Derivative (finance)

... In finance, a derivative is a financial instrument derived from some other asset; rather than trade or exchange of the asset itself, market participants enter into an agreement to exchange money, assets or some other value at some future date based on the underlying asset. A simple example is a futu ...

... In finance, a derivative is a financial instrument derived from some other asset; rather than trade or exchange of the asset itself, market participants enter into an agreement to exchange money, assets or some other value at some future date based on the underlying asset. A simple example is a futu ...

Digital Options

... Barrier options are a generic name given to derivative securities with payoffs which are contingent on the spot price reaching a certain level, or barrier over the life time of the option. A number of different types of barrier option regularly trade over the counter (OTC) market. They attractive to ...

... Barrier options are a generic name given to derivative securities with payoffs which are contingent on the spot price reaching a certain level, or barrier over the life time of the option. A number of different types of barrier option regularly trade over the counter (OTC) market. They attractive to ...

Document

... • A new concept is elicitability, that means that there exists a function such that one can measure whether a measure is better then another. • In other words, a measure is elicitable if it results from the optimization of a function. For example, minimizing a quadratic function yields the mean, whi ...

... • A new concept is elicitability, that means that there exists a function such that one can measure whether a measure is better then another. • In other words, a measure is elicitable if it results from the optimization of a function. For example, minimizing a quadratic function yields the mean, whi ...

Static Hedging and Pricing American Exotic Options

... European Installment options (Davis, Schachermayer, and Tompkins (2001)) ...

... European Installment options (Davis, Schachermayer, and Tompkins (2001)) ...

Option Value = 162 - 145 = $17 mil

... project are shown. The project costs $180 million, either now or later. The figures in parentheses show payoffs from the option to wait and to invest later if the project is positive-NPV at year 1. Waiting means loss of the first year’s cash flows. The problem is to figure out the current value of t ...

... project are shown. The project costs $180 million, either now or later. The figures in parentheses show payoffs from the option to wait and to invest later if the project is positive-NPV at year 1. Waiting means loss of the first year’s cash flows. The problem is to figure out the current value of t ...

Pricing and Hedging under the Black-Merton

... discount back with riskfree rate, we do not really care about the actual probability of each scenario happening. We just care about what all the possible scenarios are and whether our hedging works under all scenarios. Q is not about getting close to the actual probability, but about being fair wrt ...

... discount back with riskfree rate, we do not really care about the actual probability of each scenario happening. We just care about what all the possible scenarios are and whether our hedging works under all scenarios. Q is not about getting close to the actual probability, but about being fair wrt ...

1 Ralph`s 157 Dilemma Ralph is attempting to audit a client`s

... Ralph is attempting to audit a client’s implementation of SFAS 157 on “fair value measurements.” The client, a diversified firm whose manager is an advocate of fair value accounting, commonly trades derivatives. Ralph and the client understand that under SFAS 157, level one evidence involves direct ...

... Ralph is attempting to audit a client’s implementation of SFAS 157 on “fair value measurements.” The client, a diversified firm whose manager is an advocate of fair value accounting, commonly trades derivatives. Ralph and the client understand that under SFAS 157, level one evidence involves direct ...

Application for processing and option pricing by trinomial model

... Employees of economic and foreign departments of large enterprises do not usually use these instruments because they do not know them very well, and they are afraid of these processes. They have not understood importance and significance of financial derivatives. Before 1989, these instruments used ...

... Employees of economic and foreign departments of large enterprises do not usually use these instruments because they do not know them very well, and they are afraid of these processes. They have not understood importance and significance of financial derivatives. Before 1989, these instruments used ...

PART 5: RISK MANAGEMENT CHAPTER 15: Hedging Instruments

... Futures contracts are mark-to-market, which means that gains and losses are settled at the close of trading each day, not at the end of the contract. The reporting of financial futures differs from that of spot markets. The prices listed are points of 100 percent, not percentages of face value. Bris ...

