Chapter 8 Heath–Jarrow–Morton (HJM) Methodology

... (and not on the P-drift α(t, T )). Hence option pricing only depends on σ. This situation is similar to the Black–Scholes stock price model. We can give sufficient conditions for Z(t, T ) to be a true Q-martingale. Corollary 8.2.3. Suppose that (8.3) holds. Then Q is an EMM if either ...

... (and not on the P-drift α(t, T )). Hence option pricing only depends on σ. This situation is similar to the Black–Scholes stock price model. We can give sufficient conditions for Z(t, T ) to be a true Q-martingale. Corollary 8.2.3. Suppose that (8.3) holds. Then Q is an EMM if either ...

17. The Greek letters

... A bank has sold for $300,000 a European call option on 100,000 shares of a non-dividendpaying stock S0 = 49, K = 50, r = 5%, s = 20%, T = 20 weeks, m = 13% The Black-Scholes-Merton value of the option is $240,000 How does the bank hedge its risk to lock in a $60,000 profit? ...

... A bank has sold for $300,000 a European call option on 100,000 shares of a non-dividendpaying stock S0 = 49, K = 50, r = 5%, s = 20%, T = 20 weeks, m = 13% The Black-Scholes-Merton value of the option is $240,000 How does the bank hedge its risk to lock in a $60,000 profit? ...

Chapter 1: Intro to Derivatives

... – Outright purchase (buy now, get stock now) – Fully leveraged purchase (borrow money to buy stock now, repay at T) – Prepaid forward contract (buy stock now, but get it at T) – Forward contract (pay for and receive stock at T) ...

... – Outright purchase (buy now, get stock now) – Fully leveraged purchase (borrow money to buy stock now, repay at T) – Prepaid forward contract (buy stock now, but get it at T) – Forward contract (pay for and receive stock at T) ...

the university of chicago modeling the stock price process

... Birth-death processes have the virtue that they allow perfect derivative securities hedging. This is not quite as straightforward as the continuous model. In the latter, in simple cases, options need only be hedged in the underlying security; in birth-death process models one also needs one market t ...

... Birth-death processes have the virtue that they allow perfect derivative securities hedging. This is not quite as straightforward as the continuous model. In the latter, in simple cases, options need only be hedged in the underlying security; in birth-death process models one also needs one market t ...

WP 2004-10 Energy Options in an HJM Framework by Thomas Lyse

... and define it in a backwards manner such that the usual no arbitrage based pricing relations are valid. On the other hand, electricity is also an example of a real good that can be transported instantly over long distances, provided the relevant transmission lines have been established. When volatil ...

... and define it in a backwards manner such that the usual no arbitrage based pricing relations are valid. On the other hand, electricity is also an example of a real good that can be transported instantly over long distances, provided the relevant transmission lines have been established. When volatil ...

Stochastic Asset Liability Modelling: An Indian Perspective

... the infamous Black Monday (stock market crash in October 1987) is attributed to a large number of players using portfolio insurance. As the market started declining, traders that used PI started selling which led to a vicious downward spiral leading to a fall of more than 20% in the Australian stock ...

... the infamous Black Monday (stock market crash in October 1987) is attributed to a large number of players using portfolio insurance. As the market started declining, traders that used PI started selling which led to a vicious downward spiral leading to a fall of more than 20% in the Australian stock ...

OPTIONS AND FUTURES CONTRACTS IN ELECTRICITY FOR

... Nowadays, the typical instrument of trade with electricity at wholesale level is the forward contract, so it was before and it continued being after taking place the reorganization of the sector. The forward contract is an agreement between a buyer and a seller of power to trade a given quantity of ...

... Nowadays, the typical instrument of trade with electricity at wholesale level is the forward contract, so it was before and it continued being after taking place the reorganization of the sector. The forward contract is an agreement between a buyer and a seller of power to trade a given quantity of ...

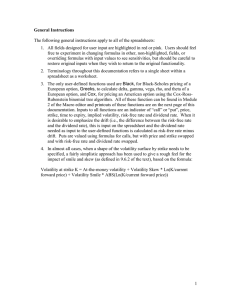

General Instructions

... The following general instructions apply to all of the spreadsheets: 1. All fields designed for user input are highlighted in red or pink. Users should feel free to experiment in changing formulas in other, non-highlighted, fields, or overriding formulas with input values to see sensitivities, but s ...

... The following general instructions apply to all of the spreadsheets: 1. All fields designed for user input are highlighted in red or pink. Users should feel free to experiment in changing formulas in other, non-highlighted, fields, or overriding formulas with input values to see sensitivities, but s ...

