8: The Black-Scholes Model - School of Mathematics and Statistics

... It can also be checked that the prices of call and put options are increasing functions of the volatility parameter σ (if all other quantities are fixed). Hence the options become more expensive when the underlying stock becomes more risky. The price of a call (put) option is an increasing (decreasi ...

... It can also be checked that the prices of call and put options are increasing functions of the volatility parameter σ (if all other quantities are fixed). Hence the options become more expensive when the underlying stock becomes more risky. The price of a call (put) option is an increasing (decreasi ...

Monetary Policy Model

... Results and Conclusions of Chile CCA-Monetary Policy Model Analysis A simple, but powerful model for monetary policy including financial sector risk indicator (DTD) Empirical evidence supports the model. DTD affects GDP growth and Output Gap Impulse Responses in accordance with theory. Robust effic ...

... Results and Conclusions of Chile CCA-Monetary Policy Model Analysis A simple, but powerful model for monetary policy including financial sector risk indicator (DTD) Empirical evidence supports the model. DTD affects GDP growth and Output Gap Impulse Responses in accordance with theory. Robust effic ...

PDF

... while allowing random, and temporary, upward jumps in prices. The special chsracteristics of electricity production, transmission and dctnand suggest a price path which has these characteristics, and that is generally distinct from that of other commodiries. As shown by Schwartz (1997j, price path s ...

... while allowing random, and temporary, upward jumps in prices. The special chsracteristics of electricity production, transmission and dctnand suggest a price path which has these characteristics, and that is generally distinct from that of other commodiries. As shown by Schwartz (1997j, price path s ...

Inventory models for deteriorating items with discounted selling price

... discounts on selling price. The mathematical model is developed in order to investigate how much discount on selling price may be given to maximize the profit per unit time when demand is both stock dependent and constant, but the time value of money and shortage are not considered. In this paper, t ...

... discounts on selling price. The mathematical model is developed in order to investigate how much discount on selling price may be given to maximize the profit per unit time when demand is both stock dependent and constant, but the time value of money and shortage are not considered. In this paper, t ...

Martingale Theory in Economics and Finance

... The notion of independence implies that the current return does not depend on past returns. Consequently, it is impossible to predict the future return using past returns. Bachelier (1900,1964) develops an elaborate mathematical theory of speculative prices. Roberts (1959) presents a largely heurist ...

... The notion of independence implies that the current return does not depend on past returns. Consequently, it is impossible to predict the future return using past returns. Bachelier (1900,1964) develops an elaborate mathematical theory of speculative prices. Roberts (1959) presents a largely heurist ...

THE INS AND OUTS OF “ACCELERATION OUT” CLAUSES IN

... THE INS AND OUTS OF “ACCELERATION OUT” CLAUSES IN STOCK OPTION PLANS: Who should be protected in the event of a sale of the business? By: Peter H. Ehrenberg1 At least for the time being, as we move into 2001, the bloom on the IPO market experienced in the late 1990’s and the first quarter of 2000 ma ...

... THE INS AND OUTS OF “ACCELERATION OUT” CLAUSES IN STOCK OPTION PLANS: Who should be protected in the event of a sale of the business? By: Peter H. Ehrenberg1 At least for the time being, as we move into 2001, the bloom on the IPO market experienced in the late 1990’s and the first quarter of 2000 ma ...

Pricing and hedging in exponential Lévy models: review of recent

... A great advantage of exponential Lévy models is their mathematical tractability, which makes it possible to perform many computations explicitly and to present deep results of modern mathematical finance in a simple manner. This has led to an explosion of the literature on option pricing and hedgin ...

... A great advantage of exponential Lévy models is their mathematical tractability, which makes it possible to perform many computations explicitly and to present deep results of modern mathematical finance in a simple manner. This has led to an explosion of the literature on option pricing and hedgin ...

