Institute for Accounting and Auditing of FBiH

... - Medium and large shareholding companies should have audited financial statements, subject of approval of annual shareholdes assembly ...

... - Medium and large shareholding companies should have audited financial statements, subject of approval of annual shareholdes assembly ...

Private Company Financial Reporting Initiative Achieves

... setting for private companies. The panel’s 18 members came from a top level cross-section of financial reporting constituencies, including lenders, investors, owners, preparers and auditors. AICPA President and CEO Barry C. Melancon, CPA, also served on the panel. The panel’s mission was unlike othe ...

... setting for private companies. The panel’s 18 members came from a top level cross-section of financial reporting constituencies, including lenders, investors, owners, preparers and auditors. AICPA President and CEO Barry C. Melancon, CPA, also served on the panel. The panel’s mission was unlike othe ...

Lesson 1 PowerPoint

... shareholders’ equity or stockholders’ equity for a corporation. Increases in equity of a particular business enterprise resulting from transfers to it from other entities of something of value to obtain or increase ownership interests in it. Decreases in equity of a particular enterprise resulting f ...

... shareholders’ equity or stockholders’ equity for a corporation. Increases in equity of a particular business enterprise resulting from transfers to it from other entities of something of value to obtain or increase ownership interests in it. Decreases in equity of a particular enterprise resulting f ...

Chapter Twelve - Dr.Mahmood Asad

... defines the set of Generally accepted accounting principles that accountants must follow. • Financial Accounting Standards Board (FASB): the group that oversees accounting practice. • Generally accepted accounting principles (GAAP): a set of principles followed by accountants in preparing reports. ...

... defines the set of Generally accepted accounting principles that accountants must follow. • Financial Accounting Standards Board (FASB): the group that oversees accounting practice. • Generally accepted accounting principles (GAAP): a set of principles followed by accountants in preparing reports. ...

ACCT 108 Title: College Accounting Division

... This course is one course from the approved program in Vocational Business/Office Education. It is taken by students preparing for accounting or bookkeeping positions, students in transfer programs with no accounting background preparing for Financial Accounting 109, small business owners, and other ...

... This course is one course from the approved program in Vocational Business/Office Education. It is taken by students preparing for accounting or bookkeeping positions, students in transfer programs with no accounting background preparing for Financial Accounting 109, small business owners, and other ...

DOC, 113 Kb

... expected to be able to apply a set of accounting concepts to understand annual financial reports of different corporations and calculate financial ratios to assess finance position. Students are expected to apply managerial accounting analytical tools for internal control, pricing and developing dif ...

... expected to be able to apply a set of accounting concepts to understand annual financial reports of different corporations and calculate financial ratios to assess finance position. Students are expected to apply managerial accounting analytical tools for internal control, pricing and developing dif ...

REPORTS TO: General Manager - California Special Districts

... QUALIFICATIONS: To perform this job successfully, an individual must be able to perform each essential duty satisfactorily. The requirements listed below are representative of the knowledge, skill and/or ability required. Reasonable accommodations may be made to enable individuals with disabilities ...

... QUALIFICATIONS: To perform this job successfully, an individual must be able to perform each essential duty satisfactorily. The requirements listed below are representative of the knowledge, skill and/or ability required. Reasonable accommodations may be made to enable individuals with disabilities ...

topic 1 - WordPress.com

... Measurement Principles Cost Principle – Or historical cost principle, dictates that companies record assets at their cost. ...

... Measurement Principles Cost Principle – Or historical cost principle, dictates that companies record assets at their cost. ...

簡介 - CTP CPA Ltd.

... Mr. Tang started his career in 1989 in a small CPA firm whose partner came from one of the big 4. He joined Coopers & Lybrand in 1991 and later worked in Kwan Wong Tan & Fong. Mr. Tang then worked for a garment manufacturer (with over 2000 workers) in Dongguan, China for 3 years. Mr.Tang started his ...

... Mr. Tang started his career in 1989 in a small CPA firm whose partner came from one of the big 4. He joined Coopers & Lybrand in 1991 and later worked in Kwan Wong Tan & Fong. Mr. Tang then worked for a garment manufacturer (with over 2000 workers) in Dongguan, China for 3 years. Mr.Tang started his ...

the report of the Listing Department on the

... English version of the statements for the year 2003 with a view to placing them in the Stock Exchange website in the very near future. A need for such a measure was prompted by deep interest in the growing securities market of Lithuania and the companies listed on the Stock Exchange shown by the inv ...

... English version of the statements for the year 2003 with a view to placing them in the Stock Exchange website in the very near future. A need for such a measure was prompted by deep interest in the growing securities market of Lithuania and the companies listed on the Stock Exchange shown by the inv ...

ch_1_intro_to_accoun..

... How much cash do we have What was our payroll cost When did we buy a piece of equipment & at ...

... How much cash do we have What was our payroll cost When did we buy a piece of equipment & at ...

Statement of Owners` Equity

... Generally accepted accounting principles (GAAP) encompass the conventions, rules, and procedures for determining acceptable accounting practices at a particular time. Financial Accounting Standards Board (FASB) is primarily responsible for evaluating, setting, or modifying GAAP in the U.S. Sarbanes- ...

... Generally accepted accounting principles (GAAP) encompass the conventions, rules, and procedures for determining acceptable accounting practices at a particular time. Financial Accounting Standards Board (FASB) is primarily responsible for evaluating, setting, or modifying GAAP in the U.S. Sarbanes- ...