SFDCP Small Cap Value Equity Portfolio

... reward per unit of risk. The higher the Sharpe Ratio, the better the fund's historical risk-adjusted performance. The Sharpe ratio is calculated for the past 36-month period by dividing a fund's annualized excess returns by the standard deviation of a fund's annualized excess returns. Since this rat ...

... reward per unit of risk. The higher the Sharpe Ratio, the better the fund's historical risk-adjusted performance. The Sharpe ratio is calculated for the past 36-month period by dividing a fund's annualized excess returns by the standard deviation of a fund's annualized excess returns. Since this rat ...

ACCT5341 SP05 Exam 1a 031405

... instruments booked at fair value on any reporting date would have what impact on hedge accounting? a. This would eliminate all hedge accounting treatments for financial instruments. [XXXXX Para 247 on Page 132] b. This would have no impact on SFAS 133 hedge accounting rules unless the FASB changed S ...

... instruments booked at fair value on any reporting date would have what impact on hedge accounting? a. This would eliminate all hedge accounting treatments for financial instruments. [XXXXX Para 247 on Page 132] b. This would have no impact on SFAS 133 hedge accounting rules unless the FASB changed S ...

Module 8 Strategies for a flat market – Australian Securities

... markets, the written straddle and the written strangle. The success of both strategies depends on the stock price remaining around current levels. If the stock moves significantly in either direction, you can suffer heavy losses. A written option can be said to reflect a neutral outlook, however the ...

... markets, the written straddle and the written strangle. The success of both strategies depends on the stock price remaining around current levels. If the stock moves significantly in either direction, you can suffer heavy losses. A written option can be said to reflect a neutral outlook, however the ...

A FAST AND EXACT SIMULATION FOR CIR PROCESS By ANQI

... The theory of interest-rate modeling was originally based on the assumption of specific one-dimensional dynamics for the instantaneous rate process rt . Modeling directly such dynamics is very convenient since all fundamental quantities (rates and bonds) are readily defined as the expectation of a f ...

... The theory of interest-rate modeling was originally based on the assumption of specific one-dimensional dynamics for the instantaneous rate process rt . Modeling directly such dynamics is very convenient since all fundamental quantities (rates and bonds) are readily defined as the expectation of a f ...

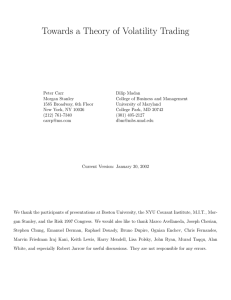

Towards a Theory of Volatility Trading

... the variance between the 2 maturities, and developed the notion of forward variance. Following Heath, Jarrow and Morton[19](HJM), Dupire modelled the evolution of the term structure of this forward variance, thereby developing the first stochastic volatility model in which the market price of volati ...

... the variance between the 2 maturities, and developed the notion of forward variance. Following Heath, Jarrow and Morton[19](HJM), Dupire modelled the evolution of the term structure of this forward variance, thereby developing the first stochastic volatility model in which the market price of volati ...

3. The Black-Scholes model

... coupon-bearing bond whose current price is $900 The forward contract matures in one year and the bond matures in 5 years, so the forward contract is to purchase a 4-year bond in one year Coupon payments of $40 are expected after 6 months and 12 months The 6-month and 1-year risk-free interest rates ...

... coupon-bearing bond whose current price is $900 The forward contract matures in one year and the bond matures in 5 years, so the forward contract is to purchase a 4-year bond in one year Coupon payments of $40 are expected after 6 months and 12 months The 6-month and 1-year risk-free interest rates ...

Disadvantages of futures

... beyond that permitted in section 117 of the 1976 United States Copyright Act without express permission of the copyright owner is unlawful. Request for further information should be addressed to the Permissions Department, John Wiley & Sons, Inc. The purchaser may back-up copies for his/her own use ...

... beyond that permitted in section 117 of the 1976 United States Copyright Act without express permission of the copyright owner is unlawful. Request for further information should be addressed to the Permissions Department, John Wiley & Sons, Inc. The purchaser may back-up copies for his/her own use ...

Financial Time Series as Random Walks

... Applications of Random Walks Estimating the probability distribution for the price of a stock at a given future time t is critical to pricing certain options. This probability distribution can be modeled as the distribution of positions after f (t) steps of a random walk. For this question, there i ...

... Applications of Random Walks Estimating the probability distribution for the price of a stock at a given future time t is critical to pricing certain options. This probability distribution can be modeled as the distribution of positions after f (t) steps of a random walk. For this question, there i ...