PowerPoint Slides

... • Recall that at maturity c=max(0,ST-X) and p=max(0,X-ST) – This should help make the sign of the ...

... • Recall that at maturity c=max(0,ST-X) and p=max(0,X-ST) – This should help make the sign of the ...

Assignment 9. 1. Let us consider independent random variables X i

... If the current asset A(t) is invested partly ( proportion of π(t)) in stock and partly in cash with an interest rate of r then dA(t) = π(t)A(t)[σ dβ(t) + µdt] + (1 − π(t))A(t)rdt If π(t) is kept constant. i.e. π(t) = π, with 0 ≤ π ≤ 1, what is the limit ...

... If the current asset A(t) is invested partly ( proportion of π(t)) in stock and partly in cash with an interest rate of r then dA(t) = π(t)A(t)[σ dβ(t) + µdt] + (1 − π(t))A(t)rdt If π(t) is kept constant. i.e. π(t) = π, with 0 ≤ π ≤ 1, what is the limit ...

The Black-Scholes Model

... Brownian motion, we can use (some versions) of the BSM formula to price European options. Dividends, foreign interest rates, and other types of carrying costs may complicate the pricing formula a little bit. A simpler approach: Assume that the underlying futures/forwards price (of the same maturity ...

... Brownian motion, we can use (some versions) of the BSM formula to price European options. Dividends, foreign interest rates, and other types of carrying costs may complicate the pricing formula a little bit. A simpler approach: Assume that the underlying futures/forwards price (of the same maturity ...

Analysis of Price Using Black Scholes and Greek Letters in

... crucial work and it cannot be used to denote for future expectations. The market is completely moving with random, wandering and it is efficient in changing of volatility. The Chicago board of trade first introduced derivatives and later it was developed all around the world and most popularly used ...

... crucial work and it cannot be used to denote for future expectations. The market is completely moving with random, wandering and it is efficient in changing of volatility. The Chicago board of trade first introduced derivatives and later it was developed all around the world and most popularly used ...

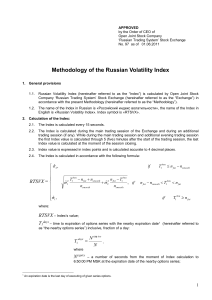

Methodology of the Volatility Index Calculation

... nsmooth – a number of calendar days for conducting the rollover, the value is equal 4 (four); ˆ 1 – aggregated volatility of nearby options series, determined in accordance with clause 2.5 herein. ̂ 2 – aggregated volatility of options series with the expiration date following the expiration date ...

... nsmooth – a number of calendar days for conducting the rollover, the value is equal 4 (four); ˆ 1 – aggregated volatility of nearby options series, determined in accordance with clause 2.5 herein. ̂ 2 – aggregated volatility of options series with the expiration date following the expiration date ...

$doc.title

... 3. step option: pays $100mm if the rate ends between 0.590-0.600£/US$, $200mm if the rate ends 0.575-0.590£/US$, and $5mm if the rate ends below 0.550£/US$. Hint: these questions are not easily solved analytically. Therefore, do a Monte-Carlo simulation (with minimum 10,000 iterations) to simulate ...

... 3. step option: pays $100mm if the rate ends between 0.590-0.600£/US$, $200mm if the rate ends 0.575-0.590£/US$, and $5mm if the rate ends below 0.550£/US$. Hint: these questions are not easily solved analytically. Therefore, do a Monte-Carlo simulation (with minimum 10,000 iterations) to simulate ...

Chapter Five

... 3. Briefly explain, in words, why the price of a put option and the price of a call option on the same stock are not independent. ANSWER: The put/call parity model shows that arbitrage opportunities can be present if the two types of options have their values determined independently of each other. ...

... 3. Briefly explain, in words, why the price of a put option and the price of a call option on the same stock are not independent. ANSWER: The put/call parity model shows that arbitrage opportunities can be present if the two types of options have their values determined independently of each other. ...

The Black-Scholes-Merton Approach to Pricing Options

... We remark that such a portfolio and hedge is useful for example when a bank sells a call option. The proceeds from selling the option must be invested so that the bank can fulfill its obligations at maturity. From no arbitrage principles we showed that there is a self-financing dynamic replicating p ...

