... This study is part of the wide international debate about the global financial downturn and, as a first step, aims to provide in-depth analysis of residential mortgage market trends in some European countries. ...

Federal Direct Loans (Cont`d) - Sam Houston State University

... An institution's cohort default rate is calculated as the percentage of borrowers in the cohort who default before the end of the second fiscal year following the fiscal year in which the borrowers entered repayment. This extends the length of time in which a student can default from two to three ye ...

... An institution's cohort default rate is calculated as the percentage of borrowers in the cohort who default before the end of the second fiscal year following the fiscal year in which the borrowers entered repayment. This extends the length of time in which a student can default from two to three ye ...

2005 Survey - Freddie Mac Home

... When asked unaided, the majority of homeowners say they are not aware of services that mortgage lenders can offer to a person having trouble with their mortgage (61% of delinquent and 73% of good standing owners). While top of mind awareness is low, when prompted homeowners express awareness of spec ...

... When asked unaided, the majority of homeowners say they are not aware of services that mortgage lenders can offer to a person having trouble with their mortgage (61% of delinquent and 73% of good standing owners). While top of mind awareness is low, when prompted homeowners express awareness of spec ...

Complete Transcript

... remember it is a lease or a legal charge which is treated as being a lease and like any lease this will carry with it a right to possess the land. And it is an immediate right to possess the land. It arises as soon as the mortgage is made and is in no sense dependent on the borrower defaulting on th ...

... remember it is a lease or a legal charge which is treated as being a lease and like any lease this will carry with it a right to possess the land. And it is an immediate right to possess the land. It arises as soon as the mortgage is made and is in no sense dependent on the borrower defaulting on th ...

Mortgage Loans

... Annual Percentage Rate (APR) — The cost of credit expressed as a yearly rate. This includes any finance charges and additional fees. Application Fee — A fee to cover the costs of processing the application, documentation and verification. Arbitration Clause — A provision in the contract that states ...

... Annual Percentage Rate (APR) — The cost of credit expressed as a yearly rate. This includes any finance charges and additional fees. Application Fee — A fee to cover the costs of processing the application, documentation and verification. Arbitration Clause — A provision in the contract that states ...

Central Asia and Azerbaijan: Regional Mortgage Market

... approved by the Gvt in Dec 2007 The main topics of the program: • Improvement of the legislation (due to list); • Create the favorable environment to attract investments; • Improving internal production of the construction materials; • improvement of social and economic situation; • Attract new cons ...

... approved by the Gvt in Dec 2007 The main topics of the program: • Improvement of the legislation (due to list); • Create the favorable environment to attract investments; • Improving internal production of the construction materials; • improvement of social and economic situation; • Attract new cons ...

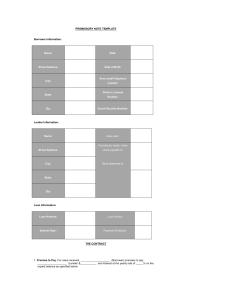

Promissory Note Template

... Borrower will pay ______ payments of $_____ each at monthly/yearly/_________ intervals on the _____ day of the month. Borrower will pay one lump payment on ______________ date. Borrower will pay ______ payments of $_____ each at monthly/yearly/_________ intervals with a final balloon payment of ____ ...

... Borrower will pay ______ payments of $_____ each at monthly/yearly/_________ intervals on the _____ day of the month. Borrower will pay one lump payment on ______________ date. Borrower will pay ______ payments of $_____ each at monthly/yearly/_________ intervals with a final balloon payment of ____ ...

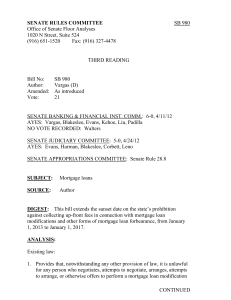

SENATE RULES COMMITTEE >

... foreclosure, or any other disposition of the property except a sale to a thirdparty that is not the loan holder. “ Under the MARS rule, any for-profit company which, in exchange for a fee, offers to work on behalf of consumers to help them obtain a mortgage loan modification or otherwise avoid forec ...

... foreclosure, or any other disposition of the property except a sale to a thirdparty that is not the loan holder. “ Under the MARS rule, any for-profit company which, in exchange for a fee, offers to work on behalf of consumers to help them obtain a mortgage loan modification or otherwise avoid forec ...

Lecture 3b Ch 11 Mortgage Markets

... Mortgage loan contracts contain many legal terms that need to be understood. Most protect the lender from financial loss. • PMI: insurance against default by the borrower • Qualifications: includes credit history, employment history, etc., to determine the borrowers ability to repay the mortgage as ...

... Mortgage loan contracts contain many legal terms that need to be understood. Most protect the lender from financial loss. • PMI: insurance against default by the borrower • Qualifications: includes credit history, employment history, etc., to determine the borrowers ability to repay the mortgage as ...

Guideline B-21 Residential Mortgage Insurance - OSFI-BSIF

... also does directly not focus on insurers’ underwriting practices and procedures, governance, internal controls and risk management. Option 2 – Identify Elements of Guideline B-20 Applicable to Mortgage Insurers Under this option, OSFI would seek to identify and apply specific elements in Guideline ...

... also does directly not focus on insurers’ underwriting practices and procedures, governance, internal controls and risk management. Option 2 – Identify Elements of Guideline B-20 Applicable to Mortgage Insurers Under this option, OSFI would seek to identify and apply specific elements in Guideline ...

25 KB - National Homelessness Advice Service

... and there is an expectation by the regulator (the Financial Conduct Authority) that the lender should not allow households to accrue unsustainable arrears and household debt. As property values increase in a number of areas (as a result of current government initiatives to encourage house purchasing ...

... and there is an expectation by the regulator (the Financial Conduct Authority) that the lender should not allow households to accrue unsustainable arrears and household debt. As property values increase in a number of areas (as a result of current government initiatives to encourage house purchasing ...

“payday” loans - Maryland Department of Labor, Licensing and

... provider may be able to to help by negotiating with creditors on your behalf. There are a number of assistance programs available to help families make ends meet in a crisis. Available state programs can be found by visiting www.benefits.gov. The high cost of payday loans can eat away at your payche ...

... provider may be able to to help by negotiating with creditors on your behalf. There are a number of assistance programs available to help families make ends meet in a crisis. Available state programs can be found by visiting www.benefits.gov. The high cost of payday loans can eat away at your payche ...

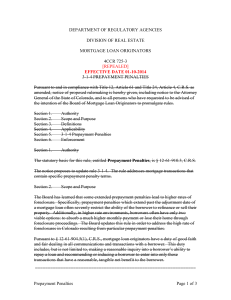

4 ccr 725-3 mortgage loan originators and mortgage companies 1

... a. Prepayment penalties that extend past the adjustment date of any teaser rate used to calculate a borrower’s monthly mortgage payment; b. Prepayment penalties that extend past the adjustment date of any interest rate used to calculate a borrower’s monthly mortgage payment; c. Prepayment penalties ...

... a. Prepayment penalties that extend past the adjustment date of any teaser rate used to calculate a borrower’s monthly mortgage payment; b. Prepayment penalties that extend past the adjustment date of any interest rate used to calculate a borrower’s monthly mortgage payment; c. Prepayment penalties ...

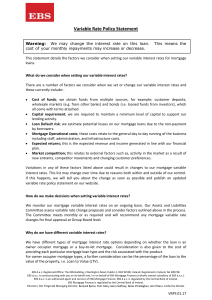

here - EBS

... Market competition; this relates to external factors such as, activity in the market as a result of new entrants, competitor movements and changing customer preferences. Variations in any of these factors listed above could result in changes to our mortgage variable interest rates. This list may cha ...

... Market competition; this relates to external factors such as, activity in the market as a result of new entrants, competitor movements and changing customer preferences. Variations in any of these factors listed above could result in changes to our mortgage variable interest rates. This list may cha ...

Chapter 9

... loans have been paid off, but can use income of the real estate investment they own. Typical term is no more than 20 years and could be for borrower’s lifetime as an annuity. Homeowners’ equity declines by amount borrowed. Copyright© 2006 John Wiley & Sons, Inc. ...

... loans have been paid off, but can use income of the real estate investment they own. Typical term is no more than 20 years and could be for borrower’s lifetime as an annuity. Homeowners’ equity declines by amount borrowed. Copyright© 2006 John Wiley & Sons, Inc. ...

An Introduction - The Mortgage and Insurance Bureau

... and shares have outperformed many other types of investment. This, coupled with the fact that the fund grows free of income and capital gains tax and can be cashed in early, makes the ISA route attractive to many people. The downside is that investing in the stock market is unpredictable. As the sma ...

... and shares have outperformed many other types of investment. This, coupled with the fact that the fund grows free of income and capital gains tax and can be cashed in early, makes the ISA route attractive to many people. The downside is that investing in the stock market is unpredictable. As the sma ...

What does it mean? Common terms for home ownership factsheet

... What does it mean? Common terms for home ownership factsheet There are many words that are specific to property buyers, sellers and lenders. This list is designed to explain some of these words which you will hear or read when looking into home ownership and home loans. AAPR - The Average Annual Per ...

... What does it mean? Common terms for home ownership factsheet There are many words that are specific to property buyers, sellers and lenders. This list is designed to explain some of these words which you will hear or read when looking into home ownership and home loans. AAPR - The Average Annual Per ...