Accounting Fraud: Learning from the Wrongs

... see it particularly in instances where there is major financial statement manipulation involving products or services, including software." At CUC International -- a shopping club company that merged with hotel and car rental company HFS to form Cendant -- phony accounting entries created the illusi ...

... see it particularly in instances where there is major financial statement manipulation involving products or services, including software." At CUC International -- a shopping club company that merged with hotel and car rental company HFS to form Cendant -- phony accounting entries created the illusi ...

Developing a Cost Accounting System for First Government Contract

... foreign entity requested our services to remedy audit findings and assist in developing new or amending existing cost accounting capabilities. The client was under pressure to have in place an acceptable accounting system within several weeks after we were notified or face withholding of payments to ...

... foreign entity requested our services to remedy audit findings and assist in developing new or amending existing cost accounting capabilities. The client was under pressure to have in place an acceptable accounting system within several weeks after we were notified or face withholding of payments to ...

Statement of Cash Flows

... Computer Associates International Deloitte & Touche Enron Ernst & Young Global Crossing ...

... Computer Associates International Deloitte & Touche Enron Ernst & Young Global Crossing ...

Fourth Week Study Guide

... accounting policy choice than how to report the transaction. Remember that accountants may be certified but their reports may not. Relatedly, an “audited” financial report is only a “fair presentation”; the firm’s management is responsible for the report’s accuracy. (Section 1) Know the components ...

... accounting policy choice than how to report the transaction. Remember that accountants may be certified but their reports may not. Relatedly, an “audited” financial report is only a “fair presentation”; the firm’s management is responsible for the report’s accuracy. (Section 1) Know the components ...

Ch3

... increasing revenues usually results in a one-time charge reduction because some baseline cost of business always remains in place. The second component of the accounting equation focuses on the efficiency in the way procedurally based care is delivered. ...

... increasing revenues usually results in a one-time charge reduction because some baseline cost of business always remains in place. The second component of the accounting equation focuses on the efficiency in the way procedurally based care is delivered. ...

Document

... Generally Accepted Accounting Principles (GAAP) Accepted principles, procedures, and practices that companies use for financial accounting and reporting in the United States. These principles, or “rules” must be followed in the external reports of companies that sell stock to the public in the ...

... Generally Accepted Accounting Principles (GAAP) Accepted principles, procedures, and practices that companies use for financial accounting and reporting in the United States. These principles, or “rules” must be followed in the external reports of companies that sell stock to the public in the ...

1. Accountants refer to an economic event as a a. purchase. b. sale

... b. an asset which is currently being used to produce a product or service. c. usually found as a separate classification in the income statement. d. an asset that a company expects to convert to cash or use up within one year. ...

... b. an asset which is currently being used to produce a product or service. c. usually found as a separate classification in the income statement. d. an asset that a company expects to convert to cash or use up within one year. ...

Prior Year Adjustment (PYA)/Extraordinary Revenue

... To determine which entry is appropriate guidelines for each type of entry are included: Prior Year Adjustments (PYAs) are rare and shall only include adjustments meeting all of the following characteristics: (a) The value per occurrence must be in excess of $10,000 for CANEX and $ 2,000 for Base Fun ...

... To determine which entry is appropriate guidelines for each type of entry are included: Prior Year Adjustments (PYAs) are rare and shall only include adjustments meeting all of the following characteristics: (a) The value per occurrence must be in excess of $10,000 for CANEX and $ 2,000 for Base Fun ...

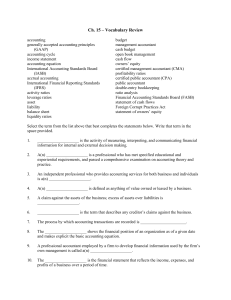

Ch. 15 – Vocabulary Review accounting generally accepted

... profitability ratios certified public accountant (CPA) public accountant double-entry bookkeeping ratio analysis Financial Accounting Standards Board (FASB) statement of cash flows Foreign Corrupt Practices Act statement of owners’ equity ...

... profitability ratios certified public accountant (CPA) public accountant double-entry bookkeeping ratio analysis Financial Accounting Standards Board (FASB) statement of cash flows Foreign Corrupt Practices Act statement of owners’ equity ...

Accounting

Accounting or Accountancy is the measurement, processing and communication of financial information about economic entities. Accounting, which has been called the ""language of business"", measures the results of an organization's economic activities and conveys this information to a variety of users including investors, creditors, management, and regulators. Practitioners of accounting are known as accountants. The terms accounting and financial reporting are often used as synonyms.Accounting can be divided into several fields including financial accounting, management accounting, auditing, and tax accounting. Accounting information systems are designed to support accounting functions and related activities. Financial accounting focuses on the reporting of an organization's financial information, including the preparation of financial statements, to external users of the information, such as investors, regulators and suppliers; and management accounting focuses on the measurement, analysis and reporting of information for internal use by management. The recording of financial transactions, so that summaries of the financials may be presented in financial reports, is known as bookkeeping, of which double-entry bookkeeping is the most common system.Accounting is facilitated by accounting organizations such as standard-setters, accounting firms and professional bodies. Financial statements are usually audited by accounting firms, and are prepared in accordance with generally accepted accounting principles (GAAP). GAAP is set by various standard-setting organizations such as the Financial Accounting Standards Board (FASB) in the United States and the Financial Reporting Council in the United Kingdom. As of 2012, ""all major economies"" have plans to converge towards or adopt the International Financial Reporting Standards (IFRS).