... Futures contracts are mark-to-market, which means that gains and losses are settled at the close of trading each day, not at the end of the contract. The reporting of financial futures differs from that of spot markets. The prices listed are points of 100 percent, not percentages of face value. Bris ...

Mathematical modeling and analysis of options with jump

... The initial focus of the dissertation is to analyze the current pricing models of financial derivatives, including the effects of volatility risk and uncertainty. Most option pricing schemes formulated to date have been based on the classical Black-Scholes theory (1973). Black and Scholes have model ...

... The initial focus of the dissertation is to analyze the current pricing models of financial derivatives, including the effects of volatility risk and uncertainty. Most option pricing schemes formulated to date have been based on the classical Black-Scholes theory (1973). Black and Scholes have model ...

Black-Scholes and the Volatility Surface

... arbitrage in the market. These restrictions can be difficult to enforce, however, when we are “bumping” or “stressing” the volatility surface, a task that is commonly performed for risk management purposes. Why is there a Skew? For stocks and stock indices the shape of the volatility surface is alwa ...

... arbitrage in the market. These restrictions can be difficult to enforce, however, when we are “bumping” or “stressing” the volatility surface, a task that is commonly performed for risk management purposes. Why is there a Skew? For stocks and stock indices the shape of the volatility surface is alwa ...

Modeling Asset Prices in Continuous Time

... • See Figure 17.3 or 18.3 (call) and 17.4 or 18.4 (put) • Delta of call always between zero and 1. • Delta of put always between -1 and 0. ...

... • See Figure 17.3 or 18.3 (call) and 17.4 or 18.4 (put) • Delta of call always between zero and 1. • Delta of put always between -1 and 0. ...

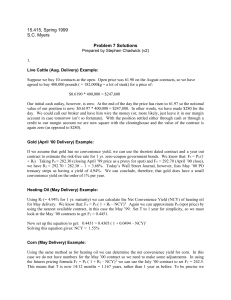

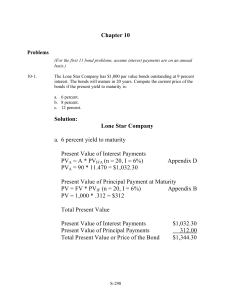

Chapter 10 Solution: Lone Star Company a. 6 percent yield to

... If the required rate of return (K e) is 13 percent, what is the anticipated stock price (P0 ) at the beginning of 2002? ...

... If the required rate of return (K e) is 13 percent, what is the anticipated stock price (P0 ) at the beginning of 2002? ...

Options on Futures Contracts - Feuz Cattle and Beef Market Analysis

... short futures position if the option is exercised. Must meet margin calls if the underlying futures contract price moves below the option strike price. Receives the option premium after the option expires. ...

... short futures position if the option is exercised. Must meet margin calls if the underlying futures contract price moves below the option strike price. Receives the option premium after the option expires. ...

Invisible Parameters in Option Prices

... The parameter /3 is a discount factor; changing /3 affects the interest rate. The function m(V, y) is a differentiable function of the asset price and a "risk aversion" parameter y.1 The important economic content of equation (2) is that M does not depend on the probability density parameter 0. In w ...

... The parameter /3 is a discount factor; changing /3 affects the interest rate. The function m(V, y) is a differentiable function of the asset price and a "risk aversion" parameter y.1 The important economic content of equation (2) is that M does not depend on the probability density parameter 0. In w ...

yield option pricing in the generalized cox-ingersoll

... The purpose of this paper is to derive the prices of yield options in the ECIR( δ ( t ) ) model by assuming that the market is complete and arbitrage-free. Nowadays, both European and American options on yields are incorporated in different interest-rate derivatives like e.g. interest-rate caps, flo ...

... The purpose of this paper is to derive the prices of yield options in the ECIR( δ ( t ) ) model by assuming that the market is complete and arbitrage-free. Nowadays, both European and American options on yields are incorporated in different interest-rate derivatives like e.g. interest-rate caps, flo ...