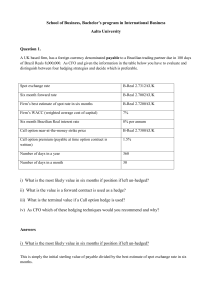

November 2013 Examinations INDICATIVE SOLUTIONS Subject CT2 – Finance and Financial

... time of buying. An option in this case would be beneficial as he could allow the option to lapse and buy the asset in the open market at a price less than the strike price of the option. However he will have pay an option premium b) Speculation To earn money from the anticipated movement in value of ...

... time of buying. An option in this case would be beneficial as he could allow the option to lapse and buy the asset in the open market at a price less than the strike price of the option. However he will have pay an option premium b) Speculation To earn money from the anticipated movement in value of ...

NBER WORKING PAPER SERIES PANELS Torben G. Andersen

... tors, enabling us to devise a formal model specification test based on the distance between the two volatility measures. Intuitively, this is feasible as, even though different volatility states (or jump intensities) are not directly observed, the (total) diffusive volatility may be filtered from t ...

... tors, enabling us to devise a formal model specification test based on the distance between the two volatility measures. Intuitively, this is feasible as, even though different volatility states (or jump intensities) are not directly observed, the (total) diffusive volatility may be filtered from t ...

Study Guide for Final

... Throughout the chapter when it refers to an option -- it implies that you are considering the case of both put and call options. CALCULATIONS: Be able to present the profit diagram and/or payoff table from “complex” trading strategies (complex -- implies that it involves more than one option) Be abl ...

... Throughout the chapter when it refers to an option -- it implies that you are considering the case of both put and call options. CALCULATIONS: Be able to present the profit diagram and/or payoff table from “complex” trading strategies (complex -- implies that it involves more than one option) Be abl ...

Chapter 20

... • Premium payable in full by buyer (taker) and credited to account of seller (writer) at time of trade. • At the same time, seller must lodge a deposit with the Clearing House to ensure performance in the event of price movement adverse to the position of seller. • Deposit levels vary depending on v ...

... • Premium payable in full by buyer (taker) and credited to account of seller (writer) at time of trade. • At the same time, seller must lodge a deposit with the Clearing House to ensure performance in the event of price movement adverse to the position of seller. • Deposit levels vary depending on v ...

Financial Accounting and Accounting Standards

... Fair Value Hedge A derivative used to hedge (offset) the exposure to changes in the fair value of a recognized asset or liability, or of an unrecognized commitment. Interest rate swaps. Put options. ...

... Fair Value Hedge A derivative used to hedge (offset) the exposure to changes in the fair value of a recognized asset or liability, or of an unrecognized commitment. Interest rate swaps. Put options. ...

On Fourier cosine expansions and the put

... with a very long time to maturity 2 . A call payoff grows exponentially in log–stock price which may introduce cancellation errors for large domain sizes. A put option ...

... with a very long time to maturity 2 . A call payoff grows exponentially in log–stock price which may introduce cancellation errors for large domain sizes. A put option ...

- Computational Finance

... - European style Call and Put options, by a closed formula due to Black and Scholes - American style and other options, by Cox, Ross and Rubinstein (1979) binomial trees model. ...

... - European style Call and Put options, by a closed formula due to Black and Scholes - American style and other options, by Cox, Ross and Rubinstein (1979) binomial trees model. ...

Asian basket options and implied correlations in energy

... basket and spread options. Nowadays, such options are also actively traded on exchanges5 . The fundamental difficulty in pricing both Asian and basket options is determining the distribution of the sum or the average of underlying asset prices. Even in the Black-Scholes framework (where the prices a ...

... basket and spread options. Nowadays, such options are also actively traded on exchanges5 . The fundamental difficulty in pricing both Asian and basket options is determining the distribution of the sum or the average of underlying asset prices. Even in the Black-Scholes framework (where the prices a ...

Problem Set 2

... CEO by using the board of directors. Additionally, the labor market for upper management will evaluate the performance of these displaced managers and value them accordingly. Another way is by takeover. Those firms that are poorly managed are more attractive as acquisitions than well managed firms b ...

... CEO by using the board of directors. Additionally, the labor market for upper management will evaluate the performance of these displaced managers and value them accordingly. Another way is by takeover. Those firms that are poorly managed are more attractive as acquisitions than well managed firms b ...