... We remark that such a portfolio and hedge is useful for example when a bank sells a call option. The proceeds from selling the option must be invested so that the bank can fulfill its obligations at maturity. From no arbitrage principles we showed that there is a self-financing dynamic replicating p ...

A EXTENDED WITH ROBUST OPTION REPLICATION FOR BLACK-

... follows that B h is not a semi-martingale and the use of fractional Brownian motion B h or a more general process Z with zero quadratic variation in a stochastic differential equation requires a different concept of stochastic integral since stochastic calculus based on semi-martingale integrators i ...

... follows that B h is not a semi-martingale and the use of fractional Brownian motion B h or a more general process Z with zero quadratic variation in a stochastic differential equation requires a different concept of stochastic integral since stochastic calculus based on semi-martingale integrators i ...

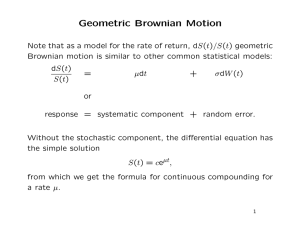

1 Geometric Brownian motion

... Notice how, in order to compute our option price, the only parameters we need are: r, σ, K, and S0 . Of these the only one we need to estimate (from past stock data) is σ; the others would be known. The pricing formula immediately extends to the price Ct of the same option at any time 0 ≤ t ≤ T : ju ...

... Notice how, in order to compute our option price, the only parameters we need are: r, σ, K, and S0 . Of these the only one we need to estimate (from past stock data) is σ; the others would be known. The pricing formula immediately extends to the price Ct of the same option at any time 0 ≤ t ≤ T : ju ...

Geometric Brownian Motion

... Consider a forward contract that obligates one to pay K at T for the underlying. At time t, with t < T , the price of the underlying is S(t). What should the price of the contract be or, equivalently, What should K be so that the price of the contract is 0? Its value at expiry is S(T )− K, and of co ...

... Consider a forward contract that obligates one to pay K at T for the underlying. At time t, with t < T , the price of the underlying is S(t). What should the price of the contract be or, equivalently, What should K be so that the price of the contract is 0? Its value at expiry is S(T )− K, and of co ...

A Close Look into Black-Scholes Option Pricing Model

... and Corporate Liabilities", published in the Journal of Political Economy by Black and Scholes who developed closed-form formula to calculate the prices of European calls and puts, based on certain assumptions by showing how to hedge continuously the exposure on the short position of an option. Part ...

... and Corporate Liabilities", published in the Journal of Political Economy by Black and Scholes who developed closed-form formula to calculate the prices of European calls and puts, based on certain assumptions by showing how to hedge continuously the exposure on the short position of an option. Part ...

Robust measurement of implied correlations

... evaporating. In the extreme case there is no diversification possible in an asset portfolio and stock picking doesn't make sense anymore as the portfolio return is not determined by the particular stocks composing the portfolio, but whether one is exposed to the stock market or not. Asset correlatio ...

... evaporating. In the extreme case there is no diversification possible in an asset portfolio and stock picking doesn't make sense anymore as the portfolio return is not determined by the particular stocks composing the portfolio, but whether one is exposed to the stock market or not. Asset correlatio ...

The Greek Letters

... • In October of 1987 many portfolio managers attempted to create a put option on a portfolio synthetically • This involves initially selling enough of the portfolio (or of index futures) to match the D of the put option ...

... • In October of 1987 many portfolio managers attempted to create a put option on a portfolio synthetically • This involves initially selling enough of the portfolio (or of index futures) to match the D of the put option ...

Economathematics Problem Sheet 2 Zbigniew Palmowski 1. Prove

... if dS = µSdt + σSdW , where W is a standard Brownian motion. 10. Derive equation for option price on stock S which pays dividend D continuously (e.g. in the same, short way as above). 11. Derive equation for option price on currency assuming continuous interest rates of level r and r0 . That is, in ...

... if dS = µSdt + σSdW , where W is a standard Brownian motion. 10. Derive equation for option price on stock S which pays dividend D continuously (e.g. in the same, short way as above). 11. Derive equation for option price on currency assuming continuous interest rates of level r and r0 . That is, in ...