FASB Accounting Rules and Implications for Natural Gas Purchase

... market exists for the relevant asset or liability similar assets or liabilities or possibly an estimated fair value is used.4 A derivative is a financial instrument (or, more simply, an agreement between two parties) that has a value, based on the expected future price movements of the asset to whic ...

... market exists for the relevant asset or liability similar assets or liabilities or possibly an estimated fair value is used.4 A derivative is a financial instrument (or, more simply, an agreement between two parties) that has a value, based on the expected future price movements of the asset to whic ...

Tails, volatility risk premium, and equity index returns - Aalto

... returns. This information also enables a comprehensive view on what risks are compensated in financial asset returns, and how to assess the riskiness of investments in general. In explaining market returns, the information in option prices seems superior to the explanatory power of market valuation, ...

... returns. This information also enables a comprehensive view on what risks are compensated in financial asset returns, and how to assess the riskiness of investments in general. In explaining market returns, the information in option prices seems superior to the explanatory power of market valuation, ...

AcSB Implementation Guide Hedging Relationships Typescript

... Answer: In general paragraph 15 of AcG-13 states that synthetic instrument accounting can only be applied if the conditions outlined in paragraph 6 of AcG-13 are met. Paragraph 6(c) states that “both at the inception of the hedging relationship and throughout its term, the entity should have reasona ...

... Answer: In general paragraph 15 of AcG-13 states that synthetic instrument accounting can only be applied if the conditions outlined in paragraph 6 of AcG-13 are met. Paragraph 6(c) states that “both at the inception of the hedging relationship and throughout its term, the entity should have reasona ...

The Tax Treatment of Contingent Options

... [a]t the time the payments were made it was impossible to determine whether they were taxable or not. In the event the sale should be completed, the payments became return of capital, taxable only if a profit should be realized on the sale. Should the option be surrendered it would then become certa ...

... [a]t the time the payments were made it was impossible to determine whether they were taxable or not. In the event the sale should be completed, the payments became return of capital, taxable only if a profit should be realized on the sale. Should the option be surrendered it would then become certa ...

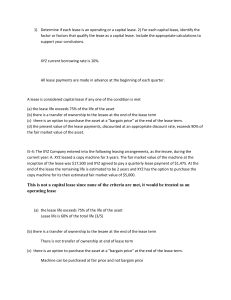

1) Determine if each lease is an operating or a capital lease. 2) For

... I5-4: The XYZ Company entered into the following leasing arrangements, as the lessee, during the current year: A. XYZ leased a copy machine for 3 years. The fair market value of the machine at the inception of the lease was $17,500 and XYZ agreed to pay a quarterly lease payment of $1,475. At the en ...

... I5-4: The XYZ Company entered into the following leasing arrangements, as the lessee, during the current year: A. XYZ leased a copy machine for 3 years. The fair market value of the machine at the inception of the lease was $17,500 and XYZ agreed to pay a quarterly lease payment of $1,475. At the en ...

Speculative Investors and Tobin`s Tax

... Short-term speculators are called flippers in our sample — those who buy and subsequently sell before project completion. In our sample, speculators have a short investment horizon: they hold their investments for about 24 months on average, less than half the average holding time for a spot market ...

... Short-term speculators are called flippers in our sample — those who buy and subsequently sell before project completion. In our sample, speculators have a short investment horizon: they hold their investments for about 24 months on average, less than half the average holding time for a spot market ...

NBER WORKING PAPER SERIES SIMPLE VARIANCE SWAPS Ian Martin Working Paper 16884

... Table 1, does not disappear in the ∆ → 0 limit. We can think of the option portfolio as a collection of calls of all strikes, as in (5). It is perhaps more natural, though, to think of the position as a collection of calls with strikes above FT and puts with strikes below FT , together with a long p ...

... Table 1, does not disappear in the ∆ → 0 limit. We can think of the option portfolio as a collection of calls of all strikes, as in (5). It is perhaps more natural, though, to think of the position as a collection of calls with strikes above FT and puts with strikes below FT , together with a long p ...

Final Exam Preparation

... The fixed rate is some spread above the Treasury yield curve with the same term to maturity as the swap. Suppose the five-year Treasury yield is 9.0%. Then the offer price that the dealer would quote to the fixed-rate payer is the five-year Treasury rate plus 50 basis points versus receiving LIBOR f ...

... The fixed rate is some spread above the Treasury yield curve with the same term to maturity as the swap. Suppose the five-year Treasury yield is 9.0%. Then the offer price that the dealer would quote to the fixed-rate payer is the five-year Treasury rate plus 50 basis points versus receiving LIBOR f ...

![Since Slonczewski calculated [1] interfacial exchange - cerge-ei](http://s1.studyres.com/store/data/005381392_1-e9747be9e01b230768e0b5cde433f905-300x300.png)