Option Prices and the Cross Section of Equity Returns

... price and growth. Kilian versus Hamilton. • Hamilton: “Nine out of ten of the U.S. recessions since World War II were preceded by a spike up in the oil price” • Evidence of nonlinear relationships • Financialization of commodities in 2004‐2005. • Effects on the cross‐section of equity returns? ...

... price and growth. Kilian versus Hamilton. • Hamilton: “Nine out of ten of the U.S. recessions since World War II were preceded by a spike up in the oil price” • Evidence of nonlinear relationships • Financialization of commodities in 2004‐2005. • Effects on the cross‐section of equity returns? ...

The convergence of binomial and trinomial option pricing models

... methods. The most popular present-time models and procedures arose in 70’s of the last century and were built up on the famous Black and Scholes approach [2]. The original Black and Scholes model was intended to price a European call option on no-dividend paying stock with normally distributed retur ...

... methods. The most popular present-time models and procedures arose in 70’s of the last century and were built up on the famous Black and Scholes approach [2]. The original Black and Scholes model was intended to price a European call option on no-dividend paying stock with normally distributed retur ...

Binomial Trees

... One principle underlying two angles If you can replicate, you can hedge: Long the option contract, short the replicating portfolio. The replication portfolio is composed of stock and bond. Since bond only generates parallel shifts in payoff and does not play any role in offsetting/hedging risks, it ...

... One principle underlying two angles If you can replicate, you can hedge: Long the option contract, short the replicating portfolio. The replication portfolio is composed of stock and bond. Since bond only generates parallel shifts in payoff and does not play any role in offsetting/hedging risks, it ...

Black-Scholes Limitations - by Jan Röman

... Most companies pay dividends to their share holders, so this might seem a serious limitation to the model considering the observation that higher dividend yields elicit lower call premiums. A common way of adjusting the model for this situation is to subtract the discounted value of a future dividen ...

... Most companies pay dividends to their share holders, so this might seem a serious limitation to the model considering the observation that higher dividend yields elicit lower call premiums. A common way of adjusting the model for this situation is to subtract the discounted value of a future dividen ...

Real Options

... Investment timing is like a call option on a stock. It gives you the right to delay investment to see if market conditions are favorable. Cash flows may all be discounted at the same rate (see earlier computer example). However, there is no possibility of losing money if you delay an investment ...

... Investment timing is like a call option on a stock. It gives you the right to delay investment to see if market conditions are favorable. Cash flows may all be discounted at the same rate (see earlier computer example). However, there is no possibility of losing money if you delay an investment ...

Financial Derivatives - William & Mary Mathematics

... risk in the underlying, by entering into a derivative contract whose value moves in the opposite direction to their underlying position and cancels part or all of it out. ...

... risk in the underlying, by entering into a derivative contract whose value moves in the opposite direction to their underlying position and cancels part or all of it out. ...

Institute of Actuaries of India INDICATIVE SOLUTION

... Portfolio insurance means that the portfolio does not fall below the floor because if it falls somebody will pay. Portfolio managers sometimes issue scheme guaranteeing a floor value for the portfolio and then to hedge the guarantee risk they need to buy a put option. Since derivative markets may no ...

... Portfolio insurance means that the portfolio does not fall below the floor because if it falls somebody will pay. Portfolio managers sometimes issue scheme guaranteeing a floor value for the portfolio and then to hedge the guarantee risk they need to buy a put option. Since derivative markets may no ...

EC372 Economics of Bond and Derivatives Markets Empirical

... dates and exercise prices suggests that the assumption of constant volatility (i.e., constant σ ), is implausible. (The evidence is usually expressed in terms of volatility ‘smiles’ and ‘smirks’.) Assignment of values for the remaining arguments of the Black-Scholes formula3 – S, X, τ and r – is reg ...

... dates and exercise prices suggests that the assumption of constant volatility (i.e., constant σ ), is implausible. (The evidence is usually expressed in terms of volatility ‘smiles’ and ‘smirks’.) Assignment of values for the remaining arguments of the Black-Scholes formula3 – S, X, τ and r – is reg ...

The logic of the option pricing theory is based on the following

... binomial option pricing model. It was developed and published by John Cox, Stephen Ross and Mark Rubinstein (the model is also known as Cox/Ross/Rubinstein or simply CRR) in 1979. We will build that model. However, in order to do that some assumptions need to be made: - We’ll talk only for European- ...

... binomial option pricing model. It was developed and published by John Cox, Stephen Ross and Mark Rubinstein (the model is also known as Cox/Ross/Rubinstein or simply CRR) in 1979. We will build that model. However, in order to do that some assumptions need to be made: - We’ll talk only for European- ...

The Greek Letters - E

... Vega tends to be greatest for options that are close to the money (See Figure 17.11, page 366) ...

... Vega tends to be greatest for options that are close to the money (See Figure 17.11, page 366) ...

18. Decision Tree and Microsoft Excel Approach for Option Pricing

... factor and d is down factor. The value of portfolio in the end of first period should be equal to the value of a call option. Therefore, HS(u)+(1+r)B=Max (S(u)-X,0) HS(d)+(1+r)B=Max (S(d)-X,0) The H can be calculated as H= [Max (u-X/S,0)- Max (d-X/S,0)]/(u-d) Based on the H shares of stock, the bond ...

... factor and d is down factor. The value of portfolio in the end of first period should be equal to the value of a call option. Therefore, HS(u)+(1+r)B=Max (S(u)-X,0) HS(d)+(1+r)B=Max (S(d)-X,0) The H can be calculated as H= [Max (u-X/S,0)- Max (d-X/S,0)]/(u-d) Based on the H shares of stock, the bond ...

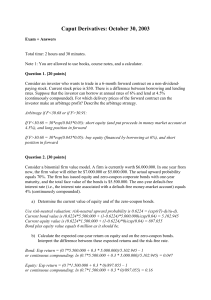

Set 10 - Matt Will

... Derivatives - Any financial instrument that is derived from another. (e.g.. options, warrants, futures, swaps, etc.) Option - Gives the holder the right to buy or sell a security at a specified price during a specified period of time. Call Option - The right to buy a security at a specified pr ...

... Derivatives - Any financial instrument that is derived from another. (e.g.. options, warrants, futures, swaps, etc.) Option - Gives the holder the right to buy or sell a security at a specified price during a specified period of time. Call Option - The right to buy a security at a specified pr ...

Valuation of Asian Option

... • It’s easy to see that, with the increase of the number of simulations, the length of confidence intervals become smaller and smaller, which means the results of simulations are more and more accurate. So we could obtain an option price very close to its real price. • In option 2, 3 and 4, we chan ...

... • It’s easy to see that, with the increase of the number of simulations, the length of confidence intervals become smaller and smaller, which means the results of simulations are more and more accurate. So we could obtain an option price very close to its real price. • In option 2, 3 and 4, we